Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

Weekly Market Update – 29th May 2015

Investment markets and key developments over the past week

- Shares had a mixed week with US shares down 0.9% and European shares down 2.5% on worries about Greece, US economic data and the Fed and Chinese shares down 1%, but Japanese shares up 1.5% and Australian shares up 2%. The US$ rose on the back of stronger US economic data and this weighed on commodity prices and the A$. Bond yields also fell they’ve been moving inversely to the US$ lately – adding to confidence that the April-May bond sell off has run its course.

- Chinese shares had a sharp one day fall of 6.5% on Thursday, supposedly in response to tougher margin requirements and a People’s Bank of China (PBOC) effort to drain liquidity, prompting some to wonder whether its bull market is over. However, this is unlikely. First, a 6.5% one day fall is not unusual for China (there was 7.7% decline January 15) and it needs to be seen in the context of a 43% gain year to date and a 126% rise over the last year. Second, the huge gain in Chinese shares over the last year has only unwound dirt cheap valuations with the forward price to earnings ratio rising from around 8 times to around 17 times, this is around Australian and US levels but below its long term average. Finally, the PBOC moves in the last week look like normal liquidity management with further monetary easing likely. So all up, we see this as just another correction in an ongoing Chinese bull market.

- Getting close to crunch time for Greece. While a payment is due to the International Monetary Fund (IMF) on June 5, Greece apparently has enough money to make the payment and in any case this and other June IMF payments can be delayed till the end of June, so there is a bit more time to reach an agreement than commonly feared. Our base case remains that a funding deal will be reached in time allowing Greece to head of a payment default, or “Graccident”. However, while there has been some progress the two sides are still apart on some issues and even if a deal is reached a missed payment may still occur if the deal needs to be passed by the Greek parliament or put to a referendum. A Graccident won’t necessarily lead to a “Grexit” (or Greek exit) from the Euro though and it could just force the Greek Government to see common sense or be replaced by a more sensible government. This all has the potential to cause more volatility. But whichever way it goes the threat of contagion to other peripheral countries is low compared to the 2010-12 period.

- A poor showing by Spain’s Governing Popular Party (PP) in local government elections has raised fears that Spain will go the way of Greece at a general election due later this year. However, this is unlikely as: apart from a win in Barcelona the anti-austerity party Podemos didn’t do that well and has been seeing declining support; the rise of the more pro-business and liberal Citizen’s party is drawing support away from Podemos; the Governing Popular Party still receives the most support; and Spain’s improving economy may see support for the Government improve over the next six months.

Major global economic events and implications

- US economic data saw a welcome return to strength. March quarter gross domestic product (GDP) growth was revised down to -0.7% annualised, but that was due to inventories and trade with domestic final demand actually being revised up. In any case the seasonal reanalysis due in July may see March quarter growth revised into positive territory. More importantly, stronger data was seen for core durable goods orders, home sales and home prices, mortgage applications and services sector conditions remain strong. The immediate reaction was a return to fear about the Fed. But it’s premature to get too excited as the June quarter growth rebound still looks soft compared to last year’s June quarter bounce back. Whatsmore the Fed has on numerous occasions noted that it will allow for the dampening impact on the US economy of a strong US$, which rebounded over the last week. Our base case remains that the first hike will be in September, and monetary tightening will be very gradual.

- Eurozone confidence held up in May and growth in money supply & bank lending improved further in April providing confidence that the pick-up in the pace of growth has continued.

- Japanese economic data showed a welcome improvement with gains in small business confidence, retail sales, industrial production and continued labour market strength. However, core inflation has fallen back to just 0.4% year on year. The Bank of Japan (BoJ) likely has more work to do, so further monetary easing/QE expansion still looks likely later this year.

Australian economic events and implications

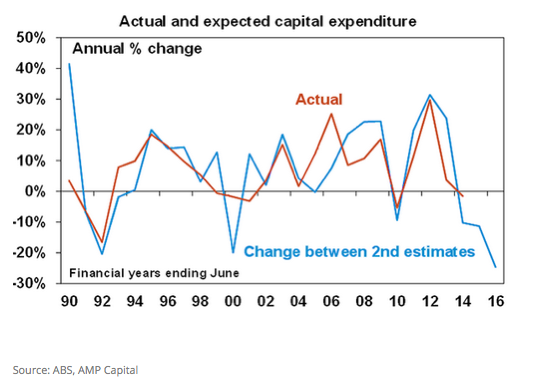

- In Australia, the outlook for business investment seems to be going from bleak to bleaker. March quarter construction and capital expenditure data were worse than expected. Dwelling investment is rising nicely but this is being more than offset by the ongoing slump in mining investment and poor non-mining investment. What is more concerning though is the further slump in the outlook for investment. Capital expenditure (capex) intentions for 2015-16 are 25% below plans made a year ago for 2014-15. See the next chart. There is no surprise that this is being driven by mining (-35%), but the real disappointment is that non-mining investment plans are also down (-10%). While the capex survey does not cover all sectors of the economy and tends to exaggerate, it nevertheless points to a further deterioration in the investment outlook for 2015-16, with current plans pointing to a roughly 23 to 25% fall in 2015-16 down from a 12 to 16% decline based on plans in the December quarter survey.

- The Reserve Bank of Australia (RBA) won’t be rushing to cut rates again in the week ahead, but just as the bleak capex outlook in the December quarter survey saw the RBA downgrade its growth forecasts in the May Statement of Monetary Policy (SOMP) and hence justify a May rate cut. The even bleaker capex outlook now could well prompt another downgrade in the growth outlook in the next SOMP to be released in August and hence another rate cut at the same time. The latest capex intentions also highlight the need for the A$ to fall further. Our view is that the probability of another rate cut is now 50/50, with the August RBA meeting the one to watch.

- In other data, April new home sales edged higher according to the Housing Industry Association and credit growth slowed across the board in April. Annual growth in property investor credit remained at 10.4% though, which is above APRA’s cap, however with banks seemingly only tightening lending conditions now, a slowing may not be apparent for a few months yet.

What to watch over the next week?

- In the US, expect a slight improvement in the Institute of Supply Management (ISM) manufacturing conditions index (Monday) to 52 ,continued strength in the services conditions ISM (Wednesday) and employment data (Friday) to show a 225,000 gain in May payrolls, unemployment unchanged at 5.4% and a slight pick-up in wages growth. Data for private income and spending, the private consumption deflator, construction spending and the trade balance will also be released. The April core private consumption deflator (Monday) is the one to watch to see if it follows the core CPI slightly higher.

- In Europe the main focus will be on negotiations with Greece. On the data front, Eurozone inflation (Tuesday) is likely to show further signs of retreat from deflation at a headline level but with core inflation remaining too low at just 0.6% year on year. The ECB meets Wednesday and while it’s unlikely to make any changes to monetary policy, President Draghi’s comments on Greece could be of interest. Retail sales and unemployment data will also be released Wednesday.

- China’s official manufacturing conditions PMI may show a slight gain consistent with the HSBC flash PMI that has already been released and the non-manufacturing PMI will also be released (both Monday).

- In Australia, the Reserve Bank (Tuesday) is expected to leave interest rates on hold. Not enough has changed since the interest rate cut last month to trigger a move in the week ahead. The positive reception to the May Budget has likely been offset in the RBA’s mind by the further deterioration seen in the investment outlook from March quarter business investment survey. Based on the experience so far this year, it would probably prefer to wait and see the next round of economic forecasts before determining whether there is a need for another cut. However, given the further deterioration in the capex outlook and to avoid another bounce in the A$, the RBA is likely to reintroduce a stronger easing bias.

- On the data front in Australia, expect March quarter GDP growth (Wednesday) to come in around 0.3% quarter on quarter with annual growth at a poor 1.7%. Dwelling construction and consumer spending are expected to just offset drags from investment and a flat trade contribution. Meanwhile, expect to see a further Sydney driven gain in home prices, a 2% pullback in building approvals (both Monday) and another 0.3% gain in retail sales (Thursday). The AIG’s manufacturing conditions PMIs are expected to remain subdued and trade data (Thursday) will also be released.

Outlook for markets

- Given the uncertainties around the Fed and Greece the next few months could remain volatile for shares. However, notwithstanding near term risks, the conditions for an end to the cyclical bull market in shares are still not in place: valuations against bonds remain good; economic growth is continuing at a not too cold but not too hot pace; and monetary conditions are set to remain easy. As such, share markets are likely to see another year of reasonable returns.

- Still low bond yields point to soft medium term returns from bonds, but it’s hard to get too bearish on bonds in a world of too much saving, spare capacity and deflation risk. Central banks won’t be ratifying a bond crash like in 1994.

- The broad trend in the Australian dollar remains down as the Fed is still likely to raise rates later this year, whereas there is now a 50/50 chance that the RBA will cut again and the long term trend in commodity prices remains down. We expect a fall to US$0.70 by year end, and a probable overshoot into the US$0.60s in the years ahead

Source: AMP CAPITAL ‘Weekly Market Update’

AMP Capital Investors Limited and AMP Capital Funds Management Limited Disclaimer