Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

Weekly Market Update – 9th October 2023

Investment markets and key developments

Global share markets were mixed over the last week. US shares initially fell as higher bond yields continued to pressure valuations not helped by political uncertainty with the replacement of the House Speaker, but then rebounded from technical support on Friday helped by a “goldilocks” (not too strong, not too weak) interpretation of the latest jobs data. This saw US shares rise 0.5% for the week. Eurozone shares fell 1.2% for the week and Japanese shares fell 2.7%. The poor global lead saw Australian shares remain under pressure despite the RBA leaving interest rates on hold with the ASX 200 falling 1.3% for the week. From their July highs to their recent lows US & Australian shares have had a fall of around 8%. Bond yields rose further. Oil prices fell sharply on concerns about slowing demand and metal and iron ore prices also fell. The $A fell, reaching an 11-month low, with the $US flat.

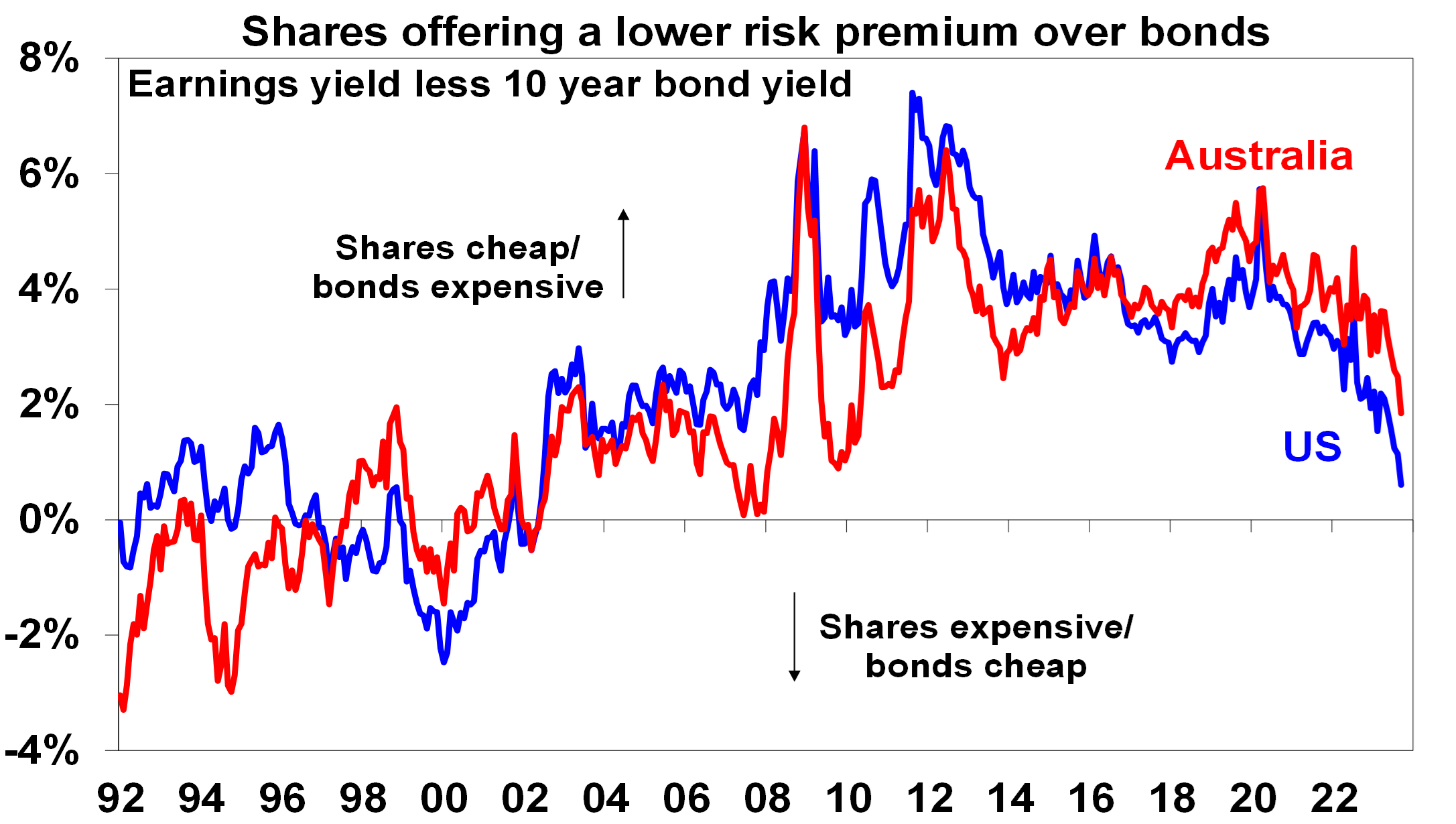

Shares were oversold at technical support and due for a bounce which we saw late in the last week, but the risk of a further correction is high. The continuing rise in bond yields has pushed the risk premium the US share market offers over bonds to its lowest in over 20 years, and that in Australia to its lowest since 2010. While the drivers of the back up in bond yields are arguably less threatening than was the case last year, being less due to inflation and more due to hopes of a soft landing, the risk of recession remains very high and is arguably rising again in the US on the back of the financial tightening flowing from higher bond yields. The combination of the high risk of recession, uncertainty around the Chinese economy and US politics going from bad to worse with the removal of the House Speaker McCarthy all suggest the risk premium offered by shares over bonds should be higher than it is now, which in turn implies a high risk of more downside for share markets unless bond yields pull back.

Source: Bloomberg, AMP

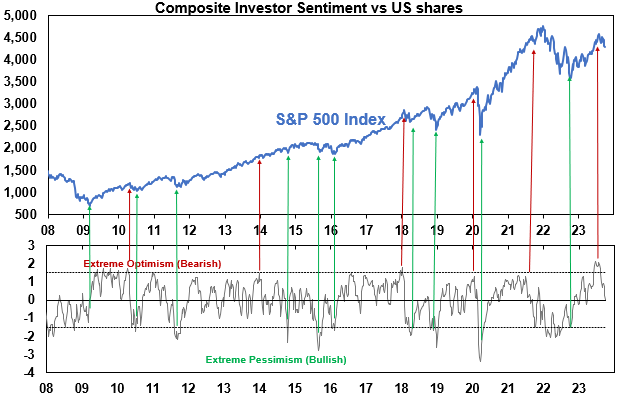

Investor sentiment has fallen sharply from the optimism seen mid-year when goldilocks was all the rage but it’s still not yet at the levels often associated with major market bottoms. See the next chart. So all of this suggests that the path of least resistance for shares is still down in the short term. While valuations for the Australian share market are more attractive – see the first chart – it would likely follow any further correction in US shares. Some things should help shares by year end through – seasonality will start to become more positive in the months ahead. inflation is likely to continue to fall which should take pressure of central banks allowing them to start easing through next year and any recession is likely to be mild. So our 12 month view on shares remains positive.

Based on surveys of individual investors, investment newsletter writers, option positioning and VIX. Source: Bloomberg, Sentimentrader, Investors Intelligence, AMP

Bad to worse US politics. While former US House Speaker Kevin McCarthy tried to play the “only adult in the house” in averting a debt ceiling debacle and government shutdown (until mid-November) it’s cost him his job leading to more uncertainty. The bigger issue is that US deficit and debt dynamics are getting worse again (with the CBO projecting a deficit of 5.4% of GDP this year) which needs to be reined in particularly with debt interest costs surging to now more than 14% of tax revenue and the odds of another US debt downgrade (this time by Moody’s) are high. House Republicans are split between fiscal hardliners and moderates making it hard to agree on anything and Democrats are yet to admit they will have to reign in spending. This all just means a bigger showdown over averting or ending a shutdown when it comes up again in November and more fiscal policy uncertainty.

We continue to see the RBA leaving rates on hold ahead of rate cuts next year, but with a 40% chance of a final rate hike by year end. As widely expected, the RBA left rates on hold following its latest board meeting with new Governor Michele Bullock making little change to the post meeting statement. With inflation still high the RBA understandably retained a tightening bias indicating that the risk of a further increase in interest rates remains high and poor productivity, signs of a pickup in wages growth, the rise in petrol prices and the fall in the $A reinforce this. So we are allowing for a 40% chance of another hike with the November meeting (after quarterly CPI data and revised RBA forecasts) and the December meeting (after quarterly wages data) being the ones to watch. However, if as we expect the economy continues to weaken as past rate hikes increasingly bite this will maintain downwards pressure on inflation heading off any further rate hikes and ultimately allowing the RBA to cut rates next year, starting around June.

But won’t the rise in petrol prices and the fall in the $A force the RBA to hike? While both may concern the RBA its more complicated than commonly thought. First, the rise in petrol prices is occurring against a very different background than was the case 18 months ago. Then many commodities and prices were up with supply shortfalls, people wore it as they were happy to be free from lockdowns and monetary policy was easy. Now many other commodity prices are down, goods prices have generally weakened, reopening euphoria has long faded and monetary policy is tight which has hit households. So, while higher petrol prices add directly to inflation the flow on will be limited or negative as its more likely to act as a tax on spending. Second, in relation to the fall in the $A it hasn’t fallen enough yet to be a major problem, the pass through of changes in the $A to consumer prices has not been as strong in recent times and while the lower $A partly reflects Australian rates being below those in the US it also reflects “risk off” sentiment amongst global investors and is a sign of concern about the outlook for commodity prices and global growth which is potentially deflationary, not inflationary. So the RBA shouldn’t be rushing into another rate hike just because of higher petrol prices and the lower $A.

Does the RBA’s semi-annual Financial Stability Review – which noted that financial stability risks have increased but most Australian “borrowers are expected to be well placed in the event of a further increase in interest rates” and that the Australian financial system remains strong – provide a green light for another rate hike? Not necessarily. The key points from the Review are:

- Global financial stability risks have increased – with the key risks being around China, a further tightening in global financial conditions and fall in asset markets and higher unemployment. This could impact Australia via financial markets and less demand for our exports.

- Most Australian households and businesses remain resilient with most household borrowers being able to adjust to higher rates by restraining discretionary consumption, reducing their savings rates or running down their savings with the strong labour market – which has resulted in more than 10% real income growth for low-income households – helping. Arrears have picked up but remain low. And fixed rate borrowers who have transitioned from low rates have managed the transition to higher rates well.

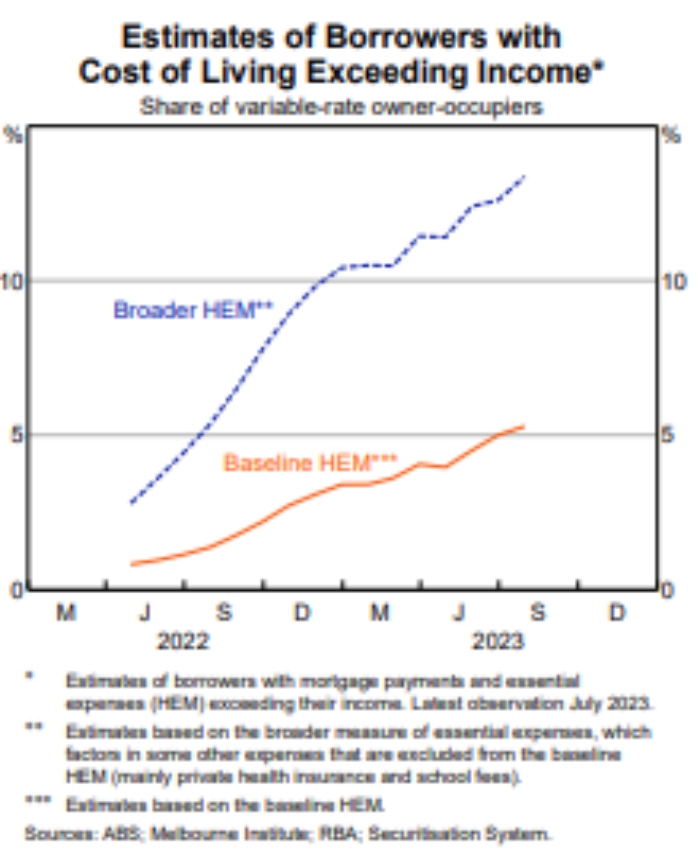

- However, a small but rising group of households are seeing rising financial stress. The RBA estimates that 5% of variable rate owner occupier borrowers were cash flow negative in July – where essential living and mortgage expenses exceeded their income – up from 1% in April 2022. And 1.5% of these (or nearly 50,000 households if similar calculations are allowed for fixed rate borrowers) are at risk of depleting their buffers within six months. Using a broader measure of essential expenses that are hard to adjust (like private health insurance and school fees), 13% of variable rate and 18% of fixed rate borrowers (or roughly 460,000 households in total) are estimated to have been cash flow negative in July.

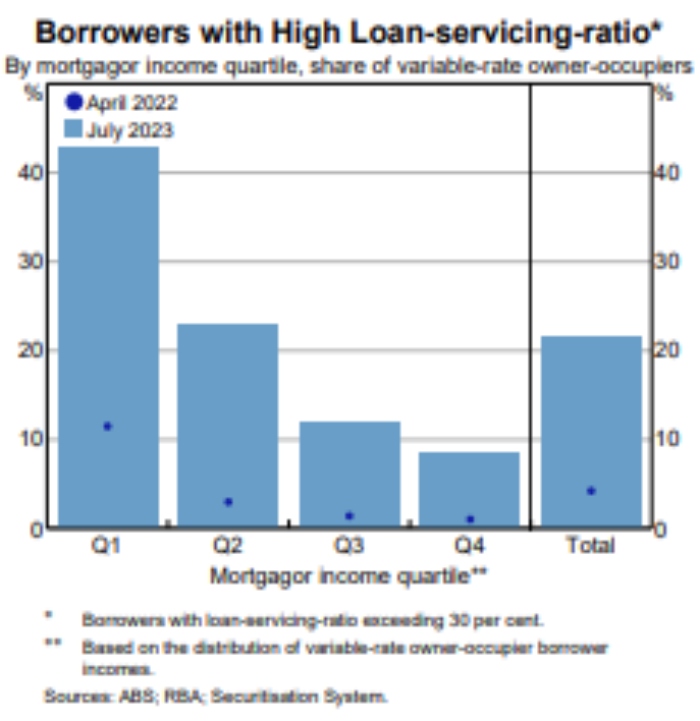

- Looked at another way the share of households with a variable rate mortgage where mortgage payments exceed 30% of their income has increased to just over 20% in July from 4% in April last year, and to over 40% for low-income households. See the next chart. This is actually very high and is despite high income growth for low-income households. And just over 40% of borrowers have saving buffers that would be depleted in less than 3 months if they were to lose their income.

- A sustained rise in unemployment is a major risk for households but “is unlikely to have material implications for system wide financial stability”. [This sounds a bit optimistic!]

- Company insolvencies have increased to pre-pandemic levels and commercial real estate remains under pressure but the risks to the financial system are judged to be low.

Overall, the conclusions in the latest RBA Financial Stability Review appear to paint a relatively benign picture of the economy, and particularly households, coping well with higher interest rates. This may be taken by some as not standing in the way of another RBA rate hike. However, as they say the devil is in the detail and the data in the Review around rising levels of cash flow negative households, depleting savings buffers and mortgage stress are more worrying and warn that the RBA needs to tread very carefully and so we would conclude are more consistent with the RBA not raising rates again. Particularly given that many households are only managing to service their mortgages by cutting back non-essential spending, which in turn increases the risk of a sharper rise in unemployment and hit to economic growth than the RBA is allowing for – which in turn will only add to the pressure on households with a mortgage.

Economic activity trackers

Our Economic Activity Trackers are still not providing any decisive indication of recession or a growth rebound.

Levels are not really comparable across countries. Based on weekly data for eg job ads, restaurant bookings, confidence, credit & debit card transactions and hotel bookings. Source: AMP

Major global economic events and implications

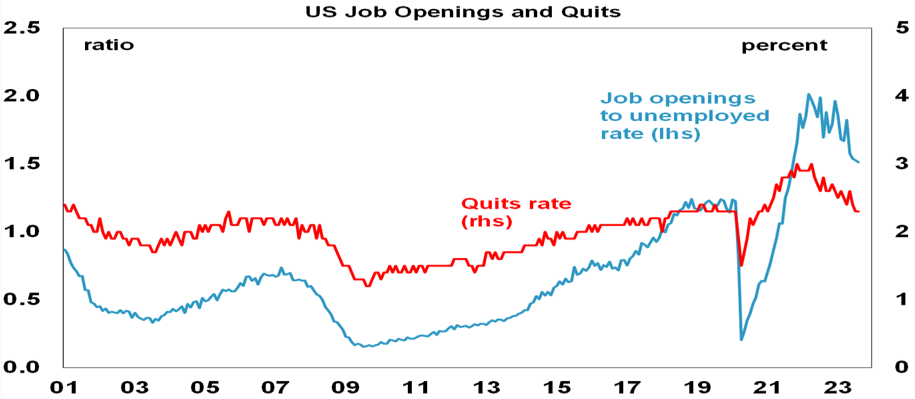

US economic data was messy. Payrolls surged by a much stronger than expected 336,000 in September, the prior two months were revised up by 119,000 and job openings rose in August all of which will keep the Fed hawkish and signalling “high for longer” interest rates. However, its not as strong as it looks: the trend in payroll growth is still down; the household employment survey rose by just 86,000; temporary employment which leads is falling; unemployment remained flat at 3.8% and is up from its low; the ratio of job openings to unemployment fell further; the quits rate and hiring rate remain in a downtrend; and wages growth slowed further to 0.2%mom or 4.2%yoy suggesting a degree of “Goldilocks”. In other data, the ISM business conditions indicators were mixed with manufacturing up but still weak and services down but still solid. Prices paid indicators in both remained well down from their highs.

Source: Bloomberg, AMP

Eurozone producer price inflation sank further to -11.5%yoy, down from a high of over 40%yoy last year with core (ex food and energy) producer price inflation of just 1%yoy. Unemployment remained at 6.4%.

Japan’s Tankan business conditions survey showed further improvement in the September quarter particularly for large businesses, but wages growth remained subdued in August.

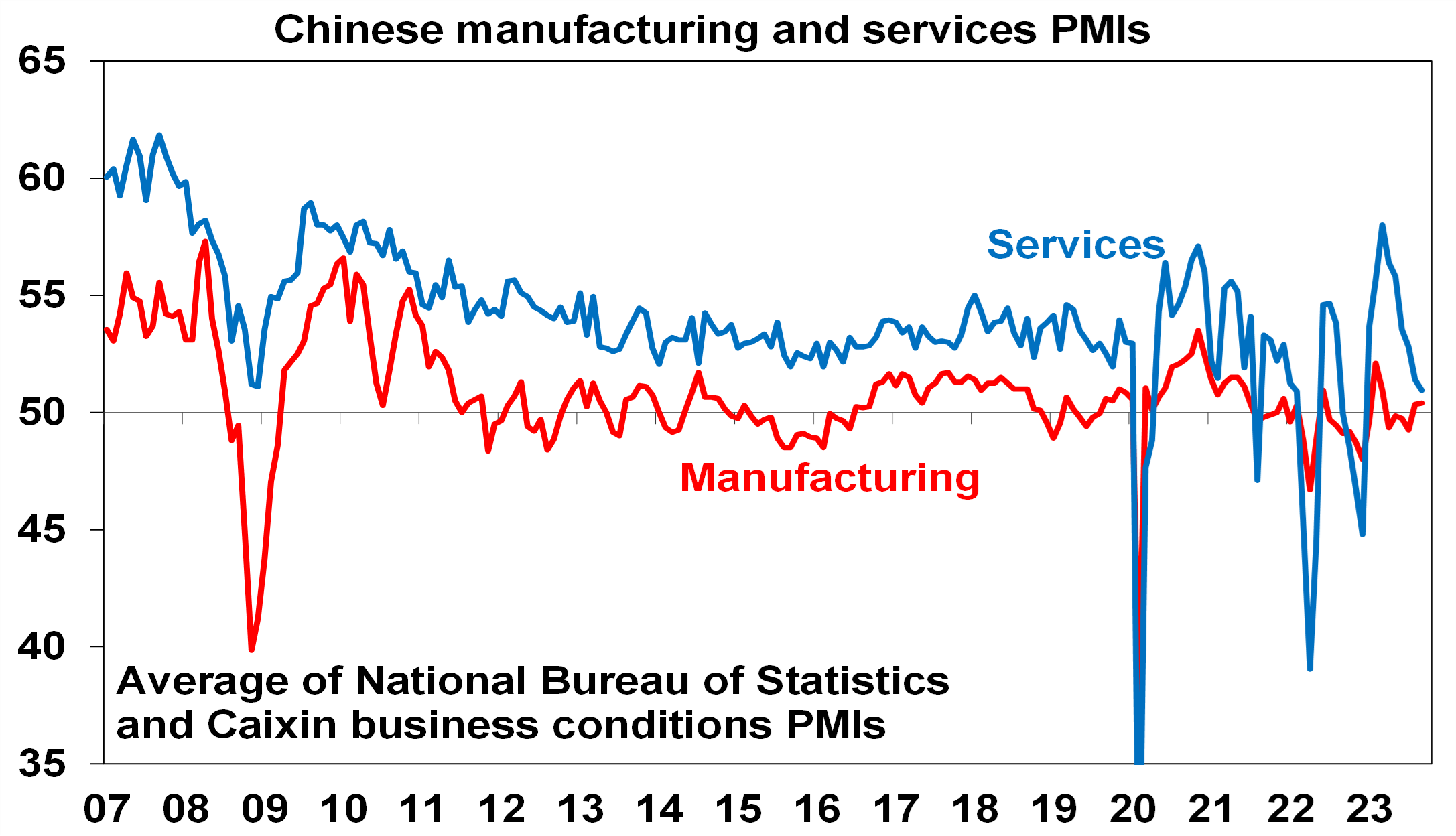

China’s Caixin business conditions PMIs fell in September offsetting the improvement seen in official PMIs and suggesting that smaller private firms (which have a higher weighting in the Caixin survey) are not doing as well as larger state-owned firms. Overall, it adds to the impression that growth has stabilised, but it still looks weak relative to pre-pandemic levels.

Source: Bloomberg, AMP

The RBNZ left rates at 5.5% as expected. Another hike looks unlikely, but it has its own version of high rates for longer noting rates may need to be restrictive “for a more sustained period.”

Australian economic events and implications

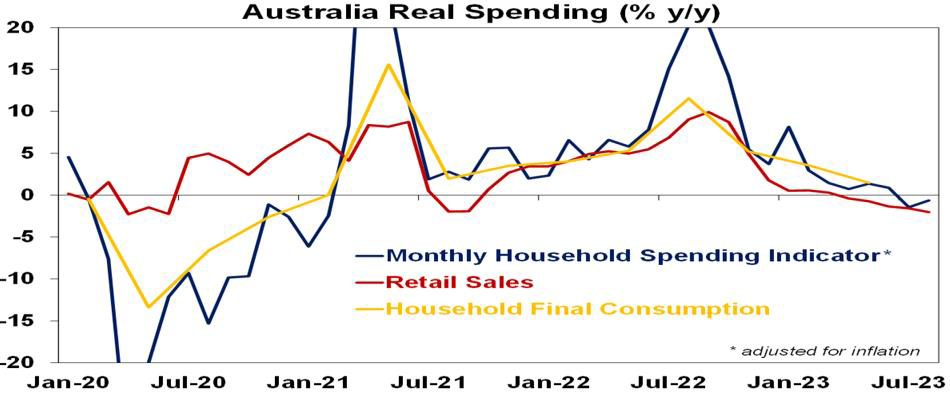

Australian economic data was mixed. The ABS’ experimental Household Spending Indicator which is based on bank card transactions data rose 4.8%yoy in August. While volatile (July was originally reported to be -0.7%yoy but now shows +3.4%yoy) the trend is down consistent with retail sales and after adjusting for inflation suggests annual growth in real consumer spending was flat or negative in the September quarter.

Source: ABS, AMP

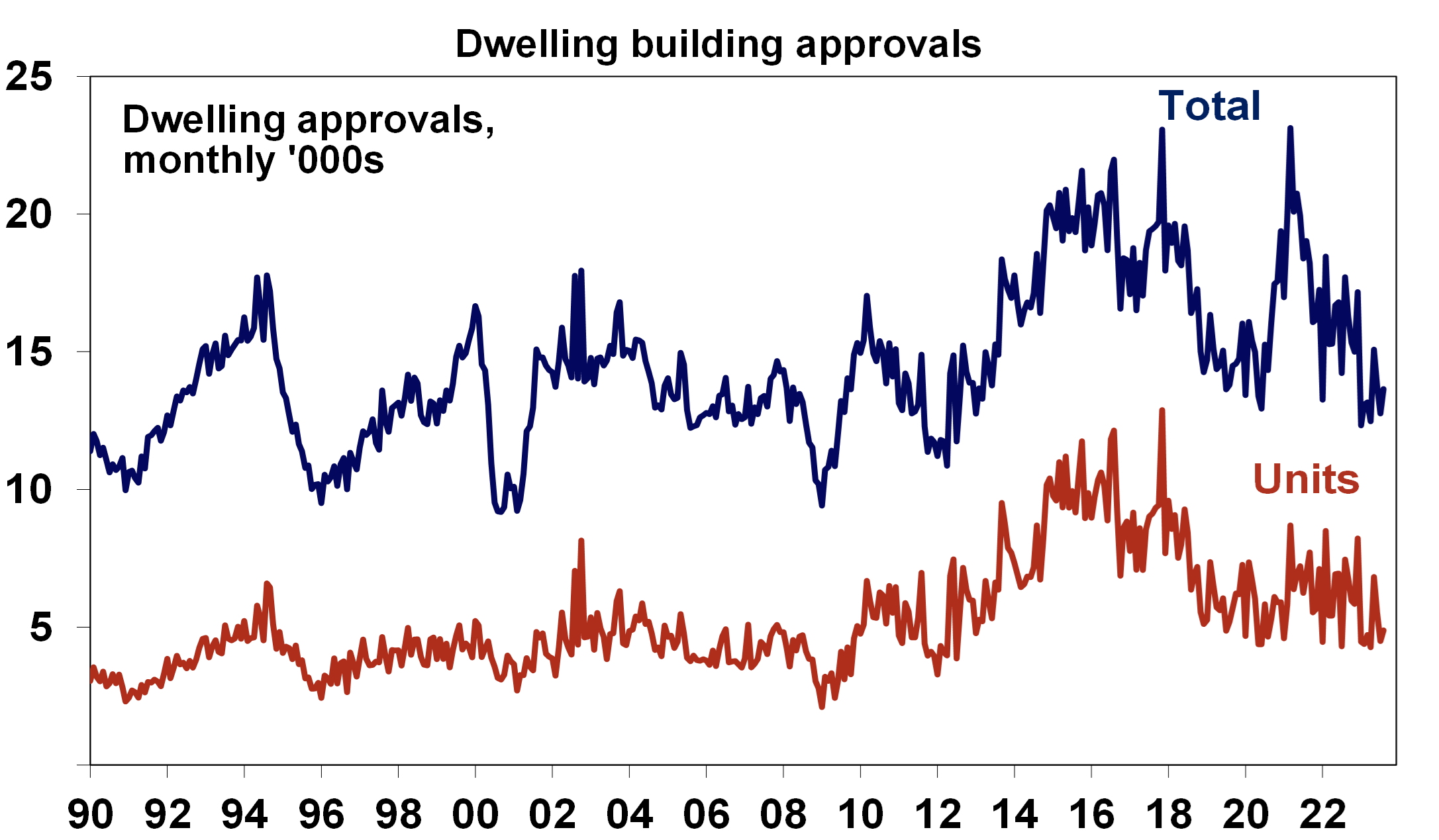

Home building approvals bounced 7% in August but remain well down on pre-pandemic levels and in the absence of lower interest rates its hard to see a sustained recovery.

Source: ABS, AMP

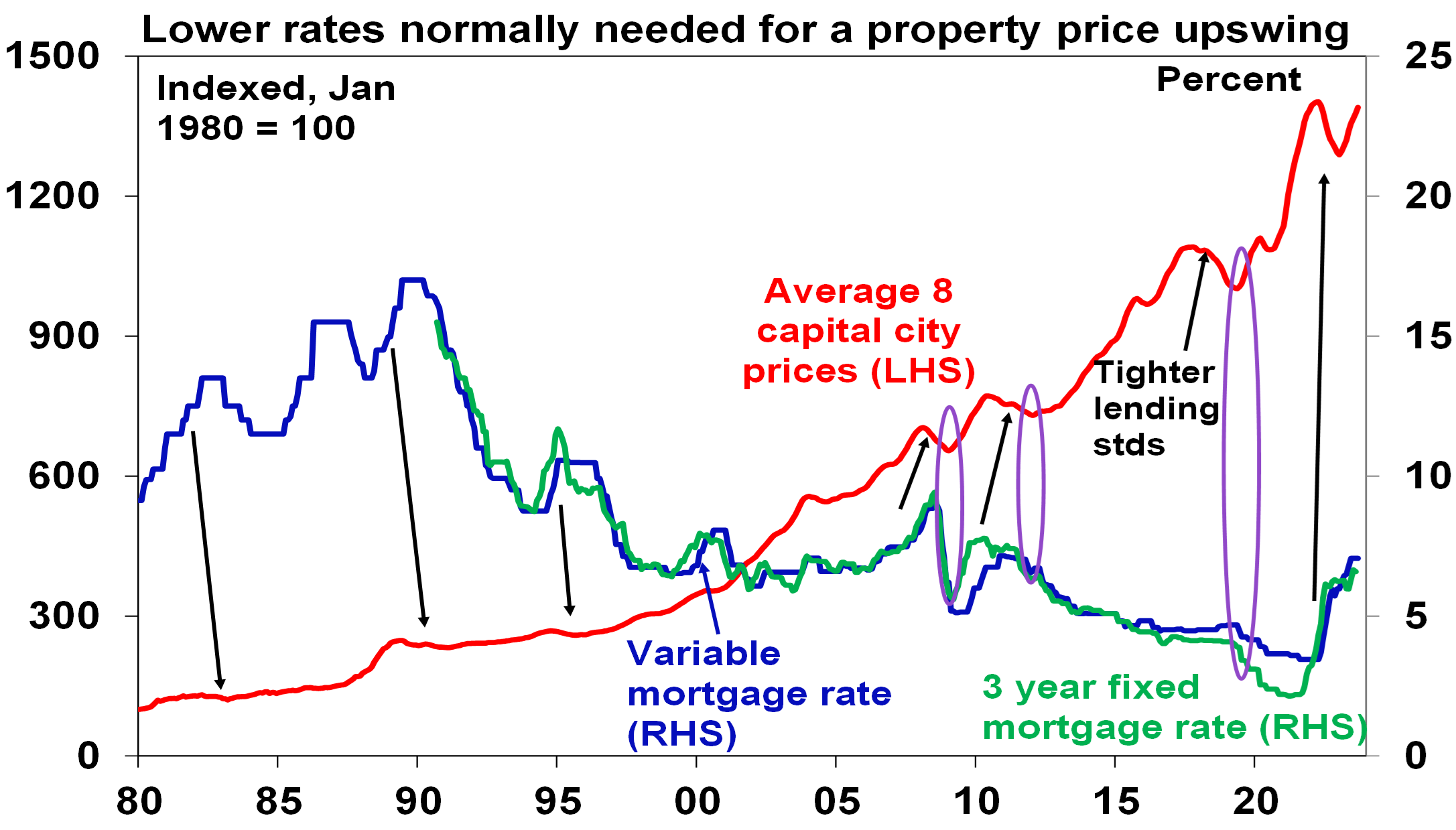

Meanwhile, CoreLogic data showed home prices up 0.8% in September. Revised data shows prices now up by 6.6% from their January low and although the pace of growth has slowed from May when it was 1.2%mom it’s still solid suggesting the underlying supply shortfall in the face of surging immigration is continuing to dominate the impact of rate hikes. Prices are now on track for an 8-9% rise this year and our base case remains for a 5% rise next year as the RBA starts to cut rates. However, uncertainty is high given rising listings, increasing levels of mortgage stress and the dampening impact on demand from reduced buying capacity as a result of the surge in mortgage rates since May last year. Normally property price rebounds are preceded by rate cuts so the rebound this year has run ahead of the normal relationship with rates, see ovals in next chart.

Source: CoreLogic, RBA, AMP

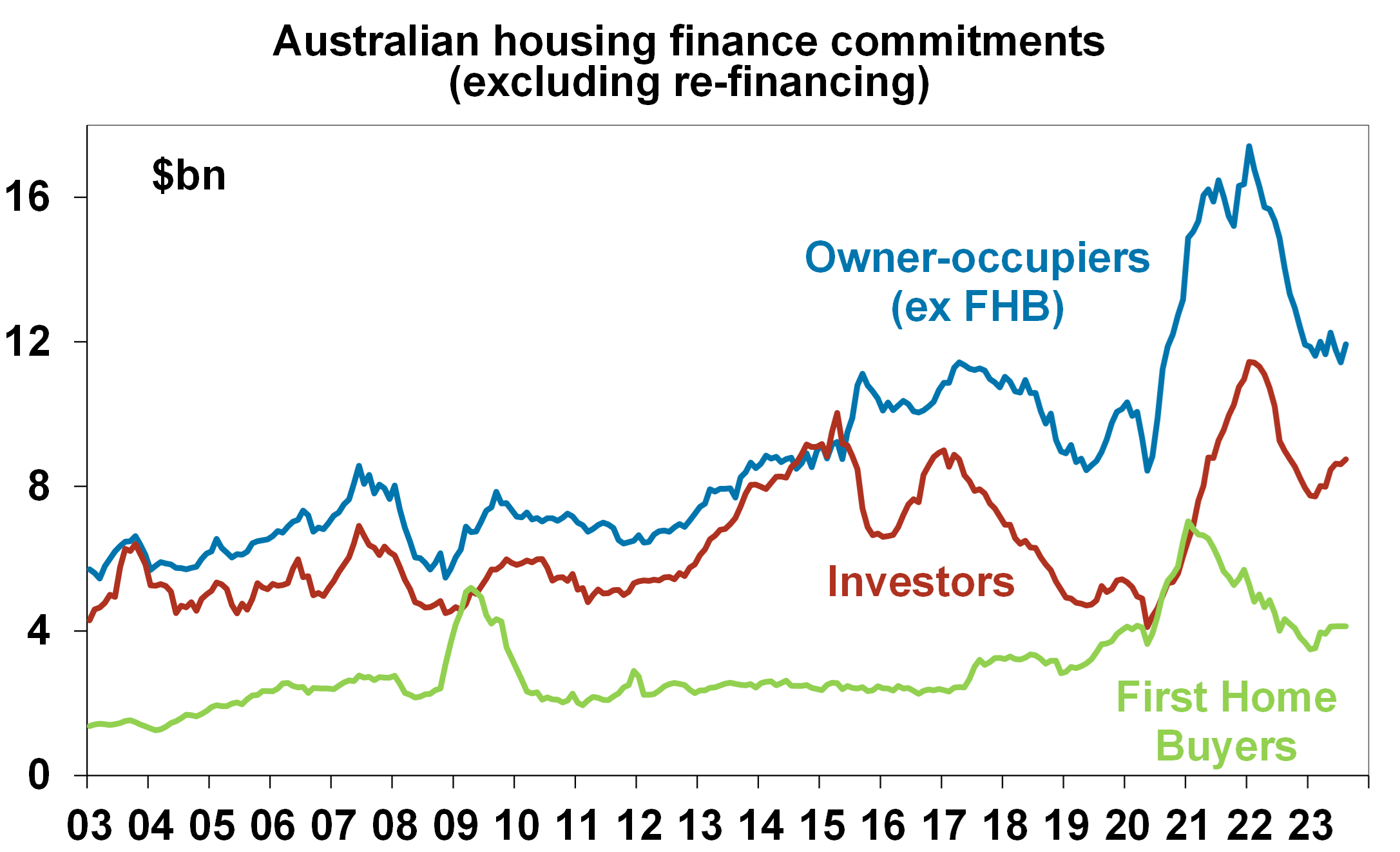

Housing finance commitments rose 2.6% in August but remain relatively weak given the rebound in home prices.

Source: ABS, AMP

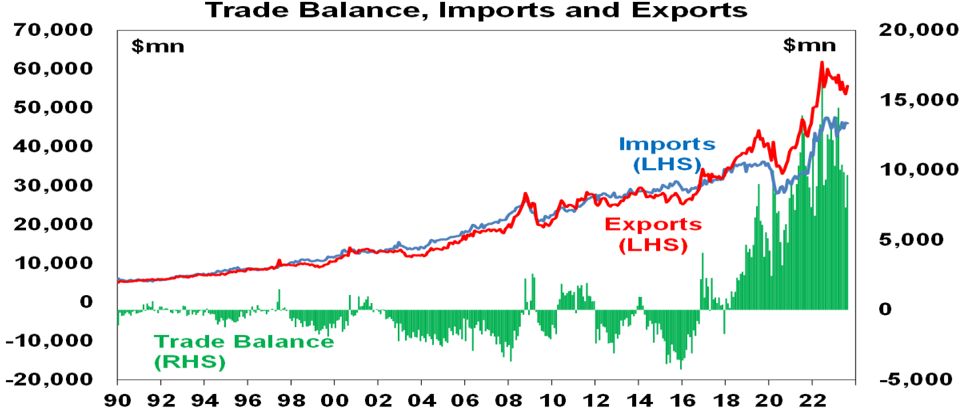

Australia’s trade surplus surprised on the upside in August rising to $9.6bn on the back of strong exports.

Source: ABS, AMP

What to watch over the next week?

In the US, the focus will be on September CPI inflation (Thursday) which is expected to slow to 0.3%mom or 3.6%yoy after 3.7%yoy in August. Core CPI inflation is likely to slow further to 4.1%yoy from 4.3%. Producer price inflation (Wednesday) is also likely to remain subdued and small business optimism (Monday) is likely to remain low. The minutes from the last fed meeting (Wednesday) are likely to reiterate the “high rates for longer” message.

Chinese inflation data for September (Friday) is likely to edge up to 0.2%yoy from 0.1%yoy, with producer price deflation easing slightly to -2.4%yoy. Trade data also due Friday is expected to show a slowing pace of falls in both exports and imports. Credit data will also be released.

In Australia consumer confidence is likely to remain weak and the NAB business survey will be watched for any cooling in so far still okay business conditions with both due Tuesday.

Outlook for investment markets

The next 12 months are likely to see a further easing in inflation pressure and central banks moving to get off the brakes. This should make for reasonable share market returns, provided any recession is mild. But for the near-term shares are at high risk of a further correction given high recession and earnings risks, the risk of higher for longer rates from central banks, rising bond yields which have led to poor valuations and still poor seasonality.

Bonds are likely to provide returns above running yields, as growth and inflation slow and central banks become dovish but given the recent rebound in yields this may be delayed a few months.

Unlisted commercial property and infrastructure are expected to see soft returns, reflecting the impact of the rise in bond yields on valuations. Commercial property returns are likely to be negative as “work from home” continues to hit space demand as leases expire.

With an increasing supply shortfall, our base case remains that home prices have bottomed with more gains likely next year as the RBA starts to cut rates. However, uncertainty around this is high given the lagged impact of interest rate hikes and the likelihood of higher unemployment.

Cash and bank deposits are expected to provide returns of around 4-5%, reflecting the back up in interest rates.

The $A is at risk of more downside in the short term on the back of a less hawkish RBA and weak growth in China, but a rising trend is likely over the next 12 months, reflecting a downtrend in the overvalued $US and the Fed moving to cut rates.

Source: AMP ‘Weekly Market Update’