Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

Weekly Market Update – 6th March 2015

Investment markets and key developments over the past week

- While European shares gained another 0.7% over the past week helped by continued good economic data and Japanese shares rose 0.9%, US shares fell 1.6% on the back of US Federal Reserve (Fed) worries after strong payroll data, Chinese shares fell 2.1% and Australian shares lost 0.5%. Australian shares fell back after almost touching the 6000 mark for the ASX 200, partly in response to the Reserve Bank of Australia (RBA) leaving interest rates on hold. Bond yields rose led by US bonds as Fed rate hike expectations were pulled forward, commodity prices fell with the iron ore price falling below US$60/tonne and the US$ continued to rise, which weighed on the A$.

- The February payroll employment report in the US was strong and confirms that the Fed is moving faster towards a rate hike than market expectations have been allowing for. Hence US bond yields are now backing up sharply after their rally early this year. Payrolls rose more than expected 295,000 and unemployment fell to 5.5%. While the Fed may soon lose its “patience” on interest rates, weak wages growth of just 2% year on year will keep the debate raging at the Fed as to whether the first hike will come in June or September.

- While the US is moving towards a rate hike and Brazil hiked its official interest rate to 12.75% over the last week, the predominant global trend remains towards global monetary easing with India and Poland cutting interest rates hot on the heels of China. In fact two thirds of the world’s population saw an interest rate cut in the last week. Brazil’s counter trend rate hike reflects the mess its economy has sunk into after years of populist policies that have led to chronic inflation and poor productivity.

- China’s announcement that its growth target for this year is “about 7%” was hardly surprising. This in fact was already our own forecast and the IMF’s forecast is 6.8%. The Chinese Government is simply managing a downshifting in growth to a more sustainable pace. Don’t forget though that 7% is still world beating growth and given the rapid growth in the Chinese economy in recent times 7% growth is equivalent to around 14% growth about ten years ago in terms of China’s demand for global resources.

- In Australia, the latest Intergenerational Report (IGR) provided yet another reminder of the need to boost productivity growth and bring the budget deficit under control before the aging population really starts to blow the deficit and net debt out (to 6% and 60% respectively of Gross Domestic Product (GDP) by 2055 on unchanged policies). However, it really tells us nothing that the first IGR in 2002 didn’t. The sad thing is that since the first IGR (which had similar deficit and net debt projections over 40 years) we haven’t really made a lot of progress in either boosting productivity or controlling the budget despite immense help in relation to the budget from the mining boom. Hopefully, we will start to see more progress out of Canberra, but this is likely to require a political consensus for change that currently appears to be lacking.

- While the RBA left interest rates on hold, its post meeting Statement indicated a clear easing bias stating “further easing of policy may be appropriate” and with economic growth remaining sub-par we expect it will act on this bias in either April or May.

Major global economic events and implications

- US economic data was mixed with soft readings for the Institute for Supply Management (ISM) manufacturing conditions index, construction spending, vehicle sales and wages growth but strong reads for the services conditions ISM and Purchasing Managers Index (PMI) and employment. The overall impression remains that the US economy is solid but not taking off. The Fed is clearly getting closer to its first rate hike, but while February employment growth has swung the dial back towards a June move, weak wages growth may still see the Fed wait till its September meeting.

- The strength of the US financial system is evident from the Fed’s latest bank stress tests which found that all 31 banks tested had sufficient capital to survive a prolonged economic downturn.

- Good news continues to flow out of Europe. While Greek funding remains a bit of a short term issue, Eurozone economic data continues to improve with strong January retail sales, a slight fall in unemployment and some lessening in deflationary momentum. Thanks to lower oil prices, the lower euro and quantitative easing (QE) even the European Central Bank (ECB) is starting to feel more upbeat and in fact has raised its growth forecasts for this year and next to 1.5% and 1.9% respectively. They could even be too pessimistic.

- India saw some more good news with a Budget focussed on infrastructure spending in the context of ongoing fiscal consolidation, the formal adoption of inflation targeting for the Reserve Bank of India and another interest rate cut. While Indian shares seem to be always expensive its impressive fundamental developments and strong earnings growth help support this.

Australian economic events and implications

- Australia saw a data avalanche, with the key message being that growth remained sub-par at 0.5% quarter on quarter or 2.5% year on year in the December quarter. On the one hand the Australian economy has not had the recession some feared following the end of the mining boom and non-mining activity has accelerated led by home construction with record high building approvals in January indicating that there is more to go. On the other hand growth is clearly sub-par with mixed PMI readings and some loss of momentum in retail sales indicating that more help from lower interest rates and a lower A$ is needed. Fortunately inflation remains benign according to the TD Securities Inflation Gauge and February house price data from RP Data shows that house price gains are concentrated in Sydney with other cities seeing far more modest gains all of which suggests that the RBA has plenty of flexibility on rates.

- One stat caught our attention as interesting over the last week. Despite the collapse in export prices the current account deficit at 2.4% of GDP is about as low as it’s ever been since the early 1980s. This is a good sign that the slump in commodity prices has not made the economy vulnerable to a withdrawal of foreign capital. In fact it seems to be becoming less vulnerable.

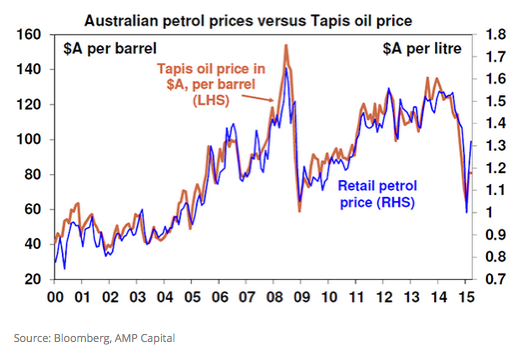

- What’s happened to Australian petrol prices? Yes the bounce in the Tapis crude oil price to US$63/barrel (from a January low of US$47/barrel) has justified a bounce in the petrol price but even when allowing for the Australian dollar around $0.78 my calculations suggest the petrol price should be around $1.18/litre not the A$1.32/litre I have been seeing in Sydney this past week. Something slippery going on here.

What to watch over the next week?

- In the US, expect a 0.6% gain in February retail sales (Wednesday) and a modest bounce in producer price inflation (Friday) on the back of a bounce in gasoline prices. Data for small business optimism and consumer confidence will also be released. While the US Government will hit its debt ceiling again on March 15, the Federal Government looks to have sufficient resources to operate out to October/November and when actually needed Congress is likely to increase the ceiling as Republicans are unlikely to want a re-run of the 2013 debt ceiling episode where they got the blame given 2016 is a presidential election year.

- In China, expect February data to show that inflation (Tuesday) remains low and that growth in retail sales, industrial production and fixed asset investment (all Wednesday) have slowed slightly. Credit and money supply growth will also be released. The net outcome will likely be ongoing pressure for further monetary easing.

- In Australia, expect business conditions and confidence in the February NAB survey (Tuesday) and consumer confidence (Wednesday) to have remained subdued, housing finance (Wednesday) to fall 1% after a solid gain in December and a modest 5000 gain in jobs (Thursday) to see unemployment unchanged at 6.4%. The ANZ job ads survey will also be released Monday.

Outlook for markets

- After recent strong gains shares are at risk of a correction with Fed progress towards a rate hike being the main potential trigger. However, the broad trend in shares is likely to remain up as: valuations, particularly against bonds, are good; economic growth is continuing; and monetary policy is set to remain easy with further easing in Europe, Japan, China and Australia and only a gradual tightening in the US. As such, share markets are likely to see another year of reasonable returns.

- Having been rejected by the 6000 level (at 5996.9 to be precise for the ASX 200), Australian shares are also vulnerable to a short term correction particularly with the forward PE around 16 times which is above its long term average of 14 times leaving it vulnerable to any bad news. Iron ore below US$60/tonne certainly won’t help. A correction would likely then set the market up for a sustainable re-test of the 6000 level a few months down the track.

- Commodity prices have been seeing a consolidation after becoming very oversold, with oil looking like it may have built a short term base around US$45/barrel. However, excess supply is expected to see them remain in a long term downtrend.

- Low bond yields point to soft medium term returns from sovereign bonds, but it’s hard to get too bearish on bonds in a world of too much saving, spare capacity and deflation risk.

- Short term gyrations aside, the downtrend in the A$ is likely to continue as the US$ trends up, the RBA continues to cut rates and reflecting the long term downtrend in commodity prices and Australia’s high cost base. We expect a fall to US$0.70 this year, with the risk of an overshoot. However, the A$ is likely to be little changed against the Yen and Euro.

Source: AMP CAPITAL ‘Weekly Market Update’

AMP Capital Investors Limited and AMP Capital Funds Management Limited Disclaimer