Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

Weekly Market Update – 6th November 2023

Investment markets and key developments

Global share markets rebounded over the last week from oversold levels on the back of increasing optimism that the Fed has finished raising rates helped by soft US jobs data, strong US earnings results and the war in Israel being relatively contained so far. For the week US shares rose 5.9%, Eurozone shares rose 4.3%, Japanese shares rose 3.1% and Chinese shares gained 0.6%. The global rebound and falling bond yields saw the Australian share market rise 2.2%. 10-year bond yields mostly fell again helped by optimism that major central banks have finished raising rates, with the exception being Japanese bond yields which rose as the BoJ further loosened control over bond yields. Oil prices fell with the Israel/Gaza war being relatively contained so far. Metal and iron ore prices rose though. The $A rose above $US0.65 as the $US fell.

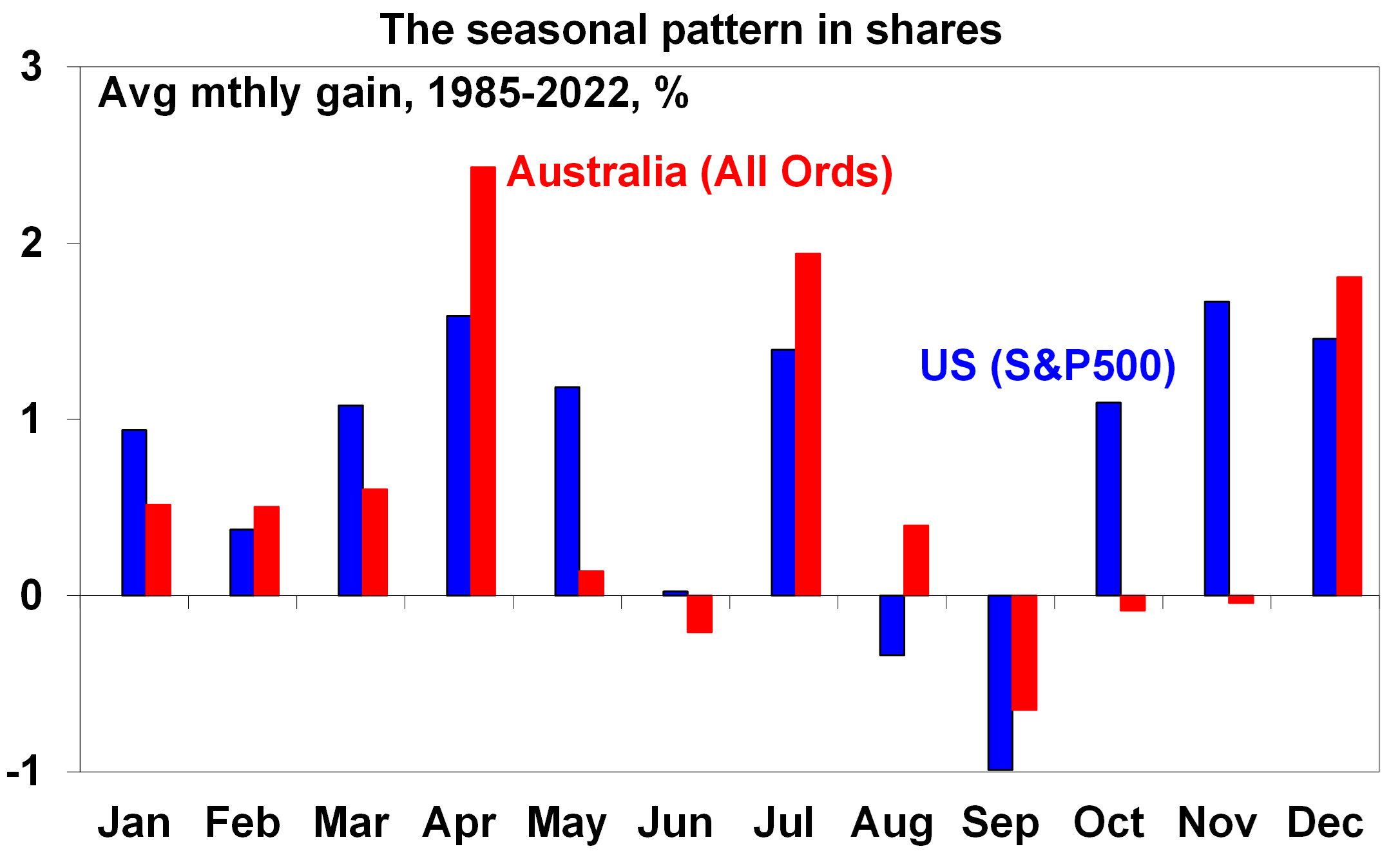

Shares have had a nice rebound over the last week from oversold levels and some positives may be starting to help: major central banks led by the Fed are increasingly looking like they are at the top on interest rates (the Bank of Japan and RBA are likely exceptions to this); inflationary pressures generally are continuing to recede; US earnings are coming in far better than expected; the $US looks to be rolling over which is a sign of “risk on”; and we are coming into what is often the strongest part of the year for shares from a seasonal perspective. November is seasonally the strongest month of the year in the US, albeit for Australia seasonal cheer often doesn’t kick in until December.

Source: Bloomberg, AMP

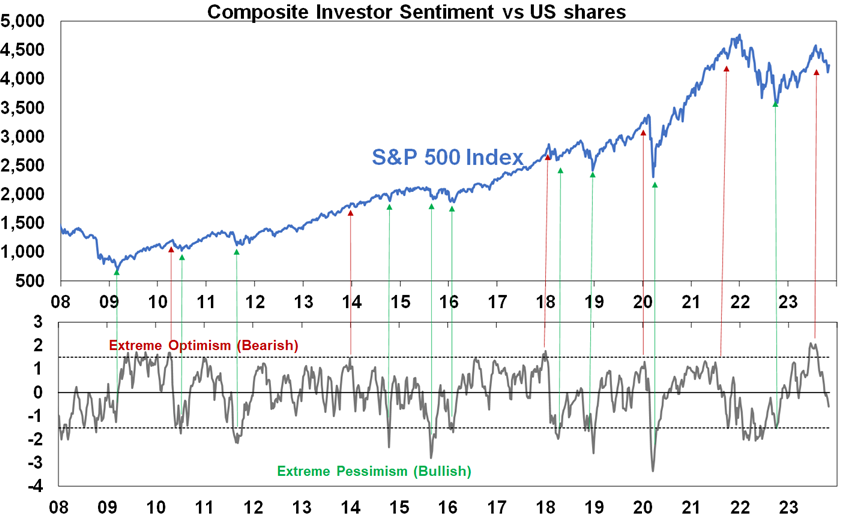

That said, there are still some significant downside risks to keep an eye on: it’s still early days in the latest war in Israel and the risk of a flare up to involve Iran and impact global oil supplies is high; the risk of recession next year remains high; the rise in US unemployment from 3.4% in March to now 3.9% would historically suggest a US recession may be near; uncertainty remains high around China’s property markets; high bond yields are still pressuring share market valuations and it’s hard to see bond yields falling much in the near term given where central bank policy rates are and if they do central banks might start tightening again; and investor sentiment is yet to fall to levels associated with major market bottoms (not that it always has too). So the ride for shares is still likely to remain volatile for a while yet.

Source: Bloomberg, AMP

The Fed has likely finished raising rates. As widely expected, the Fed left its Fed Funds rate on hold at 5.25-5.5%. While Fed Chair Powell indicated that the Fed is still not confident it has done enough and that it could still hike again, he also noted that the Fed is now “proceeding carefully”, acknowledged again that the rise in bond yields has tightened financial conditions and noted that the risks are “more two sided now”. Of course, this does not mean that the Fed has relaxed its high for longer message on rates. It’s still determined to get inflation down to target and conscious that the rise in bond yields over the last six months may reflect expectations of higher for longer policy rates so it may still have to sound tough for a while otherwise it risks seeing the financial tightening from higher bond yields reverse before it wants it too (as we have seen a bit in the last week). But the bottom line is that as long as growth slows after the surge last quarter and inflation continues to fall then it’s likely that the Fed is at the top. Slowing October jobs and wages growth and our US Pipeline Inflation Indicator continuing to point down for inflation are consistent with this.

The Bank of England also left rates on hold again at 5.25% but reiterated its high for longer message noting that “monetary policy is likely to need to be restrictive for an extended period”. Norway’s central bank also left rates on hold at 4.25%.

It’s likely that all developed country central banks have finished tightening with the probable exception of Japan and Australia. The Bank of Japan has yet to even start raising rates. However, it did take another baby step in that direction by further relaxing its cap on 10-year bond yields by dropping a pledge to buy bonds when the yield is at 1% to now describing 1% as just a “reference” suggesting it will tolerate a rise above 1%. This of course saw Japanese bond yields rise further. With core inflation spending more time above 2% a further removal of easy money is likely ahead of a rate hike next year. This will gradually reduce one source of demand for US Government bonds, but the impact will be modest as Japanese bond yields will still be very low.

In Australia, we expect that the RBA will raise its cash rate again on Tuesday by another 0.25% taking it to 4.35%. In the last few weeks, the RBA has warned that it has a “low tolerance” for a slower fall in inflation than expected and Governor Bullock noted the RBA “will not hesitate to raise the cash rate further if there is a material upward revision to the outlook for inflation”. While headline inflation in the September quarter was close enough to RBA forecasts, underlying inflation was about 0.4% higher and that along with ongoing signs of sticky services inflation and stronger than expected demand on the back of surging population growth is likely to drive an upwards revision to its inflation forecasts that its likely to regard as “material” and hence justification for another rate hike. The IMF often reflects official thinking and its upwards revision to its inflation forecasts for Australia and call for the RBA to raise rates further after having just been in Australia and met with the RBA may reflect the RBA’s own views.

However, while we expect another rate hike on Tuesday it looks like a close call for three key reasons:

- While September quarter underlying inflation was worse than expected and it’s important to keep long term inflation expectations down, our own view is that the RBA should give more time for the lags with which rate hikes impact the economy to play out and so should remain in wait and see mode for longer. This is particularly so given faltering household spending on a per capita basis, 1 in 7 households with a mortgage already being cashflow negative based on RBA analysis, inflation still falling and likely on our Inflation Indicator to fall further and increasing uncertainty globally. Continuing to raise rates will further ratchet up the already high risk of recession next year. It’s possible that the RBA could come to a similar view.

- The RBA may conclude that any upwards revision to its inflation forecasts is not “material” like Treasurer Chalmers has stated.

- Finally, the RBA’s influence on the Board is arguably a bit less at present and political pressure on it looks to be intense. A new Deputy Governor has not yet been appointed so Governor Bullock will be on her own at the Board meeting in terms of those having a vote, recent Government appointees to the Board may be a bit less hawkish and the Treasury Secretary who is on the Board may have a similar view on the inflation outlook as the Treasurer. The RBA may also want to be a bit more cautious given upcoming implementation of some parts of the recent RBA Review and discussion over the wording of its objectives.

The final point suggests a bit more politics around the decision than normal. Of course, this could go the other way with the Governor/RBA wanting to underline its independence in the face of perceived pressure from the Government, but all up we see the decision as finely balanced and put the probability of a Melbourne Cup Day hike at 55%. In fact, while most economists expect a rate hike the money market puts the chance of a hike on Tuesday at 48%, but with a 100% chance by February. Either way we expect the RBA to reiterate that “some further tightening of monetary policy may be required.”

Having just seen Paul McCartney’s Got Back concert I have to give him a mention this week. He was the first pop star I really became a fan of (after hearing Live and Let Die on 2SM) and I am always amazed at the quality of the material he produces, his constant chirpiness, optimism and enthusiasm and his commitment to his incredible talent. Even his lesser albums (like Press to Play) are better than most ever produce. Being a Beatle and having put out something like 50 albums since from McCartney I in 1970 to McCartney III in 2020 he has a lot of material to draw on and so his current tour only covers a fraction of that even though it had about 60 songs over three hours. That said he had a great mix of Beatle classics including Something with the ukulele at the start as he has been playing since “Concert for George”, Wings songs and solo year’s songs including Queenie Eye and Fuh You. I thought his 2017 concert was great, but this one was even better. Well worth checking out the fan videos on U Tube. He said in his book The Lyrics that “Tragedy can happen, but the page will turn, and I love that. Realising that I have reach in the world, that people listen to my stuff, I feel a responsibility to be optimistic till I no longer can be. That attitude naturally creeps into my songs, and I think it would be nice if they make people take a positive path.” I like that!

Economic activity trackers

Our Economic Activity Trackers are still not showing anything decisive in terms of the direction of economic activity.

Levels are not really comparable across countries. Based on weekly data for eg job ads, restaurant bookings, confidence and credit & debit card transactions. Source: AMP

Major global economic events and implications

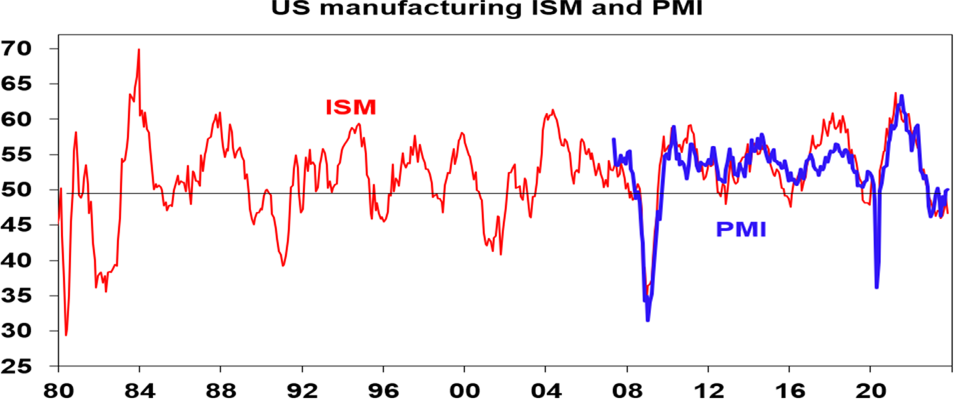

US economic data was mostly on the soft side. Home prices continued to rise in August. But the ISM manufacturing conditions index fell to a weak reading of 46.7 and prices paid remaining low and consumer confidence fell.

Source: Bloomberg, AMP

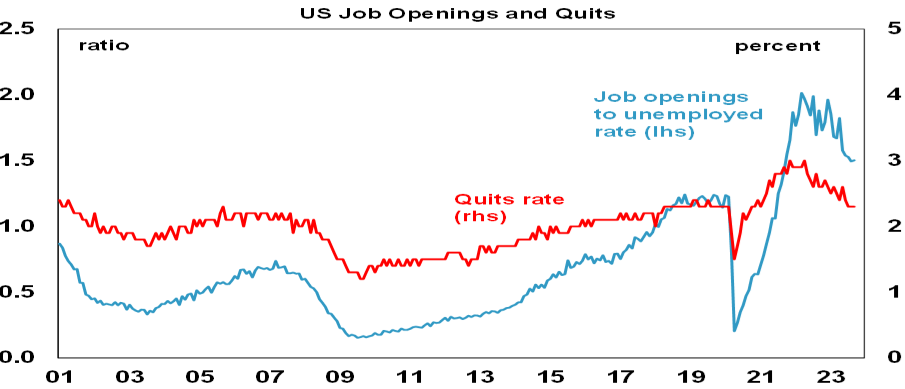

US labour market indicators continue to cool. October jobs data showed clear signs of slowing with a resumption of the downtrend in payroll growth, falling hours worked, rising unemployment and slowing wages growth. Initial jobless claims remain low but rose again and look to be starting to trend up and continuing jobless claims rose for the sixth week in a row suggesting those who lose their job are finding it harder to get a new one. The Challenger survey of hiring plans remains weak. Job openings rose but only from a downwardly revised level for August and the quits and hiring rates were flat, but with all in a downtrend consistent with a still strong but cooling jobs market. Furthermore, US labour productivity rebounded 2.2% over the year to the September quarter, pushing growth in unit labour costs down to 1.9%yoy, which is consistent with the Fed’s 2% inflation target. Pity Australia’s productivity performance is far weaker!

Source: Bloomberg, AMP

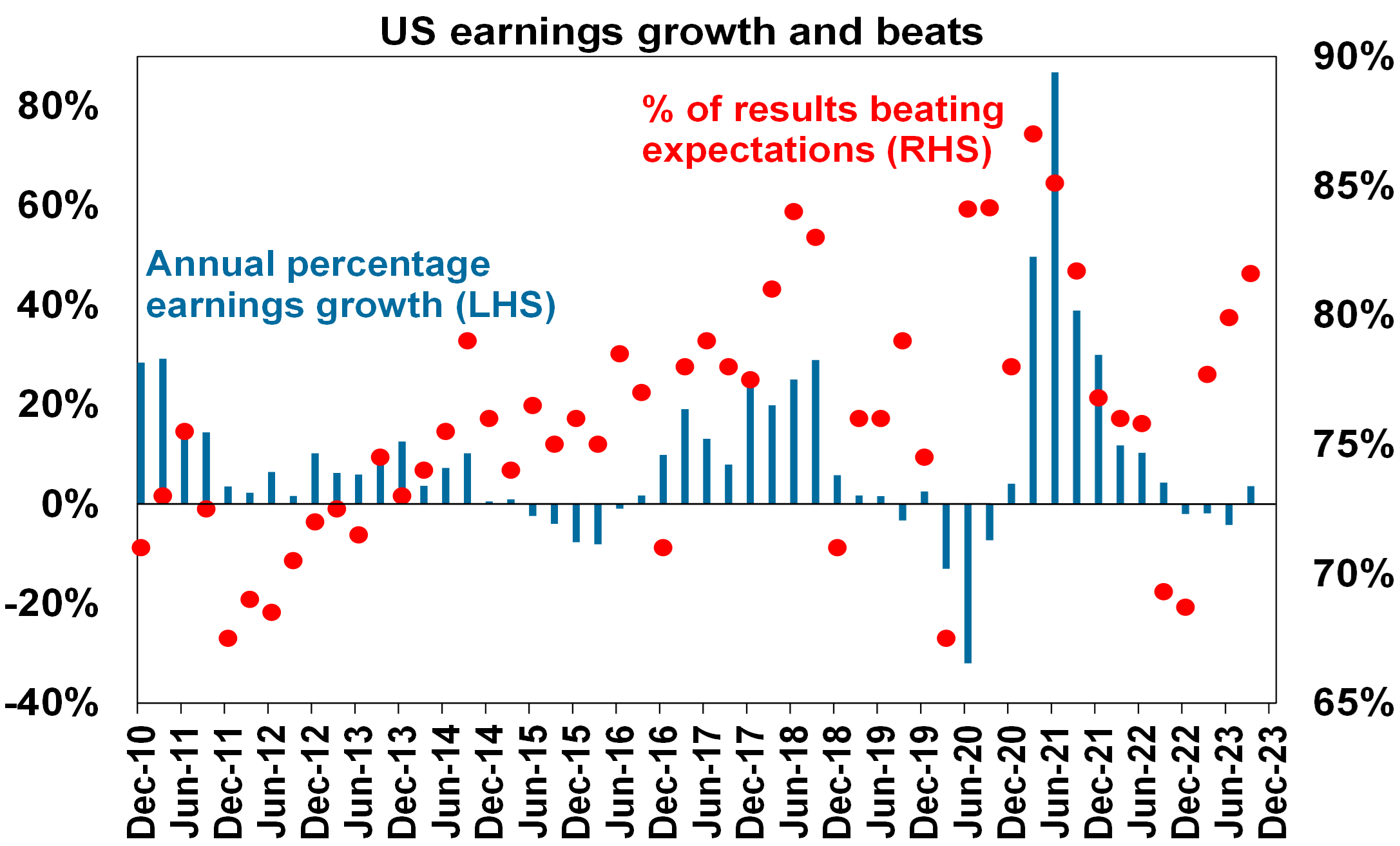

US earnings beats strongest in two years. 81% of US S&P 500 companies have now reported September quarter earnings with 81.9% beating expectations, well above the norm of 76% and the strongest in 2 years. Earnings growth for the quarter has improved to +3.6%yoy from +0.6% at the start of the reporting season.

Source: Bloomberg, AMP

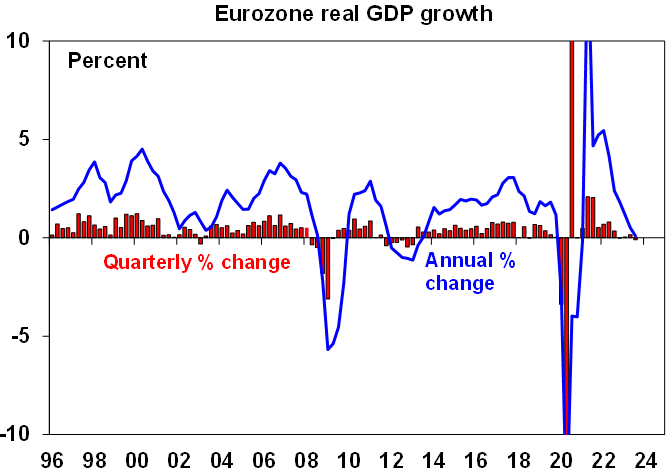

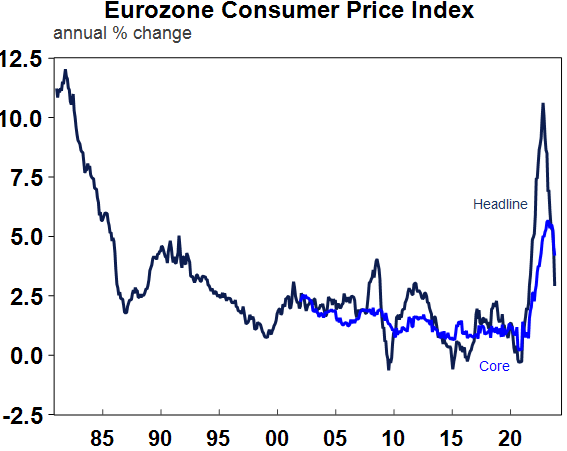

Falling GDP and inflation will keep the ECB on hold. Eurozone GDP fell 0.1% in the September quarter. The good news is that CPI inflation has fallen to 2.9%yoy (from a peak last year over 10%).

Source: Bloomberg, AMP

Source: Macrobond, AMP

Japanese data for September was mixed with industrial production up for the first time in three months but still softer than expected and unemployment falling to 2.6% but retail sales and housing starts weaker than expected.

New Zealand jobs data was weak in the September quarter with employment down and unemployment up more than expected to 3.9%, supporting expectations that the RBNZ will hold its cash rate at 5.5% before rate cuts in the second half next year.

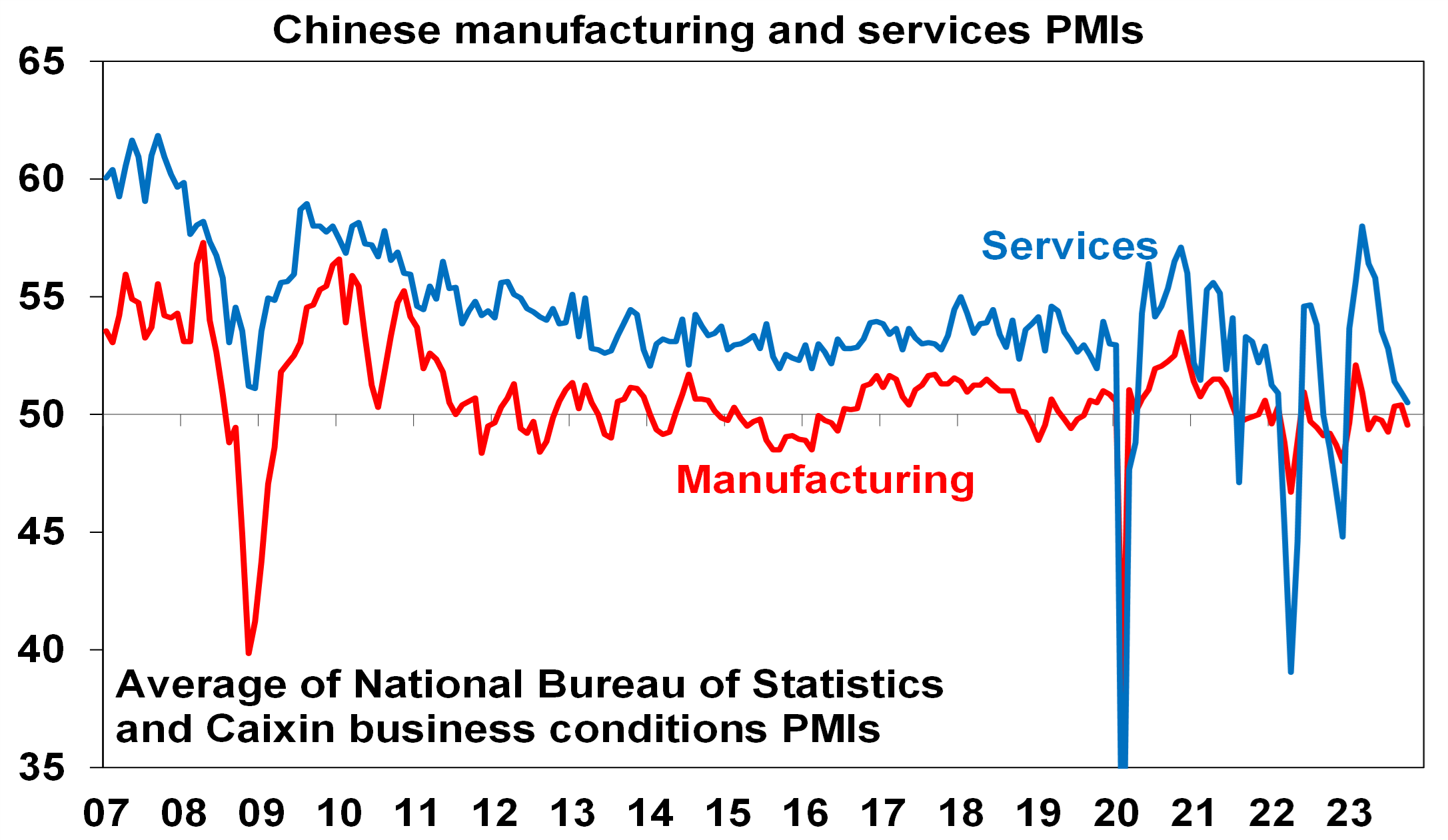

After a brief stabilisation most Chinese business conditions PMI’s fell again in October suggesting growth may have started to weaken again. Signs of this may have helped drive the recent announcement of more fiscal stimulus.

Source: Bloomberg, AMP

Australian economic events and implications

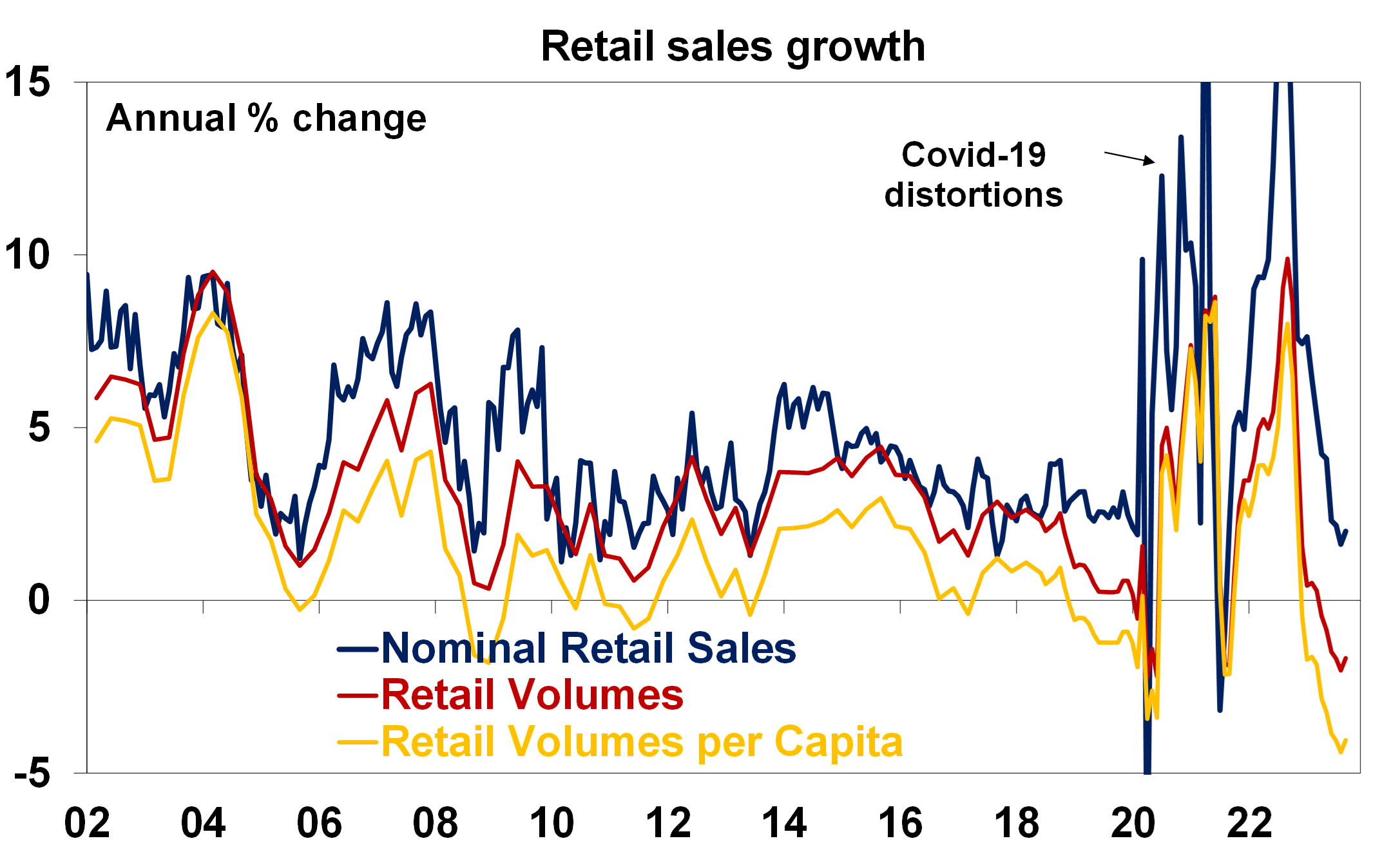

Australian economic activity data over the last week was a mixed bag. Nominal retail sales rose a far stronger than expected 0.9% in September and this pushed real retail sales up 0.2% in the September quarter. But this partly looks temporary being boosted by warmer than normal weather, the new iPhone, energy goods rebates in Queensland and the impact of the switch to 60-day prescriptions from 30 days and the Women’s World Cup all of which suggests a fall back this month. But it’s also worth noting that record population growth is helping boost retail sales – despite the rise in retail sales volumes in the September quarter, per person they are down around 0.4%qoq and by 4%yoy highlighting that the hit to spending from higher interest rates and cost of living pressures is occurring but it’s being masked by rapid population growth. So were it not for the boom in population growth things would be a lot weaker in Australia. Of course, the RBA will be more interested in total demand growth, so the population driven boost to spending arguably adds to the case for another rate hike. However, many homeowners with a mortgage who have already paid top dollar to get into the property market because of a shortage of homes won’t be too impressed to hear that rapid population growth is adding to their mortgage rate!

Source: ABS, AMP

Meanwhile, the goods trade surplus fell sharply in September. This was driven by a large fall in non-monetary gold exports and surge in transport equipment imports (notably aircraft imports up 75%) both of which are volatile and look likely to reverse this month. Net exports are estimated to detract around 0.3 percentage points from September quarter GDP growth.

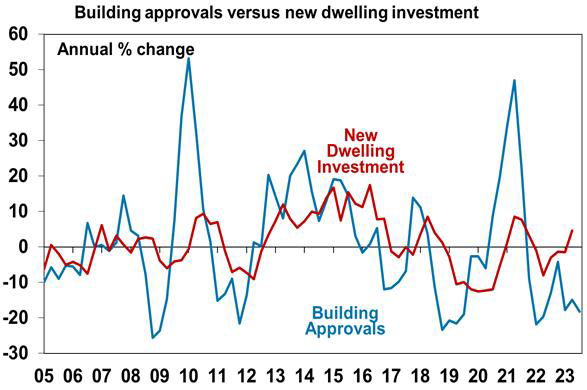

Building approvals fell in September after a rise in August. They look to have bottomed, but still point to weak home building ahead which doesn’t augur well for the housing shortage.

Source: Bloomberg, AMP

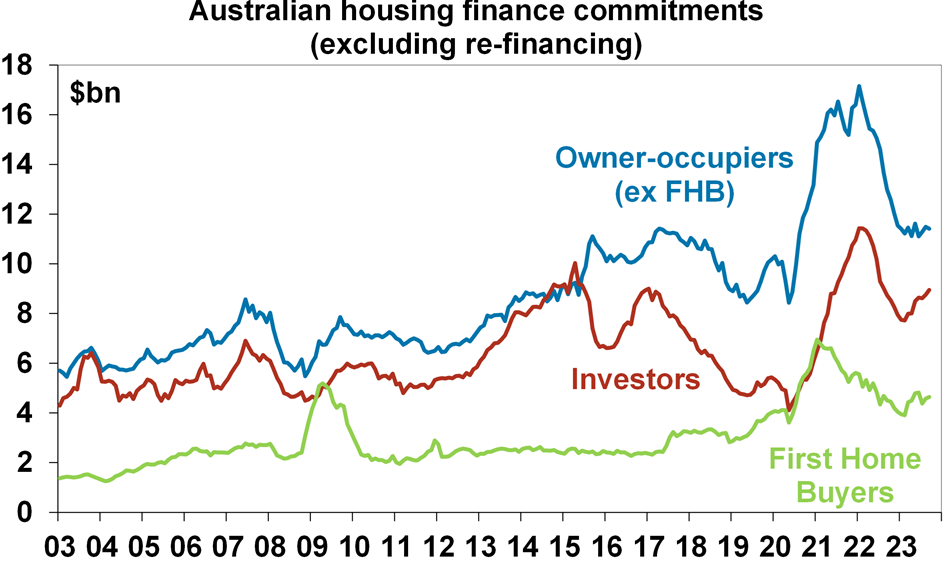

Housing finance rose slightly in September, but it remains weak considering that home prices are back to near record highs, but housing finance is well below the 2021-22 housing boom peaks. Interestingly other personal credit growth has picked up – possibly reflecting rising household financial stress.

Source: ABS, AMP

Finally, CoreLogic data showed national home prices up another 0.9% in October, leaving them 0.5% from a record high. The chronic housing shortfall on the back of record immigration levels is continuing to dominate, although the hit from high interest rates which is continuing to feed through with a lag suggests downside risks to prices next year. Interestingly price growth already appears to have peaked, auction clearance rates have been trending down since May and housing finance is still subdued suggesting demand is struggling to keep up with a slight rise in listings since mid-year.

What to watch over the next week?

Chinese trade data for October (Tuesday) is likely to show a further slowing in the rate of decline in exports and imports and inflation data (Thursday) is likely to show the CPI back in deflation at -0.2%yoy and producer prices down -2.9%yoy.

In Australia, as noted earlier, the RBA is expected to raise the cash rate for the 13th time on Tuesday by 0.25% taking it to 4.35%, but it’s a close call. The RBA’s Statement on Monetary Policy (Friday) will provide more detail around its thinking but in particular will likely see upwards revisions to its inflation forecast for this year (partly due to the upside surprise already seen in the September quarter) and next but probably still have inflation back in the target range by the end of 2025. GDP forecasts out to mid next year are also likely to be revised up slightly reflecting upwards revisions by the ABS and stronger population growth.

Another 0.25% rate hike will mean an extra $100 a month in additional debt servicing payments on a $600,000 loan and would take the total increase since April last year to an extra $1435 a month or $17,220 a year. Even if a borrower has secured a 0.5% cut to their mortgage rate their payments would be up an extra $14,856 a year since April last year.

Outlook for investment markets

The next 12 months are likely to see a further easing in inflation pressure and central banks moving to get off the brakes. This should make for reasonable share market returns, provided any recession is mild. But for the near-term shares are at high risk of a further correction given high recession and earnings risks, the risk of high for longer rates from central banks, high bond yields which have led to poor valuations and the risk that the war in Israel escalates to include significant oil producing countries like Iran.

Bonds are likely to provide returns above running yields, as growth and inflation slow and central banks become dovish but given the recent rebound in yields this may be delayed a few months.

Unlisted commercial property and infrastructure are expected to see soft returns, reflecting the impact of the rise in bond yields on valuations. Commercial property returns are likely to remain negative as “work from home” continues to hit space demand as leases expire.

With an increasing supply shortfall, our base case remains that home prices have bottomed with more gains likely next year. However, uncertainty around this is high given the lagged impact of interest rate hikes and the likelihood of higher unemployment.

Cash and bank deposits are expected to provide returns of around 4-5%, reflecting the back up in interest rates.

The $A is at risk of more downside in the short term on the back of relatively lower short term interest rates in Australia and global uncertainties, but a rising trend is likely over the next 12 months, reflecting a downtrend in the overvalued $US and the Fed moving to cut rates.

Source: AMP ‘Weekly Market Update’