Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

Reducing Aged Care Fees with Investment Bonds

As we get older it is a safe assumption that many of us will need to access aged care services. Like any other service we should also expect to pay for it, but what sort of fees should we expect and what strategies should we be thinking about to minimise them?

Aged Care Fees – At A Glance:

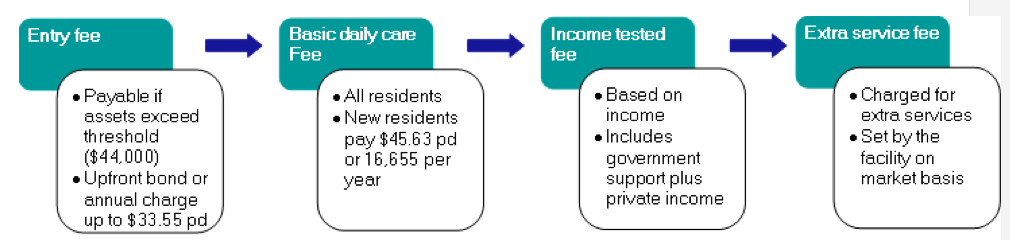

If you need to move to residential aged care you can expect to pay several types of fees:

- Entry fees – this is to pay for the right to live in the facility and is asset based

- Daily care fees – pays for your care including food, cleaning services, nursing staff, electricity

- Extra service fees – payable for higher levels of accommodation or services if the facility is accredited as extra-service.

Note: The above chart shows fees current to 31 Dec 2013

The basic daily care fee is 85% of the single rate of age pension to ensure everyone can afford to pay these fees. If you have higher levels of income you will pay a higher fee. This extra income-tested fee could be up to $72.48 per day (current to 31 Dec 2013).

Planning Strategies

With good advice and careful planning, there are strategies you can implement to minimise aged care fees and potentially maximise age pension.

For example if you can reduce assessable income (using Centrelink rules) you can also reduce the income-tested daily care fee.

Some strategies include:

- Pay a higher accommodation Bond

- Rent and keep the family home

- Gifting (limited to $10,000 per financial year or $30,000 in any five year period)

- Funeral bonds (invest up to $11,700) or prepay funeral expenses

- Investing in an investment bond through a family trust.

Investment bonds and the family trust

Family discretionary trusts can be used to hold assets for a number of reasons. This might be for management of family finances or taxation planning. If combined with an investment bond it can also be used to reduce assessable income for Centrelink and aged care purposes.

Under this strategy, a family trust is set up and money is transferred into the trust. The trust then uses this money to buy an investment bond.

Money held in a family trust is not assessed under the normal deeming rules for Centrelink/aged care purposes. Instead, the assessable income is the same as taxable income. This is where an investment bond can be handy. Earnings on an investment bond are taxed in the hands of the product provider, not the investor. So as long as no withdrawals are made (in the first 10 years), there is no taxable income to the trust. And if there is no taxable income, there is no assessable income.

If there is no assessable income, the daily care fees in aged care can be minimised and your age pension may be increased if you are on a lower pension due to the income test.

Is it always a good idea?

Everyone has a unique situation and the strategy can work differently for different people. The investment bond/discretionary trust strategy works better for people moving into aged care who:

- Are self-funded and wish to reduce taxable income to retain the Commonwealth Seniors Health Card

- Have high levels of Centrelink assessed income (for example from a super pension)

- Are paying an income-tested fee.

As with many strategies, there is an upside and a downside. You should always seek advice to determine if this strategy works for you.

This information does not consider your personal circumstances and is general advice only. Before making any decisions based on this information you should consider its appropriateness taking into account your objectives, financial situation and needs.

Copyright © KeyInvest Ltd (2013) All rights reserved. Except as provided in the Copyright Act 1969, this work may not be reproduced in any form without the written permission of KeyInvest Ltd.