Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A Finsec View – Recession fears, ASX 300, Timeless advice and more

3rd June 2022

Those tasked with running the world’s economies right now are having quite a time of it. Inflation, interest rates, property markets, unemployment, war, and lockdowns are indeed quite a line-up! Gaining clarity and a sage perspective on the topic(s) is not always easy to come by, which is why we jumped at a recent invitation to sit in on Westpac Chief Economist Bill Evans’s latest economic update.

Whilst there is not the time to distil his commentary in detail this week (more to come in future Views), he delivered a sobering yet optimistic outlook for Australia. In short, he is confident in the RBA’s ability to achieve its inflation target of 3.75% over the course of 2023. Why? He believes oil prices are now reaching their peak; a weaker US economy will alleviate much of the price pressures (mainly in oil and construction), the re-opening of China and a strong Aussie dollar. Fingers crossed!

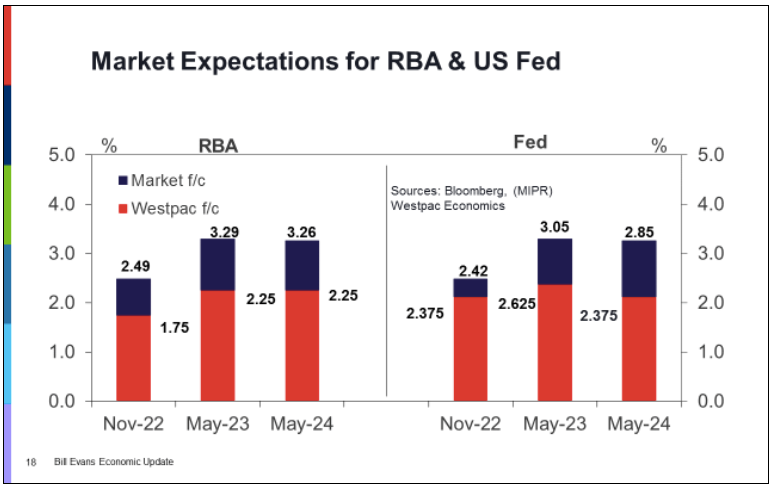

On interest rates, as the below chart depicts, Evans believes that in Australia, we will see rates peaking at 2.25% (red bar) in late 2023. This is a lot lower than the markets predict at 3.29% (blue bar).

Regarding the US, he believes rates will peak in 2022, remain on hold for 2023 and actually begin to fall in 2024. Markets are in agreeance, albeit at a higher level.

Recession fears weigh on markets

The minutes from the May meeting of the US Federal Reserve, released this week, showed most officials agreed the central bank needed to tighten in 50 basis point (0.50%) increments over the next couple of meetings, continuing an aggressive set of short-term moves that hopefully would allow policymakers some flexibility to shift gears to a less aggressive strategy later in the year, if the economy required. Markets largely welcomed the commentary as a sensible approach in what many see as necessary catch-up by the Fed for the belated commencement of the rate increase cycle in the first instance.

Over the month of May, financial-market volatility has spiked. Equities have swung in valuation, bonds have recovered modestly, and economic commentators have revisited assessments on how quickly policy rates will continue to rise. The May minutes showed that officials are acutely aware of financial conditions as they prepare to raise rates further. This is not surprising, given that US central bankers are trying to execute the holy grail of a soft landing. That is, they are attempting to cool the strongest inflation in 40 years without hitting the brakes so hard it tilts the economy into a recession.

Markets have certainly become more attuned to recessionary risks in recent weeks, with the latest US reporting season fixated on projections by front line consumer companies, particularly retailers.

The market is attempting to get a read on how much rising inflation and interest rates are eroding consumer confidence and consumer spending. Should consumers suddenly become frugal, then this is very bad news for an economy where they make up over two-thirds of GDP. However, it should be stated that financial markets move far ahead of the economic figures and are often rebounding long before a recession is officially announced. What we have seen from the equity gyrations in May, is a market rapidly assessing the likelihood of the soft landing versus a more forceful touchdown and prolonged recession. For now, the consensus is somewhere in the middle, and markets are priced accordingly.

Where will Albanese take us?

After nine years in opposition, Labor has returned to government. Regardless of your political persuasion, we should recognise the symbolism of the election of an only son raised by a single mother in a council flat. This story certainly could not be repeated in many parts of the world. It is a testament to the solid egalitarian streak running through Australia that this is possible.

So, after nine years of Liberal rule, the big question is what we should expect from our new government. Like so often, when it comes to politics, the answer is that we are not quite sure.

Upon taking Government, Treasurer Jim Chalmers and Finance Minister Katy Gallagher have wasted no time stating they have inherited a “dire” budget situation, accusing the Coalition of not disclosing pressures, which they only learned in Treasury briefings post the election win.

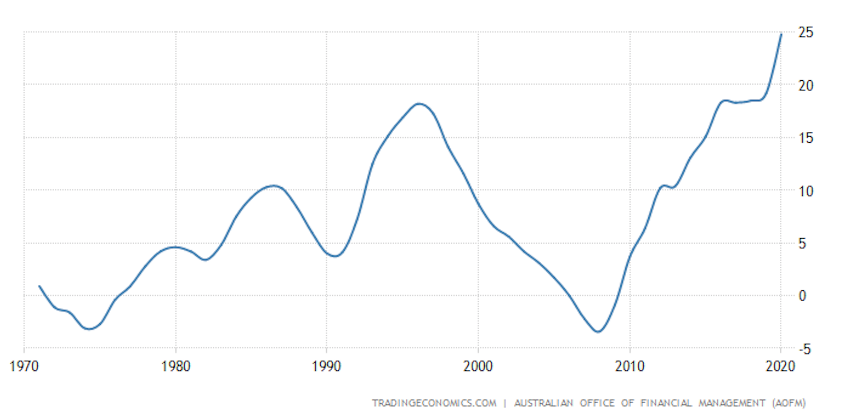

The truth is that Labor must bear much of the responsibility for the last decade of budget deficits that began under Treasurer Wayne Swan during the global financial crisis in 2008-09 and that are now projected to continue beyond 2032-33 (let us not forget those in office had to spend money for us to get out of the GFC and survive a global pandemic). The below chart depicts government debt as a percentage of GDP over the last 50 years.

Where will the money come from?

Albanese has recommitted his government to the Coalition’s legislated stage-three personal tax cuts that will leave most taxpayers paying no more than 30¢ in every extra dollar earned by mid-2024. Some will damn this as just a tax break for the rich; others will argue that the less well-off will not be helped by piling more tax penalties on enterprise as Australia seeks to compete in the post-pandemic world.

A proportion of Australians may think the obvious solution lies in a ‘special tax’ on the ‘excess’ profits of oil and gas companies (think the Rudd government’s ‘super-profits’ mining tax), the likes of which we are seeing in the UK – but, Albanese has thus far ruled this out also.

Labor’s election promises in aged care and childcare probably won’t help the cause either, inflating public expectations about the government’s ability to fund critically important services that come at a massive cost.

Now that fiscal reality has begun to bite, Labor’s focus is understandably turning to a re-anchoring of the public’s budget expectations.

Chart of the week

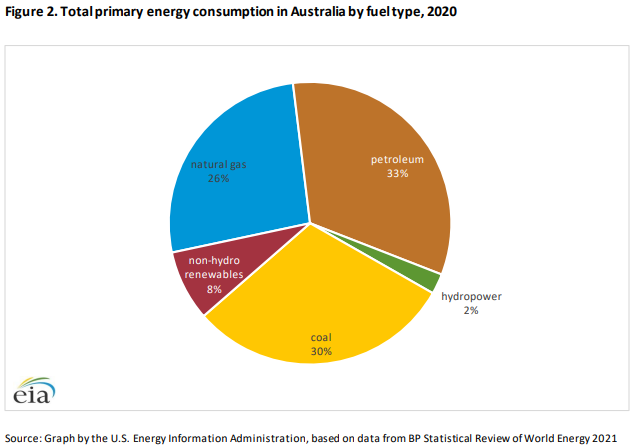

One of the earliest (and biggest) challenges for Labor is energy. New default energy prices come into effect from 1 July, rising by up to 18.3% in NSW, 12.6% in south-east Queensland and 9.5% in South Australia. With wages lagging inflation and interest rates increasing, it will be a hard hit for many.

The energy crisis is, of course, intertwined with the climate change debate, including doubts about whether new sources such as renewables can be switched on quickly enough to allow the early closure of fossil-fired generators.

Although the recent election result was a clear sign of a rising climate change focus by Australians overall, amid the best ever result for The Greens, the party’s leader, Adam Bandt, issued this qualification:

“We need to get out of coal and gas, but do it fairly.”

This tempering of the message is important; words such as ‘fair’ and ‘just’ are important components in ensuring the conversation is a balanced one. In switching to renewables, the world has a huge transition period ahead.

In Australia, for instance, renewables make up only 10% of our energy source – our reliance on fossil fuels will remain dominant for some time to come. It begs the question, perhaps we need to spend more time understanding how we can offset emissions rather than reducing to net-zero?

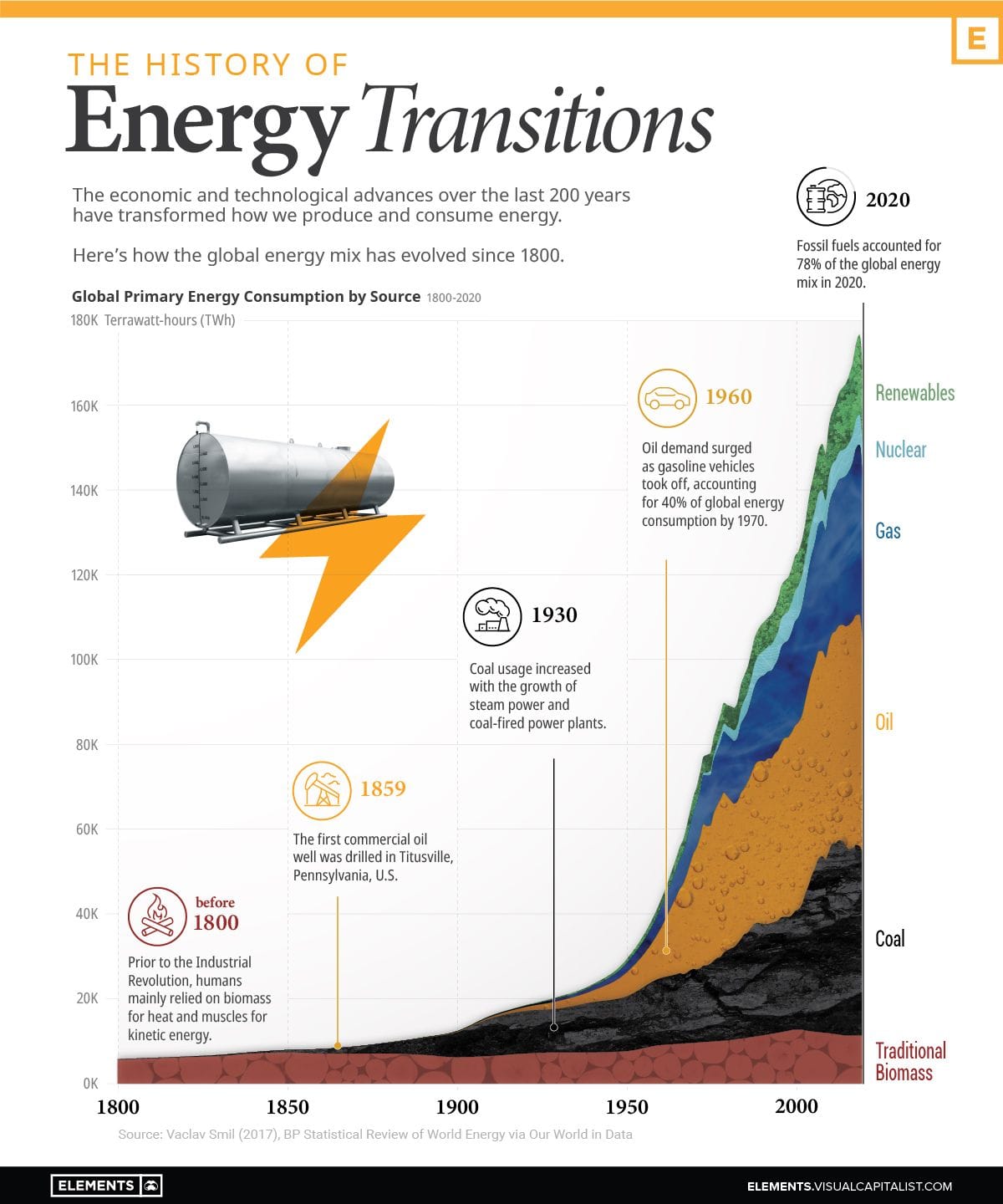

Our second chart of the week illustrates how the global energy mix has evolved over the last 200 years. The good news is, that the current energy transition to renewables is unprecedented in both scale and speed, with climate goals requiring net-zero emissions by 2050.

However, history shows that simply adding generation capacity is not enough to facilitate an energy transition. Coal required mines, canals, and railroads; oil required wells, pipelines, and refineries; electricity required generators and an intricate grid.

Similarly, a complete shift to low-carbon sources requires massive investments in natural resources, infrastructure, and grid storage, along with changes in our energy consumption habits.

Finance 101 – The Australian Sharemarket

When we refer to “Australian equities (shares)” within our market updates, we are generally commenting on the performance of an index (typically the S&P/ASX 300 or All Ordinaries), but what comprises these indices? This week we take a look at the ASX 300 by industry, classifying each one as cyclical (outperforms in good economic times and underperforms in bad economic times) or defensive (underperforms in good economic times and outperforms in bad economic times).

- Financials (26.4% of ASX 300) – Companies that engage in financial services such as banking, insurance and asset management. Real estate investment trusts (REITs) are also considered as Financials. Financial stocks tend to be somewhat cyclical, as few people are looking to borrow more money or take out a new insurance policy during an economic downturn. Examples on the ASX: the Big 4 banks, Medibank Private, Magellan.

- Materials (23.8% of ASX 300) – Companies that manufacture and distribute raw materials and commodities. Australia’s largest exports are iron ore and coal, the demand for which is heavily dependent on the business cycle. Examples on the ASX: BHP, Rio Tinto, Fortescue, Newcrest, Amcor.

- Healthcare (9.4% of ASX 300) – Companies that manufacture healthcare equipment/supplies, provide healthcare services or are engaged in pharmaceutical or biotechnology. Healthcare stocks tend to be defensive since people get sick irrespective of what is happening in the economy and require healthcare services. Examples on the ASX: CSL, Resmed, Cochlear, Fisher & Paykel.

- Industrials (7.7% of ASX 300) – Companies that distribute capital goods (e.g. heavy machinery), construction/engineering services, commercial services and transportation services. Industrial stocks in Australia tend to be cyclical, as many of them provide goods and services to mining companies which are highly cyclical. Examples on the ASX: Transurban, Southern Cross Electrical Engineering, Qantas.

- Consumer Discretionary (6.4% of ASX 300) – Companies where the consumer is making a purchase out of choice rather than necessity. For example, if you have a roadworthy car, you don’t need to buy a new one but may choose to anyway. Consumer Discretionary stocks are tightly linked to the business cycle because when times are tough, consumers tend to cut unnecessary spending (e.g. holding off on buying a new car). Examples on the ASX: Wesfarmers, Crown Resorts, Harvey Norman, Flight Centre.

- Consumer Staples (4.5% of ASX 300) – Companies where the consumer will have demand for the product irrespective of economic conditions. It doesn’t matter whether the economy is roaring or in the depths of a recession; people need groceries, toothpaste and toilet paper. Consumer Staples stocks tend to be seen as defensive, as their sales aren’t tightly linked to the business cycle. Examples on the ASX: Woolworths, Coles, Coca-Cola, Amatil.

- Energy (4.7% of ASX 300) – Companies that are engaged in providing energy/fuel or exploring and refining energy sources. Energy companies tend to be somewhat defensive, as energy is in constant demand. Examples on the ASX: Woodside, Santos, Ampol.

- Communications (4.6% of ASX 300) – Companies that provide telephone, internet and other communication services. Communications stocks tend to be defensive since their products are in constant demand. Examples on the ASX: Telstra, SEEK, Nine Entertainment, News Corp.

- Information Technology (3.9% of ASX 300) – Companies that offer software/IT services or manufacture and distribute technology hardware. IT stocks around the world have been at sky-high prices as investors bet that earnings growth will continue to be robust, meaning that they are likely to underperform in a sell-off. Examples on the ASX: Iress, Prophecy International, Xero, WiseTech.

- Utilities (1.9% of ASX 300) – Companies that supply electricity, gas and water to the broader public. Utilities tend to be defensive given the constant demand for their product and high barriers to entry from competitors. Examples on the ASX: AGL, Origin, APA Group.

What you may have noticed is how top-heavy the Australian market is, with Financials and Materials accounting for roughly 50% of the ASX 300. The largest company in Australia today is BHP, which at $231b AUD accounts for a greater share of the ASX 300 than all but two sectors, and the top 10 stocks in the ASX 300 are worth more than the bottom 280 combined!

Elementary, my dear Watson

One of our favourite quotes comes from the investing legend Charlie Munger, “It is remarkable how much long-term advantage people like us have gotten by trying to be not stupid instead of trying to be very intelligent.”.

Just ask these guys that recently locked their keys in an armoured vehicle. We are not exactly sure how long it took to resolve this situation, but we are guessing it wasn’t short on red tape or red faces….

As investors, it is natural for us to think that the way to get ahead is to outsmart the competition with a sophisticated strategy. However, more often than not, avoiding elementary mistakes (like not locking keys in an armoured vehicle) is all you need to do.

Timeless advice

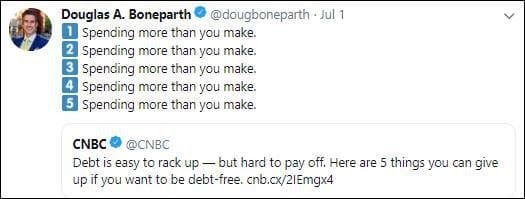

It’s an oldy but a goodie! With goods and services on the rise, this tweet – a list of the top 5 things to give up to be debt-free – serves as timeless advice.

Stay safe and look after one another. As always, if you have any concerns or questions at any time, please reach out to your FinSec adviser.