Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

Weekly Market Update – 1st may 2015

Investment markets and key developments over the past week

- Shares had a soft week reflecting a combination of somewhat messy economic data, uncertainty about the US Federal Reserve (Fed) and a backup in Eurozone bond yields. There is also an element of profit taking after recent strong gains, particularly in Europe and Japan. US shares fell 0.4%, Eurozone shares lost 2.7% and Japanese shares fell 3.3%. Australian shares lost 2% after failing to break through the 6000 level for the fourth time, not helped by a bounce in the Australian dollar, indications APRA may move faster to raise bank capital requirements and talk of Australia losing its AAA rating. Bond yields rose, but this was mainly led by Europe. The US dollar continued its correction and this saw most commodity prices up and the Australian dollar briefly bounce above US$0.80.

- The Fed is still in no hurry to raise rates. There were no real surprises from the Fed. While it’s not too fussed about the weak start to the year in US economic growth, its post meeting statement left the impression that a June hike is looking very unlikely. September remains my base case, but just bear in mind that the Fed is now in data dependent mode so a run of stronger economic data and more evidence of stronger wages growth could still bring its first rate hike forward again.

- The Australian dollar briefly bounced above US$0.80 for the first time since January – more bounce ahead? With the Australian dollar breaking resistance levels, it could have a bounce to around US$0.85. The Reserve Bank of Australia (RBA) will need to be on guard against this though as it would further threaten the return to reasonable economic growth. The recent Australian dollar bounce adds to the case for another rate cut on Tuesday and a step up in efforts to jawbone it lower.

- German 10 year bond yields are up fivefold from two weeks ago. Admittedly that’s not hard when you are coming from just 0.07% so there is a danger in reading too much into it. But it is worth noting that signs of improved Eurozone growth are continuing to mount, deflation fears are ebbing and a “reform for funding” deal looks closer for Greece. Higher Eurozone bond yields partly explain why US and Australian bond yields are up.

- What is the Chinese share market telling us? Chinese shares are up 120% over the last year and while it’s well known to be a highly speculative market its last three big swings were associated with turning points in Chinese economic growth: the 2007-2008 bear market was associated with a collapse in growth from 12% to 6%; the 2008-2009 bull market led a growth surge from around 6% to 12%; and the 2009-2013 bear market led a slump in growth from around 12% to 7%. So it begs the question whether the current share market surge is presaging a growth upturn. Certainly the shift to easier policy highlighted by the latest Politburo meeting – is pointing in this direction, although nothing like the 2009 to 2010 growth surge is likely.

- It’s coming up for Budget time again and surprise, surprise there is another debate whether Australia will lose its AAA sovereign rating. While Australia’s still low level of public debt has suggested that the risk is low, the Budget in a week’s time will be the seventh in a row that has projected or implied a return to surplus within a reasonable time frame. One could be forgiven for starting to think that such projections/commitments are hollow. So the short answer is that if Canberra does not provide more confidence of a return to surplus within a reasonable time frame then the AAA rating will be at risk. While sovereign bond yields often don’t go in the direction implied by sovereign rating changes its better not to take the risk, given the potential flow on to borrowing costs through the economy.

Major global economic events and implications

- March quarter US gross domestic product (GDP) confirmed that the US has been going through another soft patch, but it would be wrong to read too much into it. GDP rose just 0.2% annualised. Weather and the west coast port strike clearly played a role and a soft start to the year has been a pattern for years now – with average annualised growth over the last 20 years being 3% in December quarters, 1% in March quarters and 3% in June quarters – pointing to a growth rebound in the current quarter. Other US economic data was mixed with weakness in consumer confidence, personal income and construction, no change in Aprils Institute for Supply Management (ISM) manufacturing index but stronger home prices and home sales, a sharp fall in jobless claims and the employment cost index rose to 2.6% year on year suggesting wages growth may be picking up, but from a low base.

- US March quarter profit reports continue to come in better than expected. We are now 72% done and while only 48% of companies so far have beaten sales expectations, 73% have beaten on earnings and earnings growth for the year to the March quarter has improved to +0.5% from -5.6% six weeks ago. The strong US dollar is impacting, but not as much as feared.

- Eurozone economic data was better than expected, with a smaller than expected fall in economic confidence, another improvement in lending growth and strong March quarter GDP growth in Spain. Unemployment was flat at 11.3% in March, but deflation appears to be ebbing with rising oil prices now seeing CPI inflation return to flat over the year to April. But it is still way too low for the European Central Bank to think about curtailing quantitative easing (QE).

- Japanese data was a bit soft, with industrial production down in March albeit less than expected, a fall in small business confidence and Tokyo core inflation for the year to April running at zero, highlighting that the Bank of Japan has more work to do. Employment data and household spending was positive though.

- In China there was talk of a form of quantitative easing with the People Bank of China looking at ways to help smooth the local government debt swap. While pure QE is unlikely as China is a long way from needing it – as interest rates are nowhere near zero – it is clear that the focus in China has now well and truly switched to maintaining growth via policy easing. Signs of a stabilisation in the official Purchasing Managers Index (PMI) and in home prices are positive.

Australian economic events and implications

- Australian economic data provided nothing new. Annual credit growth ticked up to 6.2% in March but the monthly pace of 0.5% is unchanged from that seen over the last few months. APRA still has its work cut out though as monthly housing investor credit bounced back to 0.9% or 10.4% year on year, which is above its threshold. Home prices continued to move up in April according to RP Data, but again it’s driven mainly by Sydney with other capital cities averaging just 1.7% year on year, with the divergence again highlighting the role for APRA in trying to bring Sydney under control rather than the RBA. Meanwhile, the goods terms of trade continued to fall in the March quarter and producer price inflation remains benign.

What to watch over the next week?

- In the US, expect April payroll employment (Friday) to bounce back with a gain of 225,000 new jobs after the weather depressed result for March. Unemployment is expected to fall slightly to 5.4% (from 5.5%) and hourly wages growth is expected to pick up a bit. Expect the non-manufacturing conditions ISM to remain solid and the trade balance to deteriorate a bit (both Tuesday).

- The UK election on Thursday could see the Cameron led Government being replaced by a Labour led coalition. Amongst other things this should head off the referendum on the UK’s membership of the EU, which is probably a good thing for the UK but ultimately of little consequence for the Eurozone.

- In China, expect April export growth (Friday) to bounce back after a 15% fall over the year to March which looks to have been related to the Chinese New Year holiday related distortion. Inflation data (Saturday) for April is expected to show CPI inflation remaining low and producer prices still deflating.

- In Australia, we expect the RBA (Tuesday) to act on its easing bias and cut the cash rate to 2% (from 2.25%), but it’s another very close call. The case for another cut remains strong: the outlook for business investment remains weak, commodity prices are softer than expected, the Australian dollar remains too high and is at risk of rebounding further and inflation is benign. However, the RBA may continue to fret about housing leverage and Sydney home price gains and the bounce in the iron ore price over the last few weeks has eased the pressure on the RBA a bit. So while our base case is for a cut, another month on hold would not be surprising. Meanwhile, the RBA’s Statement on Monetary Policy (Friday) is likely to contain further downgrades to the growth outlook, mainly in response to the soft outlook for business investment.

- On the data front in Australia, expect to see a 1% gain in building approvals (Monday), a slight improvement in the trade deficit (Tuesday), a modest gain in March retail sales but solid real retail sales growth for the March quarter (Wednesday) and flat employment for April (Thursday) after two very strong months which should see the unemployment rate rise to 6.2%.

Outlook for markets

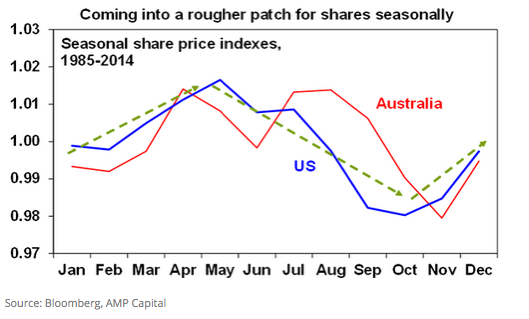

- The seasonal pattern for shares points to a tougher patch in the May-October period and uncertainty around the Fed could well be a trigger to a correction.

- However, notwithstanding near term risks, the cyclical bull market in shares likely has further to go as: valuations, particularly against bonds, are good; economic growth is continuing; and monetary policy is set to remain easy with further easing in Europe, Japan, China and Australia and only a gradual tightening in the US. As such, share markets are likely to see another year of reasonable returns. My year-end target for Australian shares is 6000.

- Low bond yields point to soft medium term returns from sovereign bonds, but it’s hard to get too bearish on bonds in a world of too much saving, spare capacity and deflation risk.

- Despite the risk of a further short term bounce in the Australian dollar the broad trend is likely to remain down as the Fed is likely to raise rates later this year whereas the RBA remains on track to cut and the long term trend in commodity prices remains down. We expect a fall to $US0.70 by year end, and a probable overshoot into the $US0.60s in the years ahead.

Source: AMP CAPITAL ‘Weekly Market Update’

AMP Capital Investors Limited and AMP Capital Funds Management Limited Disclaimer