- Share markets have seen another volatile week being buffeted by waxing and waning fears of Russia invading Ukraine and fears of inflation and interest rate hikes. This left US, European and Japanese share markets down. Solid profit results helped protect the Australian share market, which was up slightly for the week, with gains in health, property and consumer staple shares offsetting falls in IT, telco and material stocks. US and global shares are at high risk of a re-rest of their January lows and this would likely drag Australian shares back down there too. Long term bond yields had a mixed week with safe haven demand partly offsetting rising inflation and rate hike expectations with yields up in the US, Japan and Australia but down in Europe. Oil prices briefly rose to their highest since 2014 on Ukraine tensions before falling back. Metal prices were flat, but the iron ore price fell. The $A rose slightly as the $US fell.

- Pressure for monetary tightening continued over the last week. Both the UK and Canada saw higher than expected increases in inflation in January of 5.5%yoy and 5.1%yoy respectively, pointing to further rate hikes. The minutes from the last Fed meeting highlighted upside risks to inflation and that a faster pace of rate increases was likely compared to the post 2015 period but it was no more hawkish than previously flagged and there was little to point to a 0.5% initial hike.

- What could drive a June rate hike from the RBA? The base case remains that the first hike will come in August but the risk of an earlier move in June is high, and this has been reinforced by another strong jobs report for January. The RBA is clearly focussed on achieving full employment, seeing wages growth of 3% or more and the trimmed mean measure of inflation being sustained in the target range. Looking at each of these:

- Unemployment is currently at 4.2% and likely to slip below 4% by mid-year, which will leave it consistent with the RBA’s full employment objective given Assistant Governor Ellis’ indication that NAIRU (the non-accelerating inflation rate of unemployment) is between the high 3s and low 4s.

- December quarter wages data will be released in the week ahead and March quarter wages data will be released in the second half of May. RBA forecasts imply 0.6%qoq increases for both quarters, but various business surveys and anecdotal evidence point to an acceleration. For example, the ABS’s weekly payroll jobs data show a significant acceleration in total payroll wages growth relative to total payroll jobs growth since mid-last year. This is not a pure guide to wages growth as it will be affected by things like compositional change in the workforce and hours worked but it does suggest an acceleration in wages growth. Expect 0.8%qoq increases in wages in each quarter which would translate to above 3% at an annualised rate.

Source: ABS, AMP

-

- March quarter CPI inflation data will be published at the end of April. RBA forecasts imply around a 0.7%qoq increase in the trimmed mean inflation rate but given indications from businesses regarding cost pressures and price increases it could easily come in at 1%qoq again, which yet again would be well above RBA forecasts.

- A combination of a further decline in unemployment, an acceleration in wages growth to 0.8% quarter on quarter for the December and March quarters and another upside surprise on inflation this quarter together would likely clear the way for a June rate hike. A rate hike in May is conceivable but the RBA won’t have the March quarter wage report by then and May will likely be in the midst of an election campaign. So while the base case is for the first hike to be in August, a June rate hike is a high risk. First thing to watch will be this coming Wednesday’s wages data.

- There was some good news on inflation in China in January with both producer price and consumer price inflation slowing. And Japanese inflation also slowed. The slowdown in Chinese inflation partly reflects it being well ahead in terms of policy tightening which started early last year, whereas western central banks are only just starting to tighten.

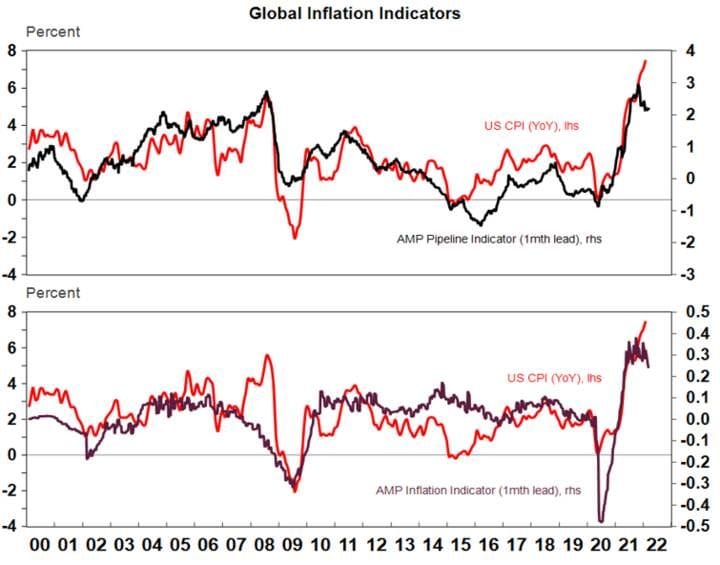

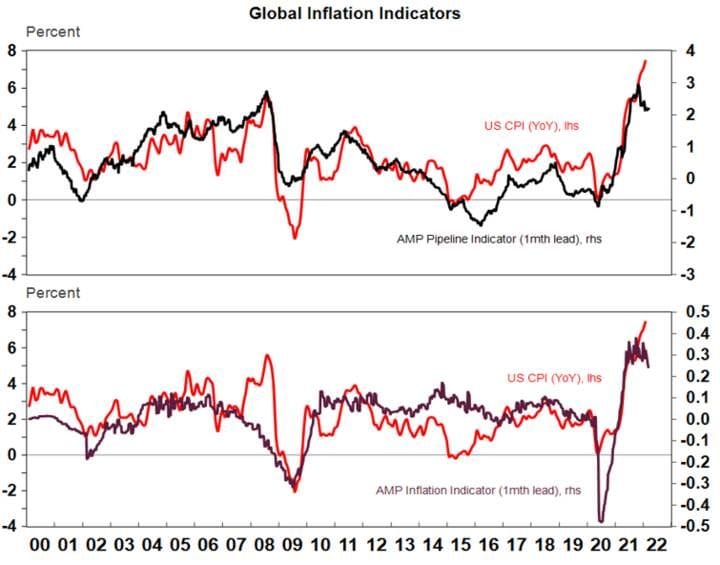

- But it’s also consistent with the message from the Pipeline Inflation Indicator, which tracks supply chain pressures, that global inflationary pressures may be starting to roll over. This is a bit tentative, and it won’t prevent rate hikes over the next 6 months but it points to some relief on the global inflation front in the next 6 months or so which should help take some pressure of global central banks in the second half of the year.

Source: Macrobond, AMP Capital

- Tensions remain high regarding Russia and Ukraine, but talks still have a chance. While indications from Russia that it would continue with talks and the announcement of a partial troop pullback saw share markets bounce early in the last week, uncertainty quickly returned as western officials said the military build-up was continuing and President Biden warned of invasion in the “next several days” only to then see some relief as the US and Russia agreed to new talks in the week ahead. Trying to work out which way this goes is not easy but there are basically four scenarios:

-

- Russia stands down – this would provide a very brief boost for share markets, including Australian shares, (eg +1%) and maybe knock 5% or so off the oil price.

- Russia moves in to occupy the Donbas (which is already controlled by Russian separatists) with sanctions from the west but not so onerous that Russia cuts of gas to Europe – this could see a brief hit to markets (say -2-4%) like in the 2014 Ukraine crisis but it would soon be forgotten about.

- Russian invasion of all of Ukraine with significant sanctions and Russia stopping gas to Europe (causing a stagflationary shock to Europe & possibly globally as oil prices rise further) but no NATO military involvement – this could see a bigger hit to markets (say -10%) but then recovery over six months.

- Invasion of all of Ukraine with significant sanctions, gas supplies cut & NATO military involvement – this could be a large negative for markets (say -15-20%) as war in Europe, albeit on its edge, fully reverses the “peace dividend” of the 1990s. Markets may then take 6-12 months to recover.

- Scenario 1 is still possible if there is a breakthrough in talks with Russian Foreign Minister Lavrov describing some western proposals as “constructive.” And it’s hard to see Russia undertaking a full invasion of Ukraine given the huge cost it would incur, let alone NATO troops being involved. But some combination of scenarios 2 and 3 is possible. Who knows for sure but there is a long history of various crisis events impacting share markets (major events in wars, terrorist attacks, financial crisis, etc) and the pattern is the same – an initial sharp fall followed by a rebound. Based on multiple crisis since 1907 Ned Davis Research found an average decline of 7% in US shares from such events, but 6 months later the market is up 10% on average and 1 year later its up around 15%.

|