Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

Weekly Market Update – 31st January 2025

Investment markets and key developments

Global shares were mixed over the last week. US shares fell 1% as tech shares fell on the back of the rise of DeepSeek’s AI app and a less dovish Fed and Trump’s tariff vows weighed. Japanese shares fell 0.9%, but Eurozone shares rose 1.3% to a record high helped by a dovish rate cut from the ECB. Australian shares also surged to a record high on the back of expectations for a February rate cut after lower-than-expected inflation data helped by the market’s low exposure to AI related tech stocks.

For the week the Australian share market rose 1.5%, although some of this will be reversed on Monday with ASX 200 futures down 1.2% on Trump’s tariff vows. Bond yields fell as did oil and metal prices, not helped by tariff talk, with iron ore flat. Bitcoin also fell but the gold price rose to a new record high. Trump’s ongoing talk of tariffs saw the US dollar rise and this along with increased expectations for RBA rate cuts saw the $A fall.

“As goes January so goes the year”…the so-called January barometer has a mixed record when it comes to falls in January, but for gains it provides a reasonably consistent but not perfect guide to the year. Since 1980 85% of positive Januarys have gone on to a positive year in the US and in Australia its 76%. So, with US shares up 2.7% in January and Australian shares up 4.6% it’s a positive sign for the year ahead.

A positive signal from the January barometer does not mean there won’t be corrections though and we continue to see a rougher more constrained ride than last year for Australian and global shares. Key risk factors are stretched valuations particularly for tech stocks with DeepSeek highlighting a key risk for them, Trump’s tariffs and other policies potentially adding to US inflation and impacting the Fed and various geopolitical risks. So, we continue to see a high likelihood of a 15% plus correction at some point this year. But ultimately, we see shares doing okay this year as Trump’s more negative policies are constrained by a desire to see shares rise at the same time that some of his policies reinvigorate the US, and with central banks continuing to cut rates, with the RBA joining in, boosting growth and profits.

Trump continues to indicate that tariffs are on the way, starting with Canada and Mexico and China this weekend. The on then off 25% tariff on Columbia highlighted Trump’s use of them for negotiation purposes and Trump’s vow of 25% tariffs on Canada and Mexico and 10% on China from 1 February may be the same, but some sort of formal announcement looks imminent. This looks like it will take the form of an announcement that the tariffs will start immediately, or it could be by a certain date leaving room for negotiation as occurred with Columbia, although the White House has denied this and Trump has said there is nothing Canada, Mexico and China can do to forestall the tariffs. And Trump continues to talk of a general tariff, with debate about whether it ramps up gradually, and is vowing to impose tariffs on the EU, semiconductors, steel, metals, oil and gas and pharmaceutical products. Often Trump sounds like tariffs are the end point rather just for negotiating, but then again, he has to sound that way to make any negotiations work. This is all very unsettling for investment markets, with some of this showing up on Friday, and central banks. In 2018, Trump’s tariff announcements drove dips in US shares and along with Fed rate hikes contributed to a near 20% fall. One estimate suggests a 25% tariff on Canada and Mexico could add around 1 percentage point to US core inflation this year which would be bad for US consumers and the Fed. Ultimately, we see Trump toning it down to avoid a long-lasting consumer and market backlash, but it could be a rough ride in investment markets until we get more certainty that this will be the case.

For Australia the direct impact of Trump’s tariffs should be minor, but it is vulnerable to an indirect impact which could result from a fall in global trade and less demand for our raw materials from China. Exports to the US are only 4% of Australia’s total exports and may be spared from Trump’s tariffs as Australia has a trade deficit with the US, but they could still be hit if Trump’s motivation is mainly to shift production back to the US and raise tax revenue. Our main US exports are beef, precious metals, pharmaceuticals, aluminium, aircraft parts and wine – some of which Trump is specifically talking about putting tariffs on. However, as an open economy with high trade exposure to China, our main vulnerability is to an intensification of global trade wars under Trump as Trump imposes tariffs and other countries respond with tariffs on the US resulting in a fall in global trade, particularly if it weighs on demand for Chinese exports. An OECD study showed that Australia could suffer a 1.2% reduction in GDP as a result of a 10% reduction in global trade between major countries. Resources shares would be most at risk and the $A would likely fall (and we have already seen a bit of that). Of course, similar fears existed during the last Trump trade war, and it didn’t turn out so bad (although the $A fell 10% in 2018 with US tariff hikes and Fed rate hikes). And there would still be demand for iron ore somewhere – it just may switch from China to elsewhere. Much will depend on how hard Trump goes, how other countries respond and how long the tariffs remain in place.

What to make of DeepSeek? It’s actually been around a while but when it’s latest R1 version surged to the top of the pops on Apple’s App Store it created wobbles for tech shares, but its more good than bad. If it can do what it claims in providing competitive AI capabilities compared to other AI apps (which appears to be the case) at much lower development and training costs at less than $10m versus billions for other apps including less energy usage flowing from the use of less powerful chips (and here there is still much debate) then it has huge implications.

- Firstly, it would suggest that AI is on the way to being commoditised as is usually the way with new technologies. If DeepSeek can do it (ie the same output with less input) then others will as well (making security concerns about it being a Chinese company irrelevant as well). Yes, the supplier for a new technology may do well but then competition comes along and costs collapse and it becomes ubiquitous. Think of what happened to flat screen TVs which collapsed in price over the last two decades or traditional computer chips.

- Second, it potentially means that the billions being spent on AI development (eg, the up to $500bn Stargate announcement Trump made with Open AI, Oracle and Softbank) may not be necessary if the same can be done with less.

- Third, if less powerful chips are required for AI development this also means that demand for electricity from data centres may turn out to be far less than commonly projected.

- Fourth, Chinese companies may be further ahead in developing AI than assumed questioning whether US tech export bans are actually working. I don’t think this really threatens the US lead though which ultimately derives from its inventiveness which China like the USSR generations ago will struggle to replicate.

- Fifth, this poses a big threat to richly valued tech stocks like Nvidia if investors seriously question whether all the tech spending priced into their valuations will materialise. This is reminiscent of dot com stocks a generation ago.

- Sixth, while AI hardware providers may be at risk, consumers and other businesses will be big beneficiaries as the productivity enhancing benefits of AI will be spread more quickly at much lower cost. So while US tech stocks may be vulnerable, non-tech shares could be big winners. Which partly explains why the low tech Australian share market made a new high in the last week. Of course, if AI gets cheaper everyone will want it which means more demand so tech suppliers to AI may recoup some of what they lose in margins via higher volumes. Eg big flat screen TVs got cheaper but demand surged.

- Finally, for investors it highlights the need for a well-diversified portfolio as part of a long-term strategy. Tech and AI related shares have provided a good ride and it will be really hard to time any correction in them, but history tells us that sooner or later it will have one but at the same time it may not necessarily drag down the rest of the market if its gradual.

On the global interest rate front the news remains mostly good with the trend still down, albeit its becoming a bit more gradual. At the less dovish end of the spectrum, the Fed stayed on hold at 4.25-4.5% as expected, but is cautious and in no hurry to cut further. The Fed’s post meeting statement lent a bit hawkish in removing a reference to progress on inflation and sounding more upbeat on jobs, and Powell was a bit more dovish but still left the message that he wants to see more progress on inflation or weaker jobs to do cut rates further and is in wait and see mode in relation to Trump’s policies. With monetary policy still “meaningfully restrictive” another two Fed rate cuts are still likely this year but March looks like it might be skipped and this assumes Trump does not go too hard on tax cut stimulus and tariffs.

However, the ECB, Swedish central bank and the Bank of Canada cut rates by another 0.25%. The ECB took its deposit rate to 2.75% and remained dovish referring to disinflation remaining “well in track” with ongoing worries about growth and is likely to cut to 2% or just less by year end. The Swedish central bank cut to 2.25% and signalled a pause. The BoC cut to 3% and ended quantitative tightening but removed its dovish guidance citing a “lot of uncertainties” mainly around tariffs. Its still likely to cut one two more times this year.

Source: Bloomberg, AMP

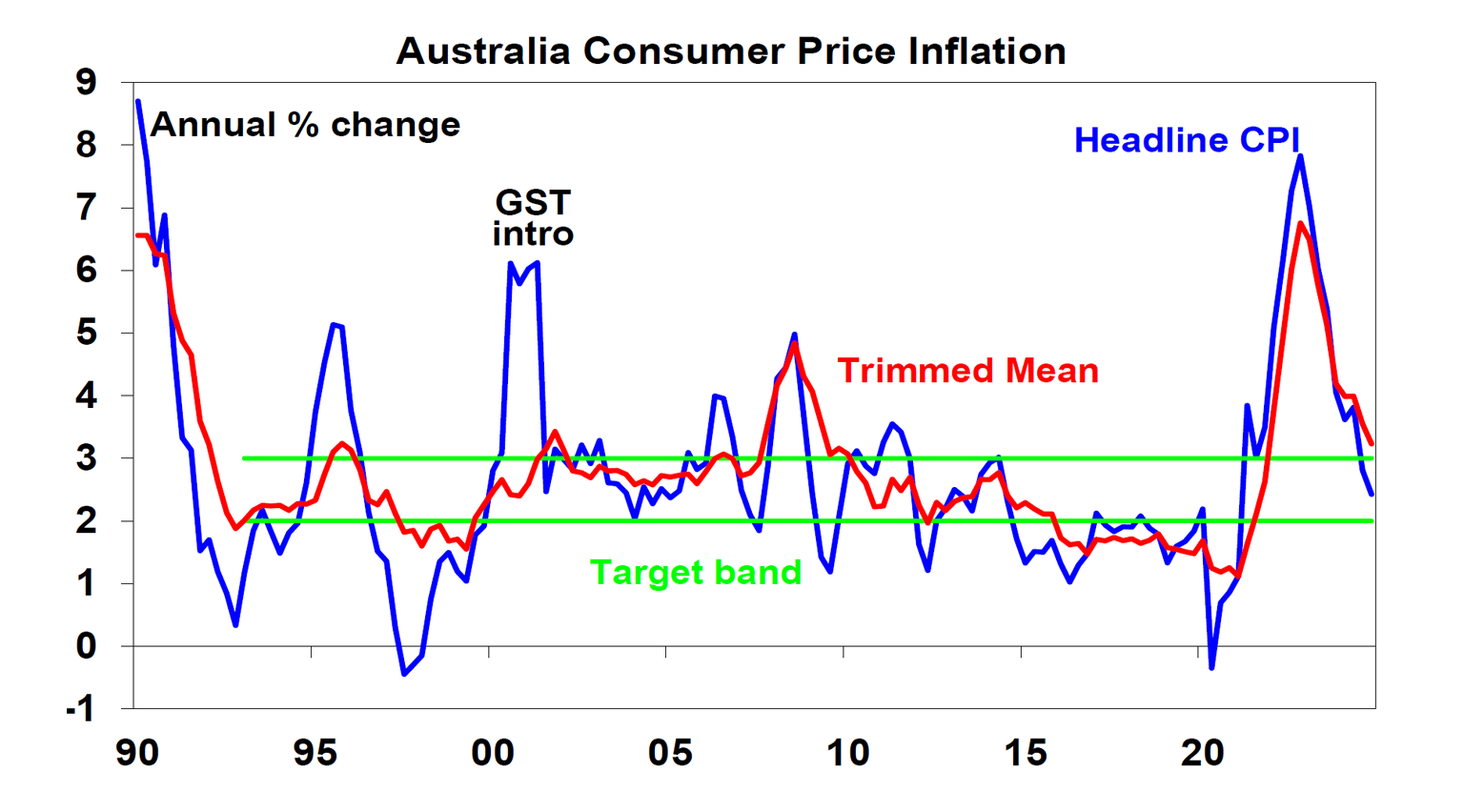

Meanwhile, Australian inflation data confirmed that disinflation is on track. Helped by energy rebates and other “cost of living” measures CPI inflation slowed to 2.4%yoy from 2.8%yoy, but the all-important trimmed mean, which mostly strips out volatile items and government subsidies to give a guide to underlying inflation, slowed to 0.5%qoq or 3.2%yoy, down from 3.5%yoy.

Source: ABS, AMP

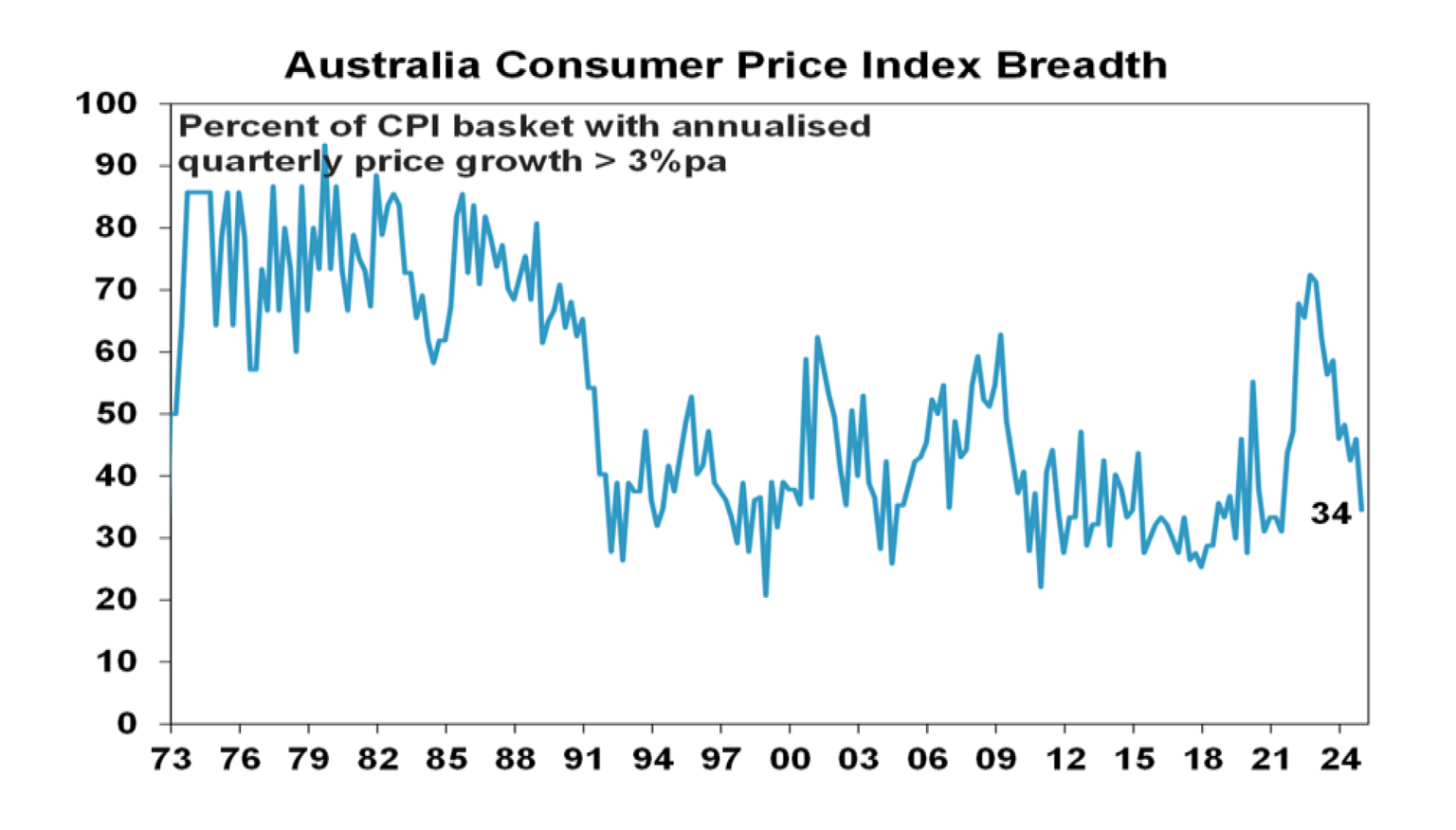

Both the headline CPI and trimmed mean were a material 0.2% less than expected by the RBA. And the annualised pace of trimmed mean inflation was just 2% for the quarter and 2.7% for the last 6 months and the December monthly trimmed mean dropped to 2.7%yoy all of which are consistent with the 2-3% target. What’s more, lower price pressures are evident in a broad range of items including including food, dwelling costs, rents and insurance. Goods price inflation fell to its lowest since 2016 and while services inflation is still too high it is cooling. Now only 34% of CPI basket items have inflation above 3% annualised.

Source: ABS, AMP

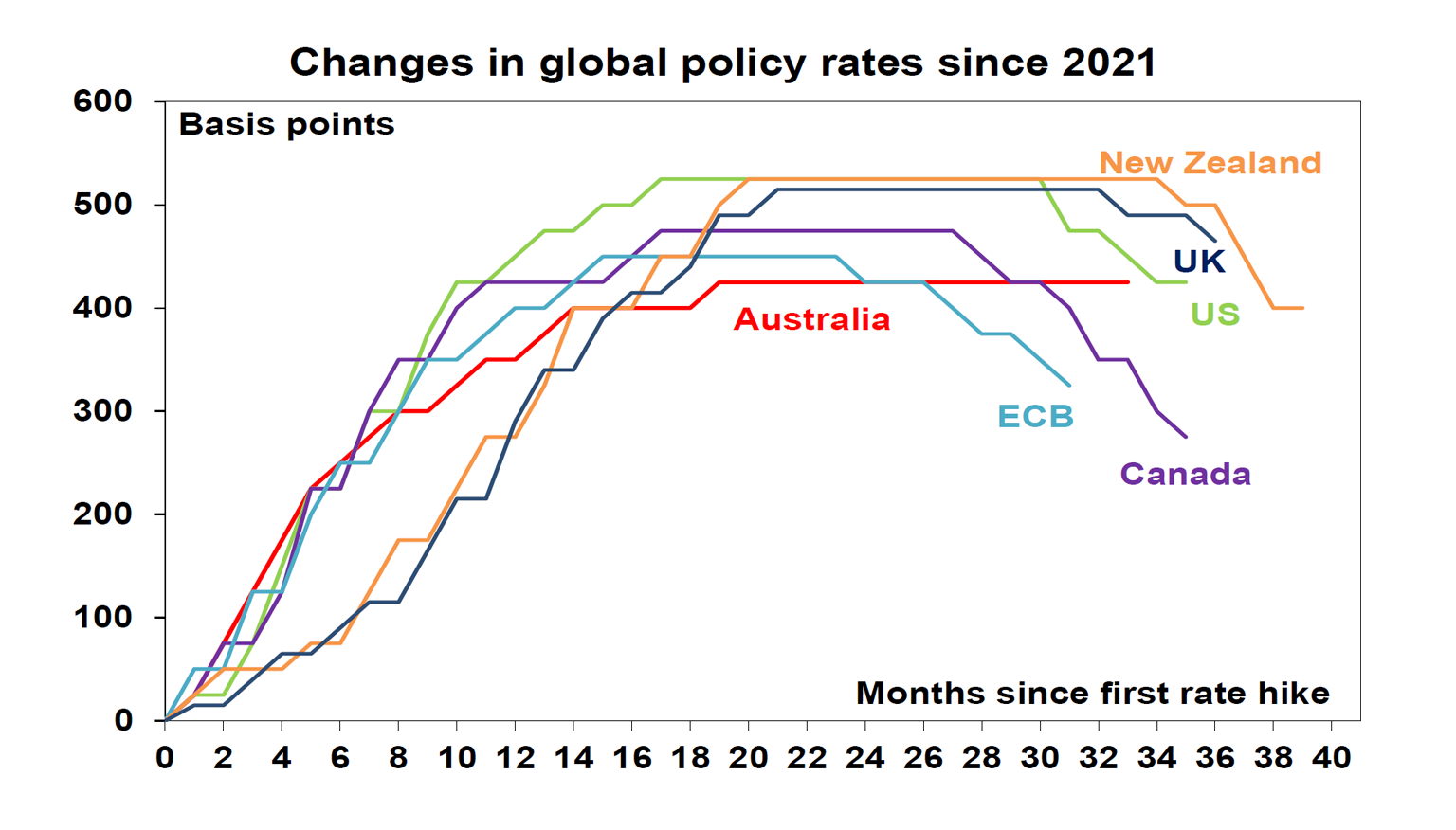

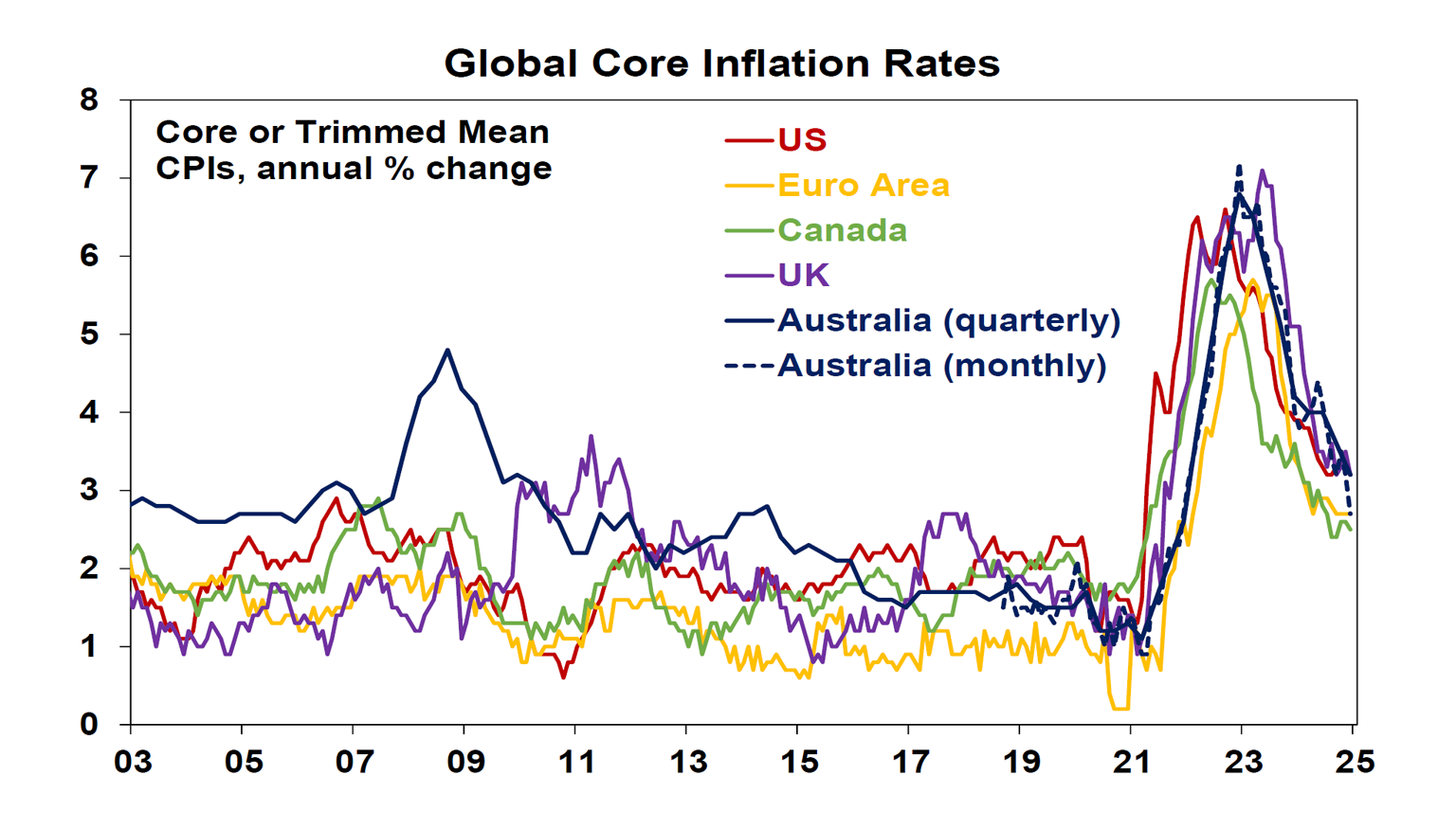

What’s more, both headline and underlying inflation in Australia is now around levels in comparable countries, some of which have cut interest rates below those in Australia. Claims that Australia is somehow different to other countries justifying higher for longer rates just don’t wash.

Source: ABS, Bloomberg, AMP

The fall in inflation likely clears the way for a February RBA rate cut. Back in December the RBA noted that “if the future flow of data continued to evolve in line with or weaker than [RBA] expectations…it would in due course be appropriate to begin relaxing the degree of monetary policy tightness.” So ahead of the CPI release our view was that “if trimmed mean inflation comes in at 0.6%qoq or less, as we expect, against implied RBA expectations for a 0.7%qoq rise it will be very hard for the RBA not to cut in February…” In the event with trimmed mean inflation coming in at 0.5%qoq and materially below the RBA’s expectations and the breadth of high price rises falling sharply implying a downwards adjustment to RBA inflation forecasts, it’s now likely that the RBA will start easing in February. Of course, its not certain and the main arguments in favour of waiting are that annual trimmed mean inflation is still above 3%, the $A is weak, the labour market is still tight and the RBA usually likes to move rates more than once in consecutive meetings. However, these arguments in favour of delaying are weak: the RBA shouldn’t wait until annual trimmed mean inflation is back at target as it risks overshooting; the $A trade weighted index is roughly in the same range it’s been in for the last four years; unemployment at 4% may actually be consistent with full employment as wages growth has actually been slowing; and the RBA doesn’t have to ease at back to back meetings, with the election possibly making it harder to cut in April as it could be in the midst of the election campaign and waiting for May to start easing may be too long. Rather we see the weak $A and still low unemployment rate as not being enough to stop an RBA cut in February, but they may serve to justify a gradual approach to easing. So given this we expect a first rate cut in February, a pause in April and then another cut in May with the cash rate hitting 3.6% in the second half.

So, we wouldn’t argue with the money market which following the low inflation reading for the December quarter is now pricing in about a 93% chance of a cut in February.

Major global economic events and implications

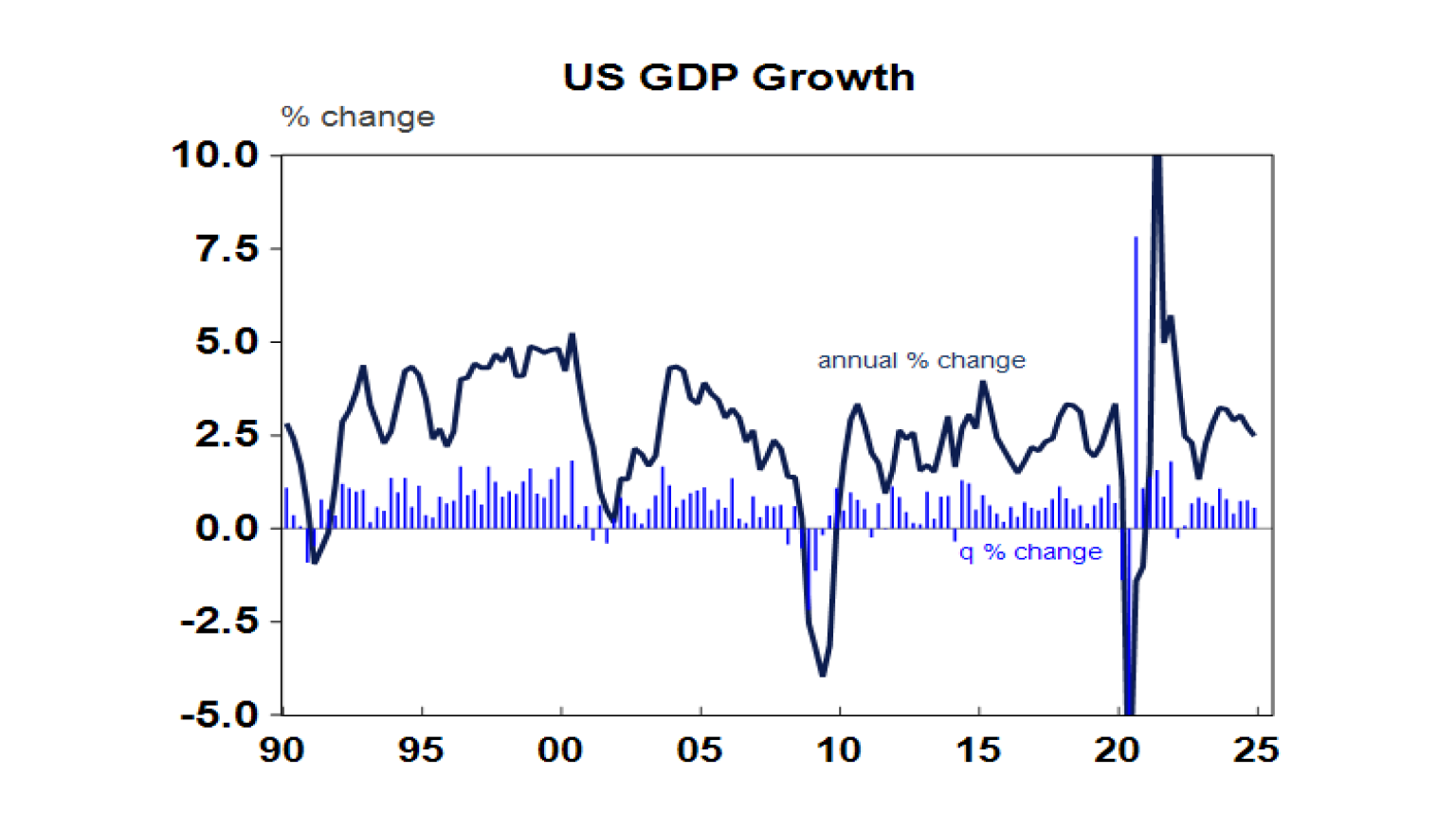

Goldilocks conditions continue in the US – hopefully tariff man Trump doesn’t mess it up! US December quarter GDP rose by a softer than expected 2.3% annualised, but inventories detracted from growth and private demand remained strong at 3.2% annualised driven by very strong consumer spending.

Source: Macrobond, AMP

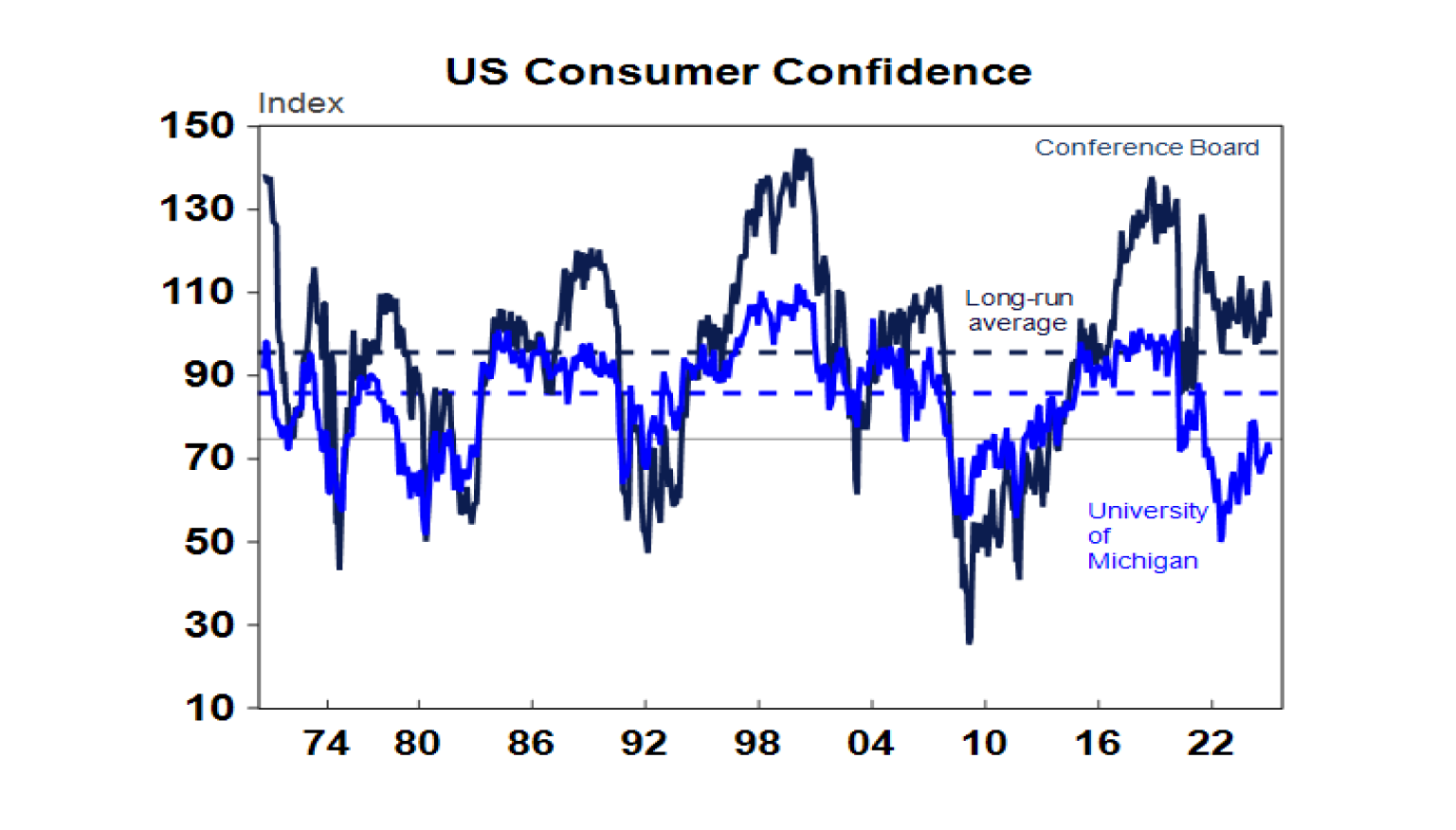

US consumer confidence fell in January, but other data was mostly strong with solid gains in personal income and spending in December, a further decent gain in underlying capital goods orders, a rise in new home sales albeit they remain weak, solid gains in home prices and jobless claims remaining low. Meanwhile, the December quarter Employment Cost Index rose 0.9%qoq resulting in a further slowing in annual growth to a benign 3.8%yoy which is down from 5.1%yoy in 2022. And December core private final consumption inflation came in on the soft side at 0.16%mom leaving annual inflation steady at 2.8%yoy, after a downwardly revised 0.11%mom rise in November. The benign ECI and PCE should help ease Fed concerns about stalling disinflation.

Source: Macrobond, AMP

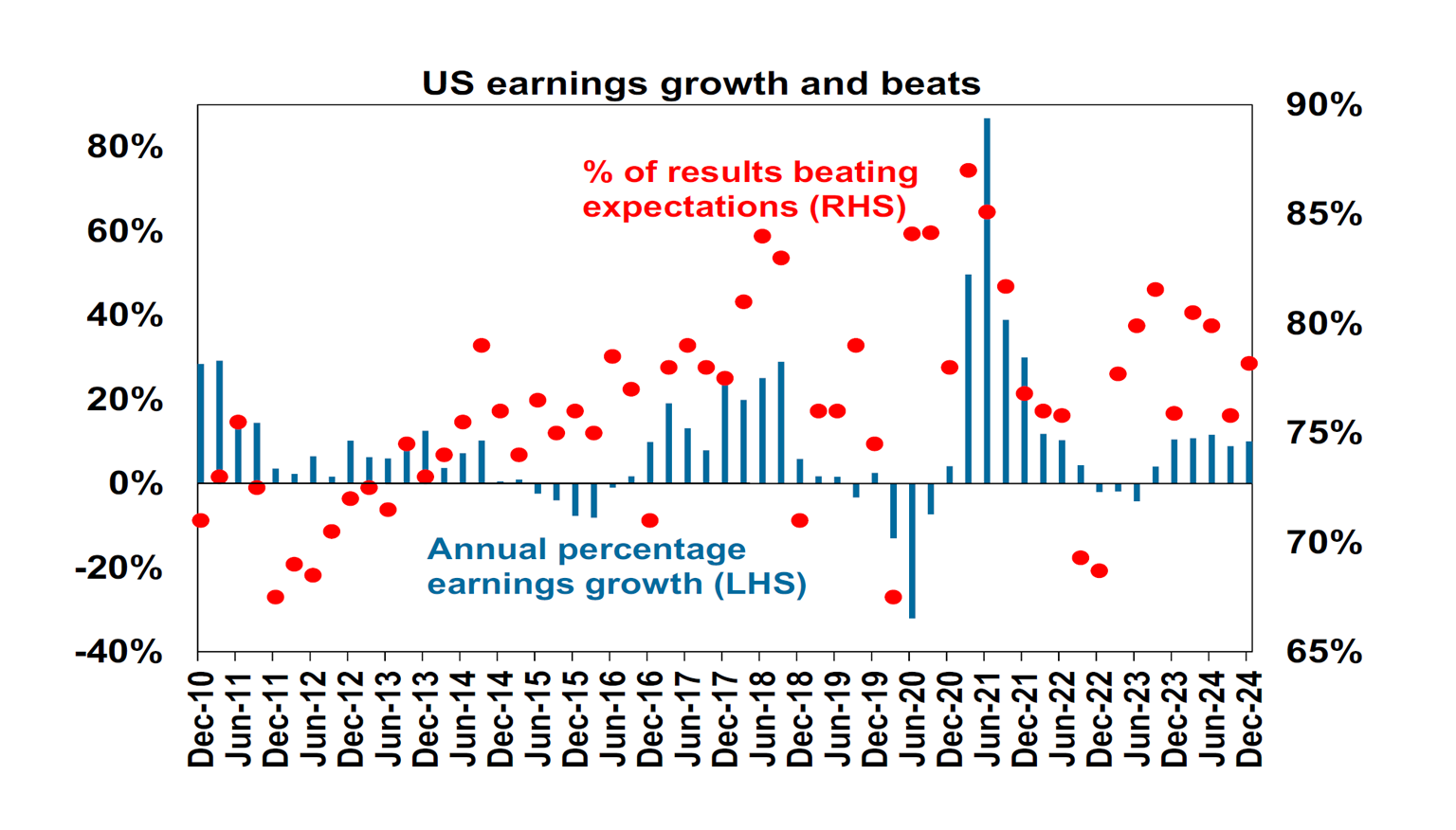

Around a third of S&P 500 companies have now reported December quarter profit results and the results are generally solid with 78% beatings earnings expectations on the upside against a norm of 76%. Consensus earnings growth expectations for the quarter have risen to 10%yoy, which is up from 8.4%yoy at the start of the reporting season. A final outcome of around 12%yoy is likely with tech and financials leading the way.

Source: Bloomberg, AMP

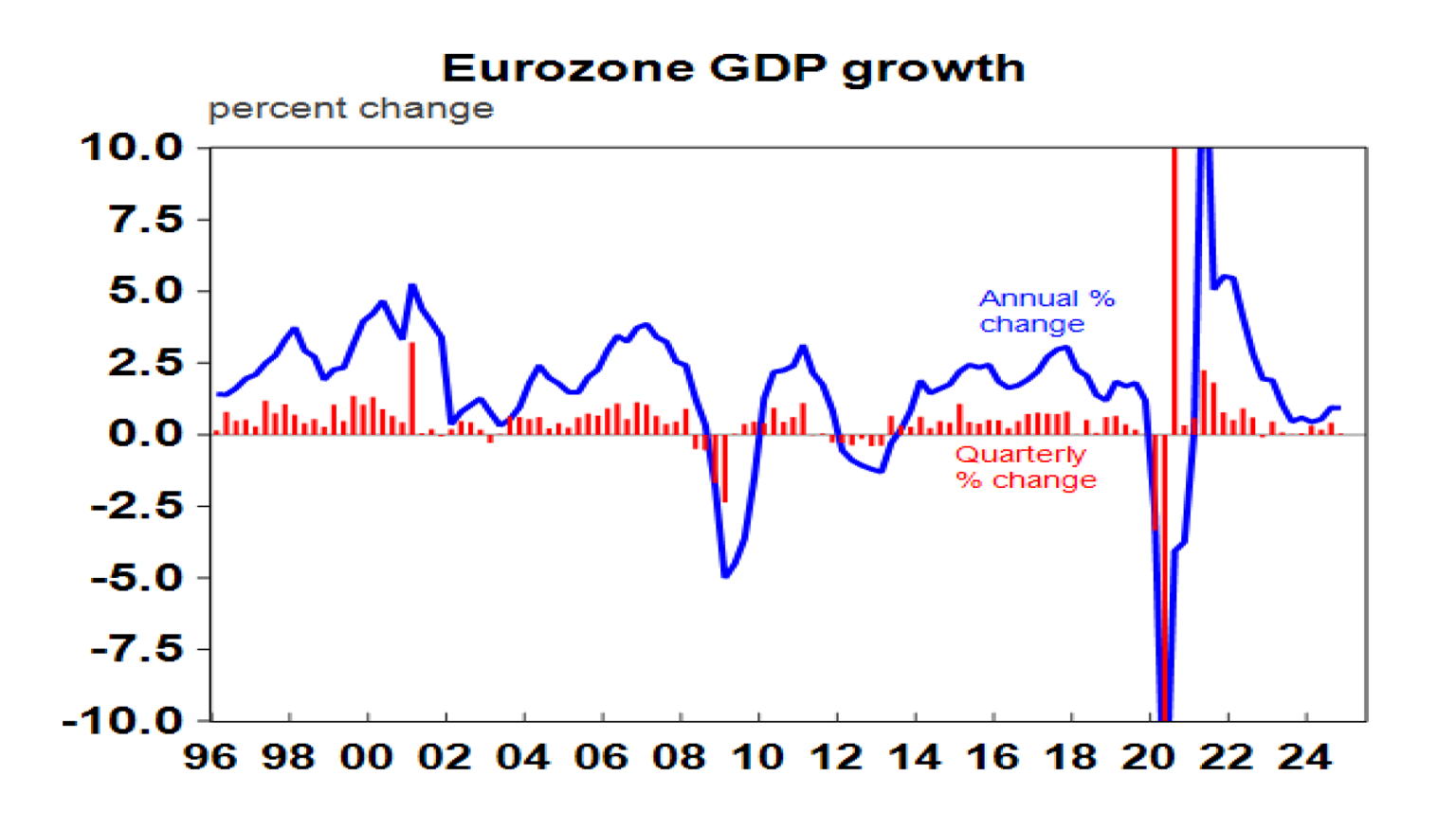

Eurozone December quarter GDP was flat in the quarter and up just 0.9%yoy, with strength in Spain buts falls in Germany and France. Unemployment was 6.3% in December up from a downwardly revised 6.2%. Economic confidence rose in January along with business conditions PMIs suggesting some improvement this quarter, but both remain soft. Ongoing weak economic conditions support the case for further ECB rate cuts.

Source: Macrobond, AMP

Japanese data was mostly solid with slightly stronger but still weak industrial production, a rising trend in retail sales and a fall in unemployment. Tokyo inflation rose to 3.4%yoy in January but this was due to higher food prices with core (ex food & energy) inflation falling to 1%yoy.

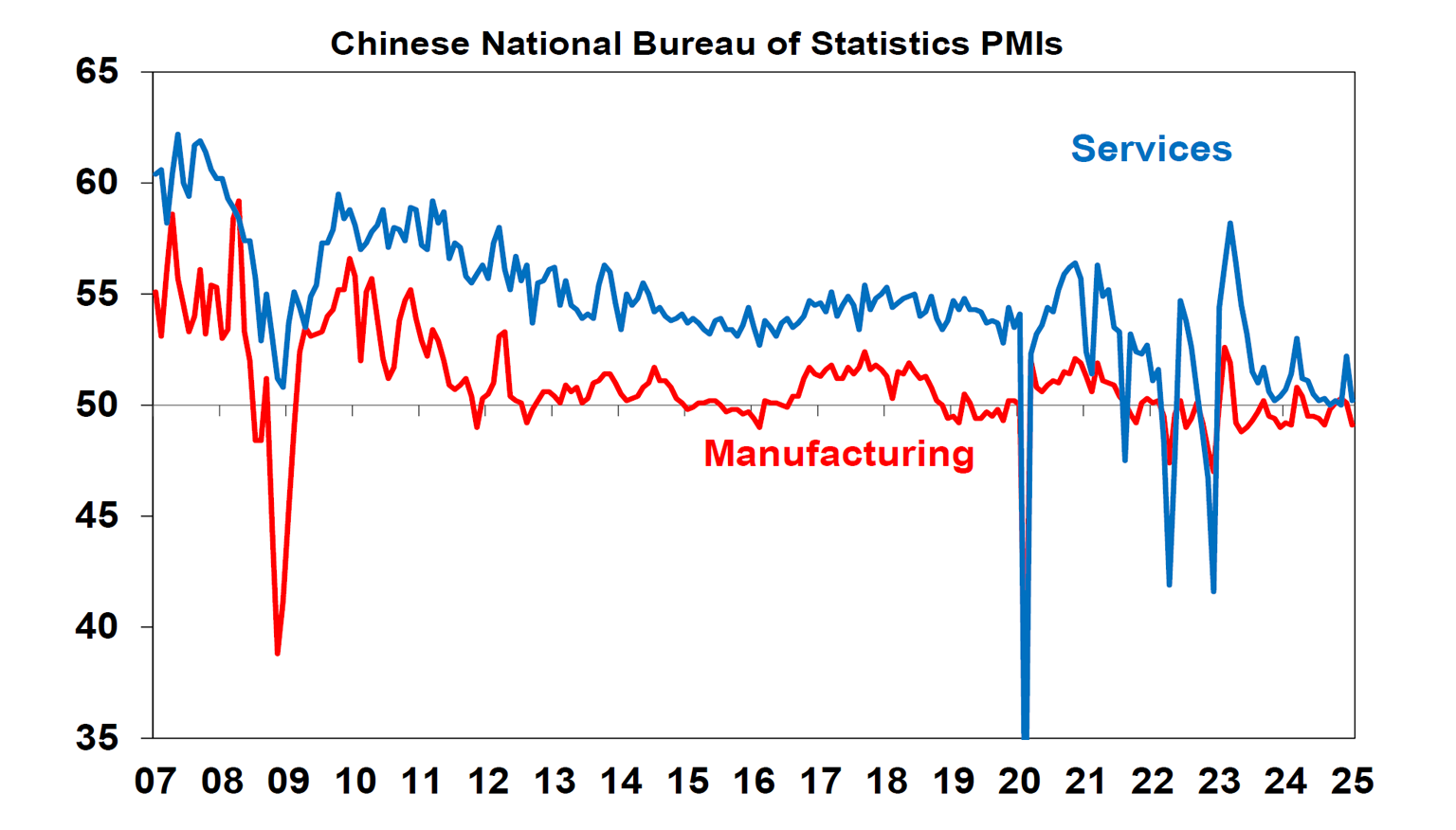

Chinese official business conditions PMIs for January weakened sharply although this may be partly due to the earlier than normal timing this year of the Lunar New Year.

Source: Macrobond, AMP

Australian economic events and implications

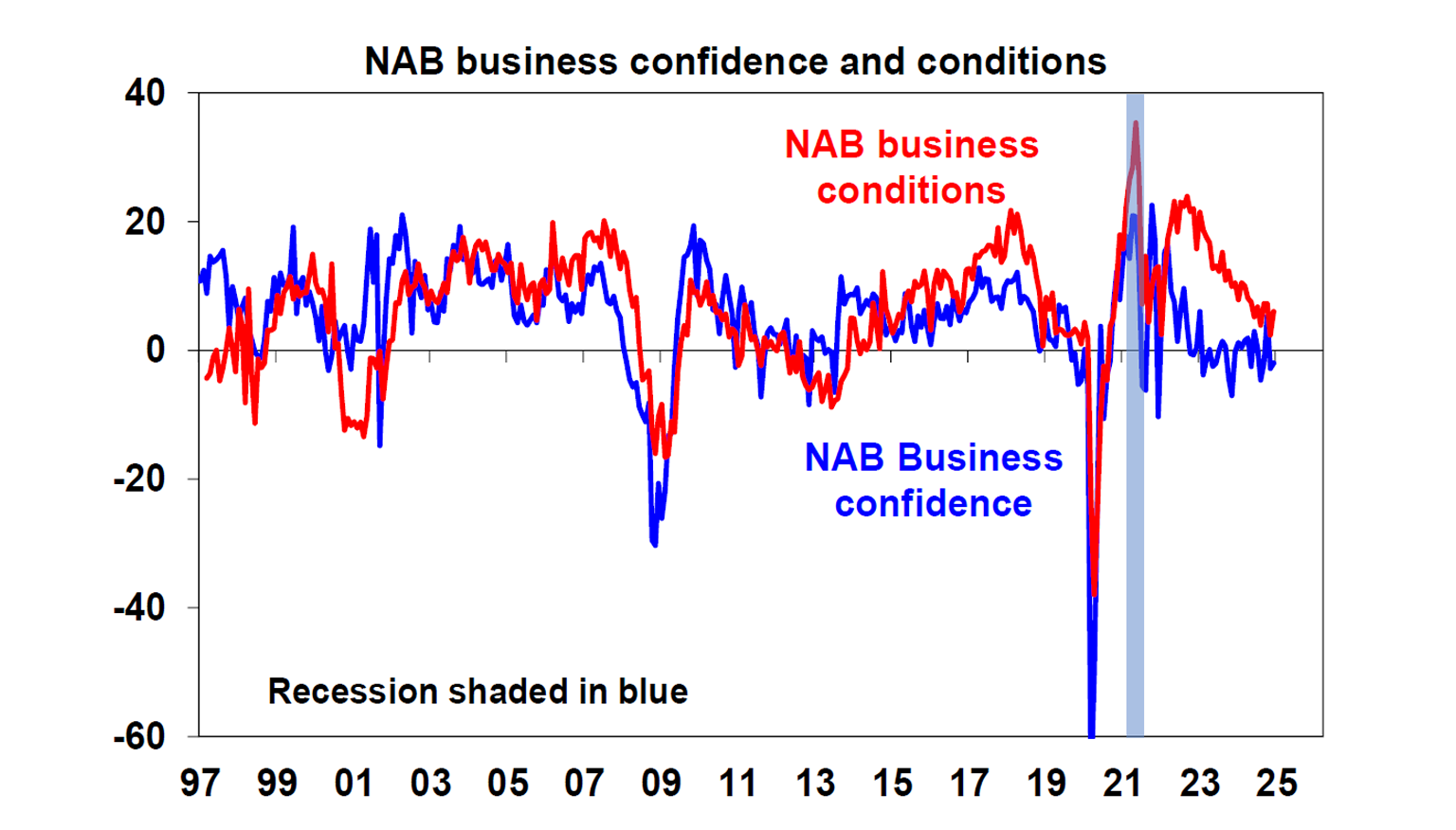

In Australia, the December NAB business survey showed slightly higher business conditions and confidence although the trend is still down in conditions and confidence is still soft.

Source: NAB, AMP

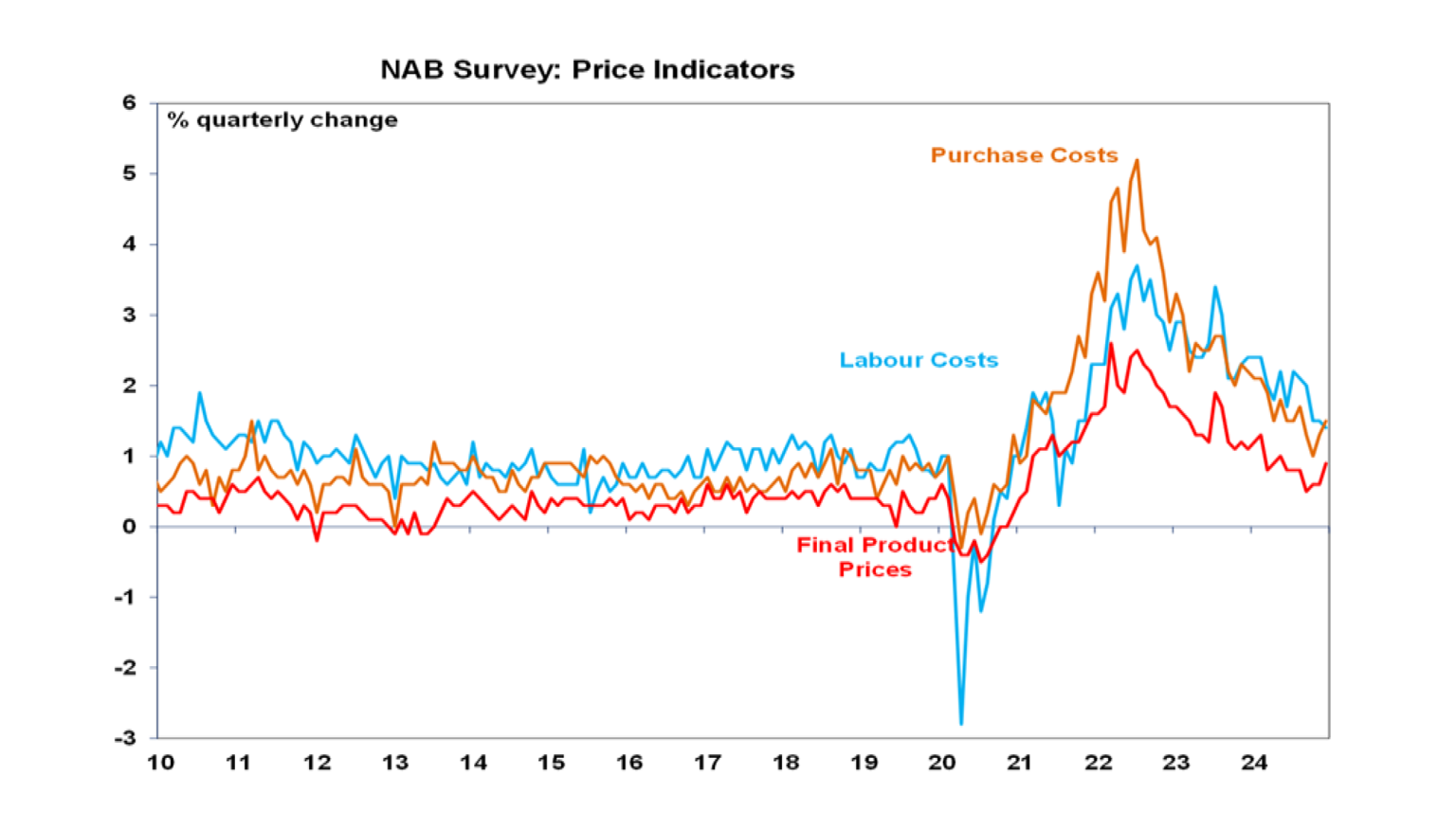

Price and cost measures were mixed with a slight fall in labour costs but input & final product prices up. The trend is still down, but it may be one reason for the RBA to be gradual in cutting rates.

Source: NAB, AMP

Fortunately, despite the fall in the $A import prices rose just 0.2%qoq in the December quarter implying little impetus to inflation (albeit it shows up with a lag) and export prices rose 3.6%qoq, resulting in the first rise in the terms of trade since 2023. December quarter producer price inflation slowed to 3.7%yoy, consistent with business surveys showing still elevated cost price inflation relative to final product price inflation.

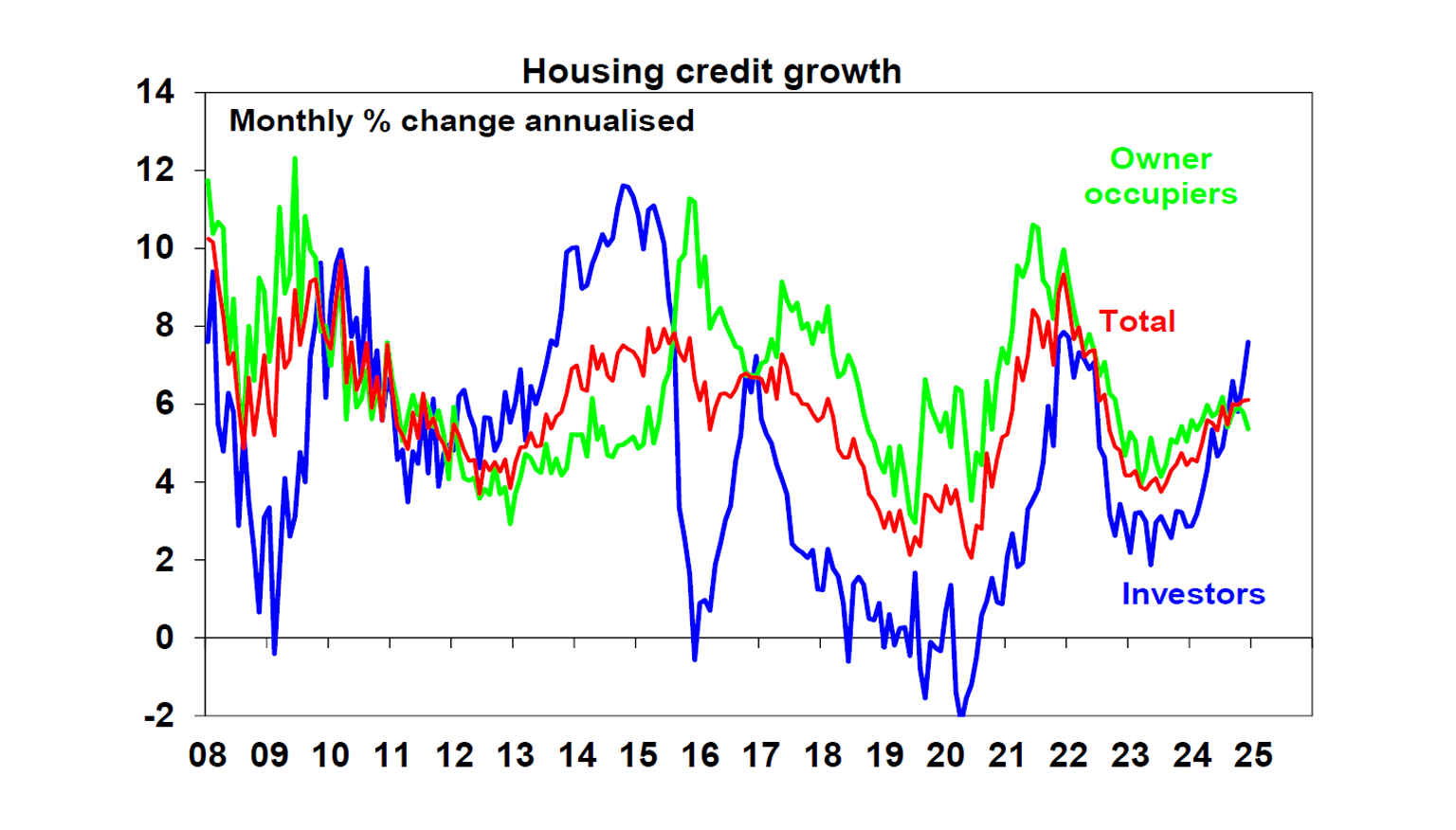

Private credit growth remained solid in December at 0.6%mom or 6.5%yoy with business lending growth remaining strong and housing credit growth remaining moderate but with investor credit accelerating relative to owner occupiers.

Source: RBA, AMP

What to watch over the week ahead?

In the US, the main focus will be on January jobs data (Friday) which after the strength seen in December is likely to be a bit softer. Payrolls are expected to rise by 150,000 but with unemployment remaining low at 4.1% and wages growth remaining benign at 0.3%mom or 3.8%yoy. In other US data expect the manufacturing conditions ISM for January (Monday) to have remained subdued at around 49 but the services ISM (Wednesday) to have remained solid at around 54, December job openings (Tuesday) to fall after several gains and December quarter earnings results will continue to flow including from Amazon on Thursday.

Eurozone inflation data for January (Monday) is likely to rise slightly to 2.5%%yoy, but with core inflation falling to 2.6%yoy.

The Bank of England is expected to cut rates by another 0.25% (Thursday) taking its policy rate to 4.5% with dovish guidance pointing to more gradual cuts this year.

Chinese inflation for January (Sunday 9 January) is likely to remain low with CPI inflation remaining around 0.1%yoy.

In Australia, expect December data to show a 0.8% or so fall in retail sales (Monday) and just a 0.2% gain in household spending (Tuesday) after Black Friday provided a boost in November, but with December quarter real retail sales showing a 0.7%qoq gain. December building approvals are expected to bounce 2% after a fall in November with CoreLogic data showing another 0.1% dip in national home prices for January (both Monday). Trade data (Thursday) is likely to show the trade surplus rising to $8.5bn with higher commodity prices.

Outlook for investment markets in 2025

After the double digit returns of 2023 and 2024, global and Australian shares are expected to return a far more constrained 7% in the year ahead. Stretched valuations, the ongoing risk of recession, the risk of a global trade war and ongoing geopolitical issues will likely make for a volatile ride with a 15% plus correction somewhere along the way highly likely. But central banks still cutting rates with the RBA joining in, prospects for stronger growth later in the year supporting profits, and Trump’s policies ultimately supporting US shares, should still mean okay investment returns.

Bonds are likely to provide returns around running yield or a bit more, as inflation slows to target, and central banks cut rates.

Unlisted commercial property returns are likely to start to improve in 2025 as office prices have already had sharp falls in response to the lagged impact of high bond yields and working from home.

Australian home prices are likely to see further near-term softness as high interest rates constrain demand. Lower rates should help from mid-year, and we see home prices rising around 3% in 2025.

Cash and bank deposits are expected to provide returns of around 4%, but they are likely to slow as the cash rate falls.

The $A is likely to be buffeted between changing perceptions as to how much the Fed will cut relative to the RBA, the negative impact of US tariffs and a potential global trade war and the potential positive of more decisive stimulus in China. This could leave it stuck between $US0.60 and $US0.70, but with the risk skewed to the downside if Trump acts more decisively on tariffs.

Source: AMP ‘Weekly Market Update’