Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

Weekly Market Update – 21st November 2014

Investment markets and key developments over the past week

- Shares were mixed over the last week with US shares up 1.2% and European shares up 4% helped by a combination of good US economic data, a rate cut in China which came after Asian markets closed and a strong signal from ECB President Mario Draghi that its quantitative easing program will be expanded. Chinese shares also rose but by just 0.3%, while Japanese shares fell 0.8% and Australian shares fell 2.8% dragged lower partly on the back of further falls in the iron ore price. Bond yields mostly fell but some commodities got a late boost by the Chinese rate cut. The $US continued to rise and despite a late boost the $A ended down for the week.

- At last China cuts rates. It’s been apparent for some time from the combination of very low inflation, slowing investment and the threat to growth from the property slump that Chinese interest rate settings are too high. While targeted easing has helped, the People’s Bank of China (PBOC) has finally realised that it’s not enough and so it has cut its benchmark interest rates with the 12 month lending rate being cut by 0.4% taking it to 5.6% and the 12 month deposit rate being cut by 0.25% taking it to 2.75%. This will lower the rates at which banks lend most of which are at or above the benchmark lending rate. The move may be modest but it sends a signal that the PBOC is determined to support growth and also likely signals more cuts ahead as there is rarely just one rate move on its own. Quite clearly the PBOC now wants a lower interest rate structure in China and it will get its way. As such the move is positive for the Chinese growth outlook and for Chinese shares. Chinese shares rallied 4.5% one month after the last rate cut in 2012 and were up 16% six months later.

- More aggressive quantitative easing likely on the way from the ECB. President Draghi’s comment that “we will do what we must to raise inflation and inflation expectations as fast as possible” clearly signals more aggressive easing on the way. This is likely to take the form of expanding its QE asset purchase program to include corporate debt at its December meeting and possibly including additional public debt next year.

- Japan back to the polls with the next sales hike likely delayed. News that Japan is back in recession is mildly disappointing and having another election next month may create a bit of short term uncertainty. However, there is no reason to change our positive view on Japan: the Q3 contraction in GDP was due to lower inventories with private final demand up slightly; the broad trend in Japan’s manufacturing conditions PMI remains gradually up; the Bank of Japan’s substantially ramped up monetary stimulus now has very strong support at the Bank of Japan and will help over time; Prime Minister Abe will almost certainly be re-elected giving him an additional two years to push through reforms; and the likely delay in the next sales tax hike (to 2017) will remove a key risk hanging over next year.

- A mildly dovish message from the Fed. While the Fed may have ended QE at its last meeting, the message from that meeting’s minutes is that it is clearly conscious of the risk to the US posed by global weakness and declining inflationary expectations. The risks are skewed to its first rate hike coming beyond mid-next year.

- RBA firmly on hold, probably into second half of next year. There was nothing new in the minutes from the last RBA Board meeting and similarly a speech by Governor Stevens reinforced the message that the period of stability in interest rates has a long way to go. While the Australian economy is coping with the mining investment and terms of trade slumps reasonably well, growth is still sub-par and the combination of improved productivity growth, slow wages growth and corporate cost cutting means inflation is not an issue.

- The global policy message from the last few weeks signals a determination to avoid deflation and support global growth. While quantitative easing may have ended in the US, it’s being replaced by QE in Japan and Europe and rate cuts in China. Rate hikes remain a fair way off in the US and a long way off in Australia. This in turn augurs well for shares and other growth assets.

Major global economic events and implications

- US data was solid. While the Markit manufacturing PMI fell it remains strong and regional surveys rose, the leading index rose, jobless claims fell and strength in the NAHB home builders’ conditions index, permits to build new homes and existing home sales point to a continuation of the housing recovery. While inflation was a bit more than expected it remains benign and below target giving the Fed plenty of flexibility on rates.

- Eurozone PMIs for November disappointingly fell, resuming the downtrend that started in August. While they still point to economic growth, it’s only modest. Quite clearly the ECB President Draghi is responding to this.

- Japanese September quarter GDP unexpectedly fell due to inventories for the second quarter in a row marking a return to recession, but a rising trend in its PMI points to a return to growth this quarter.

- Chinese business surveys for November provided mixed readings with the HSBC PMI falling slightly but the MNI business conditions index up solidly. The HSBC PMI has just been making random wiggles in the same 48-52 range for the last three years now so it’s hard to read too much into it. Meanwhile, property prices continued to fall in October but at a slower rate which could be just noise or a sign property easing measures may be working.

Australian economic events and implications

- Australian data was light on and didn’t really change the outlook either way with a nice rise in car sales but softish readings for weekly consumer confidence and skilled vacancies.

What to watch over the next week?

- In the US, the start of the holiday shopping season on Black Friday after the Thanksgiving holiday Thursday will be watched to gauge the strength of retail sales. On the data front expect to see: Q3 GDP growth (Tuesday) revised down to 3% from the 3.5% pace initially reported; modest gains in house prices (Tuesday); a further slight rise in consumer confidence (Tuesday); a continued rising trend in durable goods orders (Wednesday); gains in pending home sales and new home sales (Wednesday); and continued benign inflation according to the core private consumption deflator (Wednesday).

- In the Eurozone, economic confidence readings (Thursday) are likely to soften in line with recent PMI readings and the November flash inflation reading (Friday) is likely to show very low inflation.

- Japanese data for household spending, retail sales, industrial production, housing starts and the labour market on Friday should add to confidence that growth is returning in the current quarter. Inflation data (also Friday) will likely show that after the impact of the tax hike it remains too close to deflation reinforcing the need for the BoJ’ s latest monetary easing.

- In Australia, the focus will be on September quarter construction data (Wednesday) and business investment (Thursday) as guides to September quarter GDP growth. We expect continued growth in dwelling investment but business investment to have remained soft resulting in falls in both construction and capex data. Investment intentions are likely to show a further decline in mining investment ahead but more tentative evidence that non-mining investment is bottoming out. Data for new home sales will also be released (Thursday) and credit data (Friday) is likely to show further growth, but led by lending to housing investors, which of course won’t do anything to dissuade the RBA from placing restrictions on bank lending to investors.

Outlook for markets

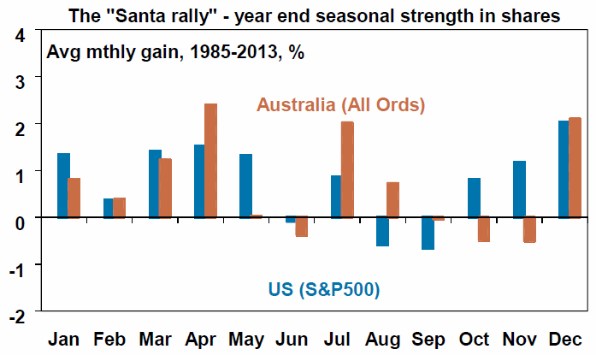

- Shares are well placed to see gains into year-end and through next year as the cyclical bull market that started in 2011 remains alive and well. November and December are both seasonally strong months for US and global shares as we run into the “Santa rally”, and seasonal strength in Australian shares usually commences in December. More fundamentally valuations, particularly against the reality of low bond yields, are good. Monetary policy is set to remain easy with QE in Europe and Japan and rate cuts in China replacing QE in the US. Rate hikes in the US and Australia remain a long way off and investor sentiment remains cautious which is positive from a contrarian perspective. Australian shares are likely to remain a relative laggard though as commodity price weakness continues to impact, but the positive global lead, Chinese monetary easing and the lower $A should help push the ASX 200 up into year-end and through into next year.

Source: Bloomberg, AMP Capital

- Low bond yields will likely mean soft medium term returns from government bonds. That said, in a world of too much saving, spare capacity and low inflation it’s hard to get too bearish on bonds.

- While Chinese monetary easing may provide a short term boost to the $A, it is likely to head even lower over the year ahead with the $US trending up, weak commodity prices and the $A still too high given Australia’s high cost base. $US0.75-0.80 is likely to be seen in the next year or so. A relatively greater fall in the $A/$US rate is necessary as the $A is unlikely to fall much against the Yen and Euro given their monetary stimulus programs

Source: AMP CAPITAL ‘Weekly Market Update’

AMP Capital Investors Limited and AMP Capital Funds Management Limited Disclaimer