Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

Weekly Market Update – 4th September 2015

Investment markets and key developments over the past week

- While most share markets managed to remain above recent lows they had a volatile week, falling back again thanks largely to ongoing worries about Chinese economic growth and the Fed, with indications from the ECB that it is prepared to ease further if needed – “the Draghi put” – providing only partial support. Over the week US shares lost 3.4%, Eurozone shares fell 2.9%, Japanese shares fell 7%, Chinese shares fell 2.2% and the Australian share market lost 4.2%. Commodity prices were mixed, with oil up but metals down and the combination of global worries and poor Australian growth saw the $A fall to just above $US0.69 for the first time since 2009. Bond yields declined as deflation fears and safe haven demand persisted.

- The much anticipated August US jobs report keeps the prospect of a September Fed rate hike on the table, but doesn’t settle the debate. Payrolls rose a less than expected 173,000, but against this the previous months were revised up and unemployment fell to 5.1%. Wages growth edged up but remains very low at 2.2% year on year. Taken on its own, the jobs report would support a Fed rate hike this month, but it’s not strong enough to offset the downside threats to US growth and inflation coming from global uncertainties, including the risks to Chinese growth, weak commodity prices and now the prospect of more ECB easing putting more upwards pressure on the value of the $US. As a result, the US bond market’s implied probability of a September hike of around 30-35% sounds about right. It would also seem unlikely for the Fed to want to hike at this point with the markets seemingly unprepared for it, given the uncertainties around the outlook.

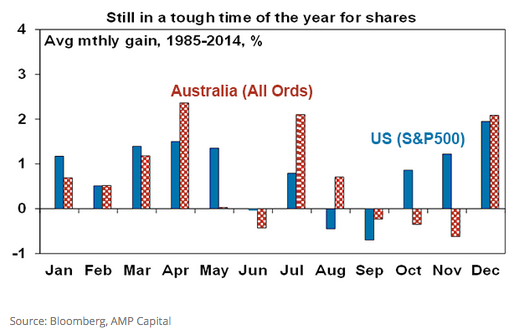

- Our assessment remains that the next few months are likely to remain rough for shares as September and October are often tough months and the worries about China and the Fed are likely to linger for a while. As a result, it’s still too early to be confident we have seen the low.

- Beyond the uncertain near term environment we expect to see the usual December quarter seasonal strength helped along by much improved valuations, increasing confidence that China has got its growth under control and investors getting more comfortable that the Fed is not going to do anything to upset US/global economic growth.

- One thing that will ultimately help the Australian economy and share market is the continuing plunge in the value of the Australian dollar. When it comes to currency forecasting J.K Galbraith’s observation that “there are two kinds of forecasters: those who don’t know, and those who don’t know they don’t know” is particularly pertinent. So I have to be humble and admit that I don’t have a clue how low the $A will ultimately go. But my analysis indicates that – in the context of commodities being in a long-term downtrend, the Australian economy struggling and the interest rate gap in favour of Australia likely to narrow further – the $A has a lot more downside. Having broken below $US0.70, the $A is expected to fall to $US0.60, and possibly fall even further.

- The plunging $A which is now down 37% against the $US since its 2011 high – is certainly bad news if you are planning an overseas holiday or if you do a lot of purchases online at offshore websites, but that’s the point. Its forcing Australian’s to think about holidaying more in Australia, it’s helping drive a return in foreign tourists and foreign students to our universities and its turning Australians off their love affair with shopping overseas which is good for our retailers. Manufacturers who survived the high $A years will likely now survive and hopefully prosper and farmers and miners will get a benefit when their $US earnings are translated back into Australian dollars. And at the same time it’s not exactly causing a surge in imported inflation. So on balance a lower $A is just what Australia needs right now to help rebalance the economy in the face of the mining downturn.

Major global economic events and implications

- US economic data was mixed with a fall in the much watched ISM manufacturing conditions index for August and slightly softer than expected employment but stronger than expected construction spending and vehicle sales, continued strong readings for the ISM services conditions index, a narrowing in the trade deficit for July and a further fall in unemployment. The Fed’s Beige Book of anecdotal evidence indicated “modest to moderate growth” with “slight to moderate” wages pressure and “stable” prices. Cutting through the volatility the US economy looks to be continuing to grow somewhere around 2-2.5%, which is good but a long way from booming.

- As expected the ECB left monetary policy unchanged at its meeting, but in response to downwards revisions to growth and inflation forecasts and global uncertainties has adopted a strong easing bias with a “willingness, readiness and capacity to act”, suggesting that if the downside risks don’t recede soon an expanded quantitative easing program could be announced before the end of the year. Eurozone inflation was a touch stronger but still well below target providing plenty of motivation for the ECB to do more if global risks increase. The good news though is that despite all the uncertainty lately the Eurozone composite business conditions PMI for August was actually revised up to its highest level for this recovery.

- China’s business conditions PMI’s added to concerns about Chinese economic growth with the official manufacturing PMI down slightly in August and services PMIs also down. The falls were not dramatic and in normal times would not have had a huge impact but with so much interest in China now they served to rattle global share markets again. Meanwhile, the risks of a property crash last year’s big China worry continue to recede with home prices up in August for the fourth month in a row led by Tier 1 cities.

Australian economic events and implications

- In Australia the good news was that GDP growth did not have a feared dip into negative territory in the June quarter. The bad news was that at just 0.2% quarter on quarter it came pretty close and only avoided it thanks to a surge in public spending. With detractions from trade and inventories unlikely to be repeated in the current quarter, growth should bounce back a bit but only to around the average pace of the last year of 0.5% qoq or 2% yoy as the slump in mining investment continues to unfold. July/August data so far provides a rather messy read: the trade balance improved in July; building approvals remain strong but increasingly look to have peaked; and July retail sales fell. Manufacturing and services PMIs both rose in August to solid levels but then again there have been a few temporary spikes in these PMIs over the last few years. The overall impression is that annual growth looks like it will be stuck around 2% for some time. With this being well below potential (even if potential is now just 2.75%) spare capacity evident in rising unemployment will continue to build. So the economy is likely to need more help.

- With fiscal stimulus seemingly ruled out due to the focus on budget repair and with seemingly little appetite for serious economic reforms the pressure will fall back on the RBA to cut rates further and on the $A to continue to slide. Low inflation pressures according to the TD Securities Inflation Gauge and possible signs that APRA’s measures to cool property investors are showing up in slowing home price gains suggest that the RBA will have the flexibility it needs to move again. While the RBA’s post September meeting statement indicated it was comfortably on hold for now, it’s expected to resume easing by year-end with the November meeting being the one to watch or early next year.

What to watch over the next week?

- In the US, it will be a relatively quiet week on the data front with data for small business confidence (Tuesday), labour market indicators (Wednesday) and producer prices and consumer confidence (Friday). Expect producer price inflation to have remained benign.

- The big focus internationally is likely to be on Chinese economic data for August. This is expected to show continued softness in exports and imports (Tuesday), a further rise in headline inflation (Wednesday) to 1.9% year-on-year due to higher pork prices but non-food inflation remaining around 1.1% year-on-year and producer prices falling around 5.5% and a stabilisation/slight improvement in growth in industrial production, retail sales and investment (Sunday). Money supply and credit data will also be released.

- In Australia, expect China/global uncertainties to have weighed on business confidence (Tuesday) and consumer confidence (Wednesday), July housing finance to have risen slightly (also Wednesday) and August employment data to be flat with unemployment remaining at 6.3% (Friday). A speech by RBA Deputy Governor Lowe (Wednesday) will also be watched for any clues on interest rates.

Outlook for markets

- Share markets could still see more volatility in the next month or two as we are still in a seasonally weak period of the year for shares, uncertainties regarding China and the emerging world are likely to linger and uncertainty still remains around the Fed.

- But beyond near term uncertainties we see the cyclical bull market in shares as likely to resume: share market valuations against bonds are now even better; monetary conditions are set to remain easy, with the latest global growth scare likely to drive further global monetary easing and see the Fed delay raising rates yet again. This in turn should help see the global economic recovery continue. Finally, investor sentiment has deteriorated rapidly into the sort of pessimism that provides great buying opportunities. As such, despite the recent set-back, developed country share markets are likely to remain in a broad rising trend.

- Low bond yields point to soft medium term returns from bonds, although the recent share market downswing, which saw bonds rally, provides a reminder that government bonds remain a great portfolio diversifier.

- Notwithstanding occasional bounces, the broad trend in the $A is likely to remain down as the Fed is still likely to raise rates sometime in the next six months despite ongoing delays, whereas the RBA is likely to cut rates again and the trend in commodity prices remains down. Having broken through $US0.70, the $A is expected to fall to $US0.60 in the next year or so, with the risk that it will go even lower.

Source: AMP CAPITAL ‘Weekly Market Update’

AMP Capital Investors Limited and AMP Capital Funds Management Limited Disclaimer