Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

Hunting for Income

Lower cash rates and government bond yields have prompted a widespread hunt for income-producing investments.

Although rates are likely to head up when the economy shows sustained signs of improvement, the yield climate will probably remain challenging for the foreseeable future. As a consequence, demand for investments such as dividend-paying stocks and investment-grade corporate bonds is likely to remain high.

For an investor entering retirement, holding a well-diversified, managed portfolio will be key. Growth and defensive assets both play an important part of the asset mix to meet the longer-term needs of retirees.

However, the proportion of the portfolio that’s dedicated to equities or bonds will largely depend on what age the investor plans to retire, and how much capital they’ve accumulated.

The case for bonds

Bonds aim to preserve capital, making them the ideal place for people who don’t want losses, such as those approaching retirement. Looking over the past 10 years, the worst year for investment grade bonds was 2008 when they lost 5.1 per cent.

Compare this with global equities which fell around 40 per cent that same year. As well as their defensive characteristics, we believe corporate bonds are currently offering superior yield for risk.

A typical diversified corporate bond fund currently offers a yield of around 5 per cent per annum (as measured by the AMP Capital Corporate Bond Fund in November 2013) while the Australian three-year government bond is yielding just over 3 per cent (as of November 2013).

Although many corporate issuers have healthy balance sheets, they’re not being rewarded for this, and the excess yield offered by corporate bonds over government bonds has subsequently remained high.

Watch out for the red flags

While there is a strong case for investments offering a decent yield, it needs to be acknowledged that this can come with its pitfalls. The dangers that can be encountered while seeking yield in today’s low-yield environment have just as much potential to derail retirement for unsuspecting investors as some of the dangers that can be found when seeking high levels of capital growth.

For corporate bonds, higher yields mean more credit and liquidity risks. To lessen the risk of capital loss, investors should take the time to really understand the securities they’re buying. Some of the red flags to look out for include companies that have made major capital outlays and large acquisitions, as they may be susceptible to unforeseen risks.

Also, any changes in the corporate strategy of the issuer can signal a change in credit risk. For example, companies that are deleveraging are generally attractive fixed-income investments, but companies that are releveraging should be avoided.

Woolworths – Australia’s largest food and liquor retailer – is an example of a company with strong credit fundamentals that operates in a very favourable duopoly-like environment. With this security, investors have gained exposure to stable non-discretionary cash flows while earning a very attractive coupon of 6 per cent per annum, or a yield of 4.5 per cent as of November 2013.

The case for dividend-paying equities

One way to access a steady source of income with exposure to capital growth is through dividend-paying equities. In addition to the growth available from equities, they can also provide a remarkably stable income for investors, that can also grow as a company’s share price grows.

Areas of opportunity

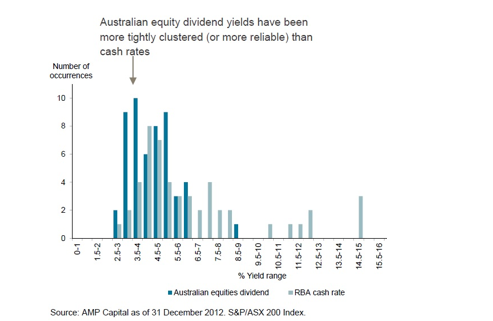

A market which is currently providing attractive income opportunities is Australian equities. In fact, dividends from Australian equities have been more stable than cash for the past 50 years.

The chart plots the frequency distribution of official Australian cash rates and Australian dividend yields, taking one sample point for each of the past 51 years. It can be seen that, in the past, dividends have been far more tightly clustered (or more reliable) than cash rates.

Watch out for the red flags

It’s critical when investing in income-producing equities that investors focus on opportunities that have a track record of delivering reliable earnings and distribution growth. Yes, healthy dividends are important, but they shouldn’t be at the expense of all earnings growth.

An investor needs to ensure that future earnings, and therefore dividends, can be maintained or can grow. It’s worth remembering that high-dividend stocks don’t always equate to sustainable income. There have been many examples where companies with negative earnings outlooks, or highly geared or distressed companies, have issued high dividends.

These dividend payments have eaten into the company’s capital base, making it difficult for the organisation to invest for its growth. So, it pays to invest with a manager who will thoroughly research stocks, understand the fundamental characteristics of the company they’re investing in, and ensure your retirement income is sustainable.

Your income investment checklist

Look for companies that:

* Deliver the expected dividend

* Can maintain their dividends over time

* Don’t reduce the total return of the portfolio

* Are likely to outperform the overall market

Jeff Brunton, AMP Capital head of credit markets and Michael Price, co-head of Australian Equities