Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

Weekly Market Update – 16th October 2023

Investment markets and key developments

Global share markets were mixed over the last week. US shares rose as Fed officials sounded less hawkish before higher than expected inflation and nervousness over the war in Israel weighed later in the week, leaving them up 0.5% for the week as a whole. Japanese shares also gained 4.3% but Eurozone shares fell 0.2% and Chinese shares fell 0.7%. The positive global lead along with talk of more stimulus in China saw Australian shares rise 1.4% for the week. The less hawkish central bank commentary along with safe haven demand saw bond yields fall back. Oil prices rose 6% on the back of the war in Israel, albeit they are still down on late September highs. Metal and iron ore prices fell as did the $A, as the $US rose.

Was that it? Have we seen the bottom in shares? The rebound in share markets from their recent lows after falls of around 8% is impressive given the wall of worries around Israel, US politics, recession risk, share market valuations, China, etc. However, its consistent with several key positives:

- First, shares had become oversold technically and had fallen to levels of technical support (in particular the 200 day moving average for the US S&P 500) that can attract buying interest.

- There are reports that China is considering expanding its budget deficit by issuing 1 trillion (or $A214bn) for infrastructure spending. This sounds over the top (as it would be 5.6% of GDP) and may not eventuate. But its possible something is on the way. Of course, fiscal stimulus is no panacea for China’s structural problems but it would provide a near term boost.

- The upcoming US profit reporting season may also provide a boost given the tendency for results to surprise on the upside.

- Fourth, and most importantly numerous Fed speakers have moved to acknowledge the tightening in financial conditions from the rise in bond yields which are “going to do some of the work for us.” This suggests that as things stand now the Fed will leave rates on hold in November. While the “high for longer” rates message remains in place the Fed seems to have shifted from being happy to just let bond yields keep rising to now acknowledging the tightening they bring. This in turn removes some of the upside pressure on bond yields which reduces a key worry we had in terms of share market valuations.

The risk of a further leg down or re-test of the lows in global and Australian shares remains high though. So far the rally has lacked the breadth often seen out of major bottoms and sentiment was not washed up at the low, the upside surprise in US inflation in September will keep the Fed on edge, share valuations remain stretched without a further fall in bond yields, the risk of recession remains high, uncertainty remains high around the China’s economy and property markets, the US remains at high risk of a shutdown next month and the risk of an escalation to involve Iran in the Israeli conflict which would directly threaten oil supplies is high. So, the ride for shares is likely to remain volatile.

…but several things should help shares by year end: seasonality will start to become positive from mid-October; inflation is likely to continue to fall which should take pressure of central banks allowing them to ease through next year; and any recession is likely to be mild. So, while near term uncertainties remain high our 12-month view on shares remains positive.

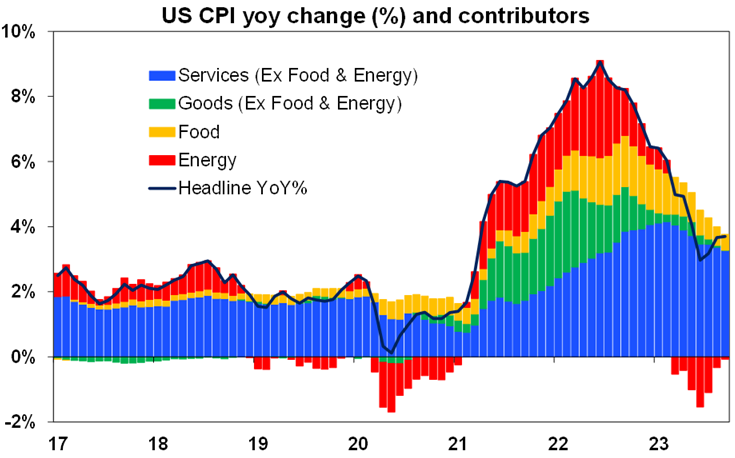

US inflation surprised on the upside in September thanks mainly to higher fuel and shelter prices. Inflation came in stronger than expected at 0.4%mom leaving it unchanged at 3.7%yoy. Core inflation also came in slightly stronger than expected at 0.3%mom but still fell to 4.1%yoy from 4.3%yoy. Higher fuel and shelter costs accounted for the upside surprise with core ex shelter inflation falling to just 0.1%mom. However, this masked falling goods prices but a rise in core services ex shelter inflation.

Source: Bloomberg, AMP

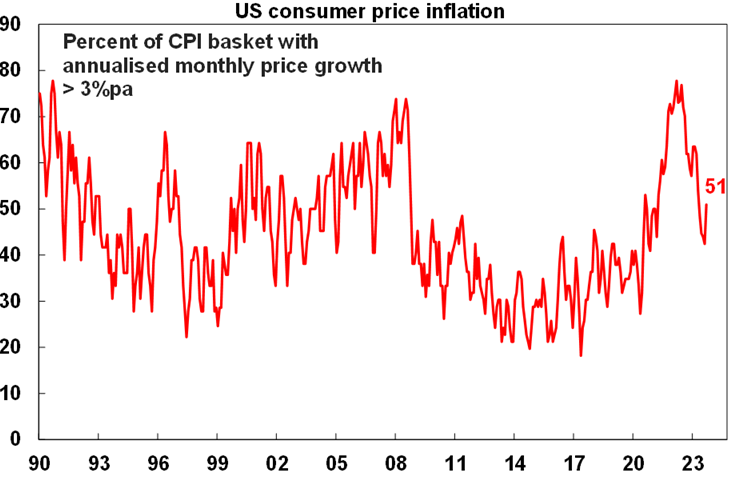

Measures of the breadth of price rises rose, with the percentage of CPI components with greater than 3% inflation rising to 51%.

Source: Bloomberg, AMP

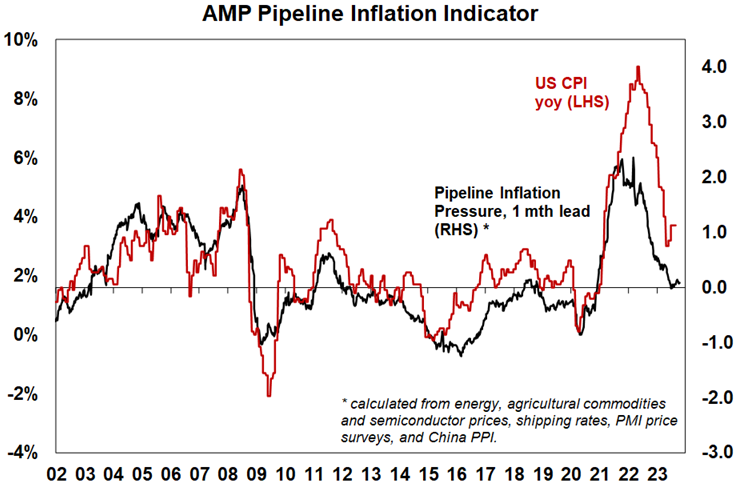

However, the fall in inflation was never going to go in a straight line and our US Pipeline Inflation Indicator has ticked down again and continues to point down for inflation. And falling asking rents point to lower shelter inflation ahead and falling gasoline prices will likely pull down October CPI inflation. Higher core services ex shelter inflation will keep the Fed concerned about sticky services inflation seeing it stick to a “high for longer” message on interest rates but its probably not enough to tip it over into a November rate hike. The US money market has a zero probability of a November rate hike priced in.

Source: Bloomberg, AMP

But why aren’t markets more concerned by the war in Israel with US and Australian shares up over the last week. Surely any conflict in the Middle East is bad via higher oil prices? The situation in Israel is terrible and will get worse before it gets better. But there have been numerous flareups in the Israeli/Palestinian conflict without much impact at all on oil supplies or prices as Israel is not a global oil supplier. And the same goes for Lebanon and Syria if they are drawn in. The Gulf Wars in 1991 and 2003 briefly impacted oil prices because key oil producers were involved. And this is not a re-run of the 1973 Arab/Israeli war that saw Arab countries against Israel and OPEC boycott oil supplies to the US which caused a fourfold increase in world oil prices and contributed to severe recession. Now, Arab countries are on the sidelines with many having better relations with Israel. In fact the timing of Hama’s actions looks motivated to prevent progress towards a Saudi/Israeli security pact which could have harmed them and Iran. So the main risk would be if Iran, which backs Hamas and Hezbollah in Lebanon, is drawn into the conflict (possibly by Israeli retaliation against it) which could threaten its oil production (2.5% of global consumption), the flow of oil through the Strait of Hormuz (through which 20% of world oil consumption flows) or even Saudi production (as Iran did in 2019).

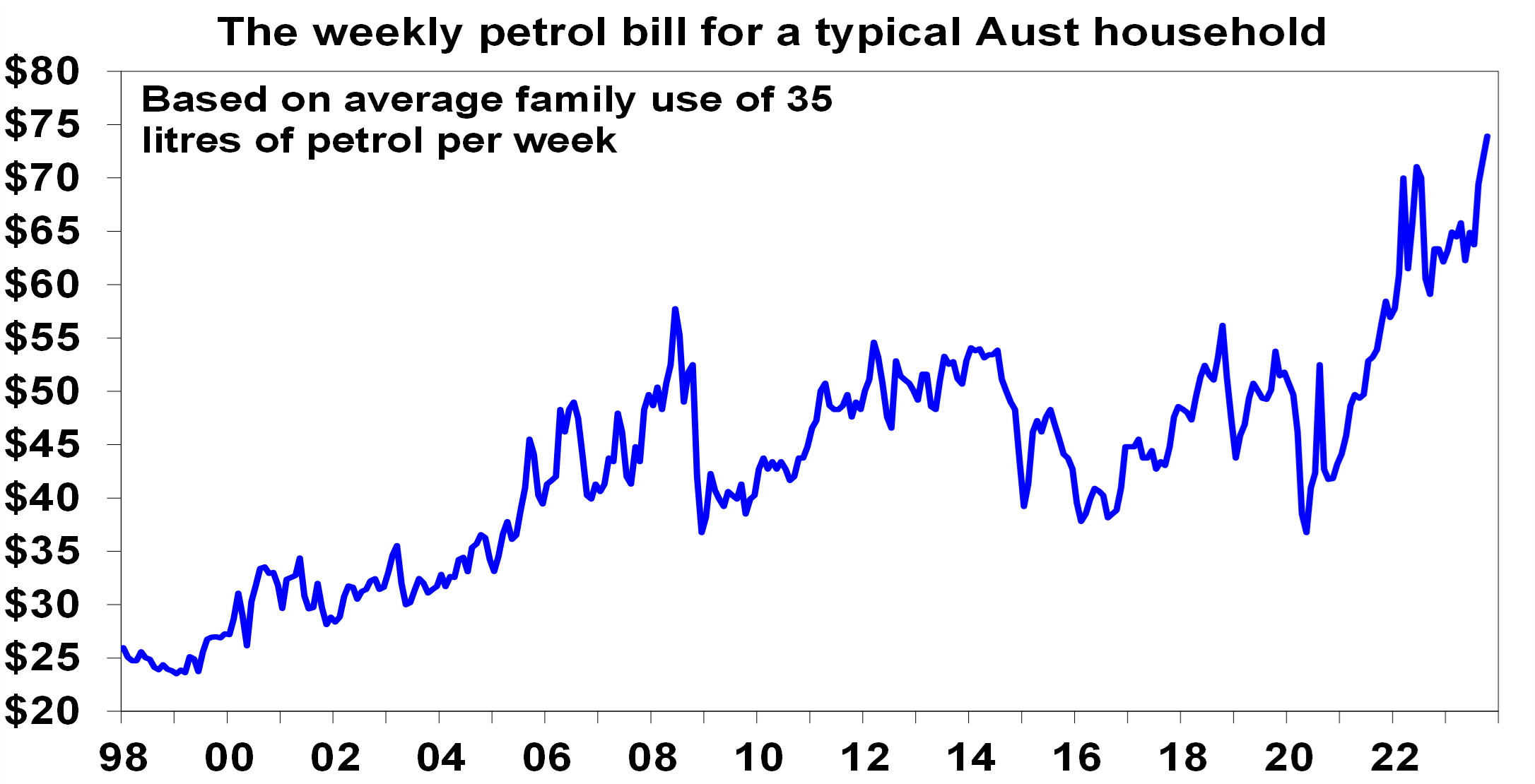

So far investment markets appear to have concluded that Iran will not become involved, with oil prices up 6% but still down from recent highs, and that the conflict will be limited to Israel with little impact on oil supply. If that remains the case, then expect minimal impact. If not, then expect a surge in oil prices. The US will likely want to avoid bringing Iran into the conflict until after next year’s election and Israel may not want to open another front just yet, but Iran’s backing of Hamas and its nuclear weapons’ breakout capability mean that Israel has a strong incentive to attack Iran at some point resulting in a greater threat to world oil supplies. But in the meantime, the risk is high and uncertainty will rise as the war escalates. However, the situation is very different today compared 18 months ago when oil and petrol prices surged into the Ukraine war and it was inflationary. Back then household budgets were strong, households wanted to get out and spend with reopening and monetary policy was easy. Now all of that is reversed so a further surge in oil and petrol prices is more likely to be a drag on growth and hence be deflationary which will make it very hard for higher fuel and transport costs to be passed on to consumers beyond the increased price at the petrol station. Our rough estimate is that a typical Australian household is now paying $12 a week more for auto fuel than back in May. With stretched household budgets this means that $12 a week less is available for spending elsewhere.

Source: Bloomberg, Motormouth, AMP

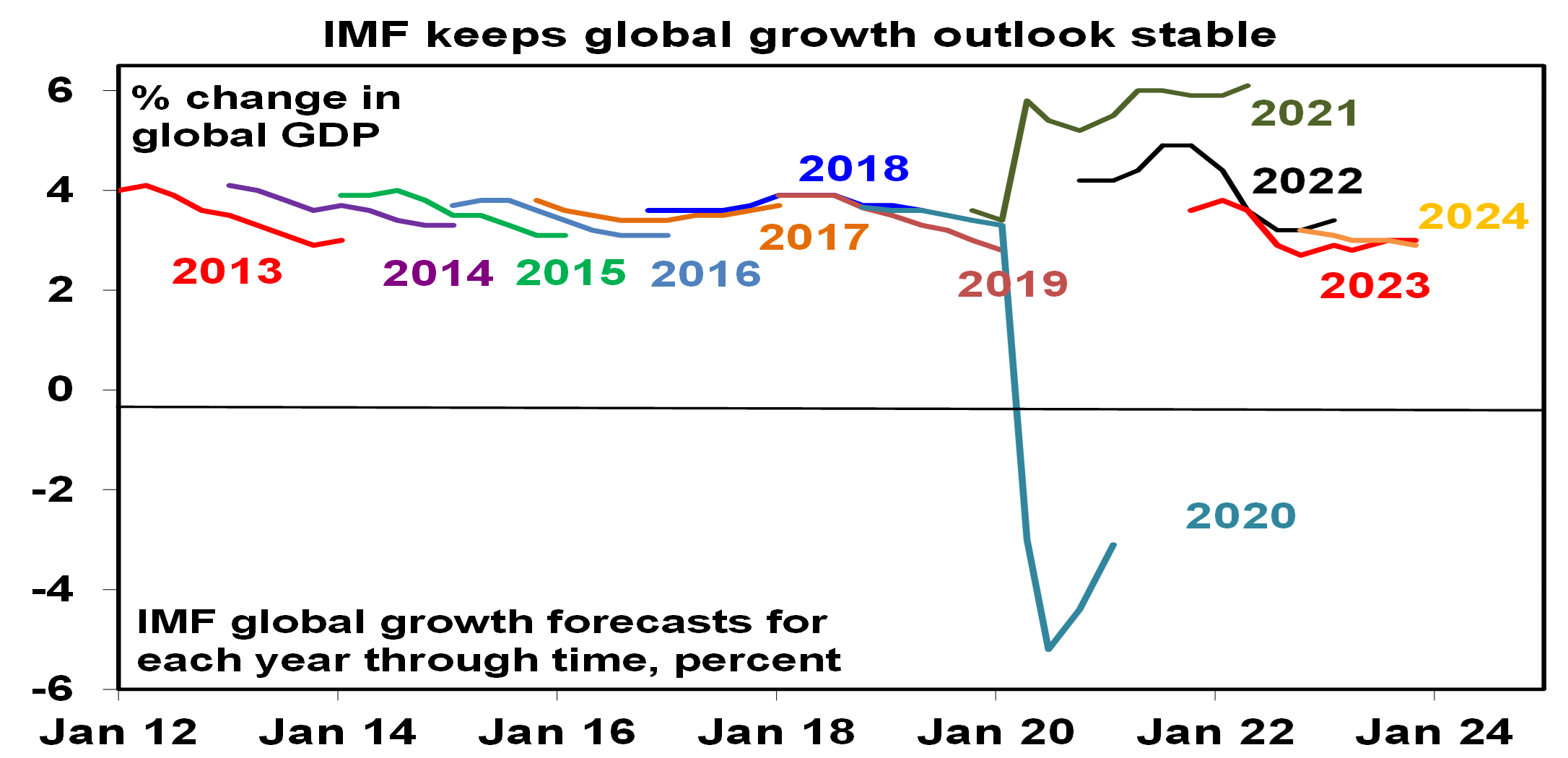

The latest IMF forecasts for the global economy provide a reminder that while things are not great – they are not bad either. Despite constant fear of recession, the IMF (which is representative of consensus expectations albeit it lags a bit) sees global growth of 3% this year and 2.9% next year and this has been stable for some time now and just a little bit below the norm.

Source: IMF, AMP

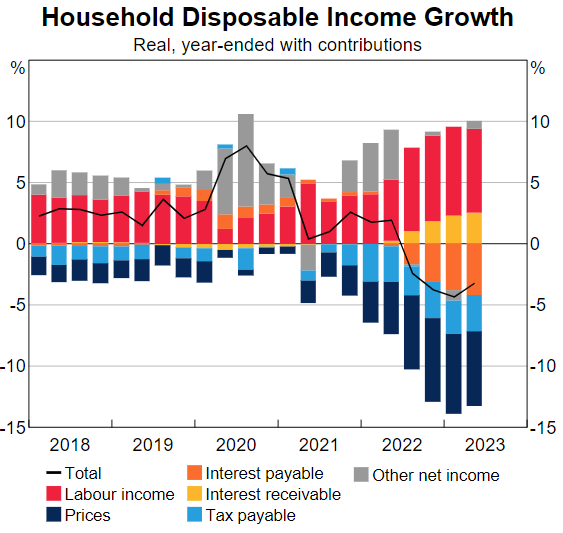

Lower interest rates are good for households in aggregate, higher rates are bad. Simple. Back in 2018 and 2019 there was a view that low interest rates were the cause of slow sub-par growth at the time. That was nonsensical. Similarly, some have argued that raising rates won’t work to slow demand because the loss for borrowers is offset by the gain for lenders. Again, its nonsensical. A chart from RBA Assistant Governor Kent helps show why. In Australia the value of household debt is roughly double that of bank deposits so with interest rates rising the rise in interest received by the household sector (yellow bars) has been swamped by the rise in interest payable (orange bars). Hence higher interest rates are net negative for household sector disposable income and with 20% of mortgages yet to transition from low 2% or so rates to rates that are now three times higher this has further to go. And as Kent points out “people with savings typically spend less of each extra dollar they earn than those with debt”, ie saver households tend to be older and have a lower marginal propensity to consume than debtors. All of which means high rates depress household spending and lower rates boost it. Right now the impact is clearly negative and has further to go and its normal for this to show up with a lag.

The fact that the RBA has already increased interest rates substantially, the dampening impact is already starting to become evident in household spending and there is more to go given lags in the flow through to spending are why we think the RBA has already raised rates enough. There is still a 40% chance of another rate hike – possibly in November (after September quarter CPI data and the latest RBA forecast revisions) or December (after September quarter wages data) – but our base case remains that rates have peaked and the next move will be a cut from around June next year. The money market has priced in a 6% chance of a rate hike in November & a 46% chance by March.

An upbeat song. It’s always nice in uncertain times to listen to an upbeat song. KT Tunstall’s Suddenly I See, which has been featured in various films including The Devil Wears Prada and Hilary Clinton’s 2008 presidential campaign, really fits the bill.

Economic activity trackers

Our Economic Activity Trackers are still not providing any decisive indication of recession or a growth rebound.

Levels are not really comparable across countries. Based on weekly data for eg job ads, restaurant bookings, confidence, credit & debit card transactions and hotel bookings. Source: AMP

Major global economic events and implications

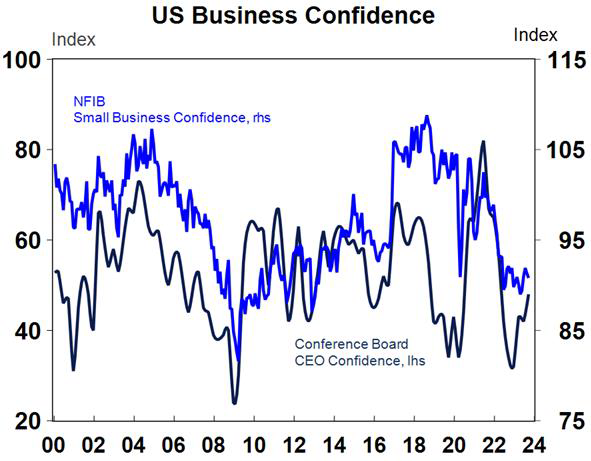

Apart from the CPI referred to earlier, US producer price inflation for September also came in a bit stronger than expected but mainly due to higher energy and food prices and it’s still low at 2.2%yoy. Small business confidence fell and remains weak but jobless claims remain low.

Source: Macrobond, AMP

Japan’s Economy Watchers business survey showed a softening in economic conditions in September but they remain reasonable. Producer price inflation slowed further to 2%yoy, well down from a peak of over 10%yoy.

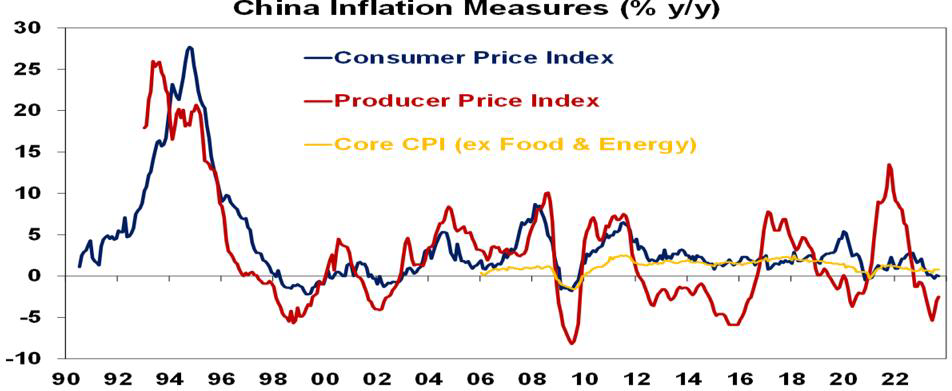

Chinese CPI inflation came in weaker than expected, falling to zero over the last 12 months, with core inflation unchanged at 0.8%yoy. Producer price deflation eased slightly to -2.5%yoy. Low Chinese inflation leaves plenty of room for further policy stimulus. Meanwhile, Chinese exports and imports were both a bit better than expected in September but are still down by 6.2% on a year ago. Total credit rose more than expected likely reflecting the impact of policy stimulus but with annual growth unchanged at 9%yoy.

Source: Bloomberg, AMP

Australian economic events and implications

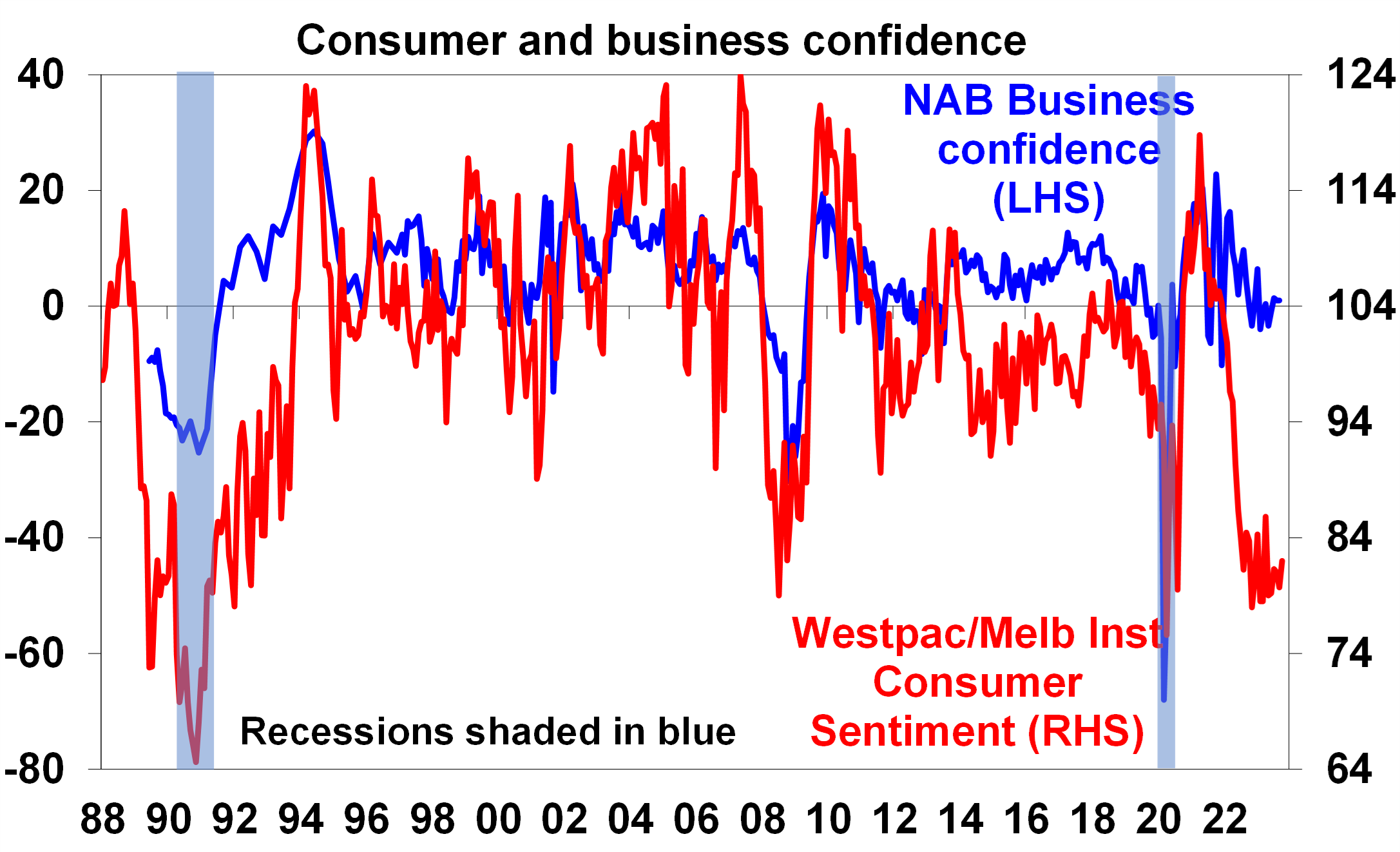

Australian consumers still depressed, but business conditions still okay. According to the October Westpac/MI consumer survey, consumer confidence rose slightly helped by another month of interest rates remaining on hold, but it still remains at recessionary levels indicating that the lagged impact of rate hikes and cost of living pressures continue to impact. By contrast business confidence according to the September NAB survey remains at average levels and business conditions fell but remain okay.

Source: Westpac/MI, NAB, AMP

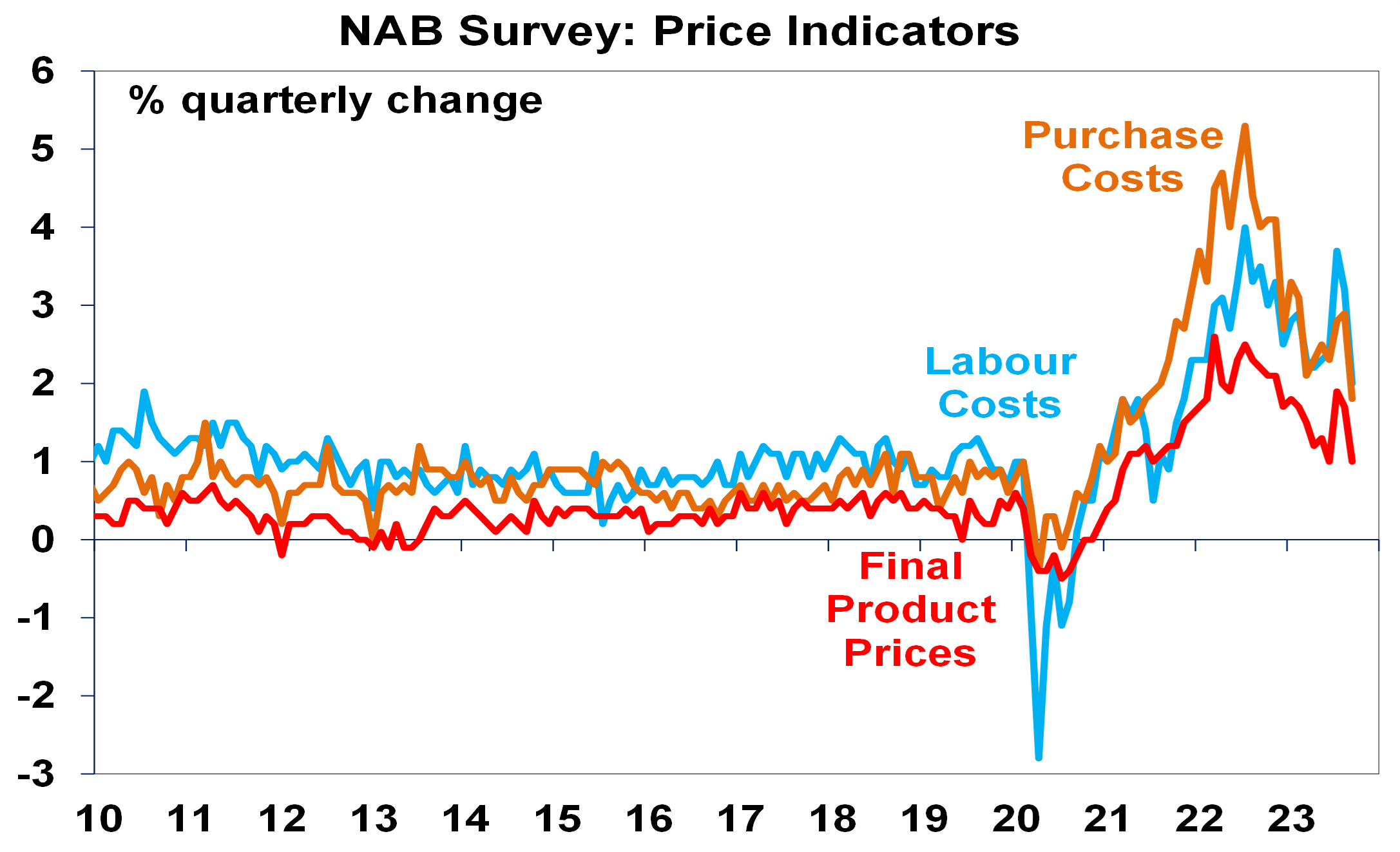

But the good news is that the NAB survey showed a resumption of easing inflationary pressures after a mid-year spike, with a sharp slowing in reported increases for labour and purchase costs and final product prices. This may reflect the flow through of the faster increase in minimum and award wages from July this year flowing from the Annual Wage Review in June, but whatever it is the resumption of the downswing in price pressures is a positive sign.

Source: NAB, AMP

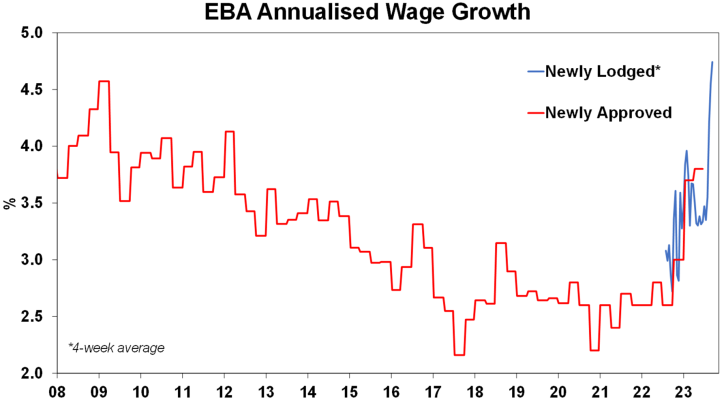

A continuing acceleration in wage increases under newly lodged Enterprise Bargaining Agreements highlights that the risk remains on the upside to wages growth. Of course, newly lodged deals are for only part of the 40% of workers covered by EBAs and so may exaggerate the pressures which may be what the NAB survey is suggesting. But it’s nevertheless part of the reason why we still attach a 40% probability to one more rate hike and why the RBA will likely retain a tightening bias for a while yet. Comments by RBA Assistant Governor Kent in the last week suggests that the RBA is not too concerned about wages growth partly based on its findings from its business liaison program. September quarter wages data are due in mid-November.

Source: Fair Work Commission, AMP

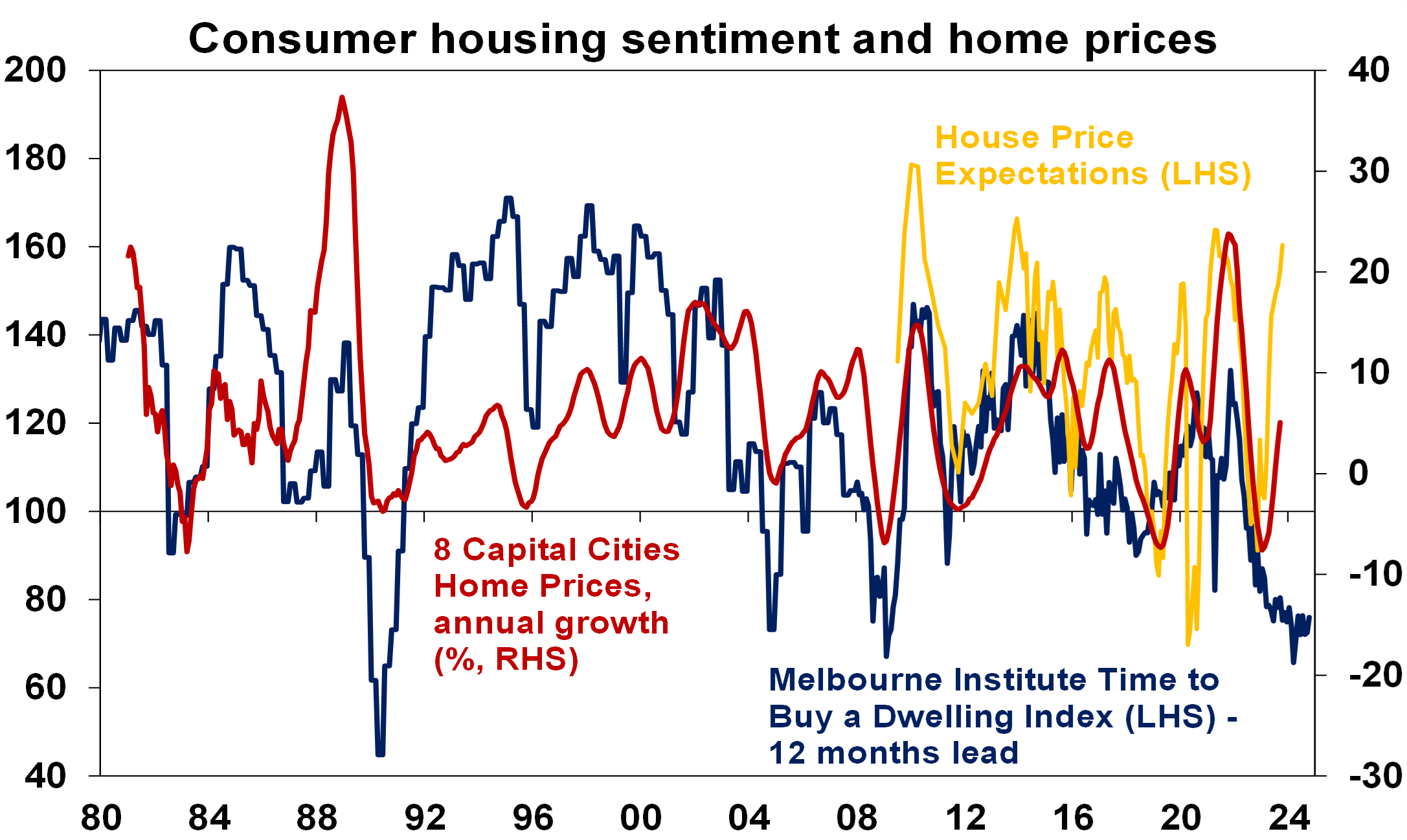

Finally, while the consumer survey shows home price expectations continuing to rise with home prices, consumers remain sceptical that now is a good time to buy a dwelling.

Source: ABS, AMP

What to watch over the next week?

In the US, manufacturing conditions in the New York (Monday) and Philadelphia (Thursday) regions for October are likely to be soft, September retail sales are expected to have slowed to just 0.2%mom growth with industrial production falling 0.1% and October home builder conditions remaining subdued (all due Tuesday), housing starts (Wednesday) are expected to bounce by 10% after a sharp fall in August and existing home sales (Thursday) are expected to fall another 3.5%. US September quarter earnings results will also start to flow with the consensus expecting earnings growth of 0.6%yoy, but results are likely to come in stronger.

September inflation data for various countries is expected to show slight falls with Canada (Tuesday) slowing to 3.8%yoy, New Zealand (also Tuesday) slowing to 5.9%yoy, the UK (Wednesday) slowing to 6.2%yoy and Japan (Friday) slowing to 3%yoy. Core (ex energy & food) inflation in Japan is likely to have slowed to 2.6%yoy.

UK jobs data for September (Tuesday) is likely to show a further easing in labour market conditions.

Chinese September quarter GDP growth (Wednesday) is expected to show a further slowing in 12 month ended growth to 4.5%yoy from 6.3%yoy as a reopening bounce a year ago drops out but quarterly growth is expected to improve to 1%qoq from 0.8%qoq. September monthly data is expected to show an improvement in growth for retail sales to 4.8%yoy, a slowing in industrial production to 4.3%yoy and investment unchanged at 3.2%yoy. Overall, this should help allay concerns about a collapse in Chinese growth albeit its still soft by Chinese standards.

In Australia, the minutes from the last RBA meeting (Tuesday) are likely to provide more details on why it left rates on hold again this month, but also provide a reminder that it may still hike again. A “fireside chat” with new Governor Bullock (Wednesday) will also be watched for any clues on the outlook for monetary policy. Both may be watched for any comments on when or if the RBA will move to active Quantitative Tightening (ie beyond just letting bonds roll off the balance sheet as they mature) with Assistant Governor Kent saying RBA had “no current plans” to undertake it. September jobs data (Thursday) is expected to show a 5000 gain in employment after the 64,900 gain in August with unemployment rising to 3.8%.

Outlook for investment markets

The next 12 months are likely to see a further easing in inflation pressure and central banks moving to get off the brakes. This should make for reasonable share market returns, provided any recession is mild. But for the near-term shares are at high risk of a further correction given high recession and earnings risks, the risk of high for longer rates from central banks, rising bond yields which have led to poor valuations and the uncertainty around the latest war in Israel.

Bonds are likely to provide returns above running yields, as growth and inflation slow and central banks become dovish but given the recent rebound in yields this may be delayed a few months.

Unlisted commercial property and infrastructure are expected to see soft returns, reflecting the impact of the rise in bond yields on valuations. Commercial property returns are likely to be negative as “work from home” continues to hit space demand as leases expire.

With an increasing supply shortfall, our base case remains that home prices have bottomed with more gains likely next year as the RBA starts to cut rates. However, uncertainty around this is high given the lagged impact of interest rate hikes and the likelihood of higher unemployment.

Cash and bank deposits are expected to provide returns of around 4-5%, reflecting the back up in interest rates.

The $A is at risk of more downside in the short term on the back of a less hawkish RBA and weak growth in China, but a rising trend is likely over the next 12 months, reflecting a downtrend in the overvalued $US and the Fed moving to cut rates.

Source: AMP ‘Weekly Market Update’