Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

Weekly Market Update – 7th October 2022

Investment markets & key developments

- Share markets had a strong bounce in the middle of the past week from very oversold levels, helped along by the UK tax backflip, softer US manufacturing and job opening data which may take pressure off the US Federal Reserve (Fed), and for Australian shares, the dovish hike from the Reserve Bank of Australia (RBA). However, the bounce was short lived, with solid US jobs data being seen as keeping the Fed hawkish for now, so US and European shares fell sharply on Friday paring gains for the week, but still leaving them above their lows. Over the week as a whole, US shares still rose 1.5% and Eurozone shares gained 1.3%. Japanese shares rose 4.5% as did Australian shares, with both missing out on the Friday fall which came after US jobs data. Bond yields rose again in the US, UK and Europe, but they fell in Australia. Oil prices rose as OPEC cut oil production and metal prices rose slightly, but iron ore prices fell. The $A fell as the $US rose.

- Are we there yet? After falling back to around the June lows, shares were due for a bounce and having seen a double bottom it’s possible that we have seen the low. However, the tech wreck and GFC bear markets saw several similar big 5%+ rallies (like in the last week) that proved short-lived, only to see the bear market resume as we (maybe) started to see on Friday in the US. From a macro perspective, the risks for shares are likely still on the downside in the short-term as central banks remain hawkish, recession risks are high and still rising, the conflict in Ukraine looks likely to escalate, oil prices could move higher on OPEC’s move to cut oil production and earnings expectations are still being revised down. Looking at key developments in the last week:

- Global central banks remain hawkish, with ongoing hawkish comments from various US Fed officials, the Bank of Canada and European Central Bank (ECB) President Lagarde (all to the effect that they remain “resolute” and there is “more to be done” in controlling inflation) and the Reserve Bank of New Zealand hiking by another 0.5%, to 3.5%, for its 8th hike in a row and signalling more rises ahead.

- OPEC’s decision to cut oil production by 2 million barrels a day risks reversing the downtrend in oil prices. The cutback relative to actual production levels is really about 1 million barrels. But coming at a time when there is a high risk that Russia will cut production further to retaliate against EU/US price caps, it risks reversing the recent downtrend in prices and exacerbating the risk of global recession. A more benign interpretation is that OPEC is simply seeking to keep the oil price around $US90/barrel (as stated by the Nigerian oil minister) and so, if Russia cuts production by more than agreed with OPEC, it will offset it with increased production to try and stop the oil price going up too far, in order to avoid making any economic downturn worse (which could result in a worse outcome for OPEC).

- The UK Government’s decision to abandon its plan to cut the top income tax rate from 45% to 40% provided a bit of relief. The reality is that it only saved about 2bn pounds of the total 45bn pounds in fiscal stimulus, so still leaves pressure on the Bank of England, which is still expected to raise rates by 1-1.25% in November.

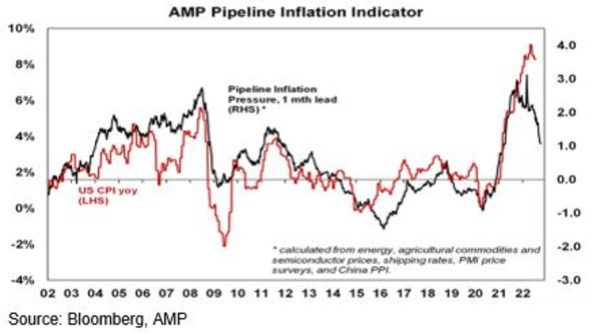

- The good news remains that the Pipeline Inflation Indicator continues to slow reflecting improving global supply conditions and reducing corporate pricing power. Views remain that this, along with slowing economic conditions, will see inflation falling faster than central banks expect through next year. This should enable them to start slowing the pace of hiking from later this year.

- The RBA has sensibly broken from the ultra-hawkish global central bank consensus and opted to slow the pace of rate hikes from the 0.5% to a more normal 0.25%. This made good sense given: the rapidity of the rate hikes so far; the need to better assess the impact of those rate hikes and in particular, allow for those on fixed 2% rates rolling over to rates two to three times higher next year; the greater sensitivity of Australian households to interest rate changes due to high household debt levels and a very high reliance on variable or short dated fixed rates (compared to 30-year fixed rates in the US); a bit of breathing space provided by lower wages growth in Australia compared to other countries; and the rising risk of global recession and financial turmoil. Of course, the slowdown in rate hikes does not mean that the RBA has finished hiking – it stressed that it “remains resolute” in returning inflation to target, will do “what is necessary to achieve that” and expects to increase rates further. Expect that the RBA will hike by another 0.25% in November or December taking the cash rate to 2.85%, which may be the peak, as a clear slowing in consumer spending is expected to emerge in the next six months. The risk is on the upside, but probably only to 3.1%. By the end of next year expect that the RBA will have started to gradually cut rates, as inflation should be falling rapidly by then as supply improvements continue and demand weakens.

- The RBA’s latest Financial Stability Review is more sombre than six months ago and consistent with its decision to slow the pace of rate hikes. The key points are that: financial stability risks have increased globally with tightening financial conditions; Australian households, firms and banks are generally in a strong financial position; but household resilience is uneven with some households already feeling the strain and a small number with high debt and low savings are particularly vulnerable. It’s clearly within the household sector that the greatest risk lies with RBA analysis showing that:

- 40% of variable rate borrowers won’t have to raise their payments after the 2.5% cash rate rise, but about 20% will see their minimum payment go above 30% of their incomes;

- A household earning $150,000 with $800,000 debt will see their monthly free cash flow fall by around $1300 following the 2.5% rise in rates so far;

- If rates go up another 1% then just over half of variable rate owner occupiers will see their free flow fall by more than 20%, with 15% seeing negative cash flow;

- Two thirds of fixed rate loans (which are about 35% of total mortgages) will expire by the end of next year and will face a 3 to 4% increase in their interest rate.

- It notes that recent home borrowers and particularly first home buyers are most vulnerable.

- A 20% fall in home prices (we expect a 15 to 20% fall) would see around 3% of all mortgages and 20% of new first home buyer loans go into negative equity.

- While the RBA notes that signs of financial stress are low right now, surveys, Google searches and liaison suggest that it’s picking up. The key is that the decline in free cash flows from higher rates and inflation will slow consumer demand. The RBA sees the direct impact on financial stability as being modest, but this could change if there is a large rise in unemployment and a large fall in home prices. Along with the rising risk of global recession, it all supports the case for the RBA to be cautious in raising rates further from here.

- In Australia, we are now getting lots of reminders that a Budget is near and under a new Government, with warnings about how bad the budgetary situation is – just as we were seeing 9 years ago with the new Coalition Government. There is nothing new with the blow out in spending (on aged, health, NDIS, defence and interest costs) as they were well known before the election (when neither side wanted to discuss how to pay for them). But it all seems to be gearing up to difficult decisions in the Budget (and beyond), including regarding the legislated final phase of the tax cuts. Regarding the latter – which is mainly about removing bracket creep from 2008-09 (under which taxpayers find themselves in tax brackets never intended for them) – there is a strong case to index tax brackets to wages growth to take it out of the hands of politicians (who use it for pretend tax cuts or to surreptitiously raise revenue).

Coronavirus update

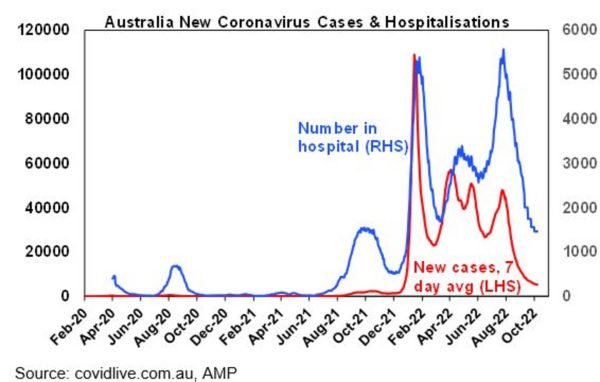

- New global & Australian COVID cases & deaths are trending down. However, new cases are up in Europe & China.

Economic activity trackers

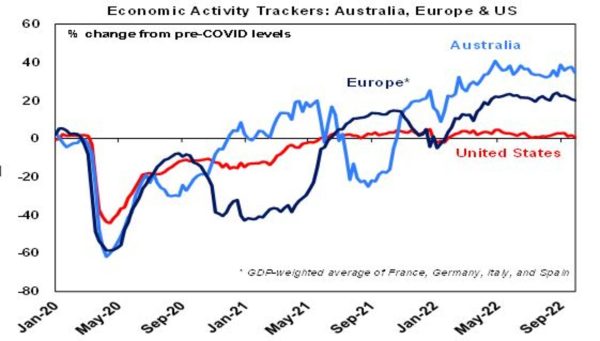

Our Australian, US and European Economic Activity Trackers slowed a notch in the last week.

Major global economic events and implications

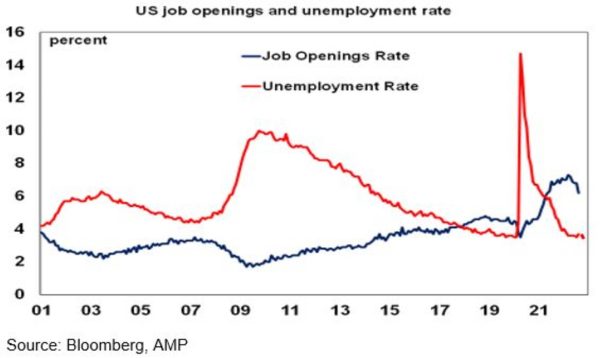

- US data suggests no (real) recession (just yet anyway), but still points to a slowing in growth. The ISM manufacturing index fell more than expected, but at 50.9, remains consistent with continuing growth, while the services ISM fell only slightly and remains strong. Both show a sharp fall in indicators relating to prices, delivery times and order backlogs, pointing to falling inflation pressures. September jobs data was solid. Payrolls growth was robust, at 263,000, but appears to be trending down and wages growth looks to be slowing a bit, but the decline in unemployment to 3.5% and underemployment to 6.7% will likely keep the Fed on track for a 0.75% hike in November. A decline in job openings suggests that the labour market is starting to cool, albeit it’s still strong.

Australian economic events and implications

- The Melbourne Institute’s Inflation Gauge rose again in September pointing to a further rise in underlying inflation, albeit it’s tending to run below the reported ABS rate of inflation.

- The ANZ Job Ads series fell again suggesting the labour market may be starting to cool, but it remains up 22%yoy.

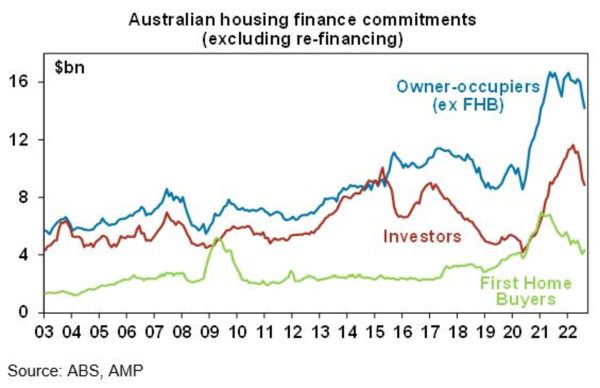

- Housing data was mostly soft. Housing approvals bounced 28% in September after a 17% fall in July due to normally volatile apartment approvals, but the trend remains weak. Housing finance commitments continued to fall sharply, with more declines likely as higher rates and falling prices impact.

- Core Logic data showed that home prices fell another 1.4% in September. National average prices are now down 4.8% from their high and have seen their fastest pace of decline over five months since the early 1980s. While the rate of monthly decline slowed a bit (including in Sydney and Melbourne), this likely reflects the market getting used to the initial shock of rate hikes, bargain hunters taking advantage of lower prices and vendors holding off selling. But with the full impact of rate hikes to date yet to be felt, interest rates still rising, and the economy set to weaken, it’s unlikely to presage an imminent bottoming in home prices. Past periods of property price falls experienced a few gyrations in the pace of price declines before prices ultimately bottomed. In the last two major up cycles (starting in 2012 and 2019) property prices did not bottom from their prior falls and start to turn up until interest rates started to fall – see the purple ovals in next chart. Continue to expect a roughly 15-20% top to bottom decline in prices to September quarter next year after, which prices will likely start to stage a gradual recovery as the RBA starts to cut rates again.

What to watch over the next week?

- In the US, the focus will likely be on September CPI data (Thursday) which is expected to show a decline in inflation to 8.1%yoy from 8.3% and some moderation in monthly core inflation. Producer price inflation (Wednesday) is also expected to slow a bit. Minutes from the Fed’s last meeting (Wednesday) are likely to be hawkish – but more interesting will be comments by Fed Vice Chair Brainard (Monday), who in comments a week ago was a bit less hawkish. Retail sales growth (Friday) is expected to be slightly negative in real terms.

- Chinese September CPI inflation (Friday) is expected to rise to 2.8%yoy but remain around 0.8%yoy at a core level, with producer price inflation falling further to 1.0%yoy. Trade data is likely to show a further slowing in export & import growth.

- In Australia, the Westpac/MI consumer sentiment index (Tuesday) is likely to have remained weak in October, with the rebound in petrol prices offsetting the slowdown in RBA rate hikes. The NAB business survey (also Tuesday) is likely to show continued solid confidence and conditions readings. A speech by RBA Assistant Governor Lucy Ellis (Wednesday) will also be watched for any implications for monetary policy.

Outlook for investment markets

- Shares remain at high risk of further falls in the short-term as central banks continue to tighten, uncertainty about recession remains high and geopolitical risks continue. However, it is likely to see shares providing reasonable returns on a 12-month horizon as valuations have improved, global growth ultimately picks up again and inflationary pressures ease through next year, allowing central banks to ease up on the monetary brakes.

- With bond yields likely at or close to peaking for now, short-term bond returns should improve.

- Unlisted commercial property may see some weakness in retail & office returns, plus the lagged impact of higher bond yields is likely to drag down unlisted property and infrastructure returns.

- Australian home prices are expected to fall 15 to 20% top to bottom to the September quarter next year, as poor affordability & rising mortgage rates impact. (This assumes the cash rate tops out around 3%, but if it rises to 4% or more as the money market is assuming, then home prices will likely fall 30%.)

- Cash and bank deposit returns remain low but are improving as RBA cash rate increases flow through.

- The $A is likely to remain at risk of further falls in the short-term as global uncertainties persist and as the RBA remains a bit less hawkish than the Fed. However, a rising trend in the $A is likely over the medium-term as commodity prices ultimately remain in a super cycle bull market.

Source: AMP CAPITAL ‘Weekly Market Update’

AMP Capital Investors Limited and AMP Capital Funds Management Limited Disclaimer