Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

Weekly Market Update – 4th March 2016

Investment markets and key developments over the past week

- The past week has seen the recovery in risk assets continue, with shares pushing higher, bond yields backing up, credit spreads narrowing, commodities rebounding and even the A$ pushing back over US$0.74. For the week US shares rose 2.7%, Eurozone shares gained 3.5%, Japanese shares rose 5.1%, Chinese shares rose 3.9% and Australian shares gained 4.3%. From their recent lows US and global shares are up 9%, Australian shares are up 7%, oil is up 37%, the A$ is up 8% and iron ore is up 34%. Maybe these rallies are telling us that all the handwringing over global growth was overdone.

- So what’s helping drive the rebound in shares and other risk assets? It’s a whole bunch of things.

- First, while global growth looks to have slowed a bit it’s not crashing. This is most evident in the US where economic data suggests no sign of the recession share markets seemed to be moving to factor in earlier this year. This was highlighted by a “just right” jobs report for February which saw payrolls up 242,000, telling us the economy remains solid, but at the same time rising labour force participation and slowing wages growth indicating plenty of scope for the US Federal Reserve (the Fed) to hold back in raising interest rates.

- Second, central banks are helping sooth market fears. In the past week, Federal Reserve Bank of New York President, William Dudley, was dovish on interest rates indicating concern about inflation expectations and an awareness of the impact of global developments adding to confidence that the Fed won’t be hiking rates at its March meeting. In addition, the People’s Bank of China relaxed monetary policy again by cutting banks’ required reserve ratios.

- Thirdly, policy uncertainty in China appears to have settled down, helped in particular by relative stability in the value of the renminbi (after its depreciation earlier this year was a major factor in unnerving investors).

- Finally, here in Australia, economic growth surprised on the upside allaying fears about local banks and the housing market.

- Of course, it’s still too early to now expect smooth sailing (to the extent financial markets are ever smooth anyway) as fears around the Fed and global growth are likely to continue to periodically test the bulls and give us volatility. But at least things look a lot less bleak than they did in the dim dark days of the northern hemisphere winter.

- There was one development over the past week that was a bit concerning the rise and rise of Donald Trump. Post the Super Tuesday primary votes it’s more and more likely it will be a Clinton versus Trump contest in the final vote later this year. Trump is still only getting 30-40% of the Republican primary vote, but the failure of the “not-Trump” Republican vote to clearly settle on one candidate is working in his favour.

- A Clinton presidency would probably mean more of the same, particularly with a Republican congress likely to help keep policy rational. What is less clear is how a Trump presidency would pan out. Apart from a number of whacky outbursts, it’s hard to know precisely what his policies as president would be. Hopefully Congress would keep him on a sensible path if he were to gain the presidency.

Major global economic events and implications

- US economic news was good with a gain in the ISM manufacturing conditions for February of 1.3 points to 49.5, with new orders and the ISM non-manufacturing figures remaining solid, construction spending gaining more than expected in January and good February jobs data.

- Eurozone retail sales for January rose by more than expected in January, unemployment continues to trend downwards and final business conditions PMIs for February were revised up a bit, suggesting economic conditions may have improved as the month progressed (and share markets recovered).

- Japanese economic data was mixed. Industrial production rose more than expected and labour market indicators remain strong. Against this, real household spending remains weak.

- China’s February round of business conditions PMIs were all disappointing, suggesting that growth may have slowed a bit further early in the year. While this may be partly due to distortions associated with the Lunar New Year holiday, further monetary easing, in the form of a 0.5% cut to 17% in the banks’ required reserve ratio, indicates that the authorities are still focussed on boosting growth. With the reserve ratio remaining high, further easing is likely ahead. Meanwhile, property prices continued to gain with the 100 city Soufun index seeing an average 0.6% gain in February. A risk is that a renewed speculative bubble in Tier one cities could be forming, which in turn could detract from equity holdings as the see-sawing between shares and property continues. Meanwhile, the fourth session of the National People’s Congress provided no surprises on the economic front with the government targeting 6.5-7% growth this year, expanding the budget deficit slightly and announcing some structural reforms.

Australian economic events and implications

- Australian economic data was remarkably robust, with GDP up a much stronger than expected 3% through 2015, manufacturing and services PMIs rising solidly in February, and January data showing gains in retail sales and new home sales and a narrowing in the trade deficit. While GDP growth is expected to slow to around 2.5% this year as mining investment continues to contract, slowing wealth gains weigh on growth in consumer spending and as slowing building approvals lead to a slowing contribution to growth from home building its likely to remain well supported. Low interest rates and the fall in the A$ are clearly helping to support non-mining activity, highlighted by surging export earnings from tourism and higher education. The coming on line of LNG export projects will also help sustain export volume growth and growth is likely to remain strong in the population rich states of NSW and Victoria.

- While the Reserve Bank of Australia (RBA) retained an easing bias at its March board meeting, and arguably strengthened it slightly by saying that “continued low inflation would provide scope for easier policy, should that be appropriate”, it’s hard to see them acting on it with growth above their own forecasts and until unemployment rises more. As such, while views remain that the RBA will need to cut interest rates again, it has become a very close call.

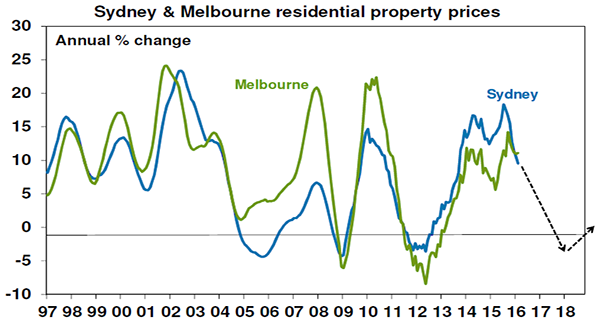

- Meanwhile, capital city home price growth was a moderate 0.5% in February with annual price growth of 7.6%, down from a recent peak of 11.1% last July. Momentum continues to slow in Sydney. For Sydney and Melbourne it would be likely to see a profile looking something like that seen in the chart below.

Source: Core Logic/RP Data, AMP Capital

What to watch over the next week?

- We are now heading into a two week period that will see key central bank meetings in Europe (Thursday), Japan (Tuesday week) and the US (Wednesday week). The European Central Bank (ECB) (Thursday) is expected to respond to an intensification of deflation and bank risks in Europe by expanding its monthly quantitative easing program from 60 billion to around 70 billion possibly by including corporate debt. Another round of cheap bank financing (LTRO) is also possible, but doesn’t look necessary given that interbank lending rates remain low. The ECB may also consider another cutting its deposit rate by another 10 basis points (from -0.3% currently), but should think twice after the Bank of Japan’s bad experience.

- In China, February economic data will be released but bear in mind that data around this time of year is often distorted by the Lunar New Year holidays. Trade data (Tuesday) is likely to show continued softness, inflation (Thursday) is likely to remain at 1.8% year-on-year with PPI deflation continuing to moderate slightly. Credit flows are likely to slow from the huge surge seen in January and industrial production data may moderate a bit but retail sales should pick up a bit (both due Saturday).

- In the US, a speech by Fed Vice Chair Fischer will be watched for any clues on interest rates.

- In Australia, expect to see continued modest growth in ANZ job ads (Monday), a slight rise in business confidence according to the NAB business survey (Tuesday), consumer confidence (Wednesday) to reverse some of last month’s rise on the back of uncertainty about taxation and a slight fall back in housing finance (also Wednesday) after a solid gain in December.

Outlook for markets

- Shares have seen a decent rebound from oversold levels which may have further to go. But with the Fed still thinking of raising rates this year and global growth worries remaining the ride is likely to remain volatile in the short-term. Beyond the near-term uncertainties, it is likely to still see shares trending higher this year helped by a combination of relatively attractive valuations compared to bonds, further global monetary easing and continuing moderate economic growth.

- Very low bond yields point to a soft medium-term return potential from sovereign bonds, but it’s hard to get too bearish in a world of fragile growth, spare capacity, weak commodity prices and low inflation.

- Commercial property and infrastructure are likely to continue benefitting from the ongoing search by investors for yield.

- National capital city residential property price gains are expected to slow to around 3% this year, as the heat comes out of Sydney and Melbourne. Prices are likely to continue to fall in Perth and Darwin, but growth is likely to pick up in Brisbane.

- Cash and bank deposits are likely to continue to provide poor returns, with the RBA expected to cut the cash rate to 1.75%.

- An ongoing delay in Fed tightening, and stronger data in Australia, pose further short-term upside risks for the A$. However, any short-term strength in the A$ is unlikely to go too far and the broad trend is likely to remain down as the interest rate differential in favour of Australia narrows as the RBA eventually resumes cutting the cash rate, or at least resorts to jawboning, and the Fed eventually resumes hiking, commodity prices remain weak and the A$ undertakes its usual undershoot of fair value.

Source: AMP CAPITAL ‘Weekly Market Update’

AMP Capital Investors Limited and AMP Capital Funds Management Limited Disclaimer