- Lots of reason for optimism. New global coronavirus cases are continuing to fall with most regions remaining in a downtrend, except Europe which is mainly due to the UK.

Source: ourworldindata.org, AMP Capital

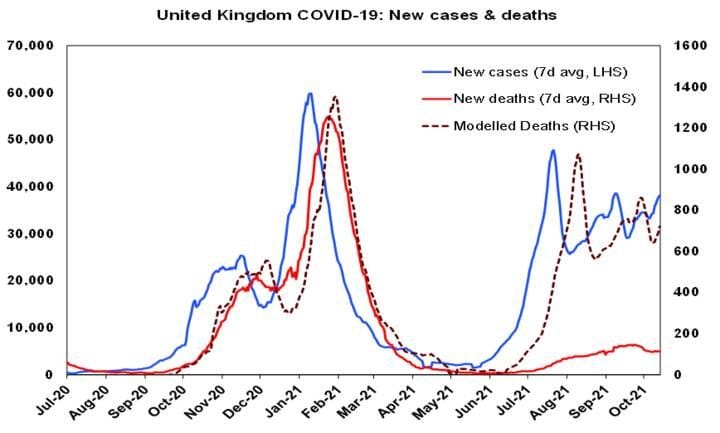

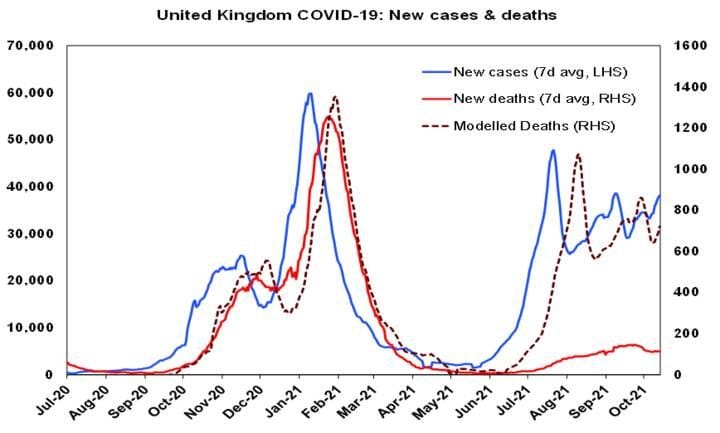

- More importantly, new deaths remain subdued relative to past waves. This is particularly evident in developed countries as vaccines have helped prevent serious illness. Deaths in the UK (the red line in the next chart) are running less than 20% below the level suggested by the December/January wave (the dashed line). While Israel saw a Delta spike in new cases in August and September – likely reflecting waning efficacy for Pfizer vaccinations from earlier this year the level of hospitalisations and deaths remained subdued compared to the previous wave and all are trending down again helped by the administration of booster shots to 42% of the population.

Source: ourworldindata.org, AMP Capital

- Another coronavirus treatment. Hot on the heals from favourable results Merck’s covid treatment pill, results from trials of AstraZeneca’s antibody cocktail show a similar halving in the risk of severe illness or death. So there’s now more ways to treat patients. These are very useful for high-risk groups for whom vaccines are less effective and the unvaccinated.

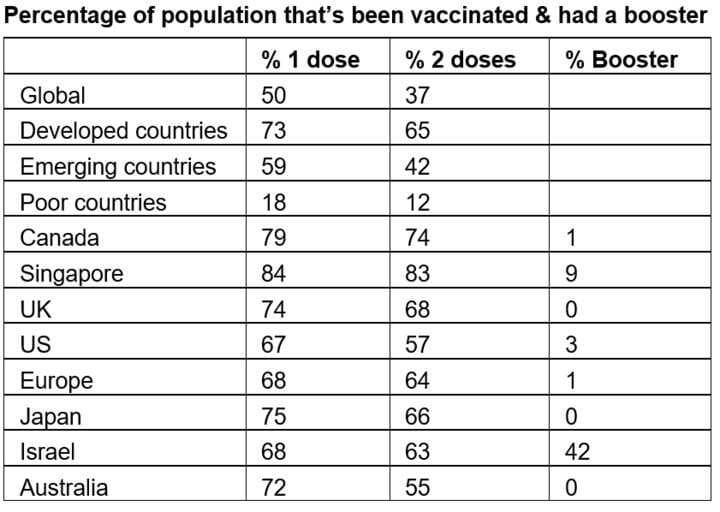

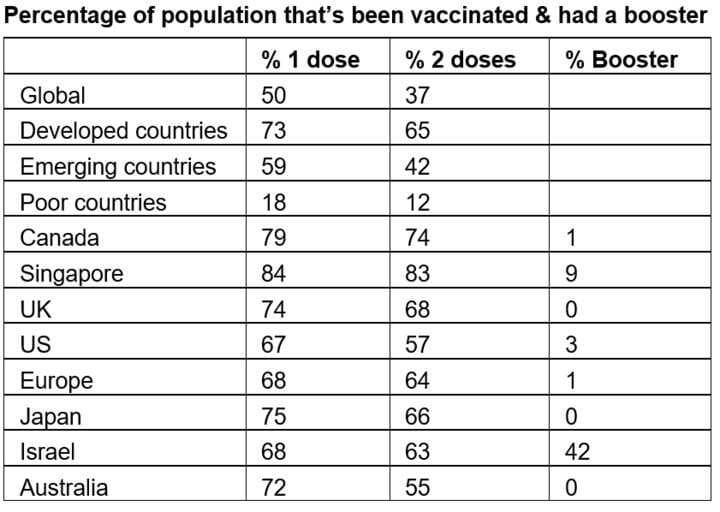

- Vaccination rates are continuing to rise, albeit slowly. 50% of people globally and 73% in developed countries have now had at least one dose of vaccine.

Source: ourworldindata.org, AMP Capital

- Key risks to watch include: a possible resurgence in cases in the northern winter particularly as vaccine efficacy starts to wear off in some countries in the absence of rapid booster programs; the low level of vaccination in poor countries; and the possibility of more transmissible/more deadly mutations. But so far good.

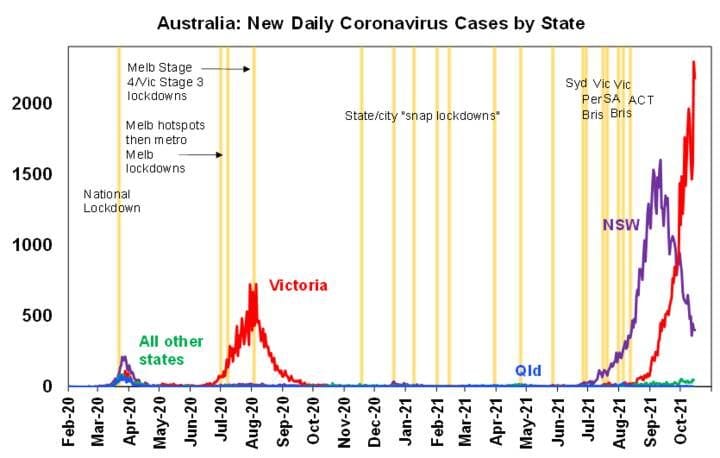

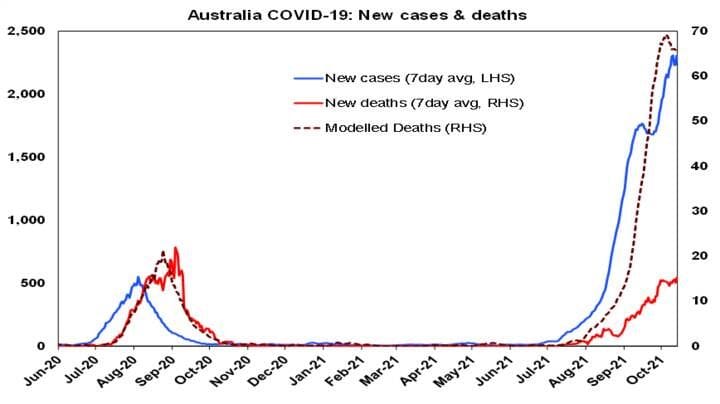

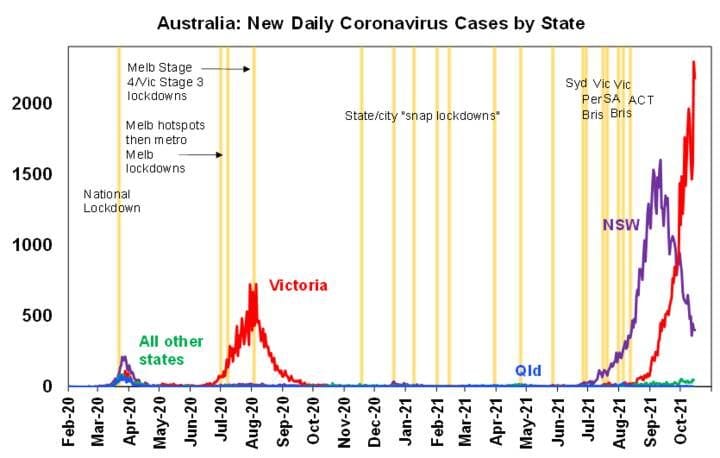

- In Australia, new cases spiked have a new high in Victoria, but if NSW, which led by a month and is continuing to see falling cases, is any guide, Victoria should peak soon.

Source: covid19data.com.au, AMP Capital

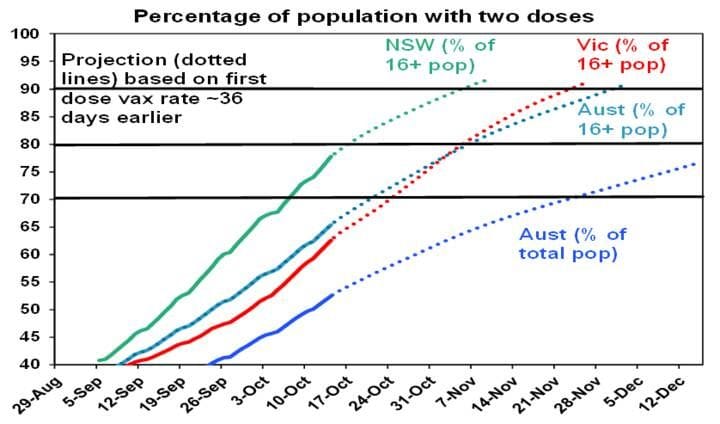

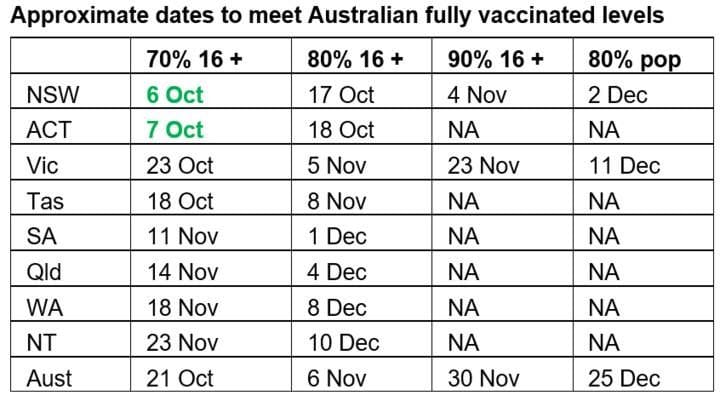

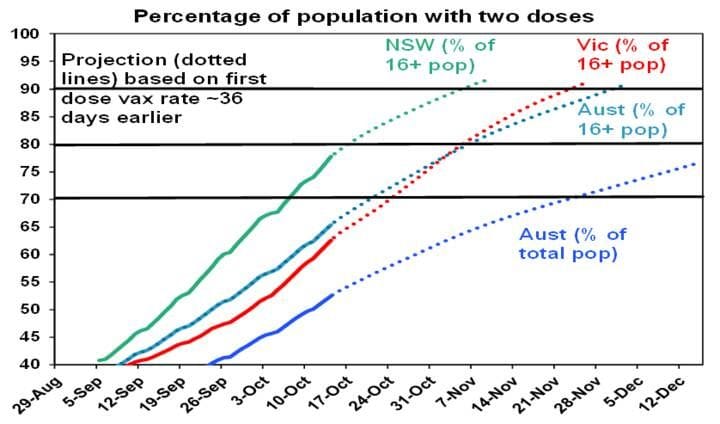

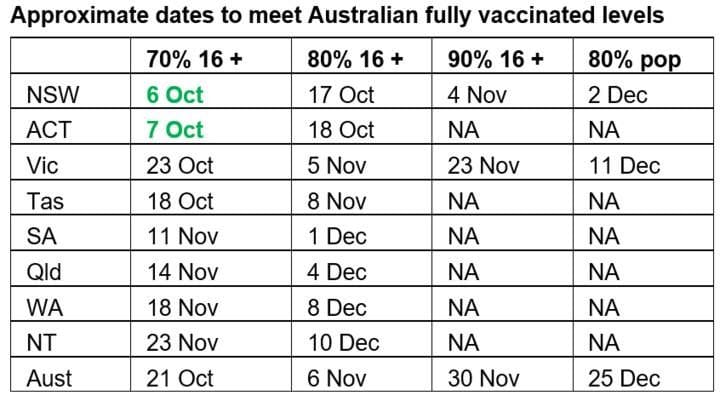

- Australia is continuing to vaccinate around 1% or more of the population a day with 72% of Australia’s whole population now having had at least one dose, which is well above the US. For first doses for adults, the ACT is now at 98%, NSW is at 91%, Victoria will reach 90% in less than a week and Australia will reach 90% in about two weeks. Making vaccination a condition of participating in the reopening from locked down states has put a rocket under vax rates. Allowing for current trends and the average gap between 1st and 2nd doses the following chart and table shows approximately when key vaccine targets will be met.

Source: covid19data.com.au, AMP Capital

- NSW and the ACT will likely hit the 80% of adults double vax target in the next few days, Victoria and Australia (on average) on average will reach 70% of adults in a week or so.

Source: covid19data.com.au, AMP Capital

- So based on reaching vaccination targets, the ACT’s lockdown has now ended and NSW will move to the second stage of reopening on Monday. NSW has also announced the removal of quarantine requirements for overseas arrivals who are vaccinated and have a negative covid test. Victoria will start reopening in about a week (cases permitting). Other states and territories will hit the 70% target in mid-November.

- The main risk in Australia is that too rapid a reopening in NSW and/or Victoria leads to a resurgence in cases – like Singapore has seen with new cases running around 3000 new cases a day – which overwhelms the hospital system necessitating some reversal in reopening to slow new cases down as seen in Singapore. Note that NSW is still only at 64% of the whole population fully vaccinated compared to 82% in Singapore. A reversal in reopening would set back the economic recovery again. This could particularly be a risk in the months ahead if vaccine efficacy for those vaccinated earlier this year starts to wear off. A big decline in the lag between vaccine doses in Australia also runs the risk of them being less effective. A less risky approach than just tying reopening steps to vaccine levels may be to allow three weeks or so between each reopening stage in order to ensure that new cases and most importantly hospitalisations are not surging and overwhelming the hospital system.

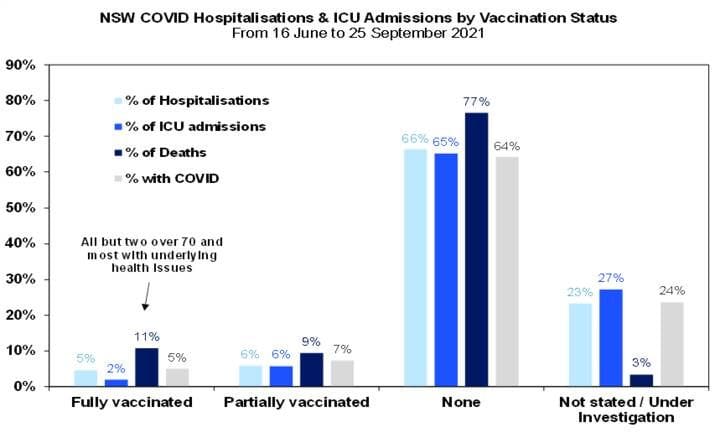

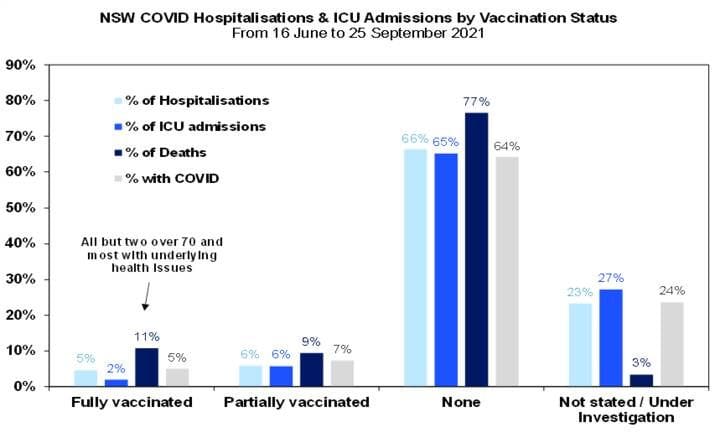

- Meanwhile, vaccination is continuing to help keep serious illness down. Coronavirus case data for NSW shows that the fully vaccinated continue to make up a low proportion of cases, hospitalisations and deaths.

Source: NSW Health, AMP Capital

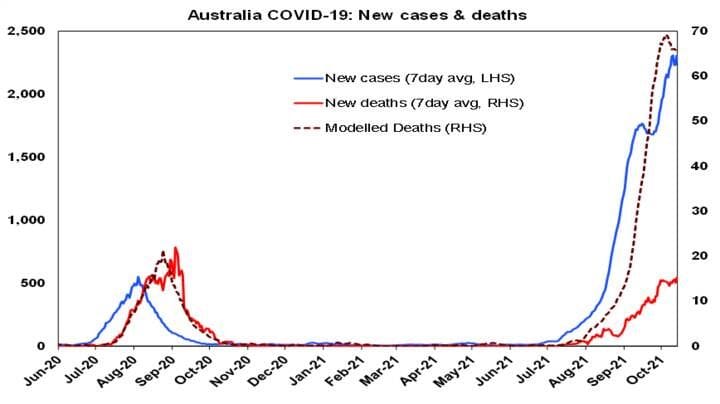

- The level of deaths (the red line in the next chart) is running at around 20% of the level predicted on the basis of the previous wave (dashed line). On this basis the vaccines are helping save roughly 52 lives a day at present.

Source: ourworldindata.org, covid19data.com.au, AMP Capital

|