Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

The Story Part 2: Federal Budget 2014/15 – what does it mean for you?

On Wednesday we brought you ‘The Story’, a budget summary outlining the key proposals from Treasurer Joe Hockey’ s 2014-15 budget.

Now the dust has begun to settle we bring you ‘The Story Part 2’ – What does it mean for you? How could the Budget proposals change the way you live, work and pay for services on a practical day-to-day level?

Here’s a round-up of what the 2014-15 Federal Budget could mean for your family finances.

As always, if you have questions relating to your personal circumstances, we encourage you to contact us by email, or phone and we can discuss the changes in greater detail.

But don’t forget, the proposals may change as the legislation passes through parliament.

1. SUPERANNUATION

Proposed effective date 1 July 2014

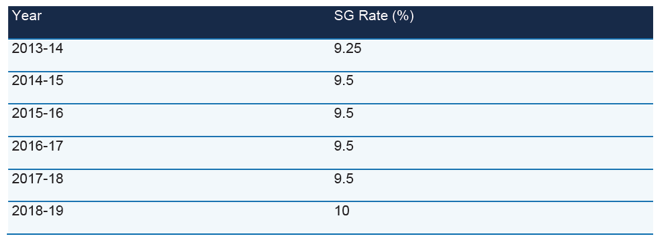

The Government will change the schedule for increasing the SG rate. SG contributions are the compulsory super contributions made by employers into the super accounts of eligible employees. The current SG rate is 9.25%. The SG rate will increase from 9.25% to 9.5% from 1 July 2014 as currently legislated. The rate will remain at 9.5% until 30 June 2018 and then increase by 0.5% each year until it reaches 12% in 2022-23 as per the following table: