Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

Weekly Market Update – 15th January 2016

Investment markets and key developments over the past week

- It’s been more of the same over the last week with worries about China, global growth and falling commodity prices led by oil continuing to rattle investors. So share markets have remained under pressure, commodity prices have continued to slump with oil falling to $US29.6/barrel for the first time since 2003 and bond yields falling further helped by safe haven buying and falling inflation expectations. While there were a few up days US shares lost 2.2%, Eurozone shares fell 2.9%, Japanese shares fell 3.5%, Chinese shares lost 9% and Australian shares fell 2%. Having broken below last year’s lows the Australian dollar looks like it is heading much lower, $US0.60 by year end.

- With worries about global growth likely to linger we could still see more downside in share markets in the short term that could see developed markets including Australian shares follow emerging markets into a bear market (defined as a 20% decline as measured against last year’s highs). Eurozone shares have already slipped into bear market territory with a decline of 20.4% from last year’s high, whereas Australian shares and Japanese shares are down 18% and US shares down 12% compared to their 2015 highs.

- However, there are some positive signs:

- First, economic data over the last week has been mostly okay, although the softness in US December retail sales is a concern.

- Second, the Chinese Renminbi appears to have stabilised for now albeit helped by jawboning by Chinese officials and People’s Bank of China intervention.

- Third, sentiment is starting to get very negative as highlighted by all the coverage given to the “RBS tells investors to sell everything” story. This is a sign we may be getting closer to the capitulation that usually presages market bottoms.

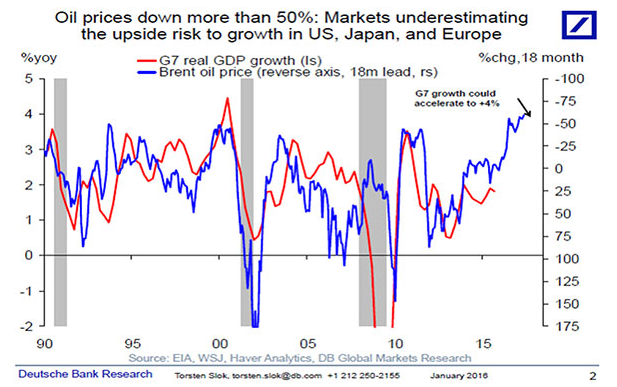

- Fourth, while the ongoing plunge in commodity prices, and particularly oil prices, is bad news for producers its great news for consumers. The chart below from Deutsche Bank – highlights that normal lags suggest that the bulk of the boost to G7 GDP growth from lower oil prices is ahead of. A 4% growth for the G7 is a significant growth boost operating in the other direction to all the gloom and doom now building up.

- Finally, it’s getting close to the point where developed central banks start to act, not necessarily by easing but by sounding more dovish. This may already be starting at the US Federal Reserve (the Fed) with St Louis Fed President Bullard expressing concern that the latest fall in oil prices will delay a return in inflation to target at a time when inflation expectations are falling. Bullard is often seen as a bellwether at the Fed so his new found dovishness may soon show up in similar views from other Fed officials. A March Fed rate hike is looking unlikely and views remain that the Fed will struggle to put through the four rate hikes for this year shown in its “dot plot”. Two at best but the risk is one or none – a bit like last year.

- The Bank of Japan is also likely to be under renewed pressure to step up its easing as the rising Yen and plunging oil will make it even harder to head towards its inflation target. Watch the ECB for its thoughts in the week ahead.

- For those worried that the fall in China’s foreign exchange reserves will push up US bond yields don’t. At least not now anyway. Despite a $US500bn fall in China’s foreign exchange reserves last year, US bond yields were little change and so far this year they are falling. Clearly other investors are filling any gap. The time to worry would be when global investors are confident (so not buying bonds) and China is still selling FX reserves.

Major global economic events and implications

- US economic data was mixed with a slight rise in small business optimism and consumer confidence, solid readings for job openings and hiring and the Fed’s Beige Book of anecdotal evidence pointing to “modest” to “moderate” growth but disappointing retail sales and industrial production data.

- Japanese data was mixed with stronger economic confidence but weaker machinery orders.

- Chinese data for exports and imports surprised on the upside in December, vehicle sales continued to surge helped by tax incentives and credit growth accelerated suggesting stimulus measures are helping. While strong trade with Hong Kong may warn of over invoicing and disguised capital outflows the overall picture is consistent with Chinese growth stabilising as opposed to collapsing.

Australian economic events and implications

- Australian jobs data yet again surprised on the upside with employment falling just fractionally after two exceptionally strong months of jobs growth and unemployment remained down at 5.8%. It’s hard to believe that jobs growth is really running at 2.6% year-on-year or a whopping 4.6% year-on-year in NSW at a time when economic growth is just 2.5%. Statistical distortions appear to be at work here rather than an economic boom. By the same token underlying jobs growth is still likely to be solid as low wages growth and growth in low wage jobs in industries like retail and construction in NSW and Victoria make up for the slump in mining related jobs in WA. Incidentally, various labour surveys (e.g. ANZ job ads, ABS job vacancies and the NAB business survey employment component) are all at levels consistent with reasonable jobs growth. Maybe not just as strong as the official figures show. While it is expected to see more Reserve Bank of Australia rate cuts and a lower Australian dollar, the bottom line though is that the economy is a long way from the collapse many fear.

- Housing finance rose more than expected in November, but mainly due to owner occupiers. Finance to property investors rose slightly but this followed sharp falls in previous months indicating that APRA’s measures designed to cool lending to property investors are still working.

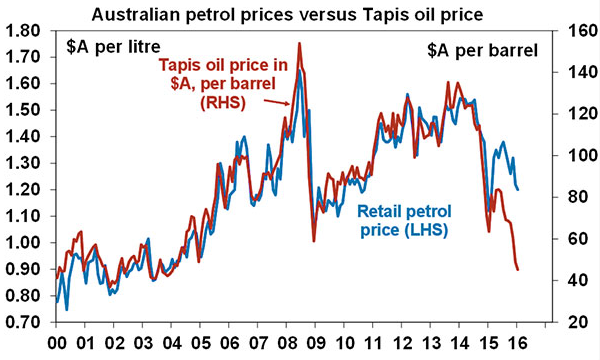

- Meanwhile back to petrol prices. Given the crash in oil prices including Asian Tapis grade oil in Australian dollars, petrol prices in Australian cities should be pushing down to 90 cents a litre. High refinery margins based on Singapore refined petrol prices seem to be the main issue here.

Source: Bloomberg, AMP Capital

What to watch over the next week?

- Perhaps the main focus in the week ahead will be on Chinese economic activity data and GDP for December which will be released Tuesday. Expect December quarter growth to come in around 6.9% year-on-year and 6.9% for 2015 as a whole as strength in consumer spending helps offset slower growth in investment. December data is expected to show a slowdown in industrial production to 6.1% year-on-year (from 6.2%), but unchanged growth in fixed asset investment and a slight acceleration in retail sales to 11.3% year-on-year from 11.2%. The overall impression is expected to be one of stable as opposed to collapsing growth.

- In the US, expect the home builders’ conditions index (Tuesday) to remain solid, December housing starts (Wednesday) to show further strength, a rebound in existing home sales after a regulatory distortion in November and a slight gain in the US Markit manufacturing conditions PMI to 51.8 from 51.2 (all Friday). Headline CPI inflation (Wednesday) is expected to remain close to zero, with core inflation running around 2%. The December quarter profit reporting season will also start to ramp up. With analysts expecting a 6.7% decline in profits and downgrades to upgrades running at high levels there is scope for upside surprise.

- The European Central Bank (Thursday) is not expected to make any changes to monetary policy, but President Draghi is likely to sound dovish following the continuing fall in commodity prices. Eurozone business conditions PMIs (Friday) are expected to have remained solid, although recently renewed global growth worries may have impacted. Japan will also release its manufacturing conditions PMI on Friday.

- In Australia, the main focus is likely to be on the Westpac consumer sentiment reading for January (Wednesday) to see whether it has been affected by the latest bout of turmoil in share markets. The TD Securities Inflation Gauge (Monday) is likely to confirm that inflation remains low and the HIA’s New Home sales data (Thursday) will also be released.

Outlook for markets

- Worries about China, the Fed and global growth are likely to drive continued share market weakness and volatility in the short term. More Renminbi stability and a more dovish Fed would certainly help. Beyond the short term shares will begin trending higher again helped by a combination of relatively attractive valuations compared to bonds, continuing easy global monetary conditions and continuing moderate economic growth. But expect volatility to remain high.

- Very low bond yields point to a soft medium term return potential from sovereign bonds, but it’s hard to get too bearish in a world of fragile growth, spare capacity, weak commodity prices and low inflation.

- Commercial property and infrastructure are likely to continue benefitting from the ongoing search by investors for yield.

- National capital city residential property price gains are expected to slow to around 3% this year, as the heat comes out of the Sydney and Melbourne markets. Prices are likely to continue to fall in Perth and Darwin, but growth is likely to pick up in Brisbane.

- Cash and bank deposits are likely to continue to provide poor returns, with term deposit rates running around 2.5% and the Reserve Bank of Australia expected to cut the cash rate to 1.75%.

- The downtrend in the Australian dollar is likely to continue as the interest rate differential in favour of Australia narrows, commodity prices remain weak and the Australian dollar undertakes its usual undershoot of fair value. Expect a fall to around $US0.60 by year end.

Source: AMP CAPITAL ‘Weekly Market Update’

AMP Capital Investors Limited and AMP Capital Funds Management Limited Disclaimer