Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

The Finsec View #18

02 October 2020

US Election

The US election is now only a month away (3 November). Watching the debate on Wednesday was nothing short of uncomfortable. From a policy perspective it offered nothing new, but to watch the behaviour of both parties was cringeworthy. In a country where people need to be encouraged to use their democratic right to vote, this spectacle gave them little reason to.

What does it mean for markets?

We expect to see continued volatility over the next month or so:

- if it’s going Biden’s way investors are likely to fret more about the prospects of higher taxes & regulation, particularly if it looks like Democrats will win control of the Senate;

- if it’s close and contested it may be a while before the winner is known and markets won’t like the uncertainty; and

- Trump may also refuse to go peacefully as he’s signalled.

For those who like to look at the trends of the past as a guide to the future, this article by Economist, Shane Oliver serves as a good summary.

For now, the polls have Biden in front for key battleground states and National polls show Biden at a significant advantage.

Trump Tests Positive

At time of writing, it has just been confirmed that President Donald Trump and first lady Melania Trump have both tested positive to COVID-19 and will now quarantine in the White House just 32 days out from the election.

The ASX reacted to the news by tumbling 1.4 per cent almost immediately. Leaving it 2.9 per cent down for the week, it’s worst performance since late April.

Whilst the Australian market was quick to factor the news in as a Trump loss (as mentioned in our first article this has tended to be viewed as negative for equity markets), on balance Trump’s incapacitation may make the result on election night clearer (even if it’s in Biden’s favour), reducing the chance of a drawn out challenge and less uncertainty.

On this basis, we expect market reaction over the coming days to be a mixed bag.

Tuesday’s Budget

Tuesday’s Budget will be the first delivered in a recession for almost 30 years and the first ever delivered after financial year end.

But this time is like no other. As the future of an uncertain workforce hangs on continued support from the government, what new tricks will the Treasurer have for Australians on budget night?

The post-budget period will be politically challenging for the government. Christmas will be blighted by perhaps one in 10 Australians out of work. Some of the toughest scenes in this recession are yet to come: JobKeeper payments and early super withdrawals actually boosted household incomes through the crisis, but the subsidies will disappear between now and next March. Many of the companies and jobs they propped up cannot be saved.

But the government will also be expected to offer the public longer-term confidence by showing that it has a plan to deal with the huge virus hit on its own finances. It will have to do so with an economy that will be 6 per cent smaller by mid-2021, generating less tax to pay for an ageing population, and with fewer new migrants to help out.

The responsibility of building a strong budget framework is not a job many would covet right now. We’ll be tuning in on Tuesday night with anticipation and look forward to bringing you our synopsis from a FinSec perspective over the coming weeks.

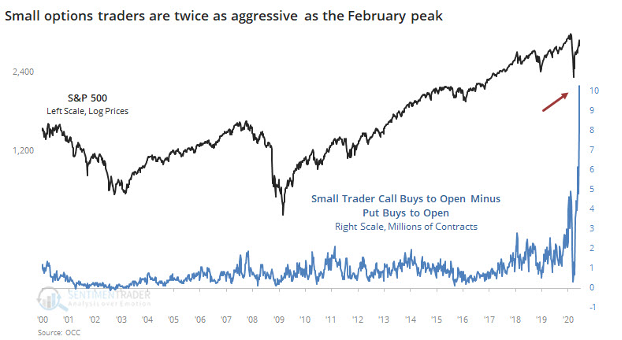

Chart of the week

This week’s ‘chart of the week’ shows the incredible growth (blue line, almost vertical) in ‘small trader call buys’, that is, stock options bought by retail punters. These ‘Robinhood traders’ have driven much of the demand for tech over the last couple of months, buying US$500 billion notional value of stock options in August alone, or five times the previous monthly high.

What happens when these new players realise markets do indeed fall? The NASDAQ (US tech index) over the last month, will be testing the mettle of many.

Property Update

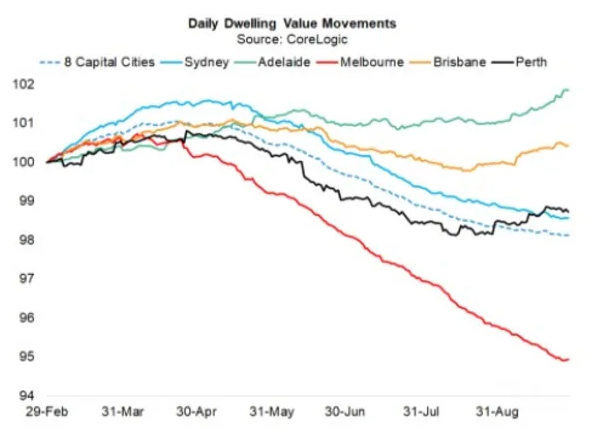

We are in the midst of a one-in-100-year pandemic and unemployment has reached levels not seen in decades. And while market observers continue to either marvel or scratch their heads at the surge in global equity prices, some truly unexpected real estate metrics are also emerging.

In Australia, house prices have started climbing again across six of Australia’s eight capital cities and throughout non-metro regional markets. In September, dwelling values recorded capital gains in Perth (0.2 per cent), Canberra (0.4 per cent), Hobart (0.4 per cent), Brisbane (0.5 per cent), Adelaide (0.8 per cent), and Darwin (1.6 per cent). The laggard is locked-down Melbourne, where dwelling values fell another 0.9 per cent in September, making for cumulative losses of 5.5 per cent since its March peak. Yet with Melbourne likely to come out of lockdown shortly, stability should return as the auction market comes online.

And, it’s not just Australia. The UK house prices are accelerating at their fastest pace since BREXIT. In the US, despite the sharp rise in mortgage delinquency rates, prospective home buyer activity (as measured by foot traffic) is at its highest level since 1994.

Just like equity markets, it would seem property is not immune to the sugar highs of fiscal stimulus either, albeit low interest rates and a myriad of grants and incentives tend to be a kicker here too!

Please note: Whilst there are a number of incentive grants and schemes now available for the first home buyer, renovator or builder, like most opportunities there are complexities to navigate. Please contact us should you require more information.

Andrew Creaser Receives SA Leaders Top Accolade

We are very proud to announce that our Managing Partner, Andrew Creaser has been named South Australian Leaders presenter of the year for 2019/20.With content curated from this newsletter, Andrew received the highest score in the history of the organisation, for his presentation titled ‘COVID 19 perspectives of a finance professional’ – no small feat considering the company.

For those unfamiliar with South Australian (SA) Leaders, it is an organisation encompassing over 100 C-suite decision makers from companies across South Australia, designed to bring together like-minded professionals in a collaborative manner. Members are given access to hand-picked experts in a wide range of disciplines, whom provide these members with valuable education, mentoring and networking opportunities.More information can be found at https://www.saleaders.com.au/.