Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

Weekly Market Update – 26th June 2015

Investment markets and key developments over the past week

- The Greek saga continues. After getting a lot closer on a deal but then failing to quite get there, Greek PM Tsipras has now called a referendum for July 5 on the latest offer from Greece’s creditors. This will probably pass with polls indicating two thirds of Greeks want to stay in the Euro, and around 56% saying that this should be the case even if it involves a bad deal with Greece’s creditors. The current situation with runs on Greek banks will provide a reminder of the chaos that will follow if Greece does not remain. However, it is not certain as the Greek Government will be campaigning against it.

- Shares had another volatile week with optimism about a Greek deal early in the week giving way to renewed concern as the saga continued. Chinese shares continued to correct and even the terrorist threat reared its ugly head again. Eurozone shares (+4.4%) held on to their gains from earlier in the week and Japanese shares (+2.6%) rose to their highest since 1996 but US shares slipped 0.4% and Australian shares fell 0.9% after two weeks of gains. Chinese shares also saw continued volatility with another 6.4% decline. Bond yields generally rose, except in peripheral Eurozone countries where yields fell on hopes of a Greek breakthrough. Commodity prices were mixed but the $A fell as the $US rose.

- The week ahead will involve significant uncertainty. A missed payment to the IMF on June 30 could be handled by the IMF allowing Greece to be in “arrears” until the outcome of the referendum is known. The situation for Greek banks is rapidly worsening though and without European Central Bank support will require a bank holiday or limits on withdrawals. So ideally the referendum needs to be held with the support of Greece’s creditors but so far this is unclear with Eurozone finance ministers telling Greece that its bailout program will expire on June 30. It’s also not quite clear what the Greeks will be voting on as the creditor offer will lapse. The continuing uncertainly will likely weigh heavily on Eurozone shares (which may give up their 4% gain of the last week and then some), the Euro and global shares generally.

- Putting aside the risks around the week ahead, having a referendum is probably a good way forward for Greece as it will indicate whether the Greeks want to stay in the Euro or not. If the referendum is passed it will send a clear signal to the Greek Government to engage constructively with the rest of Europe to provide funding and then work with the creditors to put Greece’s debt burden on a more sustainable footing. The latter was getting close last year but the election of Syriza threw a spanner in the works. However, a yes vote would not provide immediate resolution though as it may mean a new Government would have to be formed. A no vote would put Greece on the messy path to an exit (or Grexit) from the Euro.

- Whilst uncertainties around Greece remain intense leaving financial markets vulnerable, it’s worth reiterating the rest of Europe is in far better shape now to withstand a Grexit than was the case through the 2010-12 Eurozone crisis so the fall out in financial markets should be limited. If Grexit is the way it goes, at some point it will provide a big relief rally for Eurozone shares, as it will mean the whole, nearly six-year long debacle with Greece is finally over.

- China cuts interest rates again, expect more easing ahead. The People’s Bank of China has cut its benchmark 12 month interest rate by another 0.25%, taking it to 4.85%, and has cut the required reserve ratio for some banks by another 0.5%. The 19% fall in the Chinese share market from its high two weeks ago no doubt provided the cover for such a move as Chinese authorities want a calmer share market with a rising trend, but certainly not a crash. More fundamentally, monetary easing is justified. Producer price deflation of around 5% year-on-year has meant real borrowing rates for many businesses are way too high. We expect the 12 month lending rate to be cut to 4% or below by year-end.

Major global economic events and implications

- US data was mostly good, but the growth rebound after the March quarter soft patch is still looking slower than that seen last year. Housing indicators remain solid, unemployment claims and weekly mortgage applications are continuing to improve, consumer spending was strong in May and consumer confidence rose in June. But against this, the Markit business conditions PMIs for June fell to still ok levels, but are well down from a year ago and underlying capital goods orders are rising but only modestly. While March quarter GDP growth was revised up to -0.2% annualised from -0.7%, this is largely irrelevant because a seasonal reanalysis next month to remove chronic seasonal softness seen in March quarters will likely see it revised up to around 1%. The basic message is that the Fed is on track to hike later this year, probably in September, but the trajectory of rate hikes is likely to be very gradual.

- Eurozone business conditions PMI’s for June were impressive. Despite all the noise around Greece the composite PMI rose to 54.1, it’s highest in three years, driven by gains in both manufacturing and services. This is consistent with a further step-up in the pace of Eurozone GDP growth this quarter to 0.5% quarter-on-quarter, compared to 0.4% last quarter.

- Japan’s manufacturing PMI for June was disappointing, but other Japanese data was more positive with the unemployment rate remaining at its lowest since 1997, the jobs to applicants ratio rising to its highest since 1992 and household spending up strongly from its tax hike, driven low a year ago. Core inflation remains too low though at 0.4% year-on-year, indicating pressure remains on the Bank of Japan for more easing.

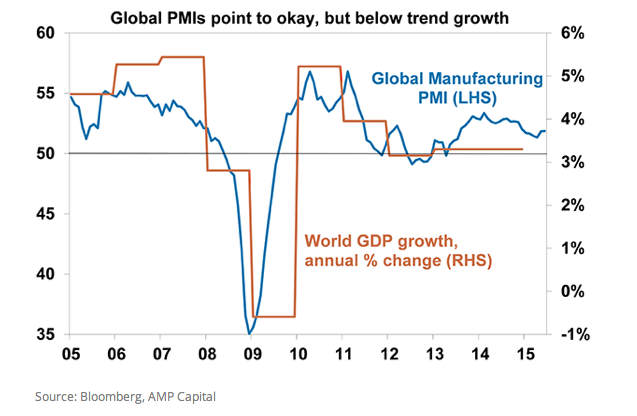

- China saw some good economic news with the flash Markit manufacturing PMI up a bit more than expected to 49.6 in June and consumer confidence up 1% in June. That said, it’s hard to get too excited as the PMI is still wallowing around in the same 48-52 range it’s been in for four years now.The overall picture from the global manufacturing PMIs released so far for June is that global growth remains uneven (with falls in the US and Japan, but gains in Europe and China) and still modest, but is okay. In some ways this is good, too weak and we worry about recession but too strong and the risks swing to inflation and aggressive central bank tightening.

Australian economic events and implications

- Official home price data for the March quarter confirmed that growth is mainly being driven by Sydney. While home prices in Sydney rose 13% over the year to the March quarter, the average pace across the other capital cities is just 2.2%. All Australian cities suffer from poor affordability, but after a couple of years of double-digit gains the Sydney market is looking a bit bubbly with buyers seemingly getting attracted by the pace of gains. It clearly needs to slow. Moves by the NSW Government to speed up land release and channel some of its stamp duty windfall into infrastructure for public housing projects are positive moves. The pressure also remains on APRA and hence the banks to slow lending for property investors, particularly into the Sydney property market. Assuming this is successful, the benign home price growth being seen outside of Sydney is certainly no barrier to another RBA rate cut.

- Job vacancy reports provided contradictory messages, but we are still looking for more constrained jobs growth ahead than seen over the last year. Population growth also appears to be slowing, providing another pointer to constrained economic growth. Our view remains that another rate cut is a 50/50 proposition. July is out but watch the August RBA meeting.

What to watch over the next week?

- In the US, the main focus will be on June manufacturing and jobs data. Expect to see a 1% gain existing home sales (Monday), further gains in home prices and consumer confidence (Tuesday), a slight gain in the ISM manufacturing conditions index (Wednesday) to 53, another solid 225,000 gain in June payrolls and a fall in unemployment to 5.4% (both Friday). Perhaps the main focus will be on whether the average hourly earnings data shows another uptick in wages growth.

- In the Eurozone, uncertainty will be intense regarding Greece ahead of its referendum. On the data front expect to see modest gains in economic confidence (Monday) consistent with gains already reported in business conditions PMIs for June. June data for inflation (Wednesday) and retail sales (Friday) will also be released.

- In Japan, expect a slight fall back in May industrial production (Monday) and the Tankan business survey (Wednesday) to show a further improvement.

- China’s manufacturing conditions PMI for June (Wednesday) will likely show a modest gain reflecting support from the monetary easing.

- In Australia, expect to see further strength in new home sales and continued modest growth in credit (Tuesday), a rebound in home prices in June after a weak May and a 1% gain in building approvals (both Wednesday), a sharp improvement in the May trade deficit (Thursday) after the partly weather related blowout seen in April and a slight rise in May retail sales (Friday). On the credit front the main interest will be in whether the growth in lending to property investors slows below APRA’s 10% target.

Outlook for markets

- Much depends on Greece in the short term with a yes vote and an eventual deal likely to see a bounce in shares, but a no vote leading to more near term weakness. Beyond this though, the combination of seasonal weakness and uncertainties around bond yields and the Fed are likely to make for continued volatility in the short term. But looking beyond near-term risks, the conditions for an end to the cyclical bull market in shares are still not in place; valuations against bonds remain good; economic growth is continuing at a not too cold but not too hot pace; and monetary conditions are set to remain easy. As such, share markets are likely to see another year of reasonable returns, despite current uncertainties. It’s worth noting that we have seen similar bouts of uncertainty at some stage through most of the last few years, so in a big picture sense it’s nothing new.

- Still low bond yields point to soft medium-term returns from bonds, but it’s hard to get too bearish on bonds in a world of too much saving & spare capacity. Central banks won’t ratify a bond crash like in 1994, by raising interest rates aggressively.

- The broad trend in the Australian dollar remains down, as the Fed is likely to raise rates later this year whereas there is a 50/50 chance that the RBA will cut again and the long term trend in commodity prices remains down. We expect a fall to $US0.70 by year end, and a probable overshoot into the $US0.60s in the years ahead.

Source: AMP CAPITAL ‘Weekly Market Update’

AMP Capital Investors Limited and AMP Capital Funds Management Limited Disclaimer