Investment markets and key developments over the past week

- The recovery rally continued over the last week, helped by a combination of the US Federal Reserve (the Fed) further delaying interest rate hikes, mostly good economic data and stimulus expectations in China. For the week this saw US shares up 1.4%, Chinese shares up 5.2% and Australian shares up 0.3%. European shares were flat though and Japanese shares fell 1.3%, with strength in the euro and yen acting as a bit of a drag. US shares are now actually up 0.3% year-to-date after being down 10.5% year-to-date at their February 11 low. Australian shares have cut their year-to-date loss to 2.1% after being down 10% at their 12 February low. The Fed’s more dovish interest rate outlook also saw bond yields fall and helped drive the US dollar lower, which in turn drove commodity prices higher. This, along with a fall in unemployment, saw the Australian dollar push up to around US$0.76.

- A lot of the worries on the worry list from early this year have faded: the US dollar has stopped rising; the Chinese renminbi has reversed its losses against the US dollar, the Fed has become more dovish; fears of a US recession have faded with some better manufacturing data; oil and commodity prices have moved higher; credit spreads have narrowed a bit as fears of significant corporate defaults have receded; and concerns about China have settled slightly following indications it will provide more stimulus support. In addition, the economic news in Australia has been okay.

- The Fed turns even more dovish. While the Fed continues to see moderate growth in the US, the key was that it acknowledged ongoing global and financial market risks and as a result lowered its so-called “dot plot” of meeting participants’ interest rate expectations to show just two 25 basis point rate hikes this year, down from four. In addition Fed Chair Janet Yellen signalled a greater willingness to tolerate upside surprise on inflation, as opposed to seeing it continue to run below 2%. The Fed appears to have no inclination to hike at its April meeting, but a June hike does look like a reasonable base case, particularly given the recent upwards momentum in US inflation, but with only around a 55% probability. And it is dependent on global threats and financial market turbulence continuing to settle down.

- By continuing to indicate that it is conscious of global risks and that US rate hikes will be data dependent and gradual, the Fed is clearly indicating that it is not going to do anything to consciously threaten the global and US outlook. Critical here is the stabilisation/softness that is now being seen in the US dollar which has helped reduce the threats of even lower commodity prices, a funding crisis in emerging countries and pressure on US manufacturers that would have flowed if the US dollar had continued to rise. So the Fed’s latest decision is supportive for shares and growth assets and should lead to an ongoing stabilisation in the value of the US dollar.

- So, while the Bank of Japan decided to make no changes to monetary policy just yet, we have now seen two of the developed world’s big three central banks move further in a dovish direction in the last two weeks, i.e., the European Central Bank (ECB) and the Fed. The bottom line is that, when ultra-easy monetary conditions in Japan and further easing in China are allowed for, global monetary conditions are continuing to get easier. Norway and Indonesia also cut interest rates in the last week.

- In the US presidential primaries, Donald Trump still looks on track to pick up a majority of delegates (which requires 1,237) to the Republican convention in July, but John Kasich’s victory in the “winner take all” Ohio primary indicates that it is far from assured, so the nomination could still end up being contested and highly fractious for the Republicans. It’s worth noting that Trump is only averaging around 35% of the votes at Republican primariesso 65% are voting for someone else.

- Is Brazil a buy? The political and economic crisis in Brazil is going from bad to worse. Meanwhile, its share market is up 35% from its January low, with investors anticipating that the impeachment of President Rousseff would turn around Brazil’s outlook. At this stage, the impeachment process still has some time to go (maybe up to six months), but it’s doubtful that it will solve Brazil’s problems which run much deeper than the president. Replacing her with the vice-President would probably mean more of the same and would be unlikely to usher in wholesale economic reform. The best outcome would be a new election but that would be a long time off. So remain a bit cautious on Brazil.

- Australia soon to be in election mode? With Senate reforms now passed, the way has been cleared for a double dissolution election and a possible early election on 2 July, which would probably also mean an early budget on 3 May. The downside for the economy is the uncertainty that election campaigns create (although this tends to be minor and we have to do it this year anyway). The upside may be more rational policy making out of Canberra if the Senate gets cleaned up with a double dissolution election.

Major global economic events and implications

- Apart from soft retail sales figures, US data was mostly good. Housing indicators were generally solid with home builder conditions remaining strong and housing starts up. Manufacturing production gained in February, with a couple of regional business surveys also looking a lot healthier, suggesting that the worst may be over for manufacturing with labour market indicators remaining strong. Meanwhile, inflation data showed a further gain in core inflation, supporting the Fed’s plans to ultimately continue raising interest rates.

- Eurozone data for construction and industrial production in January both came in stronger than expected, indicating that Eurozone growth is continuing.

- The Bank of Japan made no further changes to monetary policy and looks to be in wait and see mode after the further easing it announced back in January. Weak growth and inflation remaining way below target indicate it faces ongoing pressure to do more though.

Australian economic events and implications

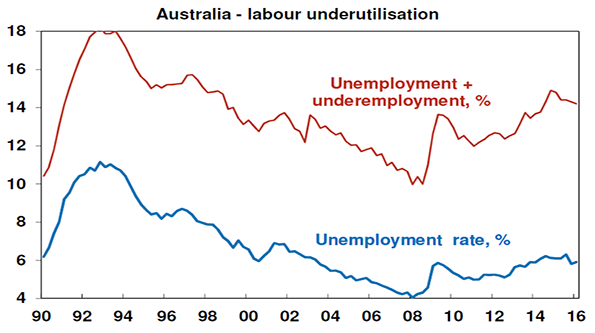

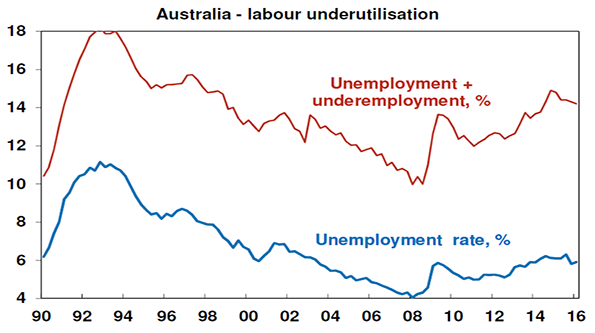

- In Australia, February saw a messy jobs report. Jobs were flat with stronger full-time employment offsetting a fall in part-time jobs and the unemployment rate fell back to 5.8%, but this was due to reduced participation. The basic message is that jobs growth has slowed from the unbelievable pace seen last year and unemployment has spent the last five months stuck around 5.8% to 6% which is not too bad, but it’s not great either. Labour underutilisation, i.e. unemployment plus underemployment, is down from its recent high, but at 14.2% remains very high.

Source: ABS, AMP Capital

- On interest rates, the minutes from the RBA’s last Board meeting offered nothing new. It did highlight the degree to which the RBA is now focused on risks around China, although its conclusion on China risks is relatively sanguine (as is mine).

What to watch over the next week?

- In the week ahead the global focus is likely to be on flash March business conditions PMIs for the US, Europe and Japan (Thursday) which will be watched for an improvement after weakness seen in February that was possibly related to financial market turmoil at the time. Expect the US manufacturing PMI to rise to 51.5 (from 51.3) and the Eurozone composite PMI to rise to 53.5 (from 53.3).

- In the US, expect to see a fall in existing home sales (Monday), continued strength in home prices (Tuesday), a rise in new home sales (Wednesday) and a slight fall back in durable goods orders (Thursday) after a strong gain in January.

- Japanese inflation data to be released Friday is expected to show that headline inflation remains around zero and that core inflation remains very low at around 0.7% year-on-year, which is well below the Bank of Japan’s 2% target.

- In Australia, a speech by RBA Governor Glen Stevens (Tuesday) will be watched for any clues on the interest rate outlook. Of particular interest will be his views on the rising Australian dollar. Meanwhile, ABS data (also Tuesday) is likely to show that home prices were flat in the December quarter last year, consistent with various private sector surveys. Data on skilled vacancies and population growth will also be released.

Outlook for markets

- After strong gains from their February lows, shares are overbought and vulnerable to a pull-back. Beyond the near-term uncertainties though, it is expected that shares will trend higher this year helped by a combination of relatively attractive valuations compared to bonds, further global monetary easing and continuing moderate economic growth.

- Very low bond yields, with something like 25% of global sovereign bonds now having negative yields, point to a soft medium-term return potential, but it’s hard to get too bearish in a world of fragile growth, spare capacity, weak commodity prices and low inflation. Bonds in higher yielding countries like Australia, the US and maybe even China are relatively attractive.

- Commercial property and infrastructure are likely to continue benefitting from the ongoing search by investors for yield.

- National capital city residential property price gains are expected to slow to around 3% this year, as the heat comes out of Sydney and Melbourne. Prices are likely to continue to fall in Perth and Darwin, but growth is likely to pick up in Brisbane.

- Cash and bank deposits are likely to continue to provide poor returns, with the RBA expected to cut the cash rate to 1.75%.

- The ongoing delay in Fed tightening and stronger data in Australia pose further short-term upside risks for the Australian dollar, which is already up 12% from its January low. However, just as was seen with the early 2014 9% bounce in the Australian dollar, any short-term strength is unlikely to go too far and the broad trend is likely to remain down as the interest rate differential in favour of Australia narrows, as the RBA eventually resumes cutting the cash rate, or at least resorts to jawboning, and the Fed eventually resumes hiking with commodity prices remaining weak and the Australian dollar undertaking its usual undershoot of fair value.

Source: AMP CAPITAL ‘Weekly Market Update’

AMP Capital Investors Limited and AMP Capital Funds Management Limited Disclaimer

FinSec Partners Disclaimer

|