Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

Weekly Market Update – 31st July 2015

Investment markets and key developments over the past week

- Share markets had a mixed ride over the last week, not helped by renewed weakness in Chinese shares early in the week. However, this was offset to a greater or lesser degree depending on the market by good US earnings results, a benign US Federal Reserve and good data in Europe. While Chinese shares fell 10% over the week, Eurozone shares only lost 0.1% and Japanese shares rose 0.2%, US shares rose 1.2% and Australian shares gained 2.4%. In fact the Australian share market rose 4.4% in July which was its best monthly gain since February, albeit this followed a bad June. Bond yields fell, spurred along by weak US wages data. Commodity prices were weak, but currencies were little changed with the Australian dollar remaining just below US$0.73.

- Chinese shares had a bad week with their biggest one-day fall in eight years, largely in response to a rumour that the China Securities Finance Corporation was no longer committed to stabilising the share market. While this was subsequently denied volatility remained high. After very sharp share market falls like the 1987 share crash or through the technology wrecks and global financial crisis, it’s quite normal to see a volatile period of base building around the bottom. So the same is likely to apply in relation to China. That said further policy stimulus is still needed in China.

- The US Federal Reserve is on track to hike interest rates, but September is looking less likely thanks to very weak June quarter wages growth. While the central bank sounded reasonably upbeat, its description of the risks to the US economy being “nearly balanced” as opposed to “balanced” suggests it’s not itching to hike just yet. A further improvement in growth and confidence that inflation will rise is needed. On the inflation front, falling commodity prices and a very weak rise in June quarter employment costs which saw annual growth fall back to just 2% suggests that a September hike is now looking less likely with the timing being pushed back to December. The weakness in wages growth suggests that the level of unemployment at which wage growth picks up in the US (i.e. the so-called non-accelerating inflation rate of unemployment) is actually lower than the US Federal Reserve has been allowing for. By the time the central bank does eventually hike it will be the most anticipated rate hike ever, which should mean it will hardly be a shock to financial markets.

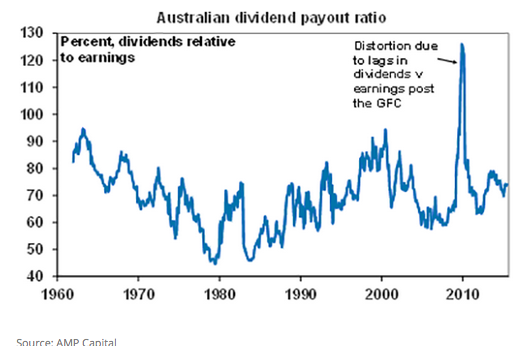

- Are Australian companies really paying out too much in dividends? With the August profit reporting season the focus will no doubt return again to the high dividend payout ratios of Australian companies in response to yield hungry shareholders. Some allege that this is robbing future growth potential and risks a “doom loop” turning Australia into a “backwater.” But is it really? First let’s put it in perspective. The dividend payout ratio of Australian companies at around 75% is not out of line with its long-term range. See the next chart.

- Yes it’s increased since 2012 but this has been driven by higher payouts for resources stocks and there is a good reason for this. After their huge investment in new mining capacity it makes sense to use excess cash flow now to return to investors via dividends. For the rest of the market the payout ratio has been going sideways! Secondly, it’s far healthier for companies to pay strong dividends (provided they are not being paid using debt) because it signals sustainable cash flows, confidence in future earnings and helps prevent corporate hubris leading to wasteful investment. Finally, capital expenditure in Australia is now too low and needs to rise – but the reason it is low has nothing to do with investors’ desire for dividends. Miners would be crazy to ramp up in investment now and the reason industrial companies are reluctant to invest owes to the beating they got through the mining boom years and a lack of corporate confidence after the global financial crisis which is a global phenomenon.

Major global economic events and implications

- US economic data was a bit disappointing. June quarter gross domestic product growth bounced back, but only to a 2.3% annualised pace, the March quarter was revised up by less than expected and the previous years’ growth was revised down. On top of this durable goods orders, consumer confidence, home prices and pending home sales disappointed. Against this, the Markit services conditions index rose to a solid 55.2 and a surge in household formation to around 1.6 million a year suggests demand for housing will remain solid. Overall the US economy is continuing to grow but it’s a long way from booming. With the June quarter employment cost index rising just 0.2% and falling back to 2% year-on-year, it’s hardly an environment where the US Federal Reserve needs to rush into raising interest rates.

- The US June quarter earnings reporting season continues to better expectations. We are now 70% done and 74% of companies have beat on earnings, 50% have beat on sales and earnings growth expectations for the 12 months to the June quarter have improved from -5.3% at the start of July to -0.1%.

- Eurozone economic confidence rose in July to a four-year high, despite the noise around Greece, and is running around levels consistent with decent growth. On top of this bank lending is continuing to improve and the Spanish economy grew 1% in the June quarter with annual growth at its fastest since before the global financial crisis. Clearly Spain is not a Greece! Meanwhile, although Eurozone core inflation rose in July to 1% year-on-year it remains well below target and is likely to fall as lower commodity prices feed through, so European Central Bank quantitative easing is set to continue.

- Japanese economic data was mixed with household spending down and unemployment up, but against this the jobs-to-applicants ratio held at its highest since 1992, industrial production rose more than expected in June with an improvement in the July purchasing managers’ index pointing to further gains and core inflation at least rose to 0.6% year-on-year in June.

- China’s economic data was better than feared with the official July manufacturing purchasing managers’ index down but only fractionally, the non-manufacturing conditions purchasing managers’ index up slightly, consumer confidence up despite the share market turmoil and average city property prices continuing to rise and property inventory levels falling. Further policy easing is likely still needed though.

Australian economic events and implications

- Australian data was weak with a sharper-than-expected fall in building approvals and another decline in export prices in the June quarter. While the fall in building approvals is not really a concern being driven by volatile apartment approvals and with the trend remaining very strong, the continuing slump in export prices indicates a continuing fall in the terms of trade and national income. Credit growth also moderated with all components soft except lending to investors which at 10.7% year-on-year is well above the Australian Prudential Regulation Authorities’ (APRA) target. But with APRA now biting hard this is likely to be a last gasp for lending to property investors.

What to watch over the next week?

- In the US the focus will be on the July institute for supply management manufacturing conditions purchasing managers’ index (Monday) which is expected to remain solid at 53.5 and July jobs data (Friday) which is likely to show continued strong jobs growth of 220,000 but unemployment remaining unchanged at 5.3%. Monthly wage earnings data will be watched closely for an acceleration.

- The Bank of Japan (Friday) is unlikely to change monetary policy, although more quantitative easing remains on the cards at some point.

- In China, expect a slowing in export and import growth for July and inflation data (Sunday) is likely to show a pork price-driven rise but with non-food inflation remaining very low.

- The Reserve Bank of Australia will most likely leave interest rates on hold (Tuesday). Recent commentary from Governor Stevens suggests the Reserve Bank of Australia is not in a hurry to cut rates again and stronger-than-expected jobs data in recent months, the fall in the Australian dollar and a desire to confirm that APRA’s efforts to slow property investment are working all suggest the central bank will leave rates on hold. However, there is a strong case for the Reserve Bank of Australia to cut again. As such the odds are strongly skewed in favour of another cut in the months ahead, thanks to the bleak outlook for investment, continued sub-par economic growth, the Australian dollar still being too high, inflation remaining benign and increasing signs that APRA’s efforts to rein in property investment are starting to really bite. And it’s worth noting that the hikes in interest rates to property investors amount to a de facto monetary tightening which ideally needs to be offset by a cut in rates for all owner occupiers. The Reserve Bank of Australia’s August Statement on Monetary Policy (Friday) will likely confirm that the central bank retains an easing bias.

- We’ll also see the usual Australian data avalanche that occurs at the start of each month. Expect to see a moderation in Core Logic-RP Data home price growth (Monday), a slight improvement in the trade balance and a modest 0.3% gain in June retail sales (both Tuesday), a 5000 gain in July employment and unemployment rising to 6.1% (Thursday) and a 4% bounce back in housing finance (Friday).

- Finally the June half profit reporting season for Australian shares will start, albeit with only seven major companies reporting results, one being Rio Tinto. Profit growth for 2014-15 is likely to be around -1% as resource sector profits slump 28% thanks to the hit from lower commodity prices. But with the rest of the market seeing profit growth of around 9% as banks and financials continue to perform well and industrials ex financials benefiting from low interest rates, the lower Australian dollar and cost cutting. Key themes are likely to be: weak revenue growth, ongoing cost cutting, competitive pressures amongst consumer staples but tailwinds for building material companies and continued strength in dividend growth.

Outlook for markets

- Share markets are likely to remain volatile as we are still going through a seasonally weak period of the year for shares, uncertainties remain regarding Chinese economic growth and a likely US Federal Reserve interest rate hike lies ahead for later this year.

- But beyond the near term, the cyclical bull market in shares likely has further to go: valuations against bonds are good; economic growth is continuing at a not too cold but not too hot pace; and monetary conditions are set to remain easy. As such, share markets are likely to remain in a broad rising trend. My year-end target for the ASX 200 remains 6000

- Still low bond yields point to soft medium-term returns from bonds, but it’s hard to get too bearish on bonds in a world of too much saving and spare capacity. Central banks won’t ratify a bond crash like in 1994, by raising interest rates aggressively.

- The broad trend in the Australian dollar remains down as the US Federal Reserve is likely to raise rates later this year whereas there is a 50/50 chance the Reserve Bank of Australia will cut again and the trend in commodity prices remains down. Our view remains that it is heading into the US$0.60’s, and this could now come before year-end.