Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

Knowledge + Clarity: Stepped V Level

Getting people engaged in a discussion about the value and worth of life insurance is, frankly, a challenge.

Helping them understand the pricing options of premiums – the regular amounts you pay – is even more difficult.

But, the more you understand about the pricing structure of your insurance premium, the more likely you are to be insured for the most affordable outcome over your time of need.

It’s natural to be attracted to the cheapest option, especially when one policy looks pretty much like the next. However locking-in today’s cheapest rate may not be the best decision when it comes to a longer time horizon.

Stepped V Level

Essentially, there are two ways cost of insurance is calculated; level cost of insurance and increasing cost of insurance (stepped).

Understanding stepped and level premiums is vital to determining just how much money you’ll pay overtime on your policy.

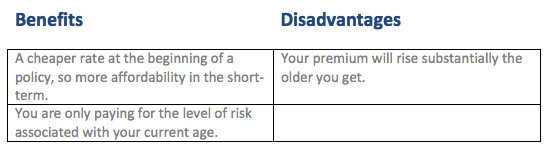

Stepped premiums are calculated on your age. Premiums are typically higher the older you get, since you’re considered more likely to fall ill or be seriously injured.

Stepped premiums are recalculated annually at the policy anniversary. While they do generally rise as your risks rise, they can sometimes drop if your circumstances are deemed less hazardous (such as a person giving up smoking).

Since stepped premiums are much more economical than level premiums at the beginning of a policy, they are good if you’re looking at keeping a short-term policy.

As a case in point, stepped premium insurance is typically more appropriate for someone in their 40s with 10 years to run on their mortgage, who only wants to have sufficient funding available in the event of their death or disability to repay that mortgage and some on-going costs. In other words, their need for greater cover will reduce proportionately along with personal debt.

Similarly, if you’re a young family struggling to make ends meet (kids do, after all, gobble up a lot of your income and savings), a stepped premium helps ease yourself into a Life Insurance policy – It’s better to choose a cheaper premium than to forego Life Insurance altogether because of unaffordability.

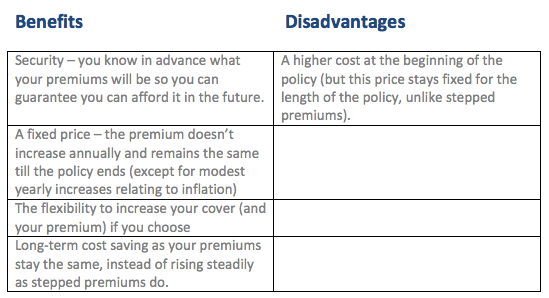

With level premiums, you pay more in the beginning, but the premium costs average out over time, typically level premiums will work out cheaper after about 15 years, depending on circumstances.

Note: Usually a level premium remains constant until the age of 65, when it reverts to a stepped premium as your risks increase.

Level premiums are ideal if you need comprehensive insurance and plan to keep your policy long-term. If you’ve just taken out a mortgage and plan to repay it over a few decades, you may want to ensure you’re covered by Life Insurance for the same length of time.

Level premiums also suit if you’re young and looking to get a head start on a long-term policy. While you may pay more initially, you can end up saving a substantial amount over time.

How do we work out which premium is right for you?

As part of the overall planning process we look at stepped v’s level premiums for each client on an individual basis. Analysis includes; how long it will take to break even, or when the benefit of higher costs now are balanced by lower costs in the future.

Each client’s circumstances are unique, so it’s important to look beyond the premiums and payouts. For instance; where you’ve got life insurance, effectively you’re creating a larger estate and this also needs consideration.