Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

Weekly Market Update – 14th August 2015

Investment markets and key developments over the past week

- The past week was volatile as investment markets reacted to China’s move to devalue the renminbi and make its determination more market oriented. The associated uncertainty saw shares, commodities, emerging market currencies and the $A fall. It was a bit like investors thinking “we don’t know what’s happening so we better sell”. Once the dust settled and investors came to the view that a large decline in the renminbi was unlikely, there was a bounce back or at least a bit of stabilisation. This left Eurozone shares down 3.4%, Japanese shares down 1% and Australian shares down 2.2% with local profit results not helping, but US shares rose 0.7% and Chinese shares gained 5.9% as they would be beneficiaries of the lower renminbi. Bond yields rose marginally. Commodity prices were mixed with oil falling to a new low for the year on ongoing oversupply concerns. China related uncertainty also weighed on the $A a bit.

- After years of the renminbi being tightly managed its 3% decline and move to greater market determination came as a bit of shock with global markets reacting to uncertainty about what it tells us about Chinese growth, how far the renminbi will fall, the implied disinflationary impact of cheaper Chinese goods and the risk of an intensified global currency war. It’s tempting to go into hyperbole about all this, but since everyone else has we’ll avoid the temptation. But several things are worth noting.

– First, with the real trade weighted value of the renminbi up 30% in the last five years and 80% in the last 10 it’s understandable China wanted it a bit lower.

– Second, further renminbi depreciation is possible. But a big fall seems unlikely as China has a big trade surplus, is growing its share of global exports and the PBOC has indicated it only wanted to see a 3% or so fall and described talk of a 10% fall as “nonsense” and indicated it has the world’s biggest reserves to prevent a free fall. Time will tell.

– At the margin China’s move is disinflationary globally and puts pressure on competing countries to depreciate and on developed countries to maintain or accelerate easy monetary policies and could, at the margin, delay the Fed from tightening. But with a 3% fall so far, this is all marginal.

– For Australia, a lower renminbi should be seen as good news ultimately. Cheaper Chinese exports will boost demand for them which in turn will boost demand for our raw materials. But again this is marginal.

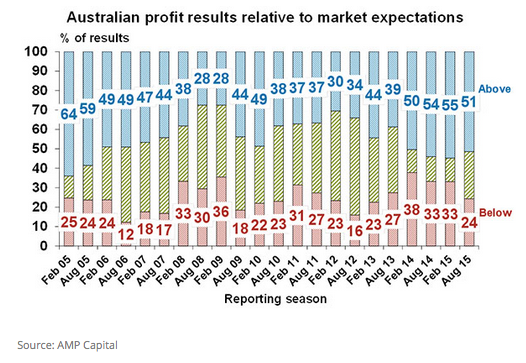

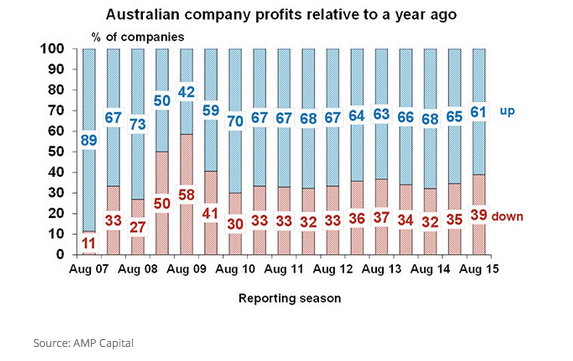

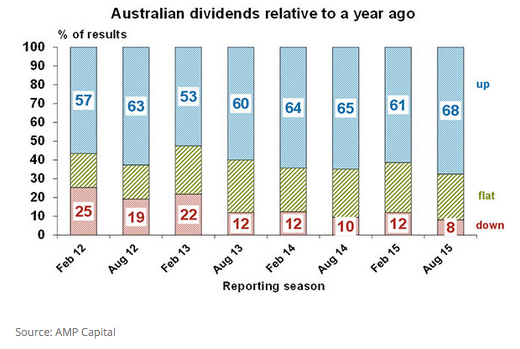

- It’s early days in the Australian June half profit reporting season, but so far the results have been rather mixed. 51% of results have beaten expectations and 61% have seen their profits rise from a year ago which is good, but good results often come out early on and at the same point in the February reporting season these numbers were 60% and 76%. Despite this, dividends are continuing to surge with 68% of companies so far raising their dividends and only 8% cutting them. Other key themes are ongoing weakness amongst resources and mining services companies, slowing profit growth for the banks at the same time they are raising more capital and implementing ongoing cost controls.

Major global economic events and implications

- US economic activity data was a bit stronger with a rise in small business optimism, solid labour market indicators and strong July retail sales and industrial production. So, in terms of the Fed raising rates in September, economic activity data gets a tick. But with falling commodity and import prices and low producer price inflation confidence around inflation is still weak. So a September move is probably still 50/50 and if it does move it might be a “one and done” for a while.

- Eurozone June quarter GDP came in slightly lower than expected at 0.3% qoq, but annual growth of 1.2% yoy is the strongest since 2011. While Germany and France disappointed, Spain is doing very well with GDP up 3.1% yoy and Greece surprisingly returned to growth. While Greek GDP is likely to fall back in the current quarter thanks to the bailout tantrum, Eurozone growth is likely to improve a bit helped by continued monetary easing and improving credit growth.

- Greece has now agreed to a new bailout deal with Europe. Key additional reforms have been passed by the Greek parliament and various Eurozone parliaments need to pass the deal in the week ahead, which seems likely. Greece is still not necessarily out of the headlines though, as it’s looking likely it will see new elections and the IMF is likely to insist its debt burden is reduced before participating in the bailout. Neither of these are likely to be major threats though. First, there is enough broad-based support for the deal in the Greek parliament and Tsipras looks like he will emerge as a more centrist leader. Second, Greece’s debt burden is likely to be relieved by lowering its debt servicing requirement via interest rate grace periods, longer maturities, etc.

- Chinese data was on the soft side with weaker readings for exports, imports, credit, industrial production and retail sales. Growth looks to have slowed again in July and it’s clear that further monetary easing is needed. With non-food inflation of just 1.1% and producer prices down 5.4% year-on-year, interest rates remain too high and a decline in the benchmark lending rate to below 4% is necessary and likely. Further bank reserve ratio cuts and fiscal stimulus are also likely.

- Indian economic data is looking better with industrial production up and inflation continuing to fall, highlighting the malaise affecting many emerging markets is not affecting India.

Australian economic events and implications

- Australian confidence data was mixed with consumer confidence up and business confidence down. This partly reflects last month’s Chinese and Greek turmoil but the message is that consumer confidence remains subdued and business confidence is around its long-term average. With wages growth remaining at record lows of just 2.3% over the year to the June quarter, it’s no surprise that consumer confidence is subdued. Fortunately, wealth gains and low interest rates are helping drive reasonable retail sales growth.

- It’s hard to disagree with RBA Deputy Governor Lowe’s comment that ever rising land values won’t make us better off as a nation. But the key to solve this is to increase the supply of land, but we seem to struggle in achieving that on a sustained basis.

What to watch over the next week?

- In the US, the minutes from the Fed’s last meeting (Wednesday) are expected to confirm that it remains on track for a rate hike later this year. On the data front, expect to see continued strength in home builders’ conditions (Monday) and housing starts (Tuesday) but a slight fall in existing home sales (Thursday). Core CPI inflation (Wednesday) is expected to remain low at 1.8% year-on-year. New York and Philadelphia regional Fed manufacturing surveys will also be released and the Markit manufacturing PMI (Friday) for August is likely to remain solid at around 53.8.

- Japanese June quarter GDP is expected to show a decline after two quarters of growth.

- In Australia, the minutes from the last RBA Board meeting (Tuesday) are likely to confirm that the RBA is happily on hold for now. Data for car sales, the Westpac leading index and skilled vacancies will also be released.

- The June half Australian profit reporting season will really ramp up with around 80 major companies reporting results, including QBE, Qantas, Wesfarmers, Stockland and AMP. Profit growth for 2014-15 is likely to be around -1% as resource sector profits slump 28% thanks to the hit from lower commodity prices, but with the rest of the market seeing profit growth of around 9% as industrials ex financials benefit from low interest rates, the lower $A and cost cutting.

Outlook for markets

- Share markets are at risk of a further correction in the next few months as we are still in a seasonally weak period of the year for shares, uncertainties remain regarding Chinese economic growth and a likely Fed interest rate hike lies ahead. In fact, the declining breadth of gains in the US share market, with just two sectors, health care and retail, keeping the market up, point to a rising risk of a correction in US shares.

- But beyond the near-term, the cyclical bull market in shares likely has further to go: valuations against bonds are good; economic growth is continuing at a not too cold but not too hot pace; and monetary conditions are set to remain easy.

- As such, share markets are likely to remain in a broad rising trend. Our year-end target for the ASX 200 remains 6000.

- Still low bond yields point to soft medium term returns from bonds, but it’s hard to get too bearish on bonds in a world of too much saving & spare capacity.

- Notwithstanding the risk of a short-term bounce from oversold levels, the broad trend in the $A remains down as the Fed is likely to raise rates later this year, whereas there is a good chance the RBA will cut again and the trend in commodity prices remains down. Our view remains that it is heading into the $US0.60s.

Source: AMP CAPITAL ‘Weekly Market Update’

AMP Capital Investors Limited and AMP Capital Funds Management Limited Disclaimer