Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

Weekly market Update – 22nd May 2015

Investment markets and key developments over the past week

- Global share markets mostly rose over the last week, as mixed US economic data was seen delaying Fed hikes and likely to ensure they are gradual, even though inflation perked up a bit in April. A European Central Bank (ECB) official talked about front-loading quantitative easing and talk of further Chinese easing continued. US shares gained 0.2%, Eurozone shares rose 2.5%, Japanese shares rose 2.7% and Chinese shares surged 8.1%. Australian shares slipped 1.2% though as banks remained under pressure. Bond yields rose slightly but remained below recent highs with the bond sell-off looking like its lost momentum. The $US rose and this weighed on commodity prices and saw the $A fall 2.6%, which is good news for the RBA.

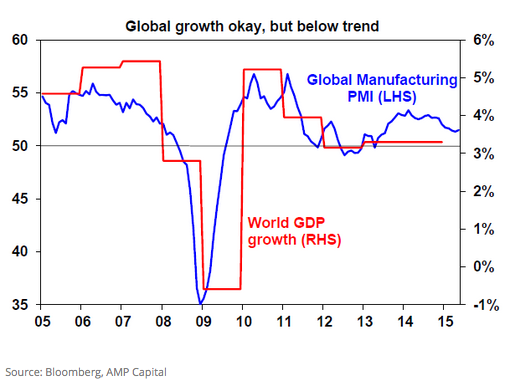

- Global growth continuing but remains sub-par. The story of the last few years has been initial optimism regarding global growth at the start of the year and then a bit of disappointment as global growth remains uneven and below trend. This year looks the same. While “flash” manufacturing conditions PMIs rose in May (up in Japan, China and Europe but down slightly in the US), their level remains consistent with okay but still sub-trend global growth. See the next chart.

- Against this backdrop, global monetary conditions are likely to remain very easy (with pressure for further easing in China) and it’s hard to get too bearish on bonds. In fact, there is a good chance that the bond sell off has run its course (at least for now).

- Falling emerging world exports are worth keeping an eye on. A range of emerging and Asian countries, including Korea and Taiwan, have reported falling exports over the last few months. Part of this may reflect earlier strength in the $US, weakness in China and falling commodity prices. However, it may also be a sign of softer global growth generally. It’s too early to get over excited about it though, particularly as Europe and Japan have picked up a bit and the US is having just another soft start to the year, but it’s worth watching.

- Still no Greek deal yet. It’s now close to crunch time for Greece which will need agreement on a funding release in the next week or so or else face a probable default event in June as it runs out of funds. Such a default or “Graccident” won’t necessarily mean that a “Grexit” (Greek exit from the Euro) is inevitable though and, by highlighting the difficult situation Greece is in, it could force an agreement to the necessary reforms. However, the political uncertainty (i.e. whether there will be a deal? how long it will take to be approved by the Greek Parliament? whether it will have a referendum on it? what will happen if there is no deal? etc.) has the potential to cause increased volatility in investment markets. Our base case remains that a deal will be reached as it’s in the interests of both sides but, whichever way it goes, the rest of Europe is in far better shape now than was the case in 2010-2012 so contagion from Greece to other peripherals is likely to be kept to a minimum.

Major global economic events and implications

- US economic data remains pretty mixed, but inflation picked up in April. While housing starts and permits rose strongly in April, and jobless claims remained low, a range of data was softer than expected including the NAHB home builders conditions index, existing home sales, the Markit manufacturing conditions PMI and regional manufacturing conditions indexes. The strong $US and the lower oil prices (via energy producers) has clearly weighed on US growth. It will likely pick up in the months ahead but it’s another year where US growth is failing to meet expectations set at the start of the year, and that includes the Fed’s own forecasts.

- Against this though, US April core inflation at 0.3% month-on-month came in a bit stronger than expectations for a 0.2% gain, raising the prospect that inflation may be starting to perk up. However, it’s too early to tell at this stage as the rise was driven by just three sectors – medical care services, used cars and shelter – so it may just be statistical noise. The minutes from the last Fed meeting offered little that was new, seeing little support for a June rate hike with September looking more likely. Fed Chair Yellen expressed confidence that growth will pick up and reiterated that the Fed will need to see continued labour market improvement and more confidence that inflation will move back to 2% over the medium term before raising rates and that it will proceed “cautiously” when it does start to raise them. Our base case remains that the Fed will wait till September before starting to raise rates.

- Eurozone data disappointed a bit, highlighting that any talk of an early end to the ECB’s quantitative easing program is way too premature. Although the manufacturing conditions PMI rose in May, services conditions fell and this dragged the composite PMI lower. While the overall PMI is still at a reasonable level, based on past relationships, it’s pointing to growth remaining around 0.3/0.4% quarter-on-quarter for now. Consumer confidence also disappointed in May, albeit from a relatively solid level.

- Japanese data provided a bit of confidence that its latest economic recovery is continuing. March quarter GDP growth was stronger than expected (albeit much of this was due to inventory accumulation). Both machine orders and the manufacturing PMI for May improved more than expected. Also, as expected, the Bank of Japan made no changes to monetary policy.

- Chinese economic data was a bit more positive with the flash HSBC manufacturing conditions PMI improving in May (albeit by less than expected) and property prices coming in roughly flat for April (in contrast to falls averaging around 1% a month in mid last year) adding to signs that the property market may be stabilising. The People’s Bank of China monetary easing has also resulted in a collapse in money market interest rates, with the overnight rate falling to around 1%.

Australian economic events and implications

- A 6% bounce in consumer confidence has confirmed that the Budget has gone down far more positively than last year’s Budget did (when confidence fell 7%). This is very welcome, as confidence has been lacking for some time now. However, with confidence still only just above long term average levels a further improvement is required to get confident that the growth outlook is on the mend. Meanwhile, the minutes from the RBA’s last Board meeting and comments by Deputy Governor Lowe to the effect that there is still scope to lower the cash rate if needed support the interpretation that the RBA retains a mild easing bias. Our base case remains that 2% is the low for the cash rate, but that the risks are on the downside particularly if the $A fails to behave. However, going by the recent experience another cut in rates is unlikely to occur before August as the RBA would probably prefer to get a look at its next set of economic forecasts (which won’t be available till August).

What to watch over the next week?

- In the US, March quarter GDP growth (Friday) may be revised down to -0.9% annualised from +0.2%. However, there is greater than normal confusion around this, as it appears that the Bureau of Economic Analysis’ (BEA) seasonal adjustment process is understating March quarter GDP growth and a re-adjustment would put it around +1.8% annualised. As a result the BEA has indicated that it is looking into this. In other data, expect a slight improvement in underlying durable goods orders, continued strength in home prices, a rebound in new home sales (all due Tuesday), a further gain in pending home sales (Thursday) and a rise in consumer sentiment (Friday) should all help allay fears that the US economy has slowed too much.

- Eurozone confidence data for May (Thursday) will be watched for evidence that the pick-up in Eurozone growth is being sustained. And of course, progress towards a “reform for funding deal” with Greece will be watched very closely given Greece is now close to crunch time.

- In Japan, expect to see labour market indicators remain solid, a slight improvement in household spending and a bounce in industrial production, but inflation to fall back to only just above zero as the sales tax hike a year ago falls out of the annual inflation figures (all Friday).

- In Australia, expect to see a 1% fall in both March quarter construction activity (Wednesday) and business capital expenditure (Thursday) driven by the ongoing slide in mining investment. The key to watch will be business investment plans for any signs of an improvement in the outlook for non-mining investment. Data for new home sales and private credit will also be released Friday. Clues on the interest rate outlook will be watched for. with RBA officials Lowe and Edey both speaking.

Outlook for markets

- In the US, March quarter GDP growth (Friday) may be revised down to -0.9% annualised from +0.2%. However, there is greater than normal confusion around this, as it appears that the Bureau of Economic Analysis’ seasonal adjustment process is understating March quarter GDP growth and a re-adjustment would put it around +1.8% annualised. As a result the BEA has indicated that it is looking into this. In other data, expect a slight improvement in underlying durable goods orders, continued strength in home prices, a rebound in new home sales (all due Tuesday), a further gain in pending home sales (Thursday) and a rise in consumer sentiment (Friday) which should all help allay fears that the US economy has slowed too much.

- Eurozone confidence data for May (Thursday) will be watched for evidence that the pick-up in Eurozone growth is being sustained. And of course, progress towards a “reform for funding deal” with Greece will be watched very closely given Greece is now close to crunch time.

- In Japan, expect to see labour market indicators remain solid, a slight improvement in household spending and a bounce in industrial production, but inflation to fall back to only just above zero as the sales tax hike a year ago falls out of the annual inflation figures (all Friday).

- In Australia, expect to see a 1% fall in both March quarter construction activity (Wednesday) and business capital expenditure (Thursday) driven by the ongoing slide in mining investment. The key to watch will be business investment plans for any signs of an improvement in the outlook for non-mining investment. Data for new home sales and private credit will also be released Friday. Clues on the interest rate outlook will be watched for with RBA officials Lowe and Edey both speaking.

Source: AMP CAPITAL ‘Weekly Market Update’

AMP Capital Investors Limited and AMP Capital Funds Management Limited Disclaimer