Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

Weekly Market Update – 7th August 2015

Investment markets and key developments over the past week

- The last week was mixed for shares with markets up in the Eurozone (+0.9%), Japan (+0.7%) and China (+2.2%), but US shares falling 1.3% on some earnings disappointments and falls in energy and biotech shares and Australian shares falling 3.9% partly due a capital raising and disappointing earnings update from ANZ weighing on bank shares. Bond yields fell in the US but rose in Europe and Australia and commodity prices remained under pressure as the US dollar rose marginally. Despite this the Australian dollar rose back above US$0.74 as the Reserve Bank of Australia (RBA) dropped its reference to a further depreciation being “likely and necessary”.

- The RBA looks a bit more comfortable with the economy, but pressure likely remains to cut interest rates again. In appearing a bit more comfortable about the labour market and the value of the A$ and in revising up its inflation forecasts slightly the RBA appears to have softened its easing bias. More fundamentally the RBA appears to be revising down its assessment of potential growth in the economy largely reflecting slower population growth. Despite this, and while it’s a close call, it’s likely the RBA will cut rates again before year end reflecting the poor business investment outlook, greater than expected weakness in commodity prices, the A$ remaining too high given the slump in commodities, a likely loss of momentum in home price growth and to offset a de facto monetary policy tightening that is flowing from higher bank mortgage rates. On this front, its notable the RBA has yet again revised down its growth outlook implying that spare capacity will linger longer.

- Potential real economic growth in the Australian economy has likely slowed thanks to lower population and productivity growth and reflecting the secular headwind from now falling commodity prices. In estimating the medium term return potential for Australian shares we have been assuming that it has slipped just below 3%. However, while this could imply less slack in the economy than previously thought, the RBA still sees spare capacity remaining. Spare capacity is evident in the 14.5% labour force underutilisation rate and record low wages growth. The combination of lower potential growth and low inflation also means a lower natural rate of interest which in the US, Europe and Japan has seen interest rates fall to around zero. In other words lower potential growth in the economy does not necessarily mean the end to interest rate cuts. In fact it might add to the case for lower rates.

Major global economic events and implications

- US economic data was the usual mixed bag. Construction spending, the ISM manufacturing index and July wages growth at just 2.1% year on year were all weaker than expected. Against this, payrolls rose by a solid 215,000 in July, the Markit manufacturing Purchasing Manager’s Index (PMI) held at 53.8, services conditions PMIs rose to strong levels and vehicle sales rose more than expected. Meanwhile, the core private consumption deflator, which is the Fed’s preferred measure of inflation, remained low at 1.3% year on year in June. While the July labour market report met the Fed’s criteria for “some further improvement in the labour market” the continued weakness in wages growth didn’t add to confidence that inflation will pick up. So debate about the timing of the Fed’s first rate hike will continue to rage. Right here right now the probability of a September hike is running around 50%. By the time it actually happens it will be the most anticipated rate hike ever so should hardly be a surprise to anyone (except perhaps in terms of the precise timing).

- The US June quarter earnings reporting season has lost a bit of momentum in the last week or so and top line growth remains weak but it has still come in better than expected. We are now 90% done and 74% of companies have beat on earnings, 49% have beat on sales and earnings, growth expectations for the 12 months to the June quarter have improved from -5.3% at the start of July to -0.1%.

- Eurozone business conditions confirm little impact from the Greek debacle in July. Final estimates show just a minor fall in the composite PMI to a still solid 53.9, a level which along with various confidence indicators points to a further slight acceleration in the pace of economic growth. While the risk of periodic Greek blow-ups remains, the combination of attractive valuations, ongoing European Central Bank quantitative easing and improving growth continue to make Eurozone shares relatively attractive.

- Japanese recovery continues. While Japan’s services conditions PMI fell in July this was more than offset by a strong gain in its manufacturing conditions PMI leaving business conditions overall at a level consistent with continuing growth.

- China’s business conditions PMIs, partly highlight the adjustment taking place in the Chinese economy with the Markit manufacturing PMI at its lows for the last four years but the services PMI rising to around its highs for the last four years. So yes growth has slowed but not nearly as much as a focus on manufacturing alone might suggest.

Australian economic events and implications

- Australian economic data was mostly positive. June retail sales data were impressive contributing to strong June quarter real retail sales growth, manufacturing and services conditions PMIs both rose nicely in July, new home sales remain strong, housing finance bounced back in June led by owner occupiers, home price growth accelerated in July and employment growth was very strong. Against this, unemployment rose back to 6.3% re-establishing a rising trend, ANZ job ads fell in July, the trade deficit widened in June with net exports looking like they will detract solidly from June quarter gross domestic product (GDP) growth and the TD/Melbourne Institute Inflation Gauge indicated inflation remains low. The basic message remains one of continuing sub-par economic growth and low inflation.

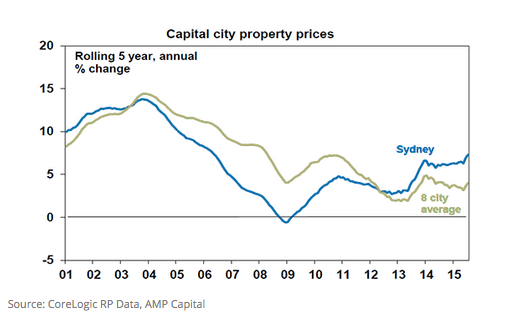

- In terms of home price growth, while Sydney and Melbourne are very strong, gains in the rest of Australia remain very modest running at just 0.9% year on year on average. Interestingly, there is a degree of mean reversion or catch up evident in the surging Sydney property market. As can be seen in the next chart, it underperformed over the 2003-2012 period and so the rebound in relative performance versus the rest of Australia since is partly making up for that.

- June half yearly profits. While the June half yearly earnings reporting season is underway, too few companies have reported so it’s far too early to draw any general conclusions, but it’s interesting that while Rio’s profits were down sharply they were stronger than expected and it continues to ramp up dividends which is appropriate as its hardly the time for miners to be ramping up investment, whereas ANZ’s capital raising and earnings update highlight the environment has become tougher for the banks.

What to watch over the next week?

- In the US, expect to see a rebound in July retail sales growth (Thursday) after June weakness and solid growth in industrial production, a rise in consumer confidence and low producer price inflation (all due Friday). The NFIB small business optimism survey and data on job openings and hirings will also be released.

- Eurozone June quarter GDP data (Friday) is likely to show a further slight pick-up in GDP growth to 0.5% quarter on quarter or 1.5% year on year, with Spanish growth out in front.

- In China, expect July activity data to show a slight further slowing in growth in industrial production to 6.6% year on year, but stable growth in retail sales of around 10.6% and fixed asset investment of around 11.5% (all due Wednesday). Growth in money supply, bank lending and credit is likely to slow from June levels but remain accommodative.

- In Australia, expect the July NAB business survey (Tuesday) to show a slight pull back in confidence and conditions reflecting the negative news around Greece and China at the time but the August consumer sentiment survey (Wednesday) to show a rise as the negative news abated. June quarter wages growth is expected to remain weak at around 0.5% quarter on quarter taking the annual growth rate to a new record low of 2.2% year on year. Speeches by RBA officials Lowe and Kent will be watched closely for any additional clues on the outlook for interest rates.

- The June half profit reporting season for Australian listed companies will start to ramp up with around 40 major companies reporting results, including JB HiFi, Cochlear, CBA, News Corp and Telstra. Profit growth for 2014-15 is likely to be around -1% as resource sector profits slump 28% thanks to the hit from lower commodity prices, but with the rest of the market seeing profit growth of around 9% as industrials ex financials benefit from low interest rates, the lower A$ and cost cutting. Key themes are likely to be: weak revenue growth, ongoing cost cutting, competitive pressures amongst consumer staples but tailwinds for building material companies and continued strength in dividend growth.

Outlook for markets

- Share markets are likely to remain volatile in the next few months as we are still going through a seasonally weak period of the year for shares, uncertainties remain regarding Chinese economic growth and a likely Fed interest rate hike lies ahead for later this year.

- But beyond the near term, the cyclical bull market in shares likely has further to go: valuations against bonds are good; economic growth is continuing at a not too cold but not too hot pace; and monetary conditions are set to remain easy. As such, share markets are likely to remain in a broad rising trend. Our year-end target for the ASX 200 remains 6000.

- Still low bond yields point to soft medium term returns from bonds, but it’s hard to get too bearish on bonds in a world of too much saving and spare capacity. Central banks won’t ratify a bond crash like in 1994, by raising interest rates aggressively.

- Notwithstanding the risk of a short term bounce from oversold levels, the broad trend in the A$ remains down as the Fed is likely to raise rates later this year whereas there is a 50/50 chance the RBA will cut again and the trend in commodity prices remains down. Our view remains that it is heading into the US$0.60s.

Source: AMP CAPITAL ‘Weekly Market Update’

AMP Capital Investors Limited and AMP Capital Funds Management Limited Disclaimer