Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

Weekly Market Update – 24th July 2015

Investment markets and key developments over the past week

- Share markets mostly fell over the last week weighed down by some weak earnings results for US multinationals, lower commodity prices depressing resources stocks, weak Chinese economic data and some profit taking after recent gains. This saw US shares fall 2.2%, Eurozone shares down 1.8%, Japanese shares down 0.3% and Australian shares fall 1.8%. However, despite some soft economic data Chinese shares continued to recover with a 2.9% gain. Bond yields fell partly in response to falling commodity prices reigniting deflation fears with oil back below US$50/barrel and gold falling to a five year low. The weakness in commodity prices saw the Australian dollar fall below US$0.73, to its lowest in six years.

- Gold bugs giving up on hyperinflation. It seems like only yesterday that gold bugs dreamt of quantitative easing causing a crash in the US$ and hyperinflation, central banks were reportedly piling into gold for their reserves and the gold price was supposedly on its way to infinity and beyond. Well as it turned out the US$ didn’t crash, hyperinflation never arrived and gold has plunged more than 40% from its 2011 high to a five year low. While there will be bounces with gold being part of the commodity complex which is in a secular downtrend, we find it hard to be optimistic on gold for the next few years.

- New Zealand cuts rates as expected. The latest rate cut by the Reserve Bank of New Zealand (RBNZ) taking its cash rate to 3% was no surprise and followed downwards revisions to its growth and inflation forecasts not helped by falling commodity prices. More cuts are likely. The NZ move (following hot on the heals of a rate cut in Canada) highlights the pressure commodity producing countries are under and that the risks are still skewed towards another cut in Australia.

- Sydney house prices above $1 million are great for existing home owners but terrible for those trying to get into the market. Average prices around $1 million would be fine if average household disposable income was around $300,000 pa, but it’s just a fraction of this. The proximate driver has been very low interest rates and buyers jumping in for fear of missing out (FOMO). But the underlying reason for exorbitant Sydney home prices is a chronic failure of the supply of new homes to match demand for nearly a decade. The long term solution is to make it easier for developers to bring new homes to market.

- The Australian Prudential Regulation Authority’s move to require banks to hold more capital should be manageable. While it requires an extra $12-14bn in extra capital to be raised by the major banks, it comes after much debate and should already be factored in to bank share prices after their average 18% correction over the March to June period. Much of the increase in capital could be achieved via dividend reinvestment plans rather than cuts to dividends and the higher cost of equity capital could be covered by an increase in bank mortgage rates/cut to deposit rates of just 0.1-0.2 percentage points, with two banks already announcing hikes to investment home loan rates. The pressure on the big banks will make life relatively easier for smaller lenders, though making the mortgage market a bit more competitive. To the extent that banks do raise their effective mortgage rates at the margin it adds to the case for another RBA interest rate cut.

- Moves by the ANZ and Commonwealth Bank to raise their investment property mortgage rates, with other banks likely to follow, combined with other moves to slow lending to property investors are likely to really start to bear down on property investor demand in the months ahead. This in turn is likely to see home price growth slow Sydney and Melbourne.

Major global economic events and implications

- US economic data was mostly solid with existing home sales rising more than expected, home prices continuing to rise, jobless claims down sharply, the leading index up solidly and the Markit manufacturing conditions PMI up slightly to a solid 53.8. However, new home sales fell and the mistaken release by the US Federal Reserve (Fed) of relatively dovish economic and interest rate staff forecasts – while somewhat dated – also highlight the uncertainty the Fed faces in considering rate hikes. June quarter earnings results are now 37% done and while there were some high profile earnings disappointments for globally exposed companies, overall results are continuing to come in better than expected with 77% beating on earnings and 53% beating on sales. Consensus earnings growth expectations for the June quarter have improved from -5.3% year on year to -1.7% yoy and look like ending slightly positive.

- Eurozone consumer confidence and business conditions PMIs fell in July, which isn’t surprising given the Greek turmoil. However, the falls were modest and they are well above levels seen through the Eurozone crisis and in fact are at levels consistent with modest to reasonable growth. Assuming Greece continues to recede as an issue then confidence readings are likely to move higher in the months ahead.

- China’s flash Markit manufacturing PMI fell in July to 48.2, suggesting a poor start to the current quarter for growth. While it’s just been bouncing up and down in the same 48-52 range for four years now, the fall nevertheless suggests growth is yet to stabilise and that more monetary stimulus is required. This means more interest rate cuts with the benchmark lending rate likely to fall below 4% by year end, more fiscal stimulus and possibly allowing a lower Renminbi/US$ rate.

Australian economic events and implications

- Australian June quarter inflation – at 1.5% year on year for headline and 2.3% year on year for underlying – remains benign. Weak pricing power is evident in prices for market goods and services excluding volatile items rising just 0.3%qoq or 1.6%yoy and clothing prices down 0.9%yoy, furnishing and household equipment prices up just 1.4%yoy, car prices down 1.4%yoy, prices for recreation and culture up just 0.9%yoy and communication prices down 3.4%yoy. Beyond the impact of higher fuel prices there is also little significant impact from the plunge in the value of the A$.

- June quarter inflation was benign but it’s not low enough to bring on another RBA rate cut on its own. That said, with inflation comfortably in the mid to low end of the RBA’s target range it’s no barrier to another rate cut either.

- A speech by RBA Governor Stevens indicates another rate cut remains on the table but that it needs to be balanced against medium term growth constraints and the risk of financial instability. Our assessment is that the combination of the ongoing downside risks to growth in Australia, the level of spare capacity in the economy which will only be used up by a period of above trend growth and the need to see an even lower A$, at a time when inflation is well contained, mean that another rate cut before year end is a 50/50 proposition.

- On the tax front it’s great to see a decent debate around the GST, but if it is to be increased it’s important that it be as a part of tax reform (including compensation for low income earners, pensioners, etc) and not a simple revenue grab.

What to watch over the next week?

- Globally the focus will likely return to the US, with the Fed meeting on Wednesday. The Fed won’t make any changes to monetary policy, but is likely to express confidence in the US growth outlook and reiterate that an interest rate hike remains on track for later this year but that it is dependent on a further improvement in growth and that future hikes will be gradual. At this stage it’s 50/50 as to whether the first hike will come in September or December, whereas the US money market appears to be attaching a 25% chance to a September move.

- On the data front in the US, expect to see a further gain in durable goods orders (Monday), another rise in home prices, a continued solid reading for the Markit services PMI but a slight fall in consumer confidence (all Tuesday) and another solid gain in pending home sales (Wednesday). The June quarter employment cost index (Friday) will be watched for a further rise in wages growth, but monthly wages data suggest it may track sideways. Gross domestic product (GDP) data (Thursday) is also likely to see June quarter growth bounce back to 3% annualised, but watch for a seasonal reanalysis of March quarter GDP growth which is likely to see it revised up from -0.2% annualised to maybe +1%. 172 S&P 500 companies will report June quarter profit results.

- In the Eurozone economic confidence indicators (Thursday) will give a further guide to how the Greek crisis affected confidence. Meanwhile expect to see a further improvement in money supply and bank lending growth (Monday), a slight fall in unemployment to 11% (Friday) and continued low inflation (also Friday) in June with core inflation remaining around 0.8%yoy.

- Japanese data for industrial production (Thursday) along with data for jobs and household spending (Friday) are expected to point to a continuation of the economic recovery but with inflation (also Friday) remaining too low at just above zero.

- China’s official PMI for July (Saturday) will be watched to see whether it moves lower in line with the flash Markit PMI.

- In Australia, expect to see building approvals remain strong (Thursday), a further decline in export prices relative to import prices (Thursday), a benign June quarter reading for producer price inflation and continued modest growth in credit (both Friday). A speech by RBA Governor Stevens (Thursday) will be watched closely for any clues on the interest rate outlook.

Outlook for markets

- Share markets are likely to remain volatile as we are still going through a seasonally weak period of the year for shares, uncertainties remain regarding Chinese economic growth and a likely Fed interest rate hike lies ahead for later this year.

- But looking beyond the near term, the cyclical bull market in shares likely has further to go: valuations against bonds remain good; economic growth is continuing at a not too cold but not too hot pace; and monetary conditions are set to remain easy. As such, share markets are likely to remain reasonable, despite current uncertainties.

- Still low bond yields point to soft medium term returns from bonds, but it’s hard to get too bearish on bonds in a world of too much saving & spare capacity. Central banks won’t ratify a bond crash like in 1994, by raising interest rates aggressively.

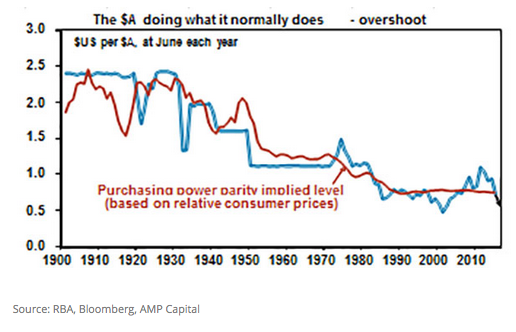

- The broad trend in the A$ remains down as the Fed is likely to raise rates later this year whereas there is a 50/50 chance the RBA will cut again and the trend in commodity prices remains down. Our view remains that it is heading into the US$0.60s, but this could now come before year end.