Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

Weekly Market Update – 22nd July 2022

Investment markets & key developments

- Global sharemarkets rallied again this week with US equities up 2.5%, Australia 2.4%, Europe 3.4%, Japan 4.2% while Chinese stocks are down by 0.2%. Positive gains in most sharemarkets after weeks of declines are leading to questions about whether we have seen the low in markets. Views have not changed – the risk is of more downside to equities until there are clearer signs that inflation has peaked (which means central banks can pause on rate hikes) and until economic data troughs (but hopefully avoids a recession). On a 6-12 month view, views are more optimistic on shares as inflation recedes, central banks stop raising interest rates (and maybe even cut rates) and a deep recession is avoided.

- Bond yields fell towards the end of the week on growth concerns, after some shocking PMI data on Friday. The US 10-yr was down to 2.75% (from 2.9% at the start of the week) and the 2-yr down to 2.97%. German 10-yr yields fell to 1.0% from 1.2% at the start of the week. Italian political developments saw Italian 10-yr bond yields up marginally to 3.3%, from 3.2% at the start of the week. The US dollar was down marginally from recent highs, but is still elevated and the $A is close to US$0.69.

- After three key parties in Italian Parliament cast a “no confidence” vote over the government, Italian Prime Minister Mario Draghi resigned, which means that an election will occur on 25 September. Italy is no stranger to political instability (it has a highly fractured parliament with many minor parties), with the last 161 years yielding 132 governments – an average 15-month tenure. (Draghi’s government lasted 18 months – more than normal!). No doubt there will now be concern around whether this instability has implications for Italy’s membership in the Eurozone. The pandemic and war in Ukraine have strengthened the Euro and support for the Euro remains very strong in Italy, with the latest Eurobarometer survey showing that 72% of respondents in Italy supported the Euro (above the 69% reported for the EU 27). Nevertheless, new elections and populist parties increase the chance of calls for Italian independence. Italian bond spreads relative to Germany were up again this week on political uncertainty, but are well below previous peaks like in the Eurozone debt crisis, or 2019/20 (which also saw political uncertainty).

![]()

Source: Bloomberg, AMP

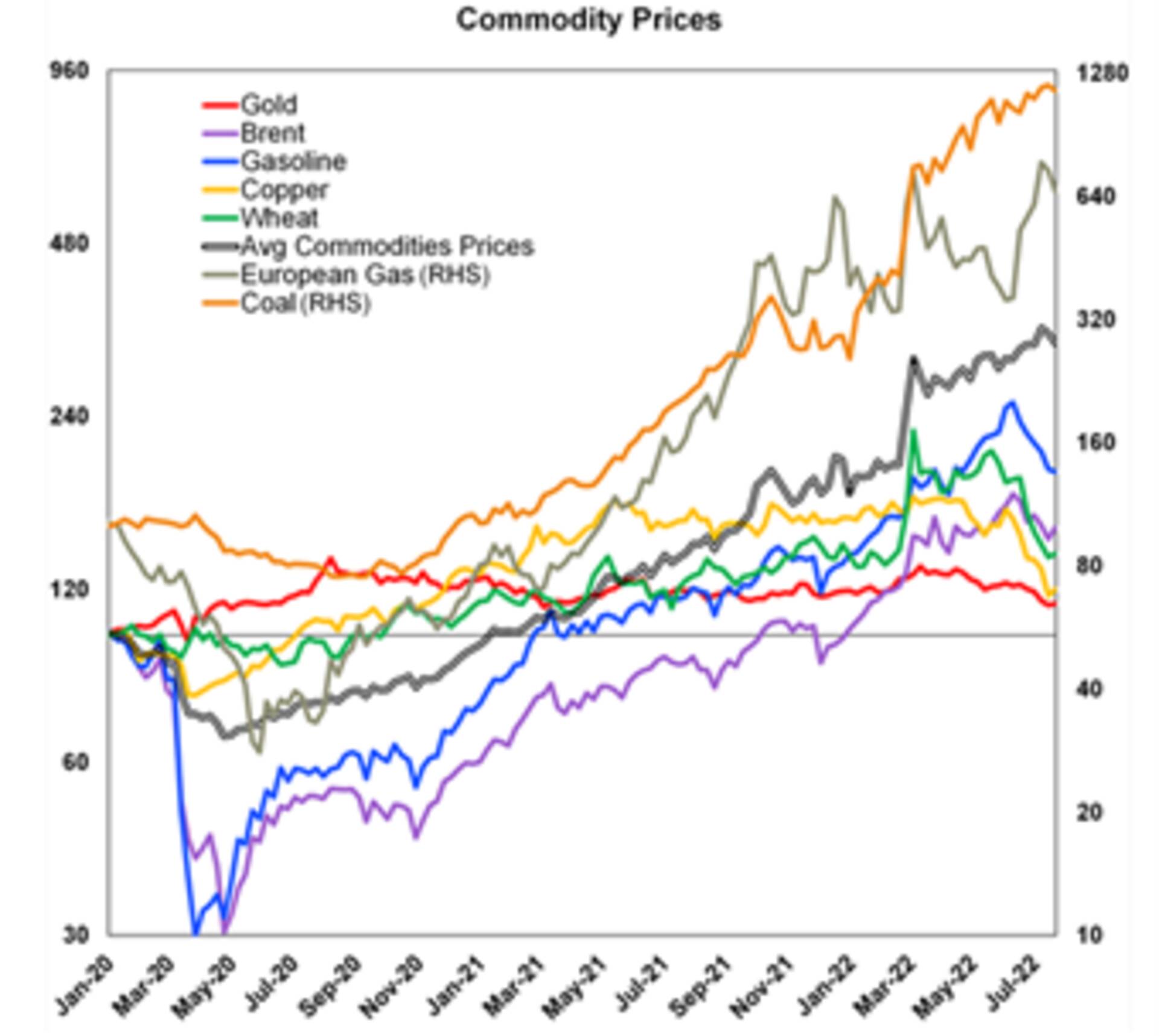

- Gas flows to Europe will restart from the Nord Stream 1 pipeline which has been halted since July 11 for scheduled maintenance. Reports are mixed, but it seems that initial gas flows will be at 40% of capacity (the same as pre-maintenance), but this could go down to 20% if disputes over sanctioned parts of the pipeline are not resolved. This uncertainty around supply will keep gas prices high for now. While most metals and agricultural commodity prices have fallen in recent weeks, gas and coal prices remain elevated (see the chart below).

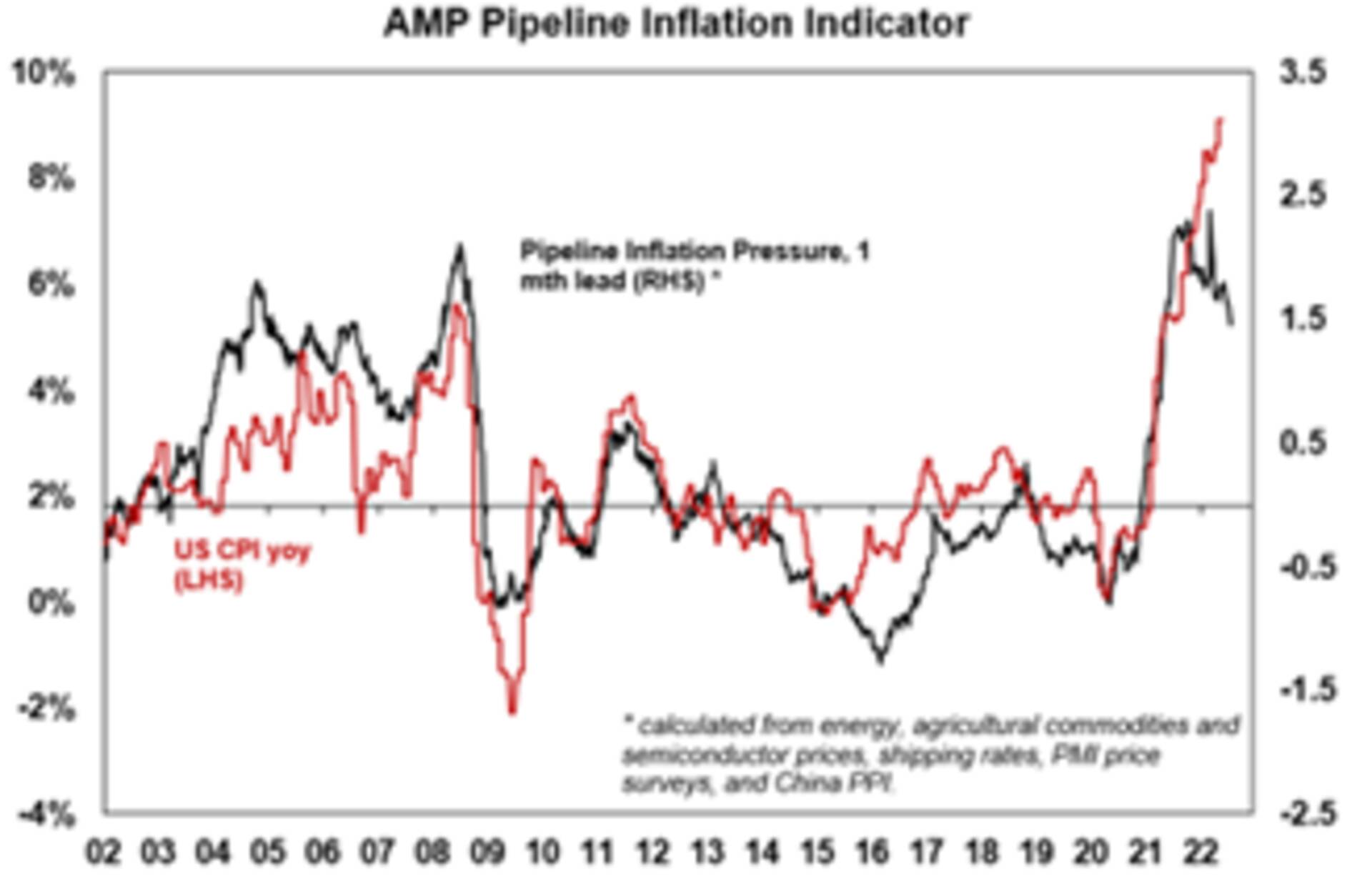

- Lower commodity prices will be necessary to see a slowing in inflation. The Pipeline Inflation Indicator (see chart below) continues to track down and points to a decline in inflation on a 6-12 month time horizon.

Coronavirus update

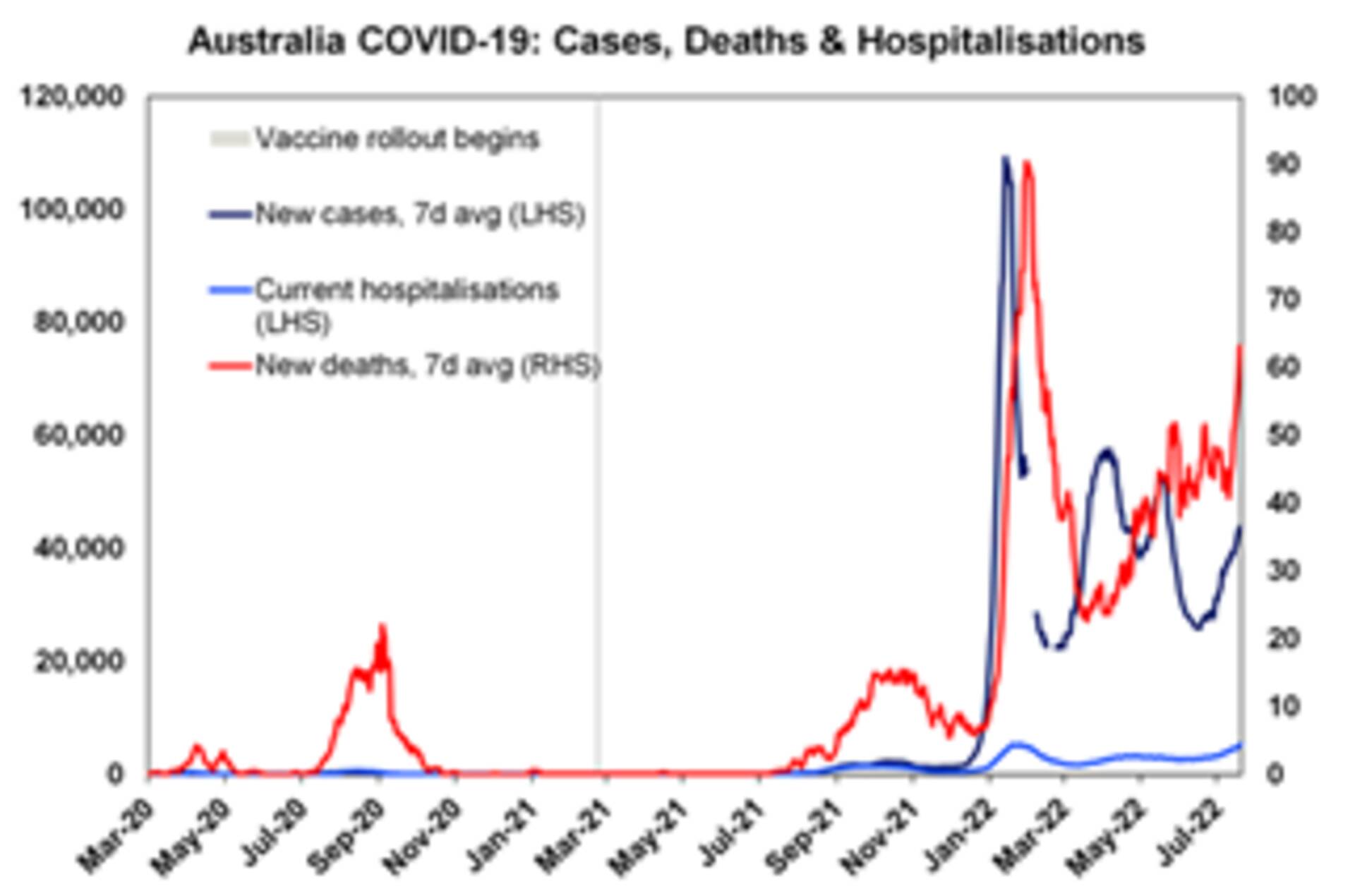

- Omicron sub-variants BA.4 and BA.5 are causing a tick-up in global COVID cases (although new cases are well below the first Omicron peak) and deaths have risen slightly but remain around their lows (see chart below).

- Australian daily COVID cases are close to 50K/day, which is still below the Omicron wave in January (when daily cases were around 100K) but deaths and hospitalisations are rising, so some restrictions around working from home mandates and masks could come back.

- The good news is that the strains originally discovered in South Africa (which saw an initial spike in cases in April/May) was brought down relatively quickly, with no major rise in deaths or hospitalisations.

Economic activity trackers

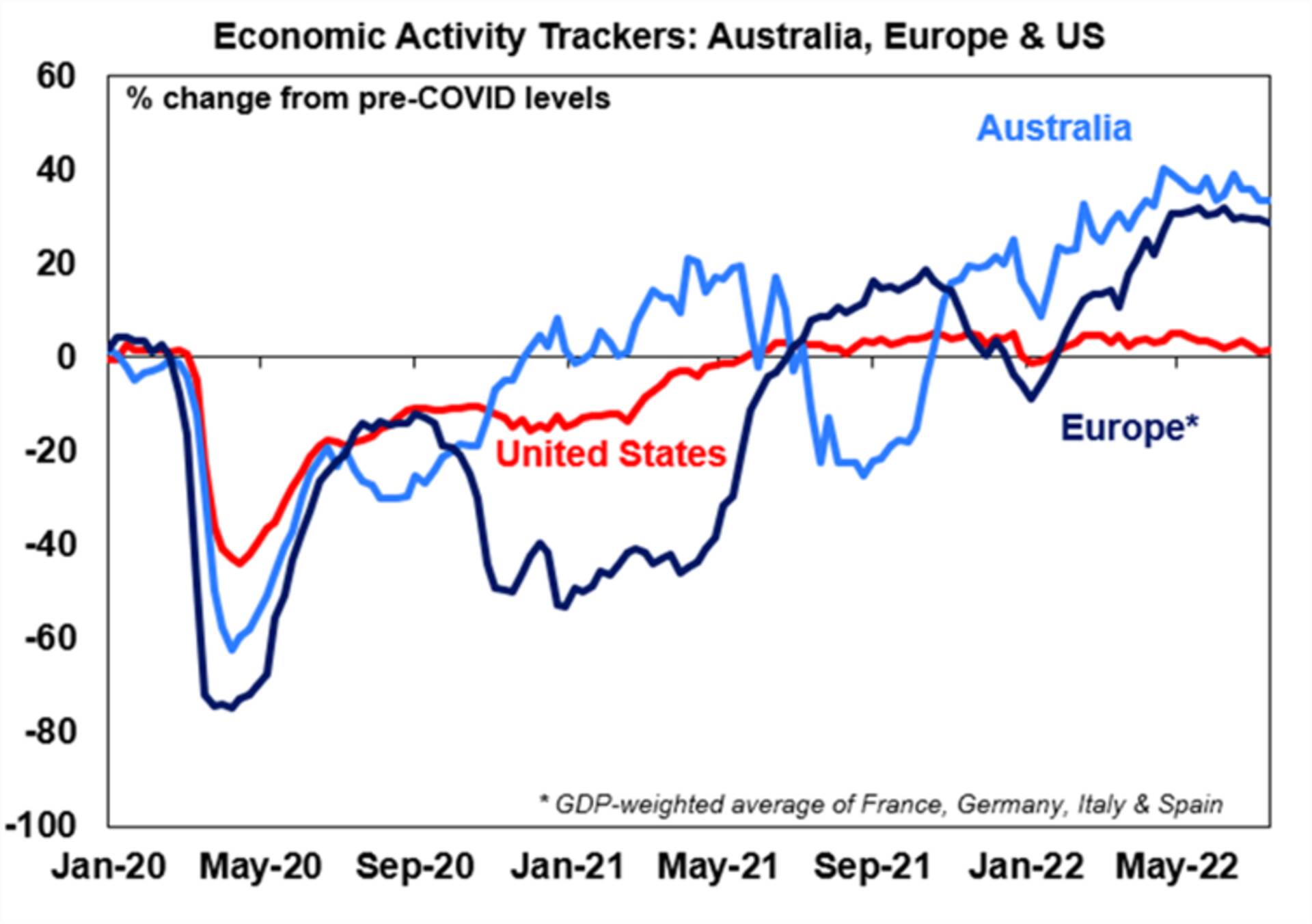

- The Weekly Economic Activity Indicators are flattening across Australia, US and Europe (see the chart below), which is to be expected as interest rates rise. The indicators however have not fallen drastically, despite economic fears and share market declines.

Major global economic events and implications

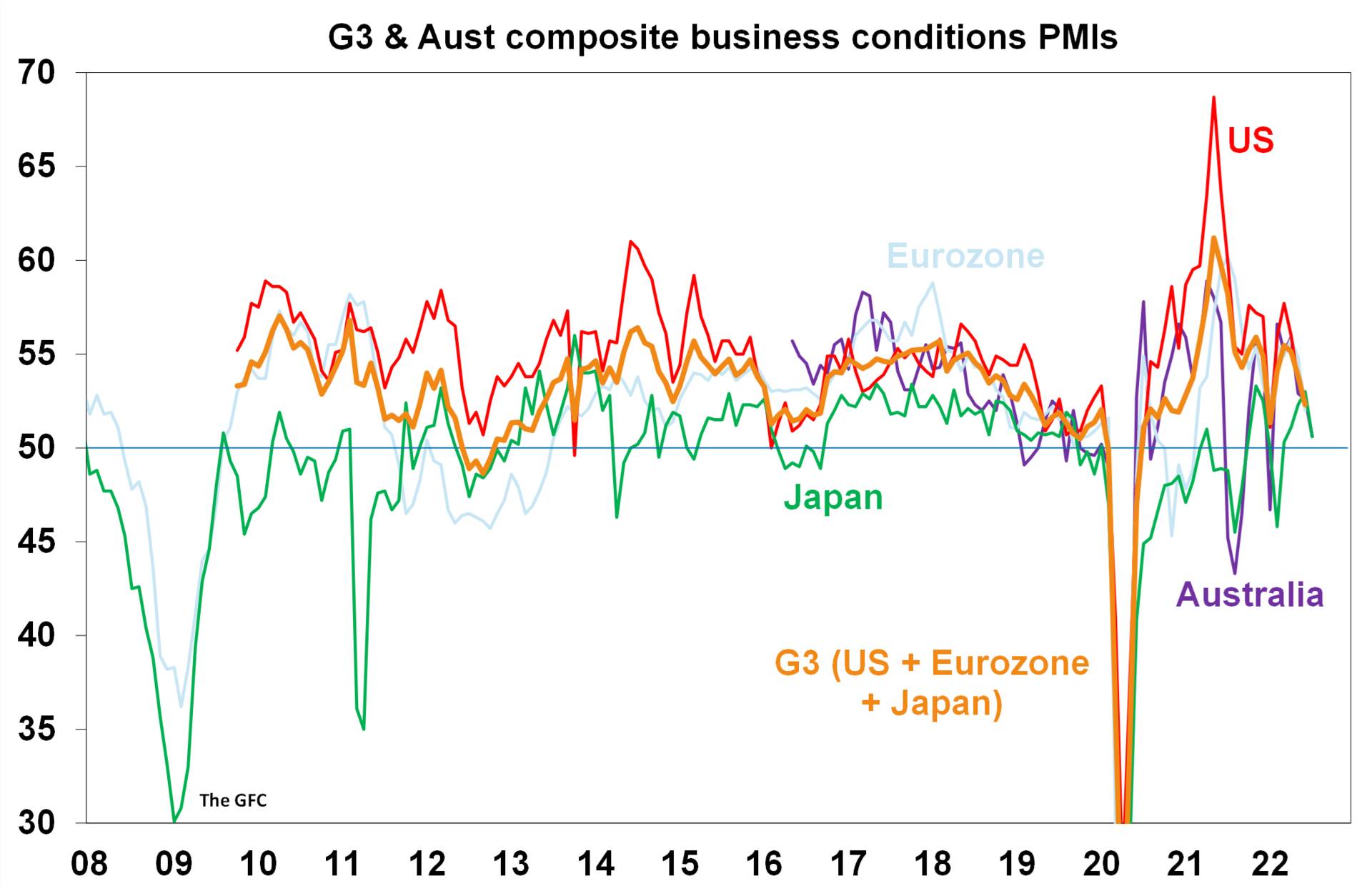

- Global PMIs plunged, especially in the US and Europe, causing concern after a severe downturn in 2H 2022. The US composite PMI dropped to 47.5 in July, from 52.3 last month (expectations were for a reading of 52.4), with services activity accounting for the decline while manufacturing activity was still positive. The Eurozone composite PMI dropped to 49.4 in July, from 52 last month (expectations were for a reading of 51). Eurozone services activity fell to 50.6 from 53, but was still positive, and holding up better than in the US. Manufacturing activity is faring worse and was down to 49.6 in July.

- The Australian July composite PMI fell to 50.6, from 52.6 last month, with a larger drop in services while manufacturing fell only slightly.

- New Zealand June quarter inflation data showed a 1.7% rise in quarterly consumer prices, which was above market expectations and takes annual growth to 7.3%, increasing the risk that the Australian consumer inflation data (released next week) will also be higher than expected (because of the high correlation between tradeable inflation across the two countries). Other data showed that consumer spending is not collapsing despite aggressive rate hikes by the Reserve Bank of New Zealand (RBNZ), with credit card spending up by 1.3% in June.

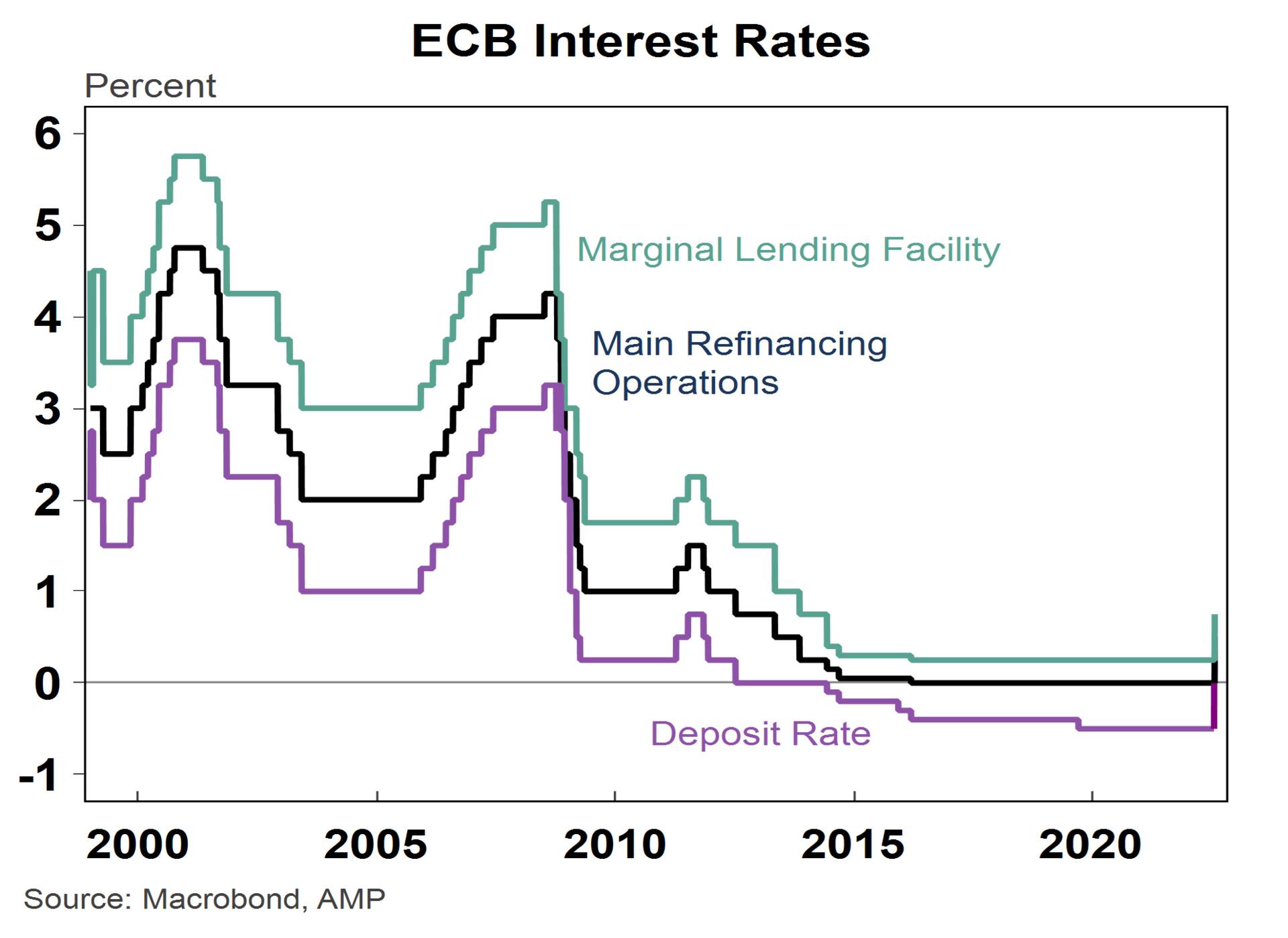

- The European Central Bank (ECB) met this week and delivered a 50 basis point rate hike, which was speculated in markets in prior days. This is the first interest rate hike by the ECB in 11 years and takes the main refinancing operations rate to 0.50% and the marginal facility rate to 0.75%. (These are rates charged to banks that borrow from the ECB). The deposit rate lifted from -0.50% to 0%, which is the rate charged to banks on deposits with the ECB (see the chart below).

- The other anticipated announcement was around the anti-fragmentation tool, called the “Transmission Protection Instrument” in response to the widening of spreads in bonds across Euro peripheral countries, which have been causing concern around borrowing costs. Details around the program were vague, but ultimately it will involve the ECB buying government or private sector debt.

Eurozone consumer confidence, also released this week, was down in July to its lowest level since the survey began in 1985.

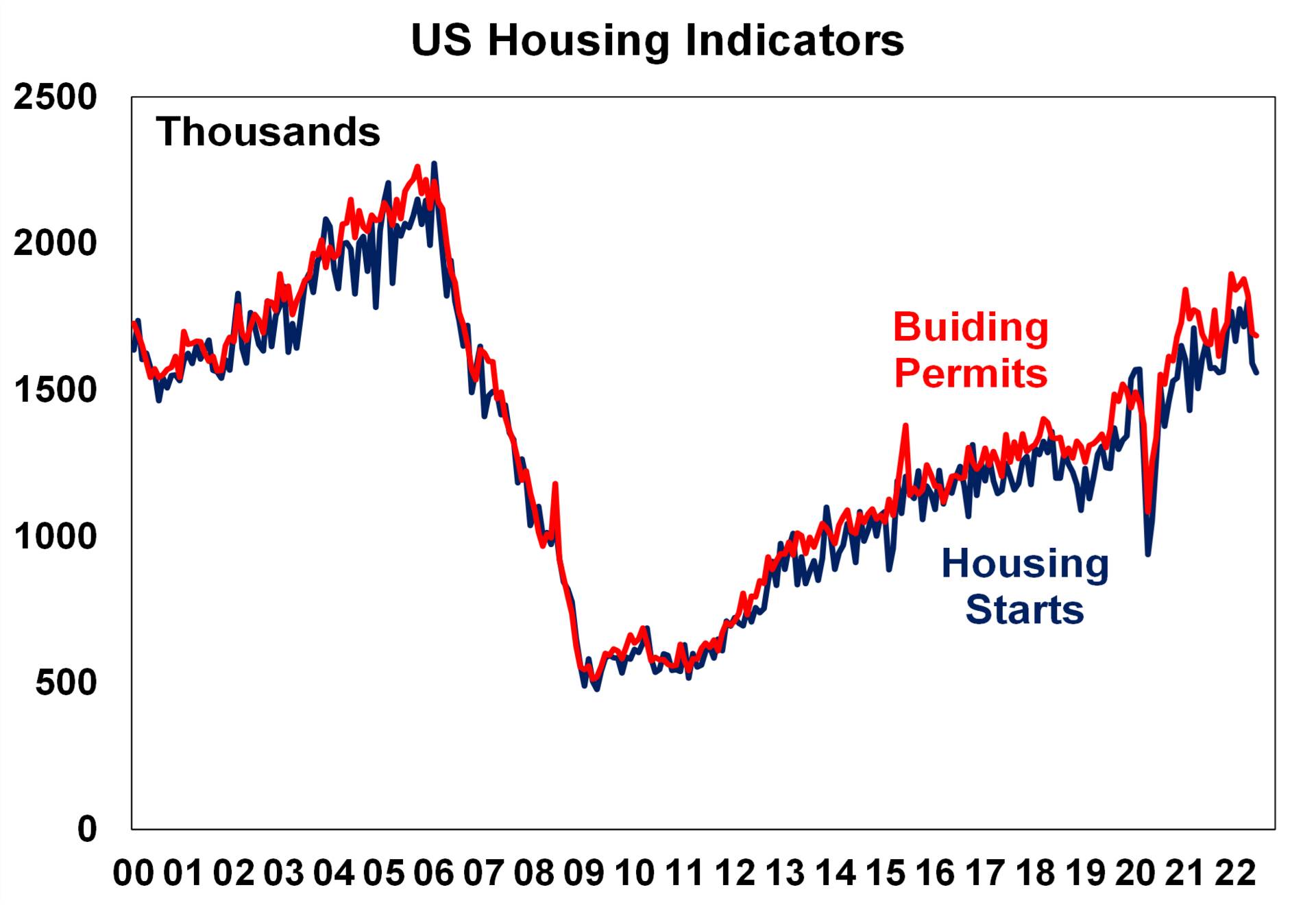

- US housing data continues to weaken (which is unsurprising given recent rate hikes… It would be more surprising to see housing indicators remain strong). Building permits fell by 0.6% in June, housing starts were down by 2% in June, the NAHB housing market index plunged in July, existing home sales fell by 5.4% in June and new purchase mortgage applications were down again over the week to 15 July. Initial jobless claims are also showing signs of ticking up.

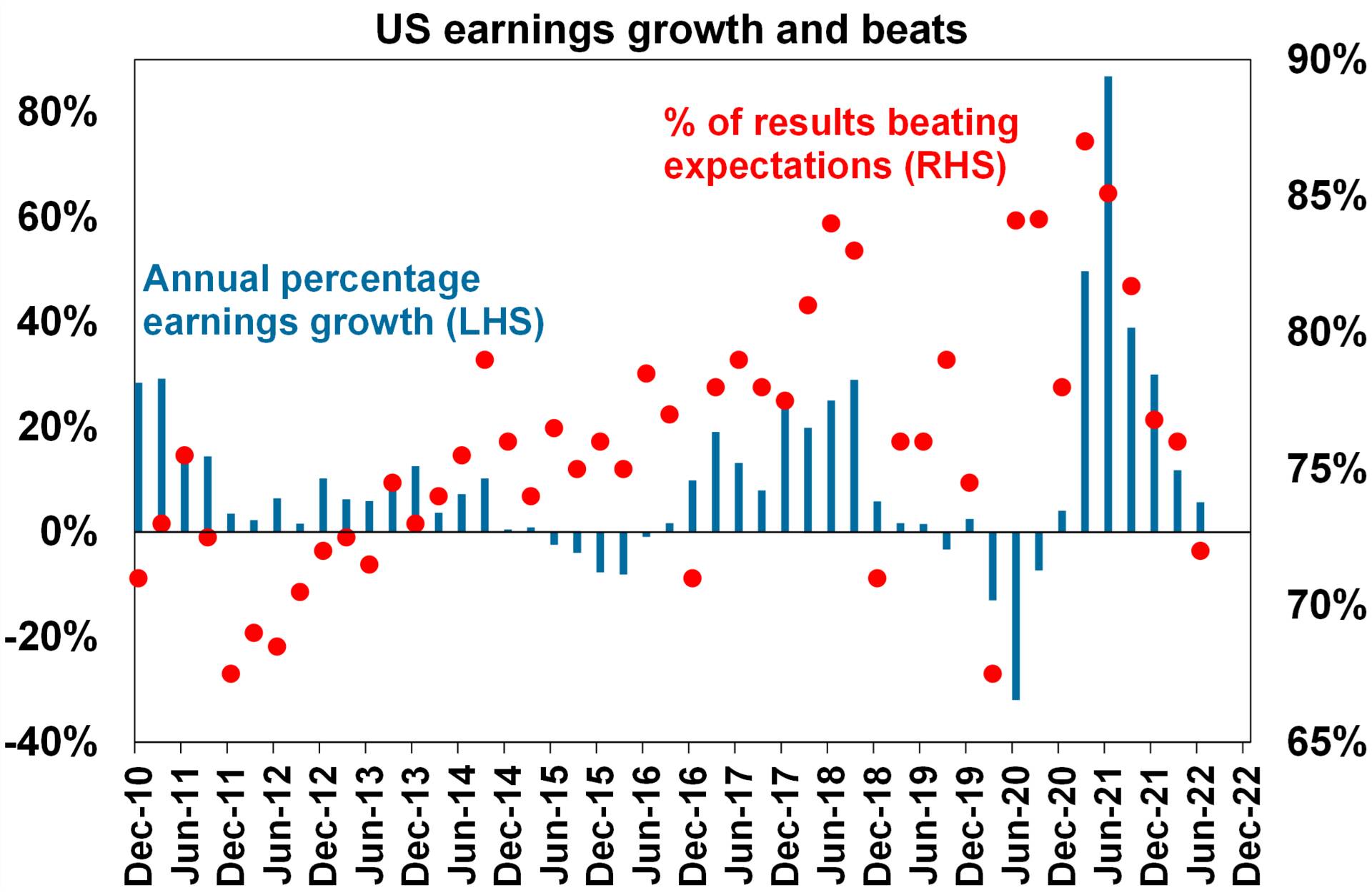

- US June quarter earnings reports have started, with 19% of S&P500 companies reporting to date. Earnings estimates are holding up better than feared, with 72% of companies beating expectations (slightly less than the historical average of 76%, although a lot of the positivity is in higher energy profits due to high prices) and earnings are on track for around a 5.7%yoy rise. There was some concern about a slowing in hiring across large tech firms, with Google and Microsoft making announcements around pausing hiring, but this should not be too surprising as the labour market is probably close to full capacity (the unemployment rate is very low, at 3.6% – close to its lowest point since 1969).

- In the UK, inflation data was strong, with headline consumer price inflation up 9.4%yoy to June, the highest since February 1982, which will keep expectations of a 50-basis point hike in August alive. May employment data was solid overall, the unemployment rate was unchanged at 3.8%, employment growth was higher than expected, but wages (as measured by average earnings) rose by less than expected, up by 6.2%pa.

- Canadian inflation was also high in June, up by 8.1% over the year, the highest level since January 1983, although market expectations were looking for an even larger lift. Core inflation is tracking at 4.6%yoy.

- Japanese inflation is also rising, up by 2.4% over the year to June and 1% on the core measure. There were no major updates from the Bank of Japan (BOJ) meeting, that kept interest rates at -0.1%.

Australian economic events and implications

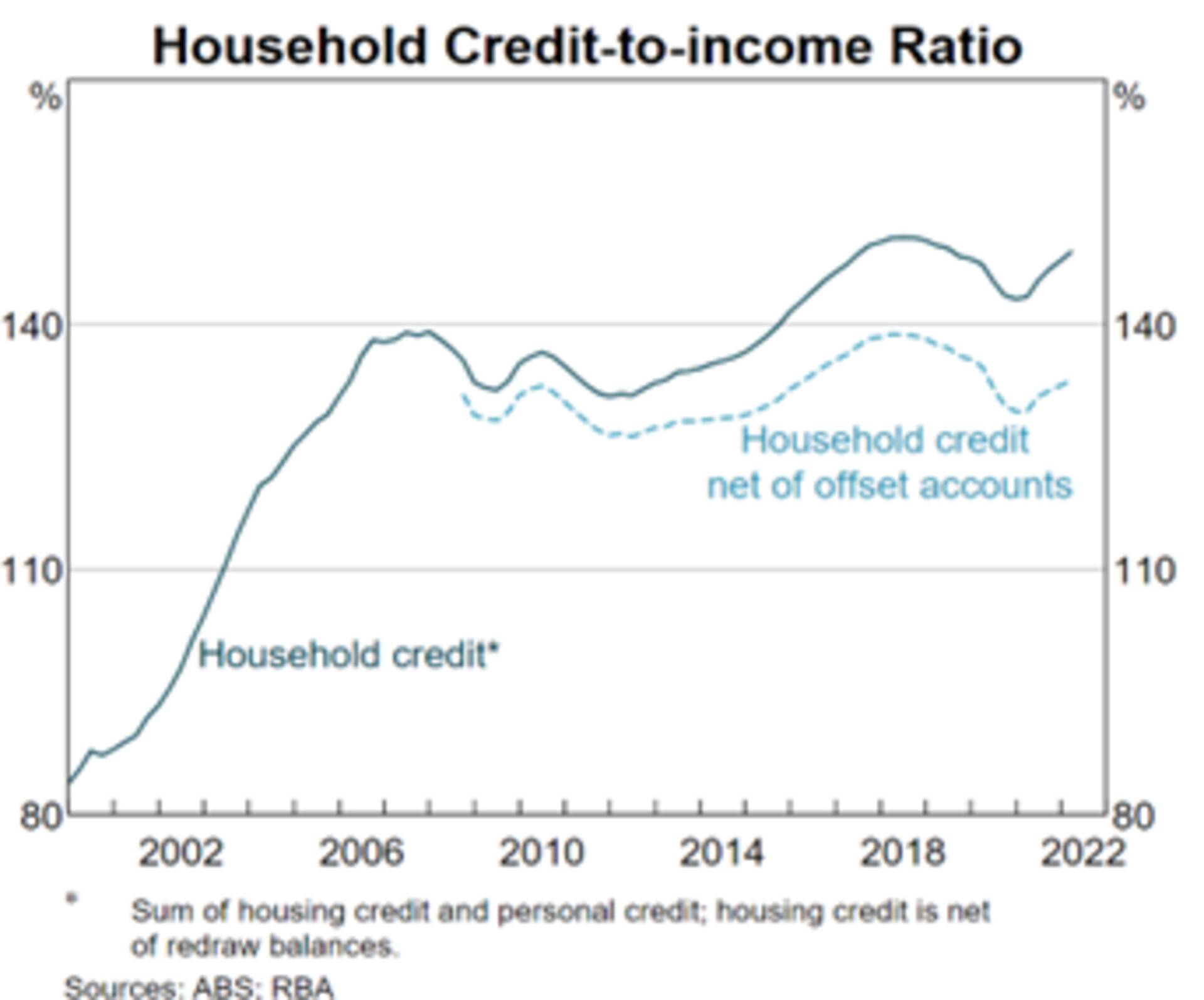

- There was lots of “RBA speak” this week. The only major update in the RBA board minutes for July was the inclusion about the Board’s discussion of the neutral cash rate, which the RBA assumes is at least 2.5% (but notes that there is a wide margin of error around this estimate) which means many more rate hikes from here. Governor Lowe’s speech on “Inflation, Productivity and the Future of Money” didn’t offer any new insights, but reiterated the importance of defending the 2-3% inflation target, which means that inflation expectations can’t shift up too much. Deputy Governor Michelle Bullock spoke on “How are households placed for interest rate increases?” and downplayed the potential impacts to indebted households from higher interest rates. Bullock highlighted the usual positive sentiment around households, including high accumulated savings worth $260bn that can be drawn down and the large stock of mortgage prepayments, with the household credit to income ratio around the same level as in 2007 once you account for offset accounts (see the chart below).

- The Reserve Bank of Australia’s (RBA) overall message is that the average household with mortgage debt will be able to withstand at least 300 basis points of rate hikes. This underestimates the risks to the economy from borrowers which are heavily impacted by rate rises. On the RBA’s own estimates, around 38% of households with a mortgage will see a lift in monthly repayments of 40% or more, which is around 1.3 million households. Out of interest, for borrowers on fixed-rate mortgages expiring next year, the median increase is expected to be around $650/month. This is a huge increase and is too large to be compensated by a rise in wages growth. Along with higher inflation (particularly on essential items), these households will have a significant pull-back in spending, especially if the unemployment rate increases.

- Treasurer Jim Chalmers formally announced the terms of reference for the review on the RBA this week, which will be overseen by three exports, with a recommendation to the government by March 2023.

- The June quarter NAB business survey was also released, which showed a drop in confidence over the quarter to June (down to 5 from 14), after a fall in the March quarter.

What to watch over the next week?

- Australian June quarter CPI data is released on Wednesday and expect to see a 1.8% increase in headline inflation, which would take annual inflation to 6.2%, its highest level since 2001, driven by further rises in petrol, electricity, gas, food and new home construction costs. Expect a 1.5% rise in the trimmed mean, with annual growth rising to 4.7%. Expect the RBA to lift the cash rate by another 50 basis points at its August meeting, but if the trimmed mean is much stronger, a 75 basis point hike is a possibility. Other price indicators next week include export and import trade figures for the June quarter (we expect an 11% lift in export prices and a 7% lift for imports), June quarter producer prices, June retail spending (we are looking for a slowing to 0.3% over the month) and June credit figures (we expect a 0.7% lift in credit growth).

- The main event in the US is the Federal Open Market Committee (FOMC) meeting on Wednesday. The US Federal Reserve (Fed) is expected to lift the fed funds rate by another 75 basis points, taking it to 2.25-2.5%. US economic data includes confidence indicators, with the July Conference Board data out on Tuesday and the July University of Michigan index released on Friday. Housing indicators include the June new home sales and pending home sales, while durable goods order data will also be released. June quarter GDP (on Thursday) will confirm whether the US economy is in a recession. The Atlanta Fed GDPNow measure is currently showing an -1.6% in June quarter GDP, which would follow a negative first quarter, but it’s unlikely that the statistics agencies will classify it as a recession because of the strength in the labour market.

- In the Eurozone, the July Economic confidence index is expected to show a further decline, consumer price data for July (released on Friday) is likely to see headline inflation rise to 8.8% on a year ago and second quarter GDP should just be positive, at 0.2%.

Outlook for markets

- Shares remain at high risk of further falls in the months ahead as central banks continue to tighten to combat high inflation, the war in Ukraine continues and fears of recession remain high. However, it is likely to see shares providing reasonable returns on a 12-month horizon as valuations have improved, global growth ultimately picks up again and inflationary pressures ease through next year (allowing central banks to ease up on the monetary policy brakes).

- With bond yields looking like they may have peaked for now, short-term bond returns should improve.

- Unlisted commercial property may see some weakness in retail and office returns (as online retail activity remains well above pre-COVID levels while office occupancy remains well below). Unlisted infrastructure is expected to see solid returns.

- Australian home prices are expected to fall by 15 to 20% into the second half of next year, as poor affordability and rising mortgage rates impact. Sydney and Melbourne prices are already falling aggressively, and most other cities and regions are seeing price gains slow ahead of likely falls.

- Cash and bank deposit returns remain low but are improving as RBA cash rate increases flow through.

- The $A is likely to remain volatile in the short-term as global uncertainties persist. However, a rising trend in the $A is likely over the medium-term as commodity prices ultimately remain in a super cycle bull market.