Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

Weekly Market Update – 29th January 2016

Investment markets and key developments over the past week

- The past week has seen most global share markets continue to rally, as the US Federal Reserve followed the European Central Bank into dovishness and the Bank of Japan undertook more monetary easing. The latter in particular provided a strong boost at the end of the week for risk assets. As a result, Japanese shares gained 3.3% over the week, US shares rose 1.8%, Eurozone shares rose 1.1% and the Australian share market gained 2.9%. Despite a rally on Friday, Chinese shares still lost 6.1%. Commodity prices also rose with oil up 4.7% and the Australian dollar gained. Japan’s further monetary easing pushed its 10-year bond yield to a record low of just 0.09% and this saw bond yields fall further globally.

- The march towards more dovish central banks is gathering pace. They are concerned that the latest bout of global growth worries and commodity price falls will further delay the return of inflation to their targeted levels. This renewed dovish tilt started with the European Central Bank which is now expected to ease at its March meeting and became clear from the US Federal Reserve following its January meeting where it was less positive on the growth outlook and indicated it was monitoring recent economic and financial developments. The probability of a March US Federal Reserve hike is now just 14% and rather than four rate hikes this year as the US Federal Reserve has been projecting in its ‘dot plot’. It is likely to see only one or none. This should help reduce the upwards pressure on the US dollar which in turn should help oil and other commodity prices and relieve pressure on emerging countries. Following on from the US Federal Reserve, the Bank of Japan surprised the market by cutting the interest rate it pays on excess bank reserves that are held with it to -0.1%, in a move to induce banks to lend more. The Bank of Japan’s rate cut, by putting downwards pressure on the value of the Japanese yen versus other Asian currencies, is likely to force other central banks across Asia to ease too. While the headlines will rave on about another round of ‘global currency wars’, easing wars are a better description and given the downside risks to global growth and inflation more global monetary easing is appropriate.

- The Reserve Bank of New Zealand has also turned more dovish and it is expected the Reserve Bank of Australia to do the same on Tuesday. An upbeat Reserve Bank of Australia and a dovish US Federal Reserve would not be a good combination in terms of getting (and keeping) the Australian dollar down!

- January has seen a terrible start to the year in share markets with the US S& P 500 down 5.1% and the Australian share market down 5.5%. It’s not the worst ever i.e. we have seen it all before. But for US shares it has been the worst January since January 2009 (when shares lost 8.6%) and for Australian shares it’s the worst January decline since January 2010 (when shares lost 5.8%). Obviously this will lead many to fear the old saying “as goes January so goes the year”, i.e. the so-called January barometer. But it’s worth noting that the track record of the January barometer is very mixed. For US shares the track record of a negative January going on to a negative year has been 43% since 1980. Similarly for Australian shares the track record of a negative January going on to a negative year has been 33% since 1980.

- Views remain that if there is to be a US/global recession then share markets have much further to fall (e.g. another 20% plus), once the current bounce in shares has run its course. But if recession is avoided and global growth continues to muddle along around 3% per annum then further downside in markets is likely to be limited and they are likely to stage a decent recovery by year-end. A recession is unlikely because we have not seen the normal excesses massive debt growth, over investment or inflation along with aggressive monetary tightening that invariably precede them. In fact, we are still seeing aggressive global monetary easing.

Major global economic events and implications

- US economic data over the past week was mixed with solid gains in home prices, a sharp rise in new home sales, an unexpected rise in consumer confidence, a fall in jobless claims and a sharp rebound in the Chicago purchasing managers’ index. Against this, the Markit services sector purchasing managers’ index fell in January although it remains reasonably solid at 53.7 – December durable goods orders were much weaker than expected and December quarter gross domestic product growth slowed to just 0.7% annualised. The slowdown in gross domestic product growth was mainly due to inventories and net exports, but business investment also fell. Gross domestic product growth is likely to stay down in the current quarter as the fall in durable goods orders points to more capital expenditure weakness and the blizzard in the north east will impact spending. So the US economy is going through yet another soft patch which along with another soft reading on wages growth – as the December quarter employment cost index rose just 2% year-on-year – adds to the pressure on the US Federal Reserve not to hike rates anymore.

- So far the US December quarter earnings reporting season is about 40% complete. While 80% of results have beat on earnings, its only 48% for sales and earnings are still down 5.6% year-on-year.

- Eurozone confidence readings slipped in January, on the back of all the news around global growth worries and share market turbulence, but remain at levels consistent with okay growth. Core inflation remained low at 1% year-on-year.

- The Japanese labour market remained strong in December but household spending and industrial production were very weak and core inflation fell to 0.8% year-on-year.

- Chinese industrial profits fell over the year to December, but consumer confidence rose in January.

Australian economic events and implications

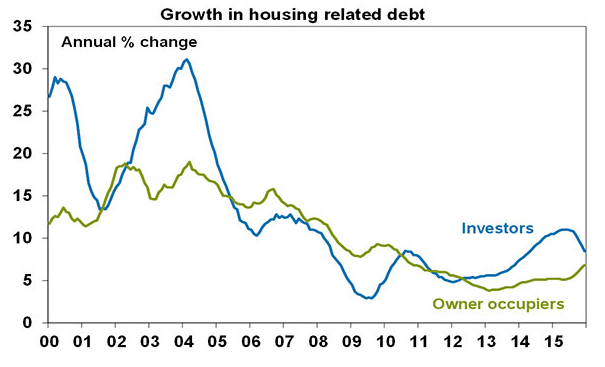

- Australian December quarter inflation data indicate that pricing power and inflationary pressures remain very weak, but probably not weak enough to trigger another Reserve Bank of Australia rate cut just yet. But with underlying inflation running at the bottom of the 2-3% inflation target it leaves plenty of room for another rate cut and helps reinforce the Reserve Bank of Australia’s easing bias. Meanwhile, another sharp slump in December quarter export prices means that the hit to national income is continuing, but that net export volumes will have continued to help real gross domestic product growth. The National Australia Bank business survey indicated business conditions and confidence fell in December, but remain above average. Finally, December credit data shows continued moderate growth overall with an ongoing slowing in lending to property investors versus owner occupiers no doubt the Australian Prudential Regulation Authority will be happy!

Source: RBA, AMP Capital

What to watch over the next week?

- In the US, expect a slight improvement in the Institute for Supply Management manufacturing conditions index (Monday) but a slowing in jobs growth (Friday) to around 190,000 consistent with a slight rise in jobless claims lately with unemployment remaining unchanged at 5%. Wages growth is likely to remain relatively subdued but with a slight rising trend. The non-manufacturing conditions Institute for Supply Management (Wednesday) is likely to remain solid and the US Federal Reserve’s preferred inflation indicator will be released Monday.

- In China, the official and Caixin manufacturing conditions purchasing managers’ indices for January (Monday) are likely to remain subdued but services conditions purchasing managers’ indices should remain a bit stronger.In China, the official and Caixin manufacturing conditions purchasing managers’ indices for January (Monday) are likely to remain subdued but services conditions purchasing managers’ indices should remain a bit stronger.

- In Australia, the Reserve Bank of Australia is expected to leave interest rates on hold on Tuesday but it’s likely to strengthen its easing bias. December quarter inflation was low but in line with Reserve Bank of Australia expectations, recent Australian economic data has been okay and it’s doubtful that the latest bout of financial and commodity market turmoil has been enough to move the Reserve Bank of Australia out of its ‘chilled out’ state. However, the latest round of worries about global growth coming at a time when domestic growth remains sluggish, national income is being hit by the continuing slump in commodity prices, the housing sector is losing momentum and inflation is low are likely to see the Reserve Bank of Australia strengthen its easing bias. It is believed that the Reserve Bank of Australia will cut the cash rate again in the months ahead. The Reserve Bank of Australia’s Statement on Monetary Policy (Friday) is likely to show a further delay in the return of economic growth to around 3% from the end of 2016 into 2017.

- On the data front in Australia expect to see continued softness in the January Core Logic RP Data home price indexes and ongoing benign inflation in the TD Securities Inflation Gauge for January (both Monday), the December trade deficit come in around A$3 billion and a 7% rebound in December building approvals (both Wednesday) and solid retail sales data (Friday). The Australian Industry Group business conditions purchasing managers’ indices will also be released.

- The Australian December half profit reporting season will start to get underway in the week ahead but with only a handful of companies reporting (including Tabcorp and Downer). Key themes are likely to be: ongoing horrific conditions for resources companies (where 2015-16 earnings are expected to fall another 52%); continued reasonable profit growth for the rest of the market (of around 6%) led by healthcare, building materials, general industrials and discretionary retail; and an ongoing focus on cost control. Given the significant downwards revision to earnings expectations (-5% over the last three months) and the fall in the share market so far this year which has taken it to a slightly below average price-to-earnings ratio there is some chance we will see an upside surprise.

Outlook for markets

- With global growth worries remaining it’s still premature to say that shares have bottomed. However, with shares having become technically oversold at their recent lows, sentiment readings at bearish extremes and central banks becoming more dovish there is a good chance that the rebound that has recently got underway has further to go. Beyond the near-term uncertainties, shares will be seen trending higher this year helped by a combination of relatively attractive valuations compared to bonds, further global monetary easing and continuing moderate economic growth. But expect volatility to remain high.

- Very low bond yields point to a soft medium-term return potential from sovereign bonds, but it’s hard to get bearish in a world of fragile growth, spare capacity, weak commodity prices and low inflation.

- Commercial property and infrastructure are likely to continue benefiting from the ongoing search by investors for yield.

- National capital city residential property price gains are expected to slow to around 3% this year, as the heat comes out of Sydney and Melbourne. Prices are likely to continue to fall in Perth and Darwin, but growth is likely to pick up in Brisbane.

- Cash and bank deposits are likely to continue to provide poor returns, with term deposit rates running around 2.5% and the Reserve Bank of Australia is expected to cut the cash rate to 1.75%.

- The downtrend in the Australian dollar is likely to continue as the interest rate differential in favour of Australia narrows, commodity prices remain weak and the Australian dollar undertakes its usual undershoot of fair value. Expect a fall to around US$0.60 by year-end.

Source: AMP CAPITAL ‘Weekly Market Update’

AMP Capital Investors Limited and AMP Capital Funds Management Limited Disclaimer