- Share markets fell sharply over the last week, reversing their rally from the previous week’s lows as US inflation surprised on the upside adding again to Fed rate hike expectations. The poor global lead saw Australian shares fall back to their lows of the previous week with falls led by property, health, consumer staple and industrial shares. Bond yields rose as higher short term interest rates for longer were factored in. Oil, metal and iron ore prices fell not helped by recession fears. The $A fell as the $US rose.

- Shares remain at high risk of further falls in the short term on the back of inflation, interest rate, recession and geopolitical risks. And as was seen in the last week if US shares head down, Australian shares will follow even if the RBA takes a less hawkish path. There is a danger in exaggerating the mid-week plunge in share markets because it just took shares back to where they were a week ago. Nevertheless, the speed of the fall highlights the vulnerability of share markets in the short term as inflation remains high, global central banks are still hawkish, recession risks are high, geopolitical tensions remain high and the period out to mid-October is known for share market weakness.

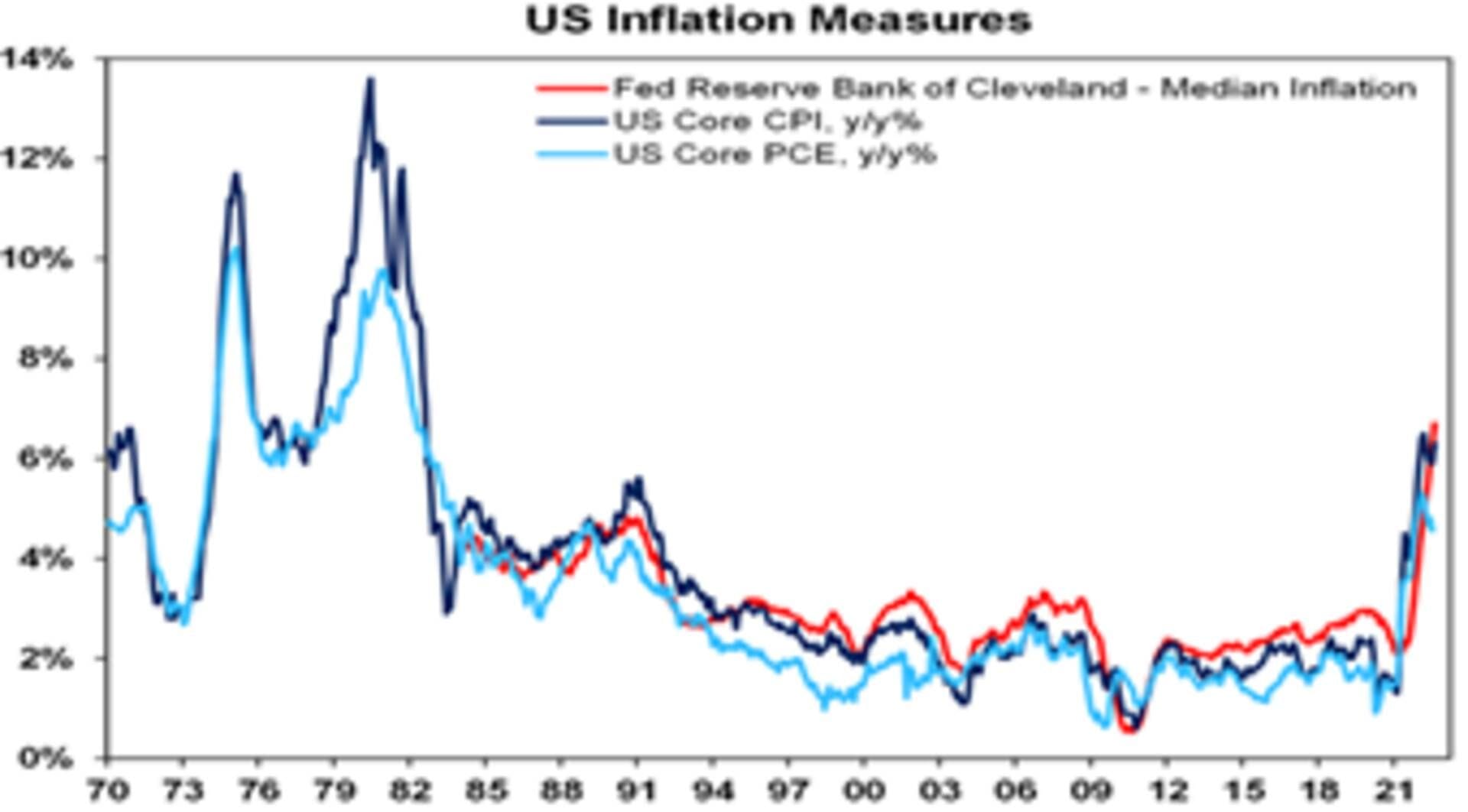

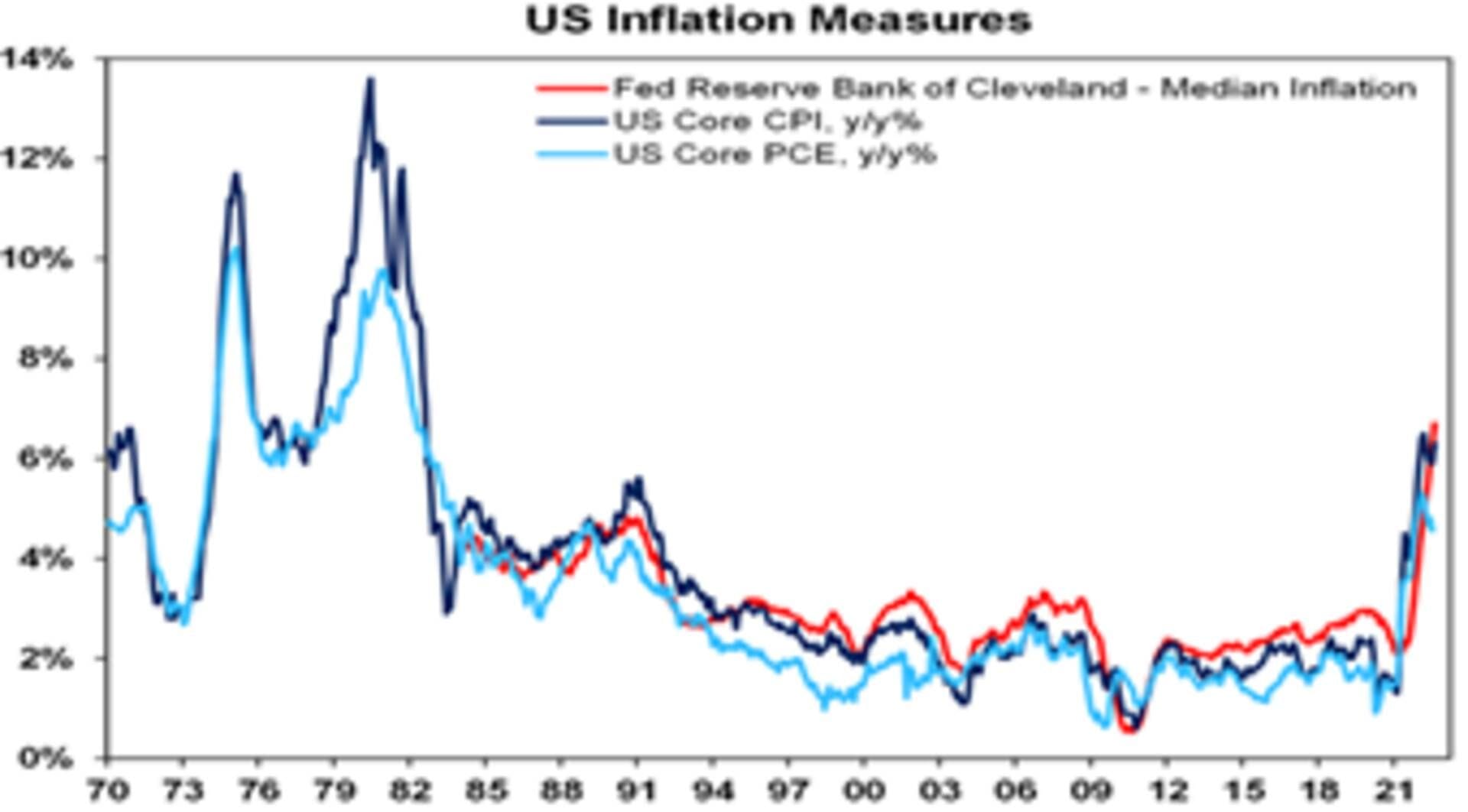

- In particular, on the inflation front US core inflation came in far higher than expected at 6.3%yoy as the breadth of high inflation continued to increase and it was a similar story in the UK with core inflation there also rising further to 6.3%. This along with hawkish Fed comments and a still strong US jobs market likely keeps the Fed on track for another 0.75% hike in the week ahead and keeps the BoE on track for another 0.5% hike in the week ahead too. The danger is that the Fed and other central banks have become locked into supersized rate hikes based on backward looking data and a loss of confidence in their ability to forecast inflation at a time when they should really be giving more attention to monetary policy lags and slowing the pace of hikes. This increases the risk of recession/deep recession as it may make it hard to slow down rate hikes when they should be.

- And technically, the rebound in shares from their June lows has lacked the cyclical leadership normally seen in new bull markets and earnings revisions remain negative.

Source: Bloomberg, AMP

- However, while short term risks remain high there are several reasons for optimism:

- Producer price inflation is slowing and looks to have peaked in the US, UK, China and Japan.

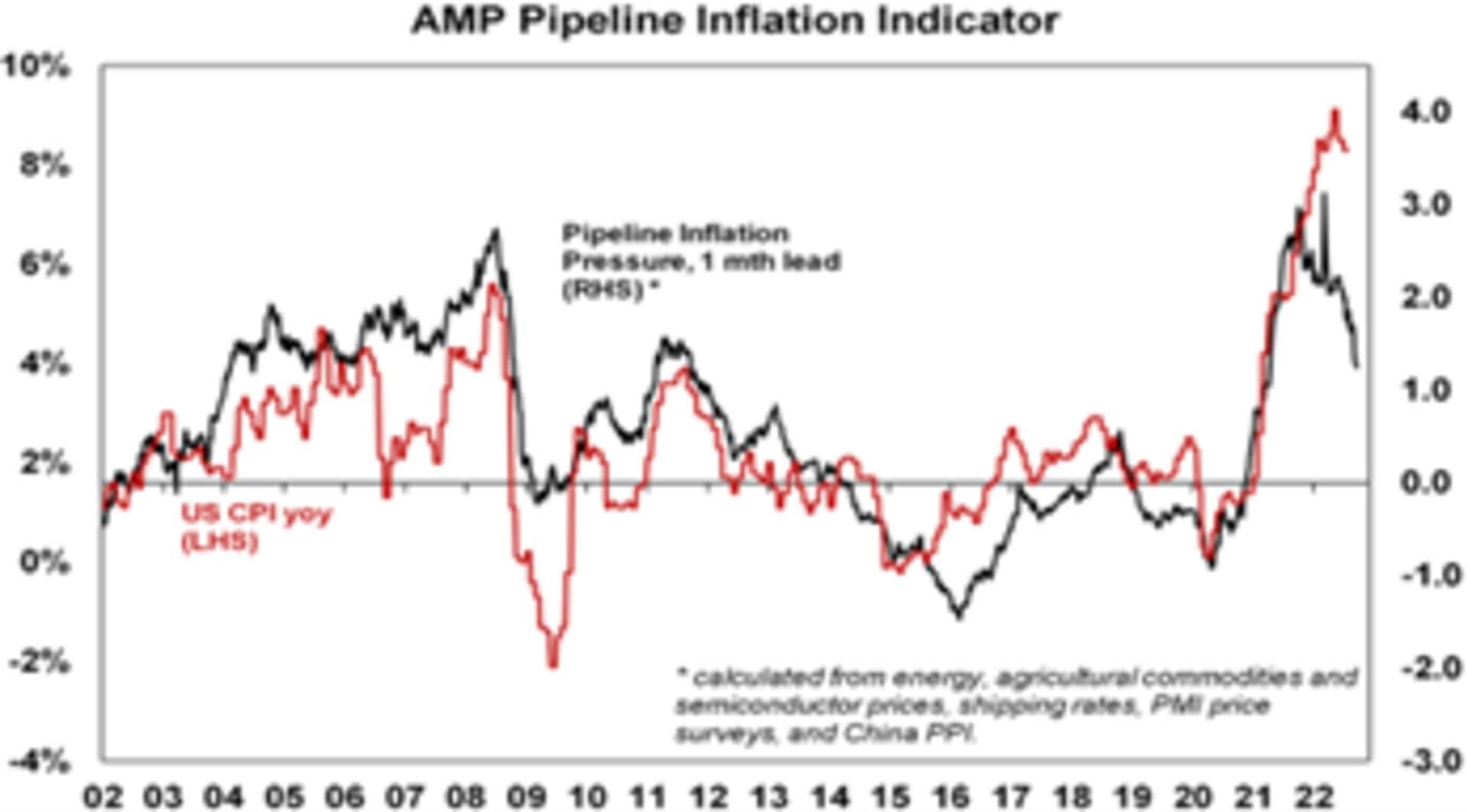

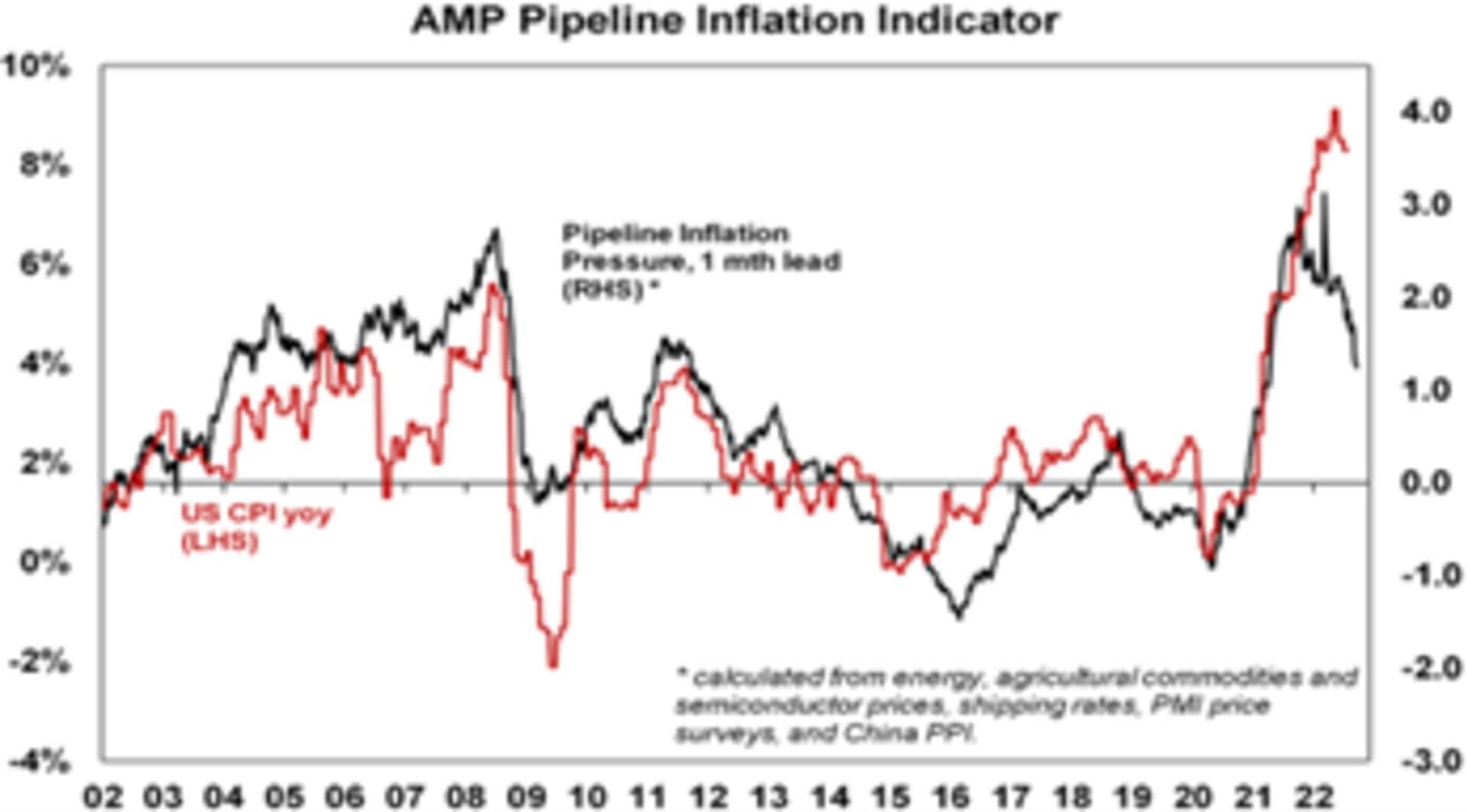

- This is consistent with the Pipeline Inflation Indicator which is continuing to trend down given falling price and cost components in business surveys, falling freight rates and lower commodity prices (outside of gas and coal).

Source: Bloomberg, AMP

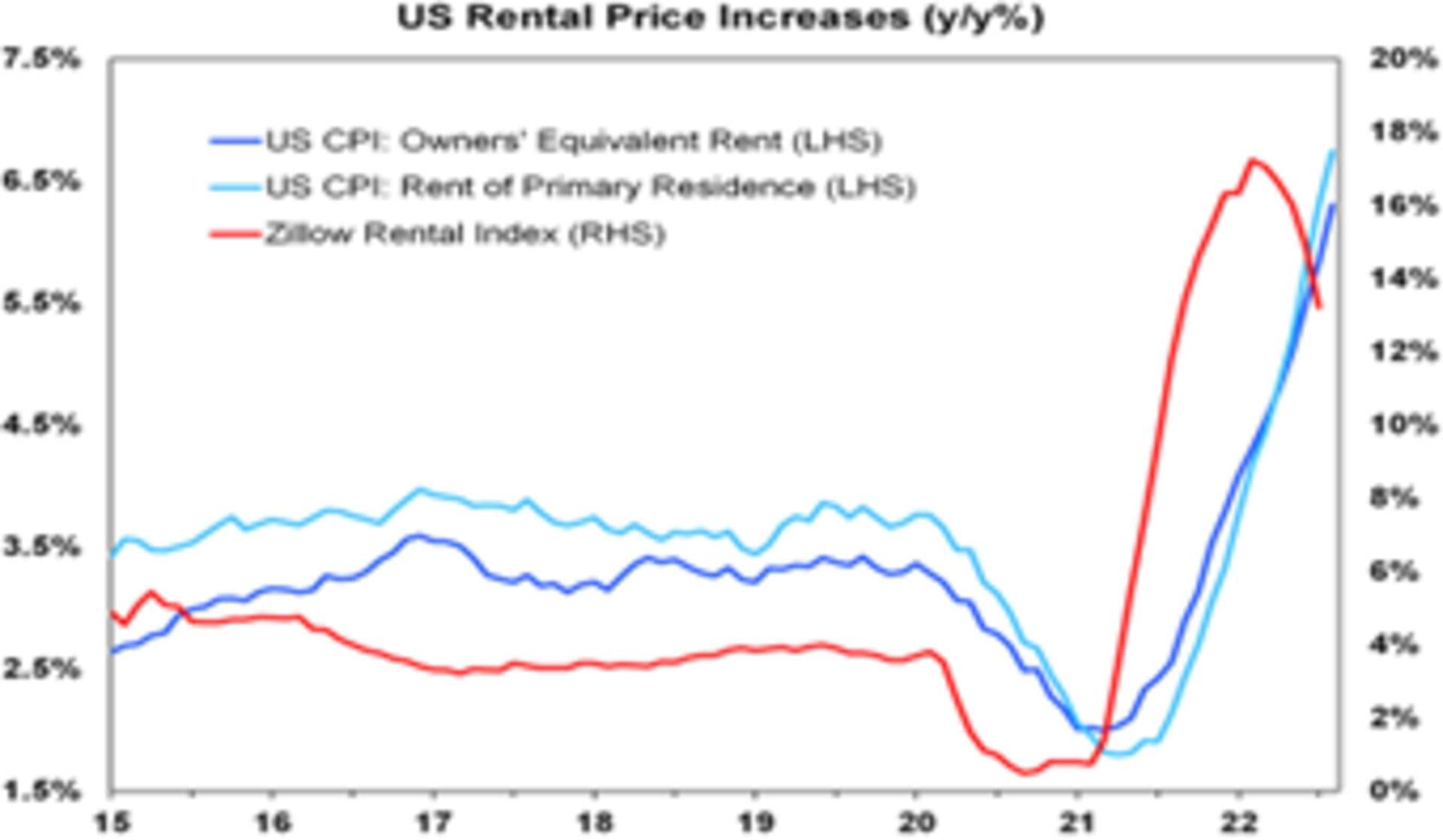

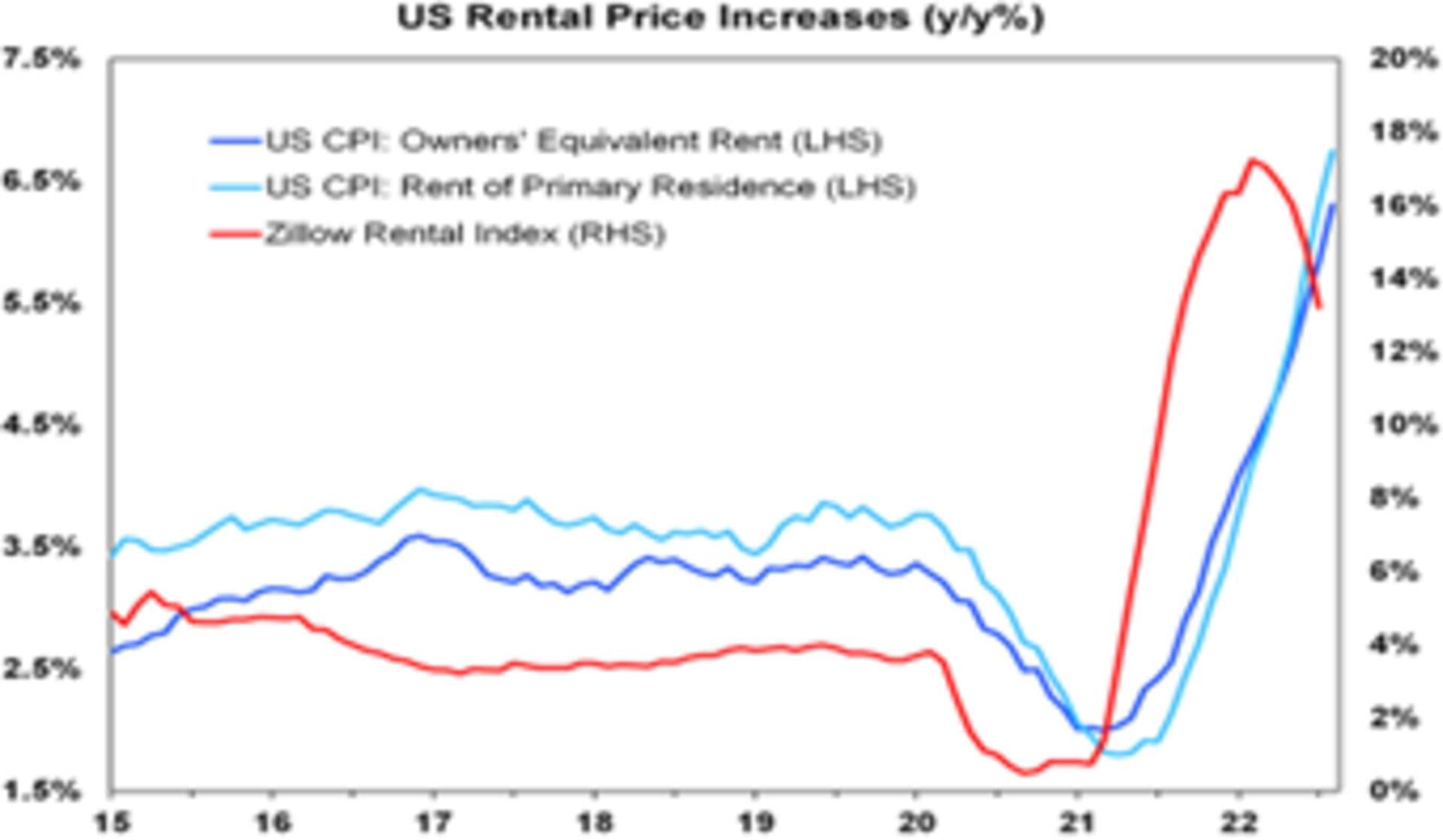

- Market reported rents as measured by Zillow in the US point to a slowing in US “shelter” inflation ahead. As this reflects new leases it impacts with a lag. This is significant because the shelter component is 33% of the US CPI and is dominated by rent and owners’ equivalent rent.

Source: Bloomberg, AMP

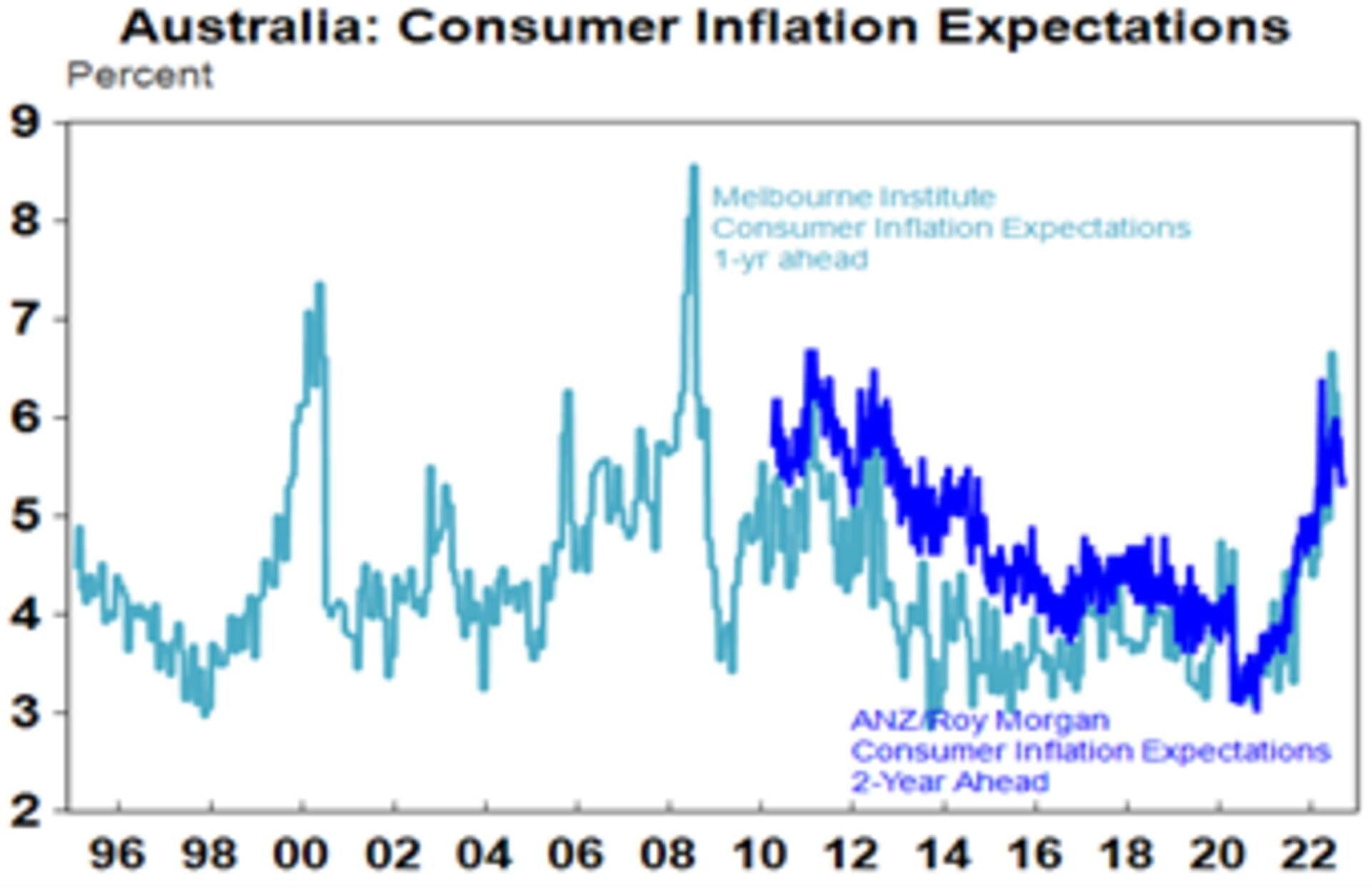

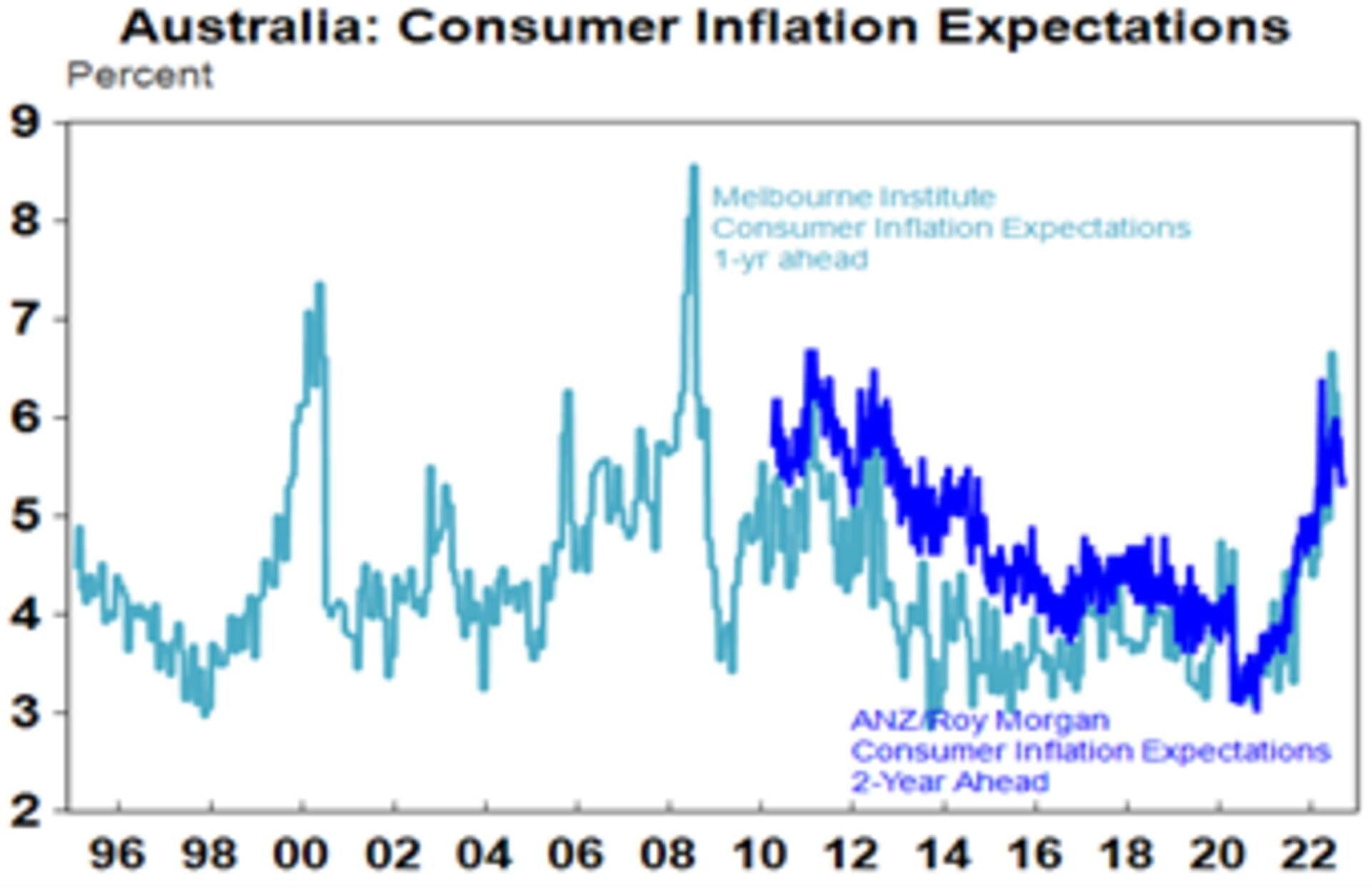

- Consumer inflation expectations have fallen in the US and Australia, helped be aggressive central bank moves and falling petrol prices. This should make it easier for central banks to get inflation back down without having to take interest rates to exorbitant levels.

Source: Macrobond, AMP

Source: Macrobond, AMP

- Finally, money supply growth has slowed from its 2020 surge, and this is likely to contribute to lower inflation ahead.

- The bottom line is that while short term inflation remains high, these considerations are consistent with the US having reached peak inflation and point to lower inflation ahead which should enable central banks to slowdown the pace of hiking by year end in time to avoid a severe recession. If this applies in the US, then Australia should follow as its lagging the US by about six months with respect to inflation. For this reason, while short term risks around shares remain high, remain optimistic on shares on a 12 month horizon.

- In Australia, the RBA has flagged that it will consider scaling back to a 0.25% hike in October – this makes good sense. Reserve Bank Governor Lowe in his appearance before the House of Representatives Economics Committee reiterated his recent messages that: high inflation damages the economy; the RBA will do what is necessary to return inflation to target; more rate hikes are likely; but the RBA is aware monetary policy operates with a lag; and there is case to consider slowing the pace of tightening. The still tight jobs market and still high price and cost pressures evident in the latest NAB business survey point to the RBA hiking again next month. Governor Lowe has indicated that the RBA will consider a 0.25% or 0.5% hike at that meeting dependent on incoming data and expect the RBA to scale back to a 0.25% hike with the peak at 2.85%. However, given the strength in lagged data and RBA worries about inflation the risk is on the upside to the interest rate forecasts. And Governor Lowe’s reference to slowing the pace of hikes “at some point” suggests it’s not necessarily imminent. But just because the Fed is likely to hike by another 0.75% in the next week does not mean that the RBA will have to keep going with 0.5% or greater hikes. The RBA sets interest rates for Australia, not the US; it would only need to match the US if its worried about a crash in the $A boosting Australian inflation but so far there is no sign of that (and the Fed hiked from 2015 to 2018 while the RBA cut without the $A crashing); and wages growth in Australia is running well below where it is in the US giving the RBA a bit more flexibility to allow for monetary policy lags.

- Recent Ukraine success in retaking territory from reportedly disorganised Russian forces have the potential to impact markets positively, but it could also prove to a false dawn. On the one hand President Putin could decide to look for paths to wind down the war. This would likely be taken positively by investment markets as it could eventually take pressure off commodities, inflation and the risk of recession in Europe. But on the other hand, backed into a corner he may decide to take even more risks and further escalate. At this stage it’s too early to tell which way it goes. Chinese President Xi’s maintenance of distance from Russia in relation to its invasion of Ukraine in meetings with President Putin may be seen as good news for investment markets though as it suggests China won’t be drawn into further support for Russia.

|