Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

Weekly Market Update – 16th February 2025

Investment markets and key developments

Global shares rose over the last week helped by hopes that Trump’s tariffs won’t be as bad as feared following more delays to their start up along with strong US earnings. For the week US shares rose 1.5%. Eurozone shares rose 2.9%, also getting a boost from perceptions that US-Russia Ukraine talks may be good for Europe in the short term (even though it might be more concerning for Ukraine and Europe in the medium term). Japanese shares rose 0.9% and Chinese shares rose 1.2%. Australian shares also surged to a new record high helped by the positive global lead, a good start to the earnings reporting season and expectations for imminent RBA rate cuts. For the week Australian shares rose 0.5% led by industrial, consumer, mining and property shares. Bond yields fell in the US on softer retail data but rose elsewhere. Oil prices rose fell but metal and gold prices rose in US dollars partly helped by fears that they may face US tariffs. But hopes for less aggressive US tariffs saw the $US fall which in turn helped the $A get back above $US0.63.

Despite lots of noise shares continue to perform well. Key risk factors are stretched valuations, Trump’s tariffs and other policies potentially adding to US inflation and impacting the Fed and cutting into global and Australian growth and various geopolitical risks. So, we continue to see a high likelihood of a 15% plus correction at some point this year. But ultimately, we see shares doing okay this year as Trump’s more negative policies are constrained by a desire to see shares rise at the same time that some of his policies reinvigorate the US, and with most central banks continuing to cut rates, with the RBA likely joining in on Tuesday, boosting growth and profits.

The Trump Administration is so far turning out as a far more organised and super charged version of Trump 1.0. Highlights of the past week include an Associated Press reporter being barred from White House press conferences for lying about the true name of the Gulf of Mexico, a Presidential Order mandating a Federal government return to plastic straws because paper straws “explode” and a claim that the previous administration was spending $50m on sending condoms to the Gaza Strip (when it was actually an HIV prevention program in Gaza Province in Mozambique). The good news for comedians this time around is that they don’t have to exaggerate – just run what’s actually coming out of the White House.

Meanwhile, Tariff man Trump continues to drip feed much hyped tariff announcements. Here are seven key points on the trade war so far:

- First, it still looks like there is much more to go. So far tariffs cover China (10%), Mexico and Canada (25% – but delayed till March) and steel and aluminium (25%), but he has confirmed that “reciprocal tariffs” (“they charge us…we charge them.”) on a country by country basis are on the way, he is planning to tariff other industries like cars, pharmaceuticals and semi-conductors and he is likely to do more after his trade policy reviews are complete by 1 April.

- Second, while some of the tariffs are a negotiating ploy (eg 25% on Canada and Mexico) and could be removed others are aimed at raising revenue and shifting production back to the US and so are likely to stick (eg those on China, eventually the EU, steel and aluminium and eventually other industries).

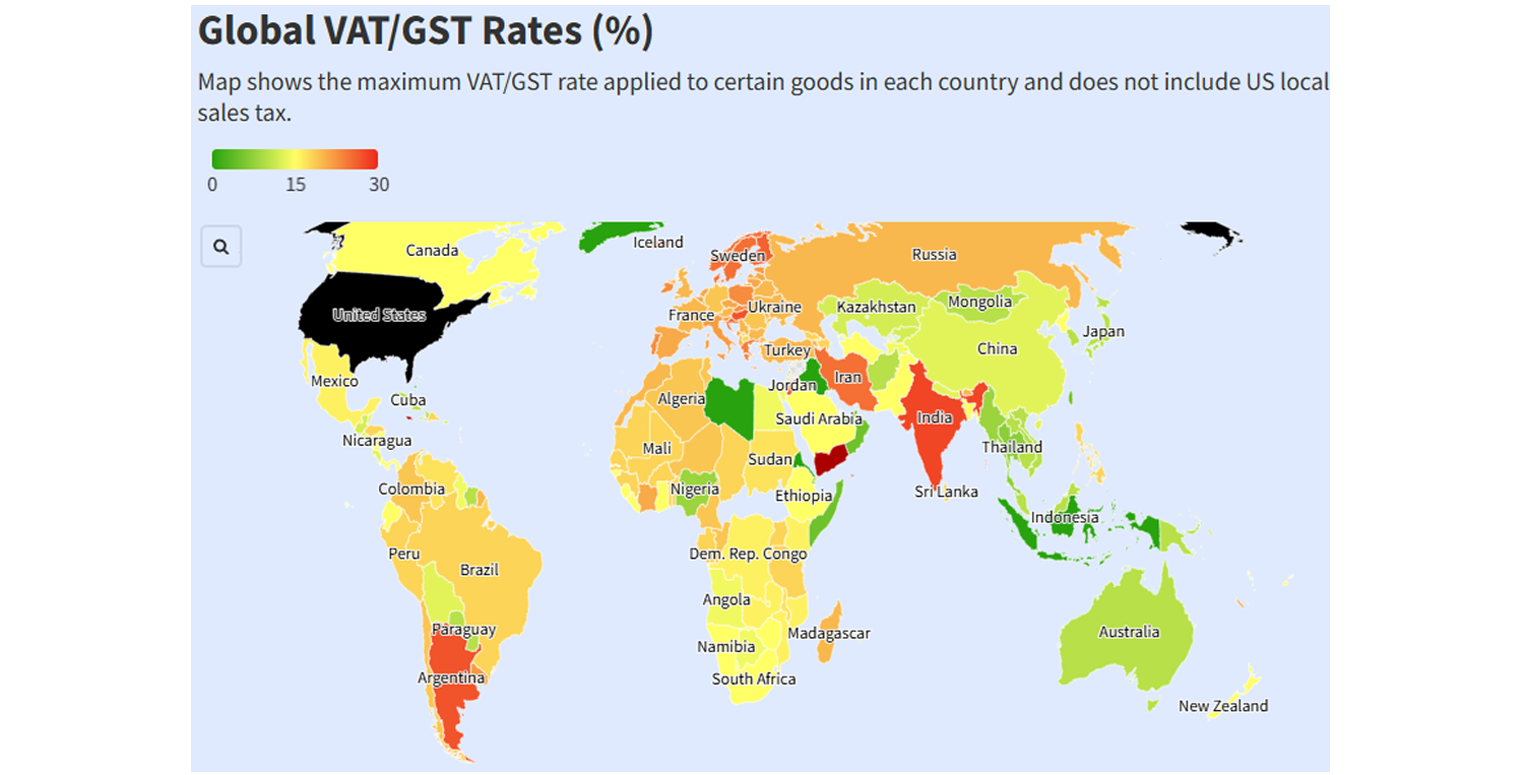

- Third, the delayed start of the “reciprocal tariffs” till after the trade policy reviews are completed on 1 April suggest that they may also be a negotiating ploy. But they will also raise a lot of issues: their level will be hard to work out which in turn creates a lot of uncertainty because the US will consider offsetting not just tariffs in other countries but non-tariff barriers including subsidies, regulations, value added taxes and exchange rates; they may hit developing countries harder than rich countries because they tend to impose higher tariffs; if they are levied to counter value added taxes as Trump has suggested it will be totally ignorant and irrational and create a huge global furore because VATs (including our GST) are levied at the same rate on imports and locally made goods so are not protectionist in any way; and Australia could be caught up because of our 10% GST…but according to the White House it will begin with countries with which the US has the highest trade deficits and they have a surplus with us. The next chart compares VAT/GST rates around the world and Australia at 10% is at the low end and it needs to be set against state and local sales taxes in the US which can go up to 10%. VAT/GST is a highly efficient tax that is not protectionist so hopefully common sense prevails, and Trump does not threaten it.

Source: VATcalc.com, Flourish, AMP

- Fourth, the tariffs will boost US inflation (leaving the Fed cautious) and hit growth via supply chain disruption, less demand for exports and uncertainty delaying business investment but this will take many months to fully show up.

- Fifth, resilient share markets may embolden Trump to do more. Shares have seen kneejerk modest falls in response to each announcement but have bounced back to record or near record highs. As in early 2018 this may partly be because the negative economic impact takes a while to show up. And it also reflects optimism that the delays in some tariffs commencements dates leave room for negotiation.

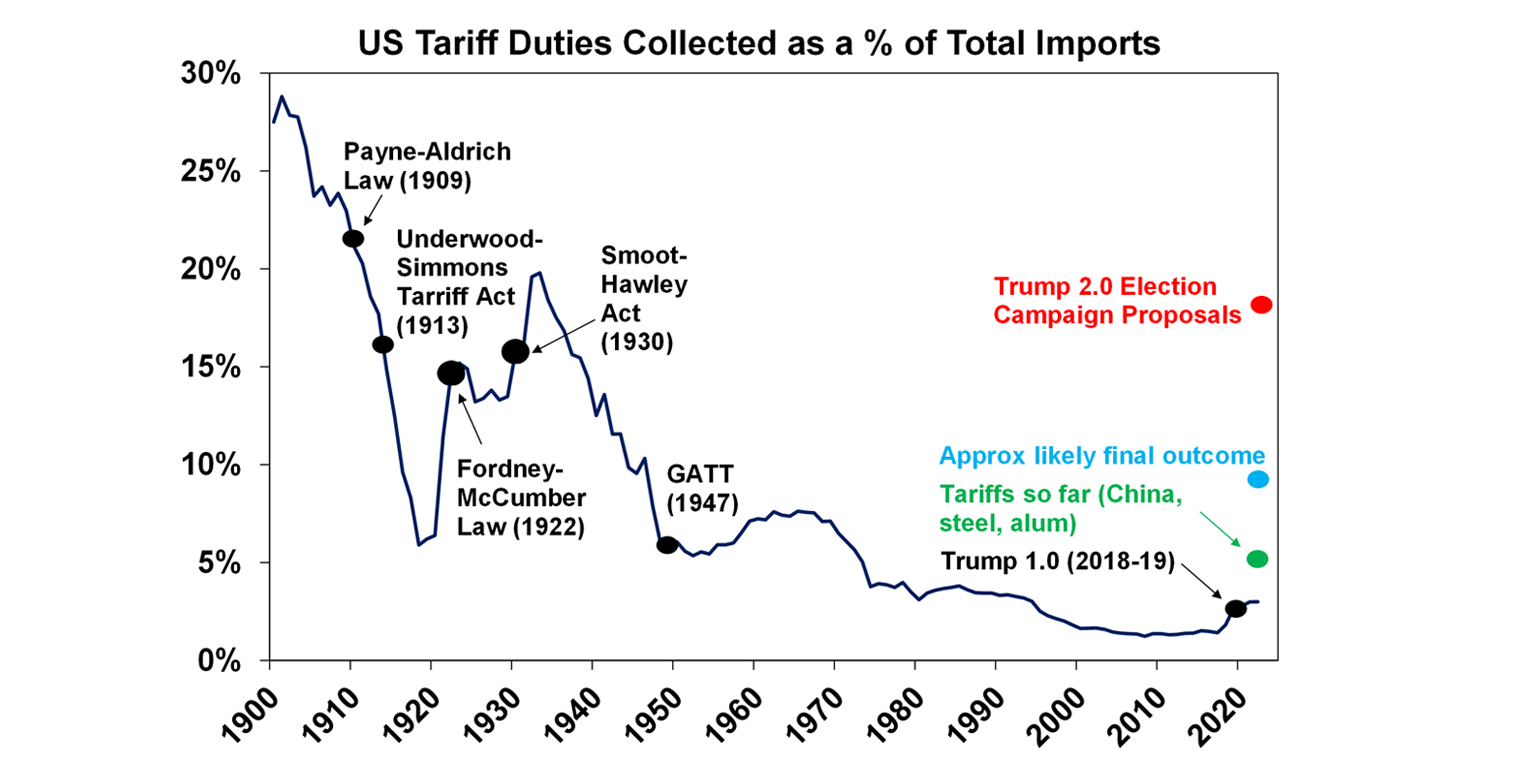

- Sixth, ultimately Trump is likely to be constrained by falling share markets and Americans (& hence Republican politicians) complaining about higher prices due to tariffs. We think this will take a while to occur though. But we think this will ultimately see average US import tariffs capped at around 9% from 3% last year which is well down from the near 20% he talked about in the election, but it could go beyond this at some point before falling back.

Source: US ITC, Evercore ISI, AMP

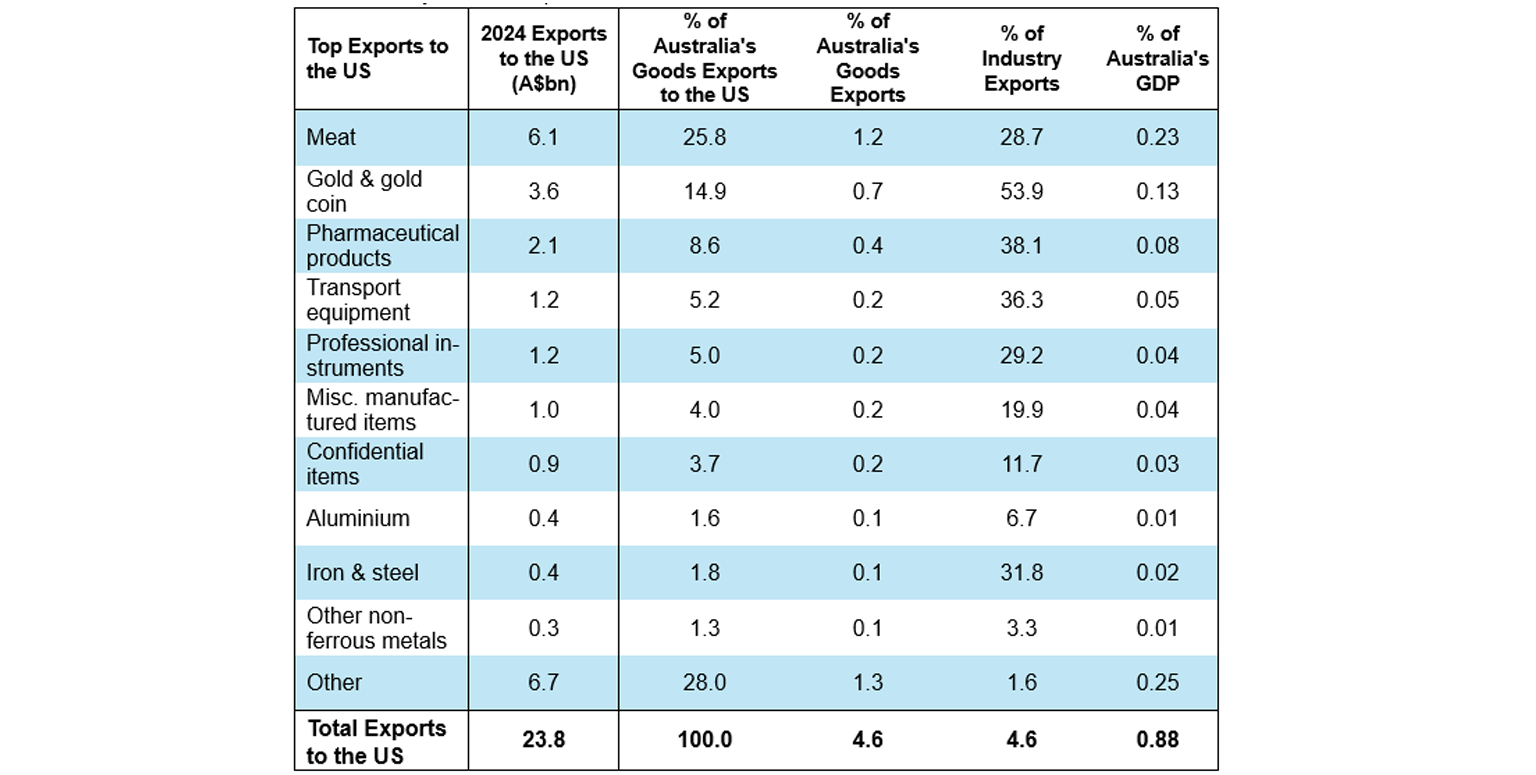

- Finally, Australia is not immune. For much of the past week the local debate has been around whether our US steel and aluminium exports will face the 25% tariffs. The Trump administration is reportedly considering an exemption (because they have a trade surplus with us and we buy planes) but this is not guaranteed (with eg, Trump’s trade adviser Navaro claiming Australia was killing US aluminium – although with Australian aluminium only making up around 2.5% of US aluminium imports this makes no sense!). And in any case if we do get an exemption for these exports, it may then move on to whether we get an exemption in the next rounds of Trump tariffs eg on pharmaceuticals which are far bigger than steel and aluminium exports. Or we may get caught up in Trump’s reciprocal tariffs if he deems our GST protectionist. (It’s not because the 10% rate applies to imports and local goods and services alike but it sounds like Trump may not see it that way.) The key though is while US tariffs may make it tough for the industries exposed (eg one third of Australian iron ore exports go the US) the direct impact on the overall economy is likely to be minor as iron and steel exports to the US are just 0.03% of GDP, pharmaceutical exports to the US are just 0.08% and total exports to the US are just 0.9% of GDP. See the next table which show’s Australia’s main exports to the US and their percentage of Australian GDP. This is about the same size as the $20bn of Australian exports to China that were restricted in 2020 with little significant macro-economic impact. Rather the main risk to Australia will come indirectly if Trump’s trade war leads to a big hit to global trade and growth generally leading to less demand for our exports.

Source: ABS, AMP

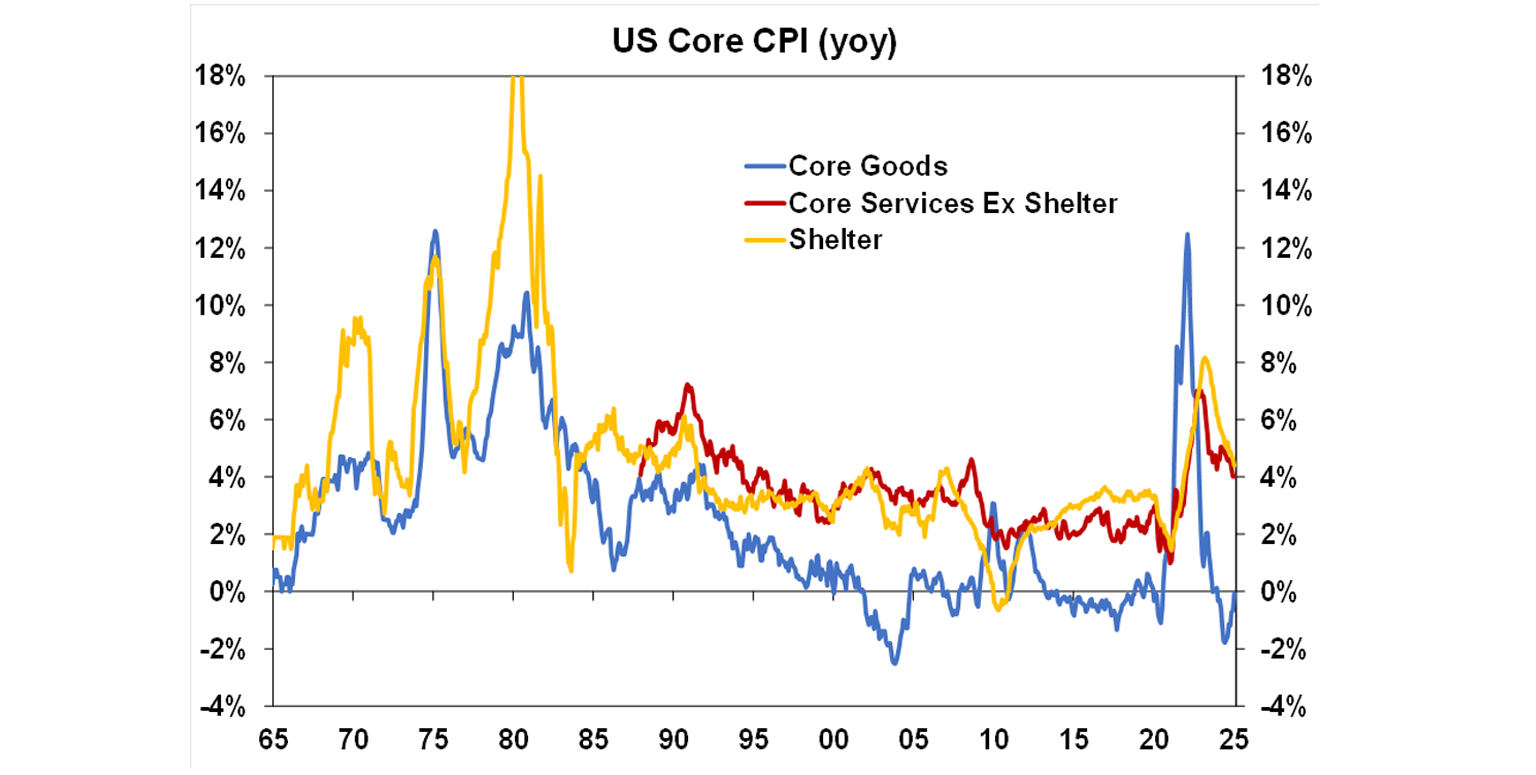

Fed caution on rates accentuated by hotter US inflation. The past week also saw Fed Chair Powell repeat his message that the Fed is in wait and see mode and in no hurry to cut rates again as inflation has made progress but is still elevated and the economy is still strong. Higher than expected inflation for January, with the core CPI up 0.4%mom or 3.3%yoy with goods price inflation picking up as services slows, reinforced this caution.

Source: Bloomberg, AMP

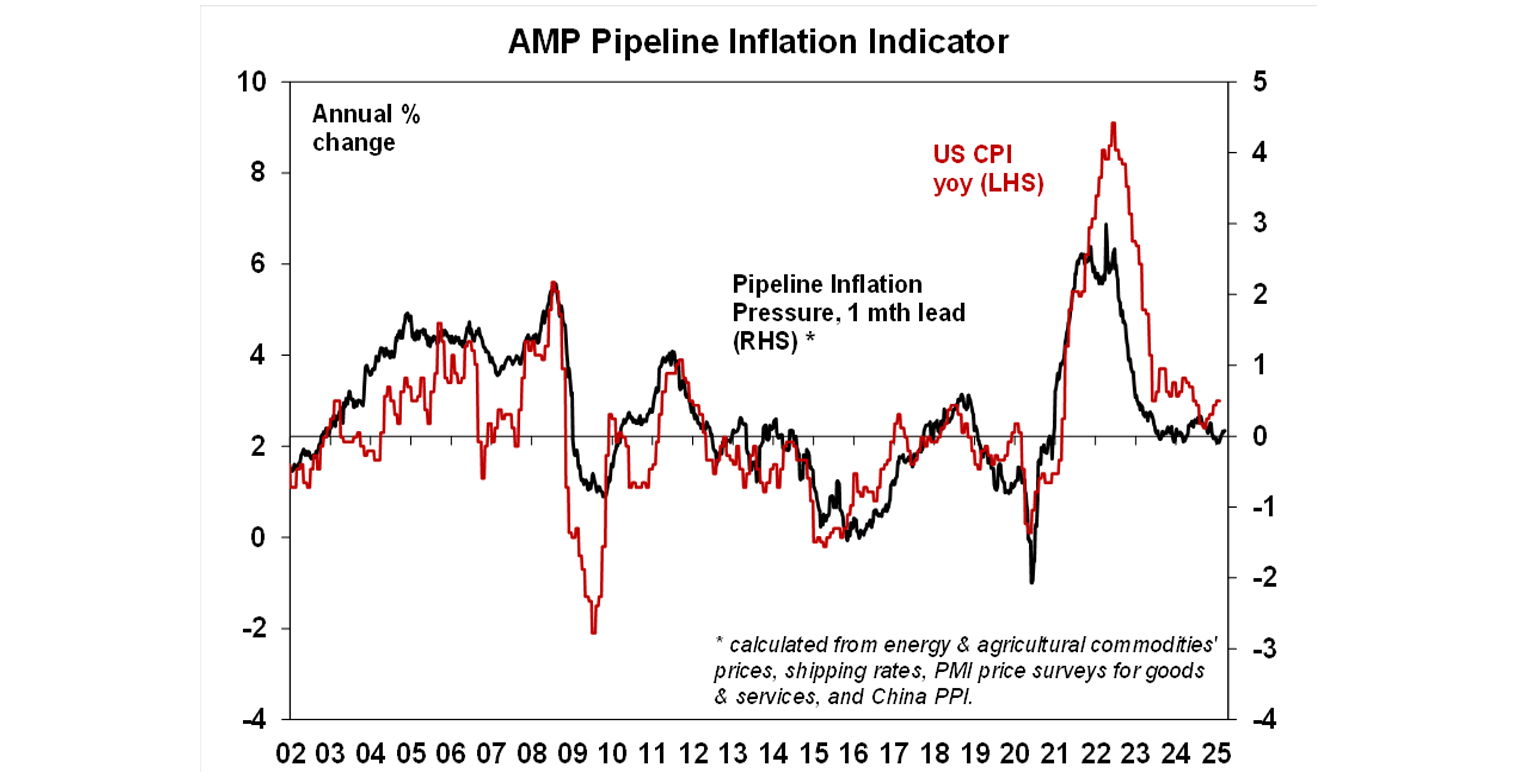

Fortunately, though some of the upside surprise in January inflation looks due to seasonal distortions around year end/new year, shelter inflation is continuing to cool, based on producer and import price inflation data core private final consumption deflator inflation looks like it will be lower at 0.26%mom or 2.5%yoy and our Inflation Indicator points to inflation around the Fed’s 2% inflation target.

Source: Bloomberg, AMP

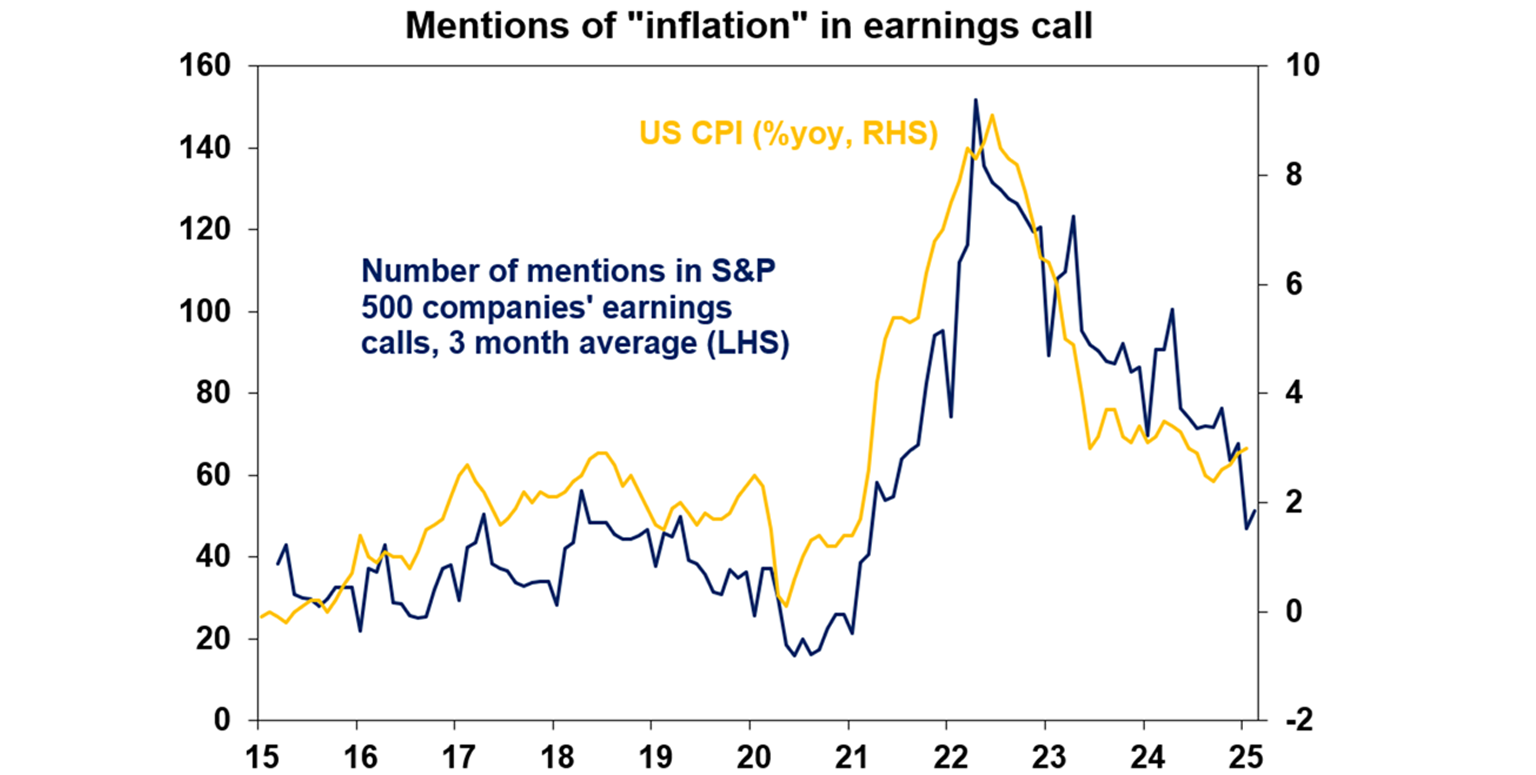

And mentions of inflation in US company earnings calls is continuing to trend down which is a good sign. (Of course, tariffs may change this.)

Source: Bloomberg, AMP

So, US inflation numbers may start to look better again in the next few months and the money market moving to wind back expectations to just one Fed rate cut this year may be over-reacting. That said the Fed is likely to remain cautious until it gets clear evidence inflation is cooling again, and it gets more visibility over the impact of Trump’s tariffs. Of course, other major central banks are still on track to continue cutting rates reflecting weaker economic conditions, a clearer downtrend in inflation and fewer risk of a boost to inflation from tariffs.

In Australia, we expect the RBA to start cutting rates in the week ahead with a 0.25% cut on the back of increasing confidence that inflation is moving sustainably back to target backed up by downwards revisions to its inflation, wages and GDP forecasts but with low unemployment and the weak $A seeing it provide cautious and non-committal guidance around future moves. We expect three rate cuts this year but its likely to be a gradual process with the next move unlikely until May, which will be well clear of the upcoming Federal election. See the “What to watch over the week ahead” section below for more details around our expectations regarding the RBA decision.

We expect the start of an RBA rate cutting cycle to support a modest uptick in economic growth over the year ahead but not enough to reignite inflation and to drive an uptick in property prices. In particular, a 0.25% rate cut will cut $100 off monthly mortgage payments on a $600,000 mortgage freeing up some spending power. However, the impact is likely to be minor at least initially: as it takes a while for interest rate moves to start impacting spending as we saw with the initial hikes in 2022; rate cuts this year are expected to reverse only 3 of the 13 hikes (or 0.75% of the 4.25% rise); and rate cuts will be gradual particularly compared to the rapid fire rate hikes back in 2022 which may dampen expectations. Our forecasts for the ASX 200 to rise to around 8800 and for residential property prices to rise 3% this year were predicated on three rate cuts this year so a rate cut in the week ahead is unlikely to alter our expectations.

And its Valentine’s Day. Australian Retailer Association projections show $535m to be spent on Valentine’s Day. Maybe it’s not so big this year as its on a Friday and people often go out Friday night anyway. Then again for an economist these things are non-events as we like to seasonally adjust them away.

Major global economic events and implications

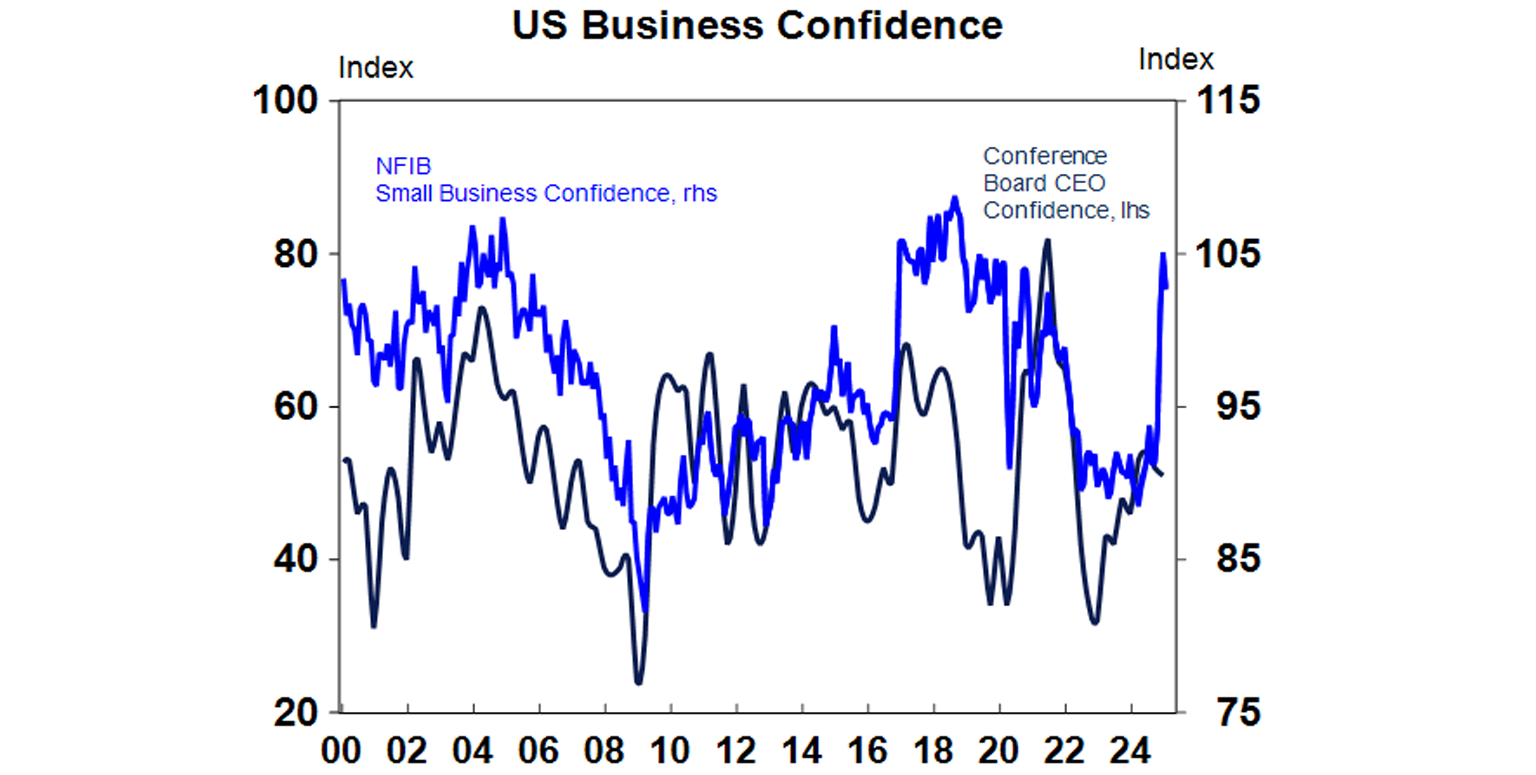

US economic data was mixed over the last week. Retail sales fell and was much weaker than expected possibly reflecting cold weather, LA fires and payback after strong holiday spending. But industrial production rose more than expected, although this was due to utilities not manufacturing production. Small business optimism fell slightly in January but remains strong. CEO confidence is not so strong reflecting differing opinions of Trump. Initial jobless claims remain low.

Source: Macrobond, AMP

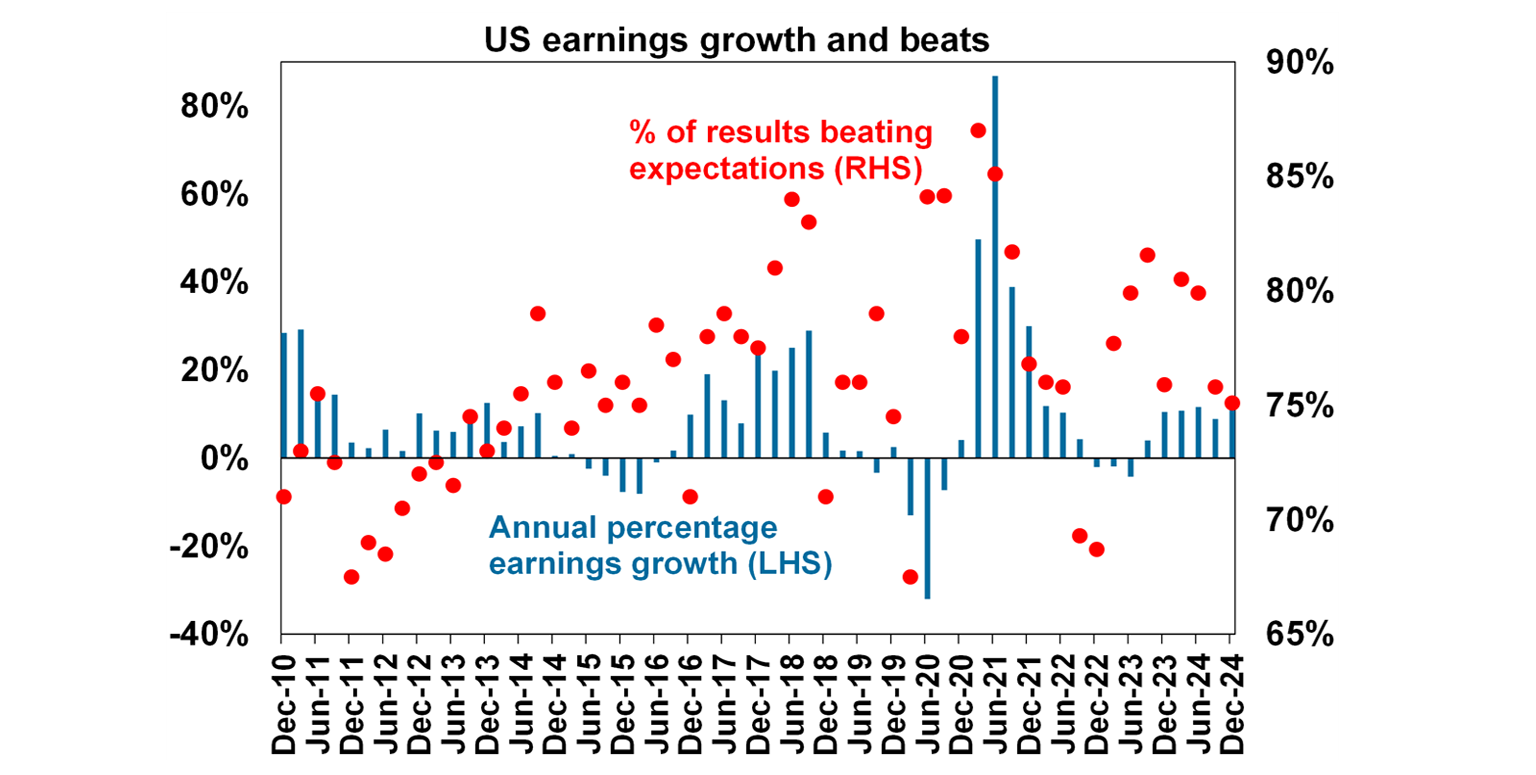

Around 77% of S&P 500 companies have now reported December quarter profit results and the results are solid with 75% beatings earnings expectations on the upside against a norm of 76%. Consensus earnings growth expectations for the quarter have risen to 12.5%yoy, which is up from 8.4%yoy at the start of the reporting season, with tech and financials leading the way.

Source: Bloomberg, AMP

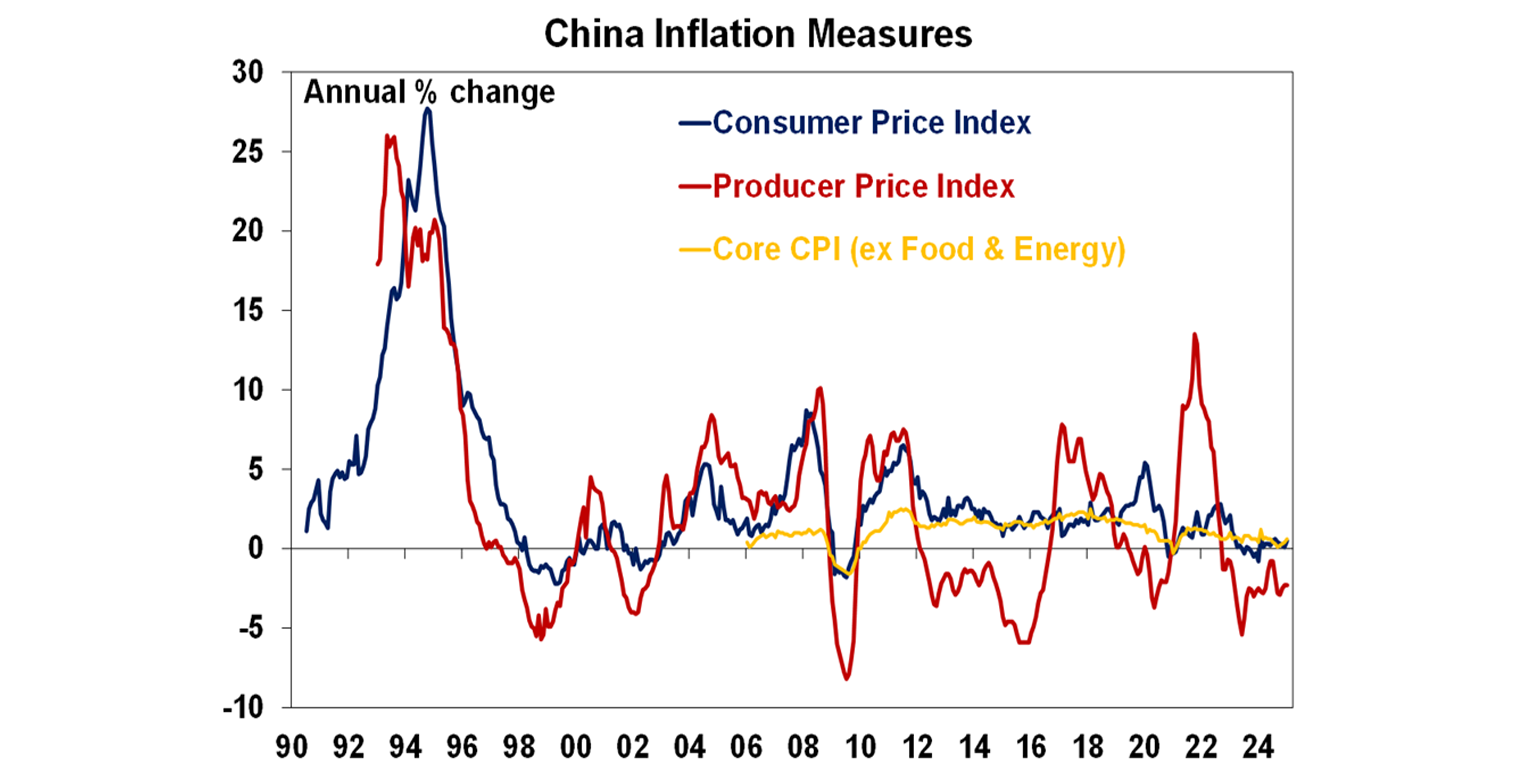

Chinese inflation rose slightly to 0.5%yoy in January, but this looks to be mainly due to higher food and tourism prices impacting annual calculations due to the earlier timing this year of the Lunar New Year holiday. So expect some payback in February. Producer price deflation remained unchanged at -2.3%. Chinese bank lending and credit came in stronger than expected in January possibly also impacted by the earlier Lunar New Year and policy stimulus but annual credit growth was unchanged at 6%yoy.

Source: Macrobond, AMP

Australian economic events and implications

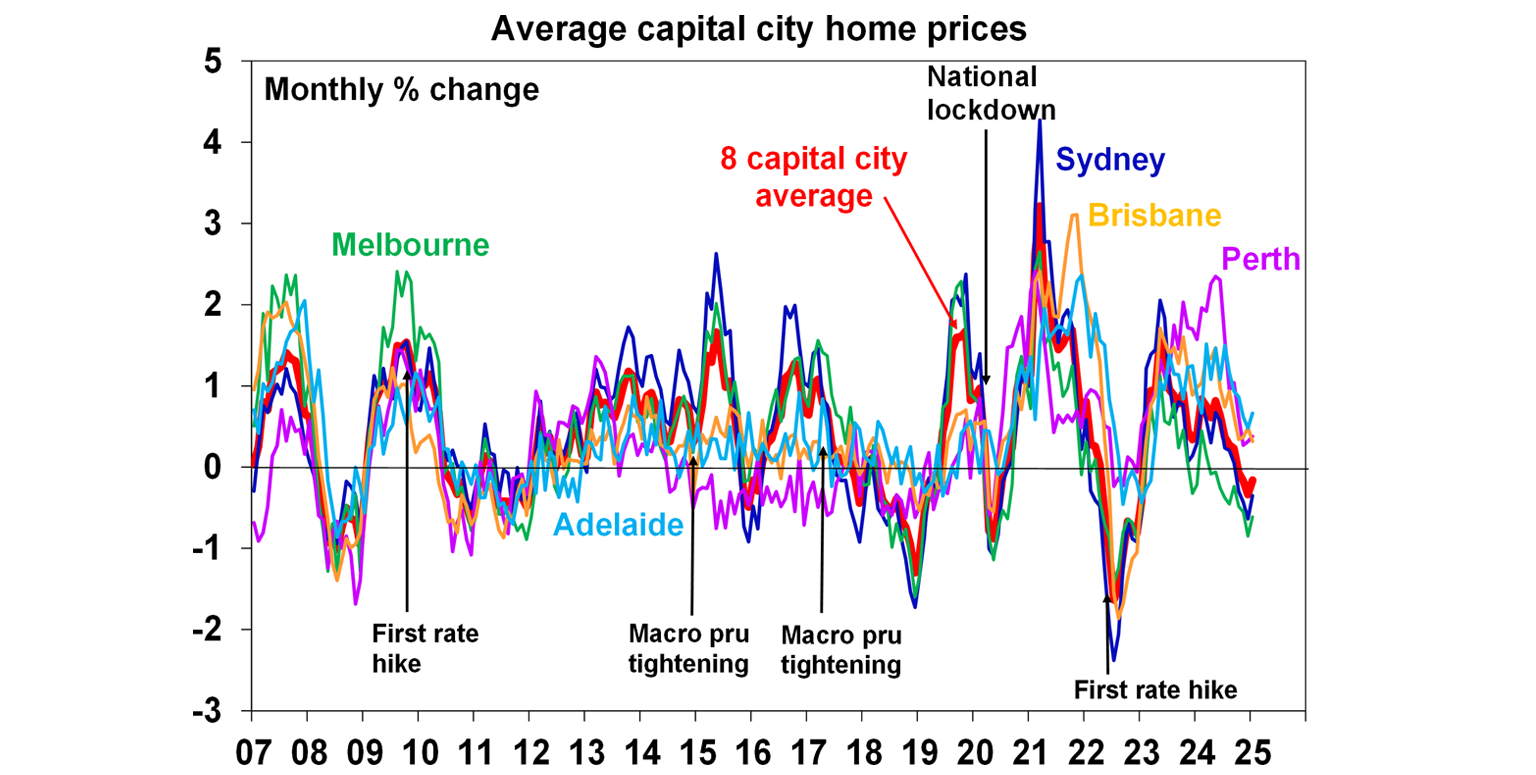

Monthly CoreLogic home price figures showed flat growth in January, with a continued fall in capital city prices but a rise in the regions. Annual growth in prices is up by 4.3%. The property market is very diverse in Australia – Melbourne, Sydney and Canberra are seeing prices fall while hot markets like Brisbane, Adelaide and Perth are still seeing positive but slowing gains. Melbourne prices are down by nearly 7% from their peak and the median dwelling value has fallen to $772,371 with the median dwelling less in Melbourne now cheaper than Brisbane, Adelaide, Perth and Canberra! The downturn in property price momentum reflects poor affordability from high home prices and interest rates as well specific tax changes in Victoria which have hit the market there. We expect average property prices to rise around 3% this year.

Source: CoreLogic, AMP

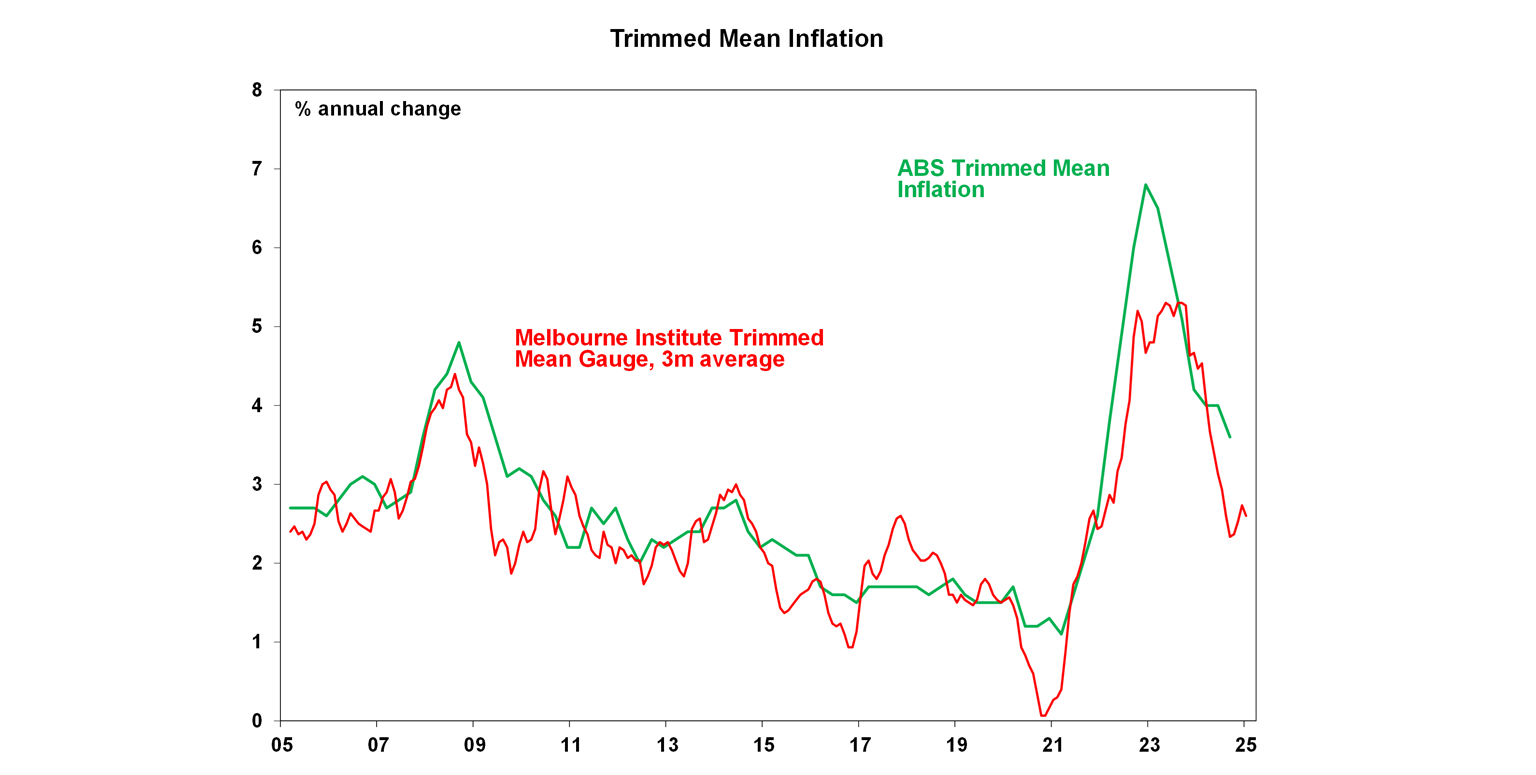

More good news on inflation with the monthly Melbourne Institute inflation gauge up 0.1% in January, or 2.3% over the year with the trimmed mean up by 2.6% (the average over the last 3 months) which suggests more downside to inflation.

Source: Bloomberg, AMP

ANZ job advertisements rose by 0.2% in January and have been trending up in recent months, although are still down by 15.1% compared to a year ago which shows that the labour market has loosened.

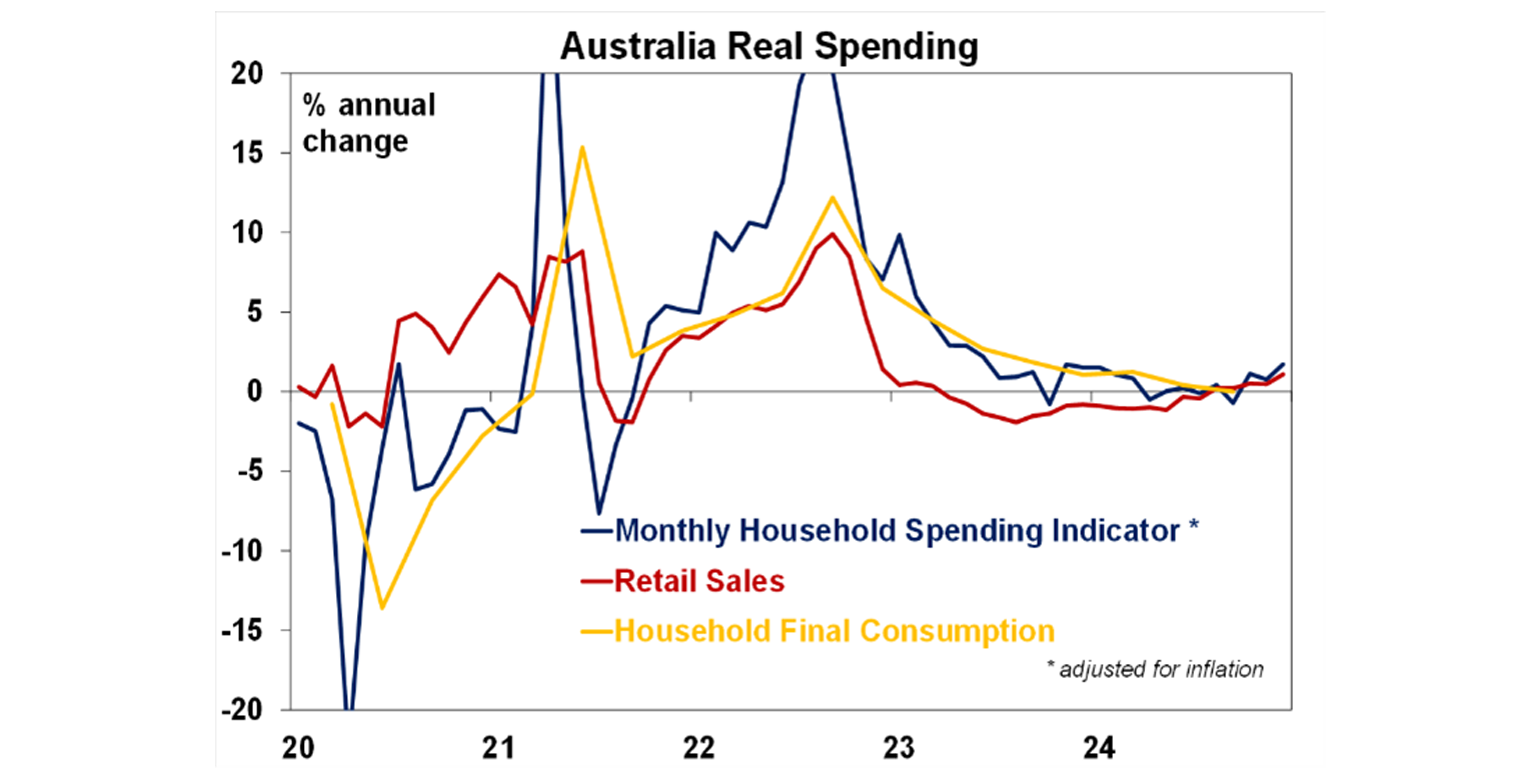

We got two consumer spending updates. Firstly, December retail spending fell by 0.1% in December which was better than expectations of -0.7%. Retail spending has dipped in December in recent years after consumers front-loaded spending in October/November to make use of sales and these changes in spending habits are not yet reflected in the usual seasonal adjustment process. Retail volumes rose by 1% in the December quarter, and will add 0.3 percentage points to December quarter GDP growth. And on a per capita basis, volumes rose by 0.5% for the first time in 2½ years! The other consumer update we got was the monthly household spending data was the monthly household spending data (a more complete picture of consumer spending), which rose by 0.4% in December or 4.3% in December, also showing improving consumer spending.

Source: Bloomberg, AMP

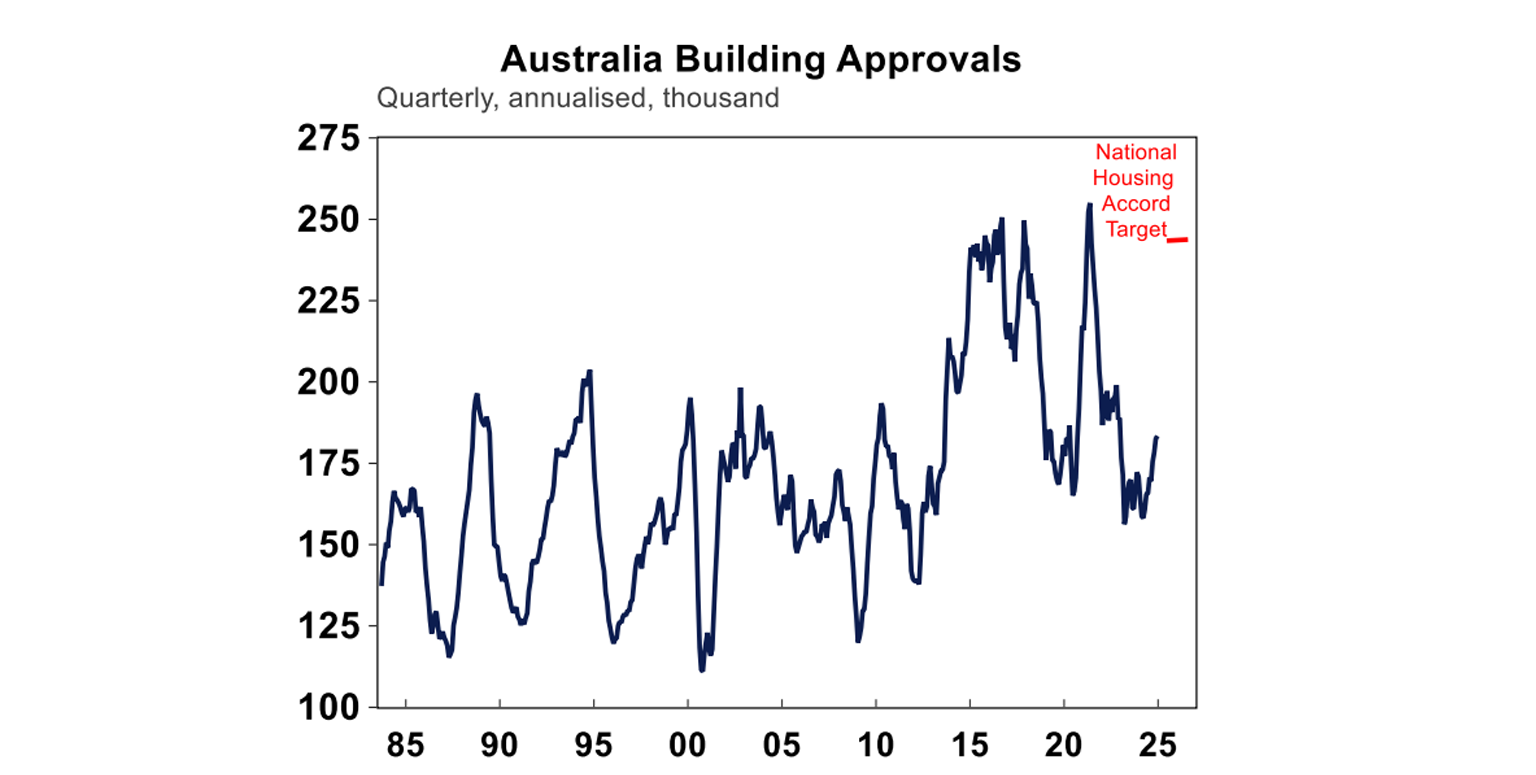

Building approvals were 0.7% higher in December, just missing consensus forecasts of 1%. On a quarterly annualised basis, approvals were running at 183K per annum, up from the lows post-pandemic but still below the 240K target (a soft target set by the government in the National Housing Accord).

Source: Macrobond, AMP

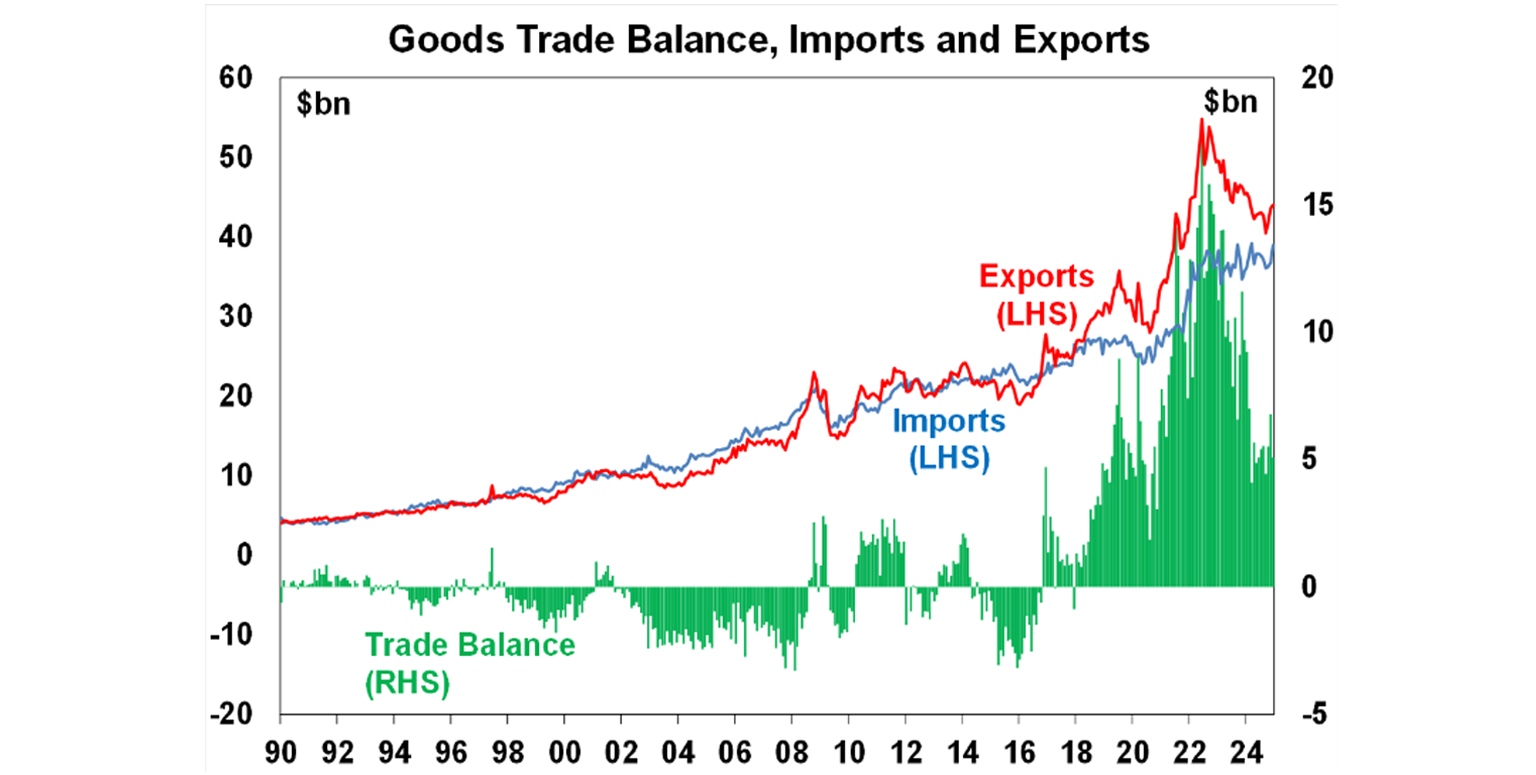

The December trade balance declined to $5.1bn, from $6.8bn last month as strong export growth (+5.9% over the month) outweighed a 1.1% rise in imports. The trade balance remains in surplus and is much stronger compared to pre-pandemic levels (see the chart below), with ongoing high commodity prices in key commodity exports a big factor behind this change.

Source: Bloomberg, AMP

Australia half-year (to February) reporting season has begun with 14% of companies now reported results. Analysts have been downgrading profit expectations in the lead up to reporting season, and expect basically flat profit growth in FY25, with a lot of the downside from the resource sector. But, the outlook statements from companies should show that better conditions are likely as the environment for consumer improves from lower inflation, the 2024 tax cuts and the high probability of near-term rate cuts.

Australian economic events and implications

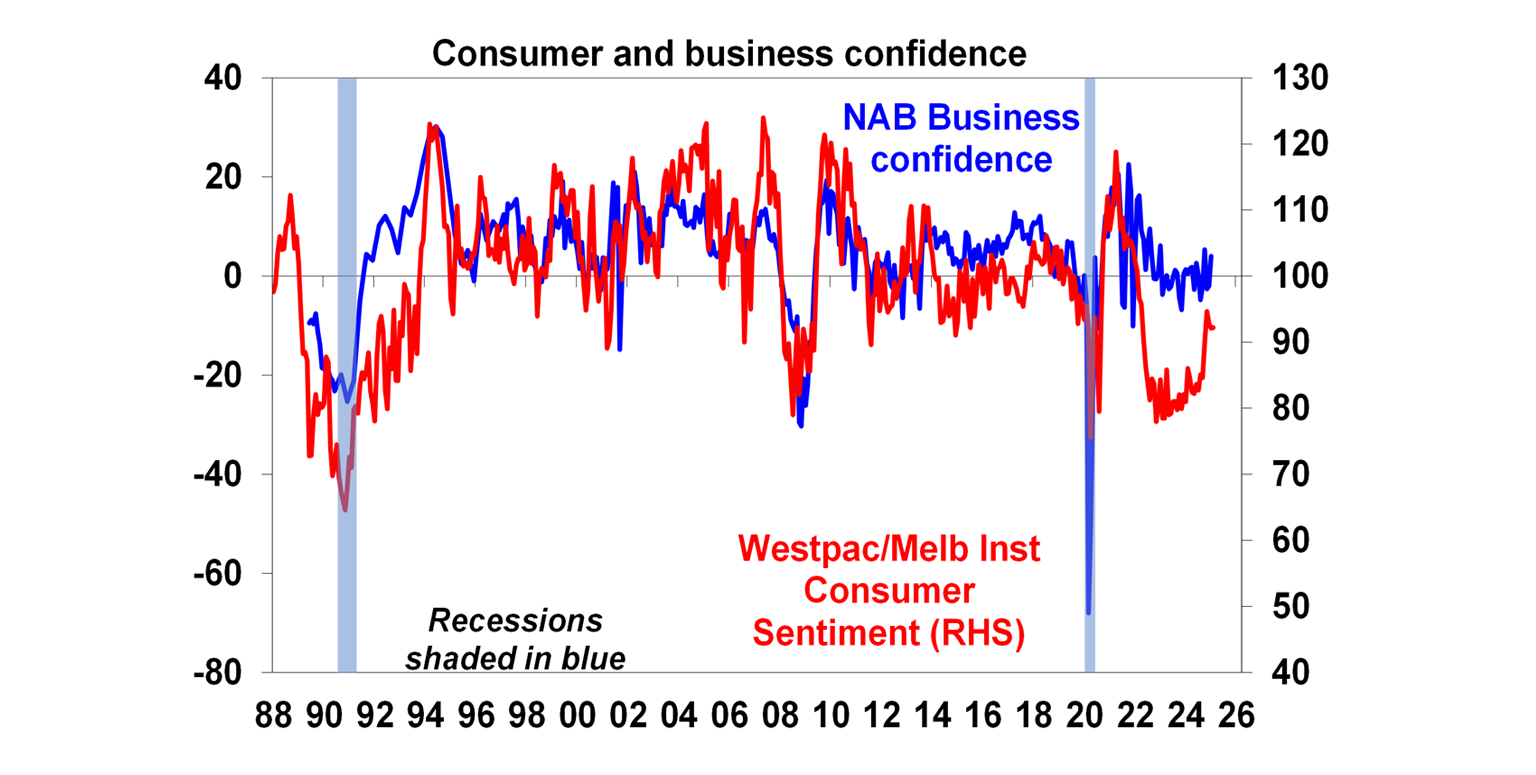

In Australia, consumer confidence was little changed in February suggesting that the bounce in confidence may have stalled at still soft levels. The rise over the last year including in assessments regarding whether now is a good time to buy major household items still points to some spending improvement though.

Source: NAB, AMP

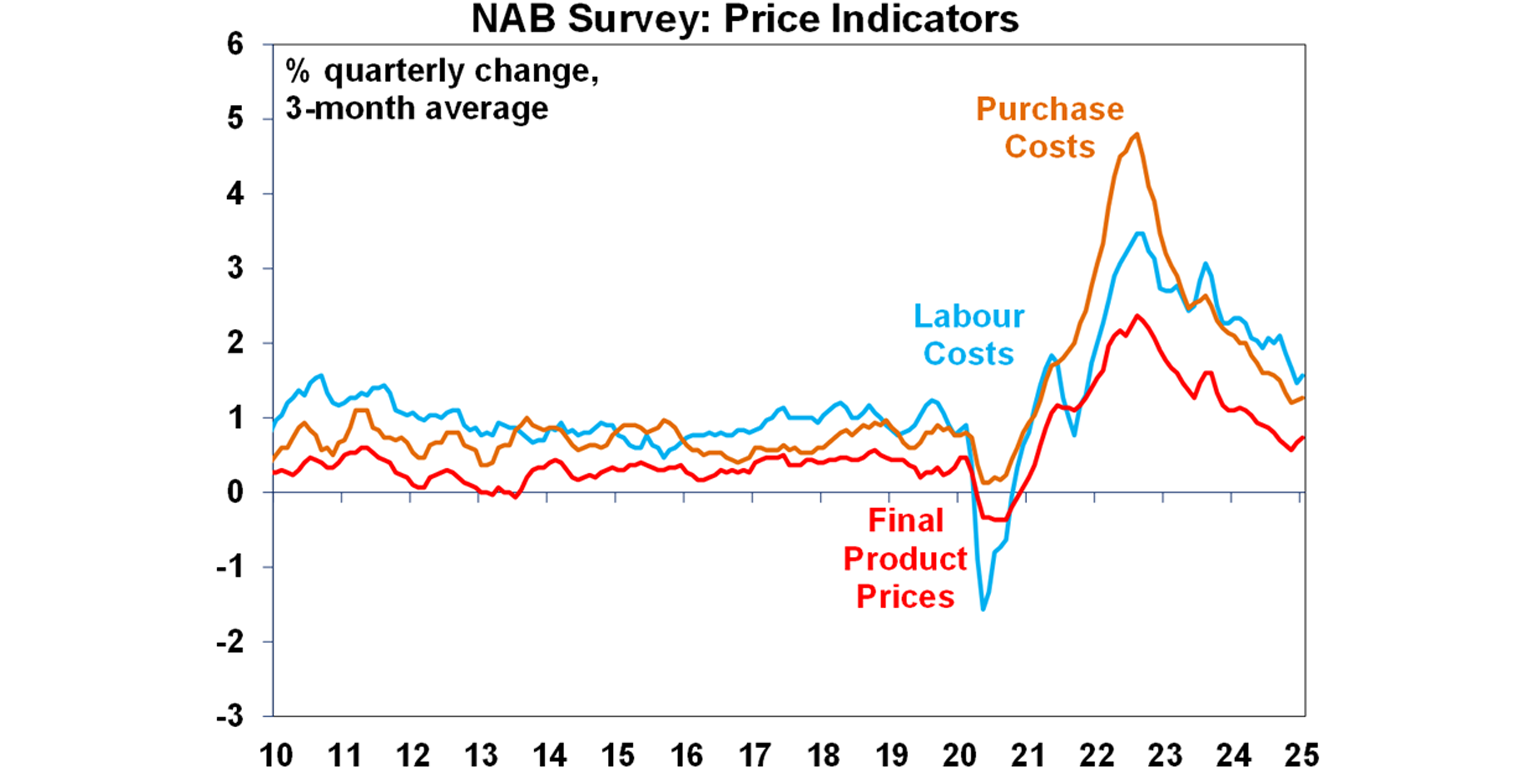

The January NAB business survey showed a rise in confidence, but a fall in conditions which is continuing to trend down. Price and cost measures in the NAB survey were mixed with a labour cost growth up, purchase cost growth down and final product price increases stable. The trend is still down but it’s a reason for the RBA to be gradual in cutting rates.

Source: NAB, AMP

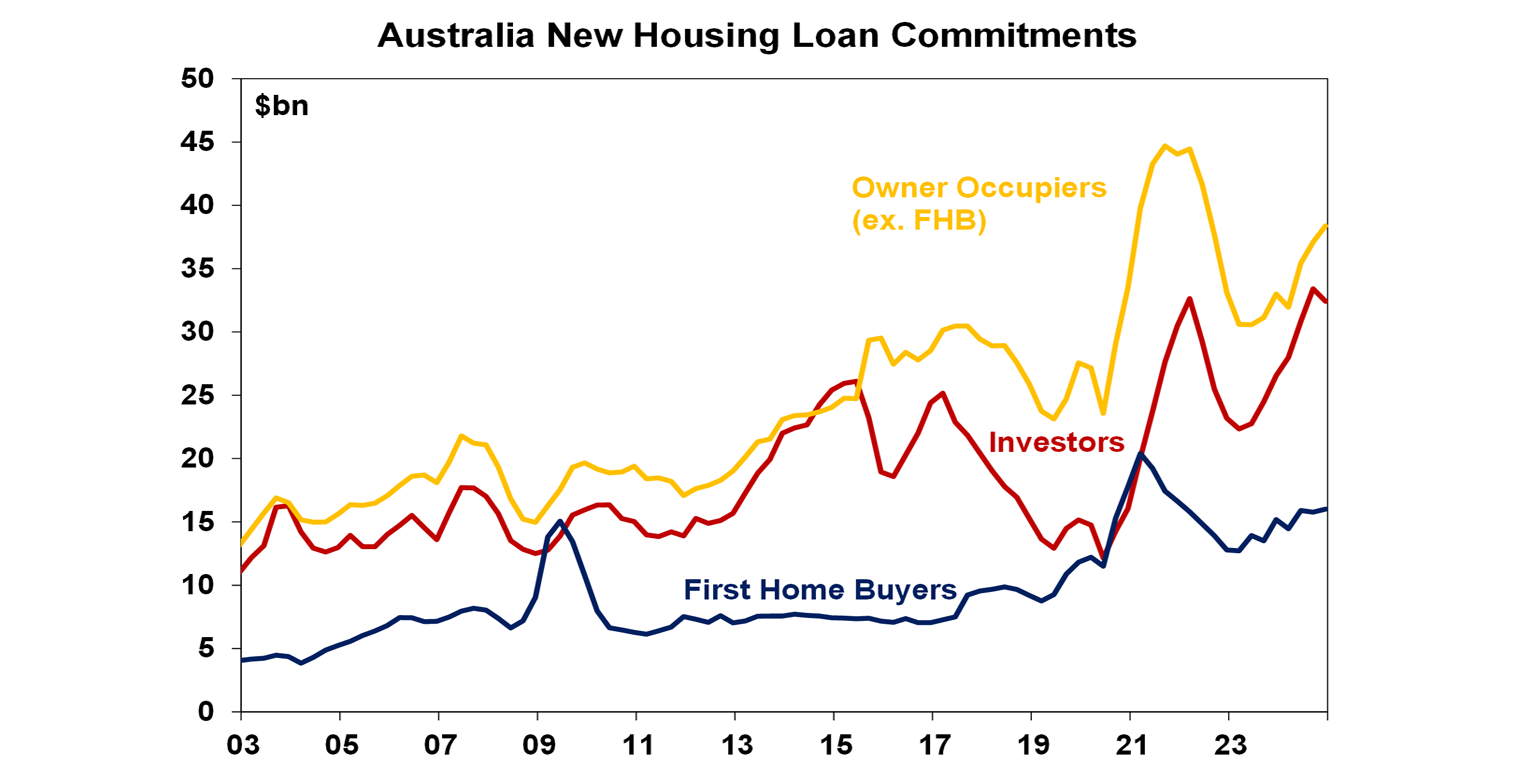

December quarter housing finance commitments rose modestly, with investor finance down but owner occupiers up, but it still remains below the peak reached in 2021-22 consistent with the lower level of sales seen last year.

Source: ABS, AMP

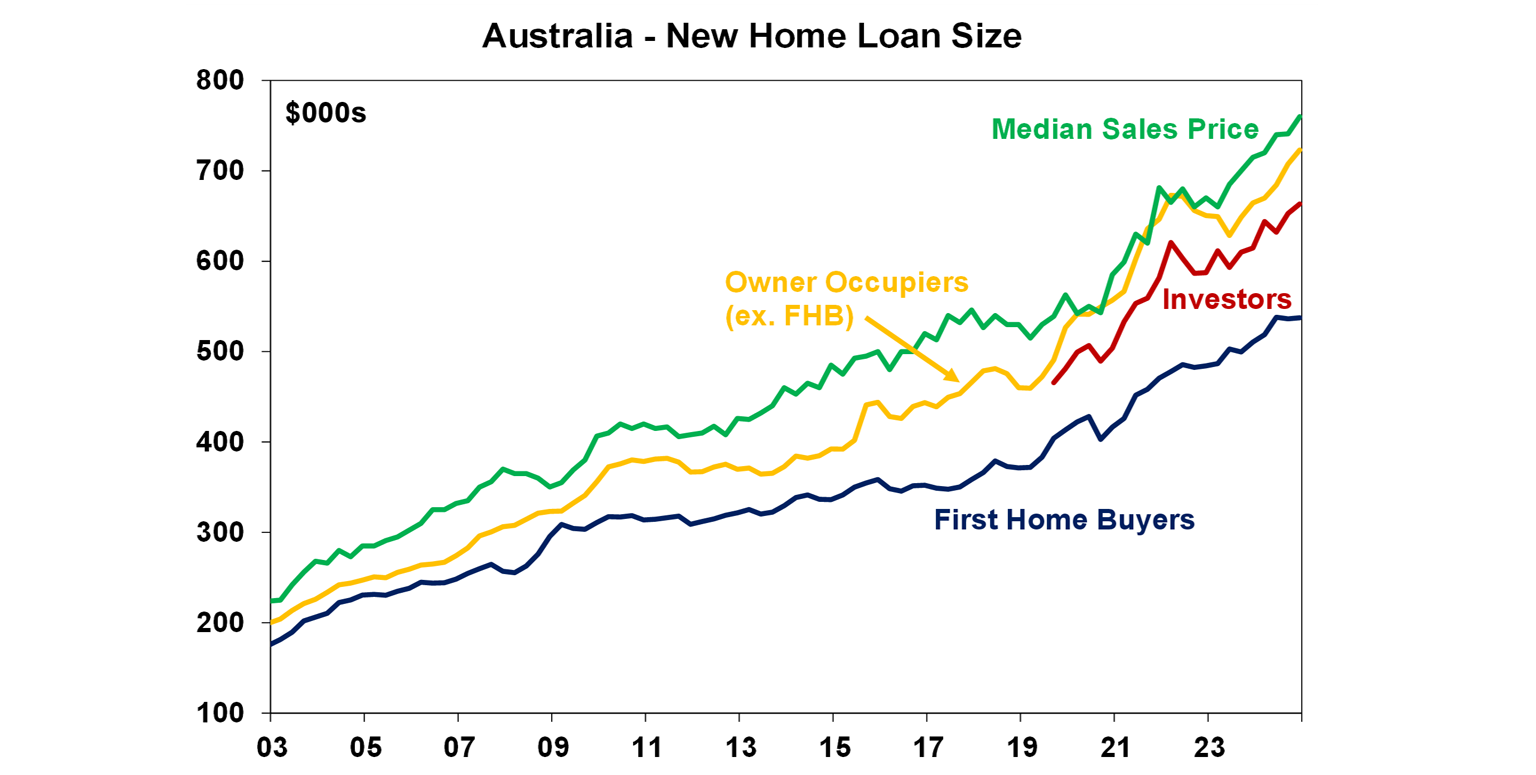

The rise in home prices to record levels last year has been associated with a continuing rise in average new home loan sizes to $723,000 for owner occupiers (ex first home buyers), $663,424 for investors and $537,421 for first home buyers.

Source: ABS, AMP

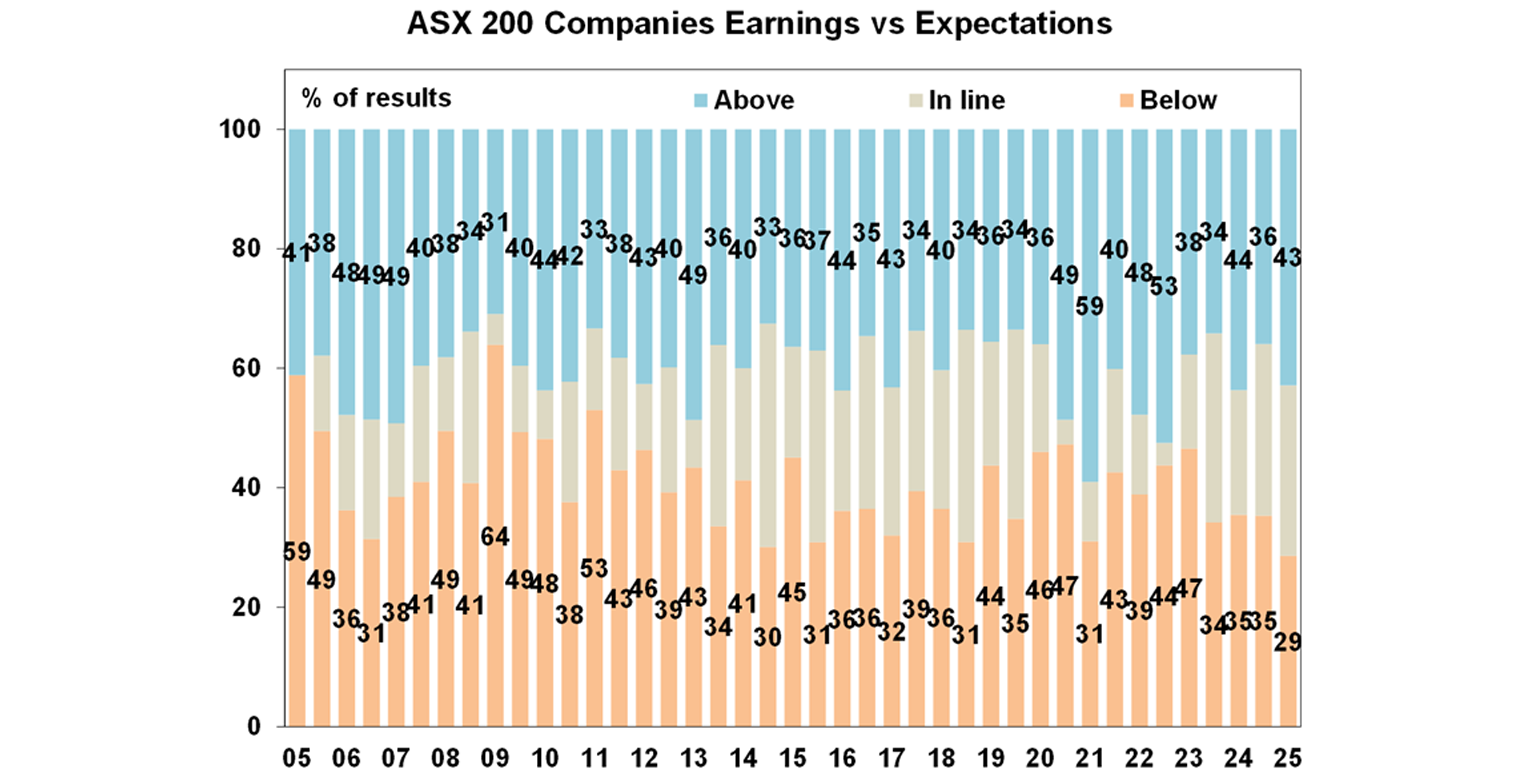

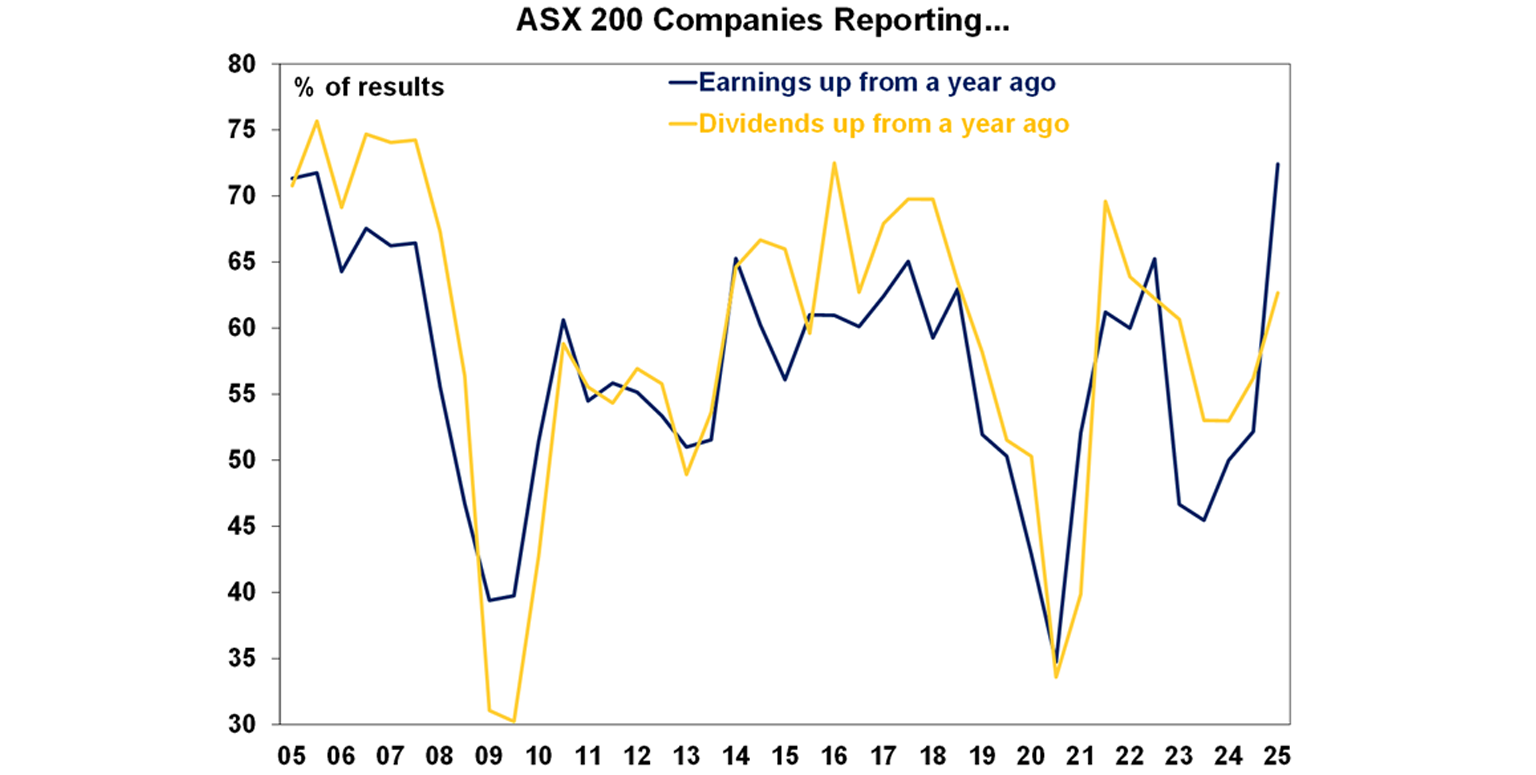

Its early days in the Australian December half earnings reporting season with only about 25% of major companies having reported. Consensus expectations are for flat earnings this financial year after two years of falls, with resources and consumer staples seeing a fall but strong increases in IT, telcos and industrials. Basically, investors are looking for signs that the worst is over for profits and that conditions are starting to improve. So far results have been good with more than normal upside surprises and a big increase in the number of companies reporting profits or dividends up on a year ago compared to the June half reporting season. The signal on consumer spending has been reasonable with solid results from JB HiFi and Nick Scali and REA seeing a stronger property market. Just bear in mind though that there is a tendency for companies with good results to report early so results may soften over the next couple of weeks. This may reflect many of the biggest, and hence more resilient, companies reporting early in the reporting season.

- So far beats are running above misses with 43% of results surprising consensus earnings expectations on the upside, which is more than the norm of 40%, and just 29% have surprised on the downside which is less than the norm of 41%. So pretty good – but its early days.

The horizontal axis data relate to reporting season. Source: Bloomberg, AMP

- 72% of companies have seen earnings rise on a year ago, and this is better than the norm of 57%. But don’t forget that falls in profits in 2024-25 are likely to be concentrated in resources and consumer staples which are yet to really start reporting.

- 63% of companies have increased their dividends on a year ago which is above the norm of 59%.

The horizontal axis data relate to reporting season. Source: Bloomberg, AMP

What to watch over the week ahead?

The week ahead sees the release of business conditions PMIs for February (Friday) which are expected to remain weak in Europe, soft in Japan and Australia and a bit stronger in the US.

In the US, expect a recovery in manufacturing conditions in the New York region (Tuesday) but a fall in Philadelphia (Thursday), another soft reading for home builder conditions (Tuesday), a fall in housing starts (Wednesday) and a fall in existing home sales (Friday).

Canadian and UK inflation for January will be released on Tuesday and Wednesday.

Japanese December quarter GDP (Monday) is expected to show another 0.3%qoq rise with solid business investment and a positive contribution from net exports. January inflation data (Friday) is expected to show a jump but with core inflation falling slightly to 1.5%yoy.

The Reserve Bank of New Zealand (Wednesday) is expected to cut rates again by another 0.5% to 3.75% reflecting the fall in inflation and poor growth.

In Australia, we expect the RBA (Tuesday) to finally begin cutting interest rates after the 13 hikes starting in May 2022, with a 0.25% cut to 4.1% on the back of a further increase in confidence that inflation is moving sustainably to the 2-3% target range. The RBA forewarned in December that it was gearing up for a rate cut, noting in the minutes to its last Board meeting that “if the future flow of data continued to evolve in line with or weaker than [RBA] expectations…it would in due course be appropriate to begin relaxing the degree of monetary policy tightness”. Since that meeting the conditions have been met for an easing in rates: trimmed mean inflation, which is the RBA’s key focus, slowed meaningfully more than it expected to 0.5%qoq or 3.2%yoy in the December quarter; this implies an annualised pace of 2% over the quarter and 2.7% over the last six months which is in the target range; and consumer spending has shown signs of picking up but the overall level of economic activity appears to be running a bit below RBA expectations. Consistent with this we expect the RBA to revise down slightly its forecasts for inflation, wages growth and GDP. Low unemployment and the improvement seen recently in consumer spending suggest no urgency to cut and this combined with the weak $A, uncertainty around the impact of Trump’s tariffs and possible concern that the latest bout of sticky US inflation may translate here do risk delaying a cut but in our view are not strong enough to stop a cut in the week ahead in the face of the better inflation news which the RBA has been telling us is key. Sure unemployment is historically low at 4% but there is no sign of a wages breakout with wages growth actually slowing, the $A has fallen but the trade weighted index is in the same range it’s been in for four years and yes, Trump’s latest trade war adds to uncertainty but absent any retaliatory tariffs by Australia which is unlikely or a plunge in the $A it poses more of a downside threat to growth than an upside threat to inflation and so adds to the case for cutting rates. Rather we see these considerations resulting in a slow easing cycle rather than stopping the first easing move.

So, while its not a certainty on balance we see the RBA cutting rates on Tuesday by 0.25%. But its guidance is likely to be cautious and non-committal indicating that future moves will be dependent on the economic data and its assessment of risks. The low unemployment rate means that the RBA can be gradual in easing and so after the initial cut in the week ahead we expect a pause in April and then another cut in May with the cash rate hitting 3.6% in the second half. The money market is pricing an 90% chance of a cut in February, which seems too high – 75% is more realistic. Interestingly, this is the first time the money market and economists have been expecting a cut at an upcoming meeting since the tightening cycle began.

On the data front in Australia expect wages growth (Wednesday) for the December quarter to come in at 0.8%qoq resulting in a further fall in annual growth to 3.2%yoy and January jobs data to show a 10,000 gain in employment resulting in unemployment rising to 4.1%. The Australian December half profit reporting season will start to ramp up with 75 major companies reporting including Bendigo Bank and Westpac (Monday), BHP and Seek (Tuesday), NAB and Rio (Wednesday), Telstra and Wesfarmers (Thursday) and QBE (Friday). And RBA Governor Bullock will likely repeat the RBA’s cautious easing message in parliamentary testimony on Friday.

Outlook for investment markets in 2025

After the double digit returns of 2023 and 2024, global and Australian shares are expected to return a far more constrained 7% in the year ahead. Stretched valuations, the ongoing risk of recession, the risk of a global trade war and ongoing geopolitical issues will likely make for a volatile ride with a 15% plus correction somewhere along the way highly likely. But central banks still cutting rates with the RBA joining in, prospects for stronger growth later in the year supporting profits, and Trump’s policies ultimately supporting US shares, should still mean okay investment returns.

Bonds are likely to provide returns around running yield or a bit more, as inflation slows to target, and central banks cut rates.

Unlisted commercial property returns are likely to start to improve in 2025 as office prices have already had sharp falls in response to the lagged impact of high bond yields and working from home.

Australian home prices may still see a bit more softness in the very short term but are then likely to start to see a boost from lower interest rates. We see home prices rising around 3% in 2025.

Cash and bank deposits are expected to provide returns of around 4%, but they are likely to slow as the cash rate falls.

The $A is likely to be buffeted between changing perceptions as to how much the Fed will cut relative to the RBA, the negative impact of US tariffs and a potential global trade war and the potential positive of more decisive stimulus in China. This could leave it stuck between $US0.60 and $US0.70, but with the risk skewed to the downside if Trump ramps up tariffs more than expected.

Source: AMP ‘Weekly Market Update’