Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A Finsec View – Property, CGT, Gates on AI, Shrinkflation and More

2nd June 2023

Never let a good crisis go to waste!

The biggest macroeconomic swing factor in global markets of the past few weeks has been the ongoing impasse around the US Debt Ceiling. And, whilst resolved for now (in principle – there are still a few bridges to cross), in considering these types of situations, it may be oddly helpful to remind ourselves that the US is home to many of the best businesses in the world. As obvious as this statement is, it’s often forgotten during times of so-called ‘crisis’.

The reason we bring it up is down to a long-term view. It is hard to believe that based solely on Washington’s antics, people would wildly change their spending habits. It stands to reason that favourite restaurants will still get eaten at and the best-loved brands purchased. In short, there’s not much that can derail people’s desire to spend over the longer term.

And if that is the case, then it seems likely that the earnings of great companies will continue to grow. And since stock prices generally follow earnings, it seems likely that markets will also grow over the long term as well.

In the long run, consumer spending and smart management teams are what will drive corporate earnings, not the representatives in Washington.

Yet, every single time the government goes through a debt ceiling debacle (which has occurred 78 times in the last 62 years), the media wants you to think that this may be the end of the world as we know it – As they say, “Never let a good crisis go to waste.”

So, they’ll go on telling you exactly what this means for the market despite nobody really knowing.

As long-term investors, the real risk was not the debt ceiling itself; rather, the decision to alter portfolios out of worry, fear, or uncertainty.

This is, and always has been, a recipe for disaster.

Knowing this to be true and that earnings are historically likely to rise in the decades ahead, it’s easy to see that as frustrating as the ‘noise’ of a ‘crises’ may be, it’s mostly a distraction from what will ultimately matter over the long term.

Right now, there is strength in the market, and the debt ceiling crisis has been averted, but there are many more short-term risks on the horizon (weakening economies and recession) – all will require a strong constitution.

One of the most important rules of investing is knowing what you can control… and what you cannot.

Market Update

While stock markets were broadly flat these past few weeks, one sector stood out: information technology. In fact, the technology sector is one of just three sectors in the S&P 500 Index that is positive year-to-date, along with consumer discretionary and communication services. Meanwhile, each of the other eight S&P 500 sectors is negative this year thus far, perhaps reflecting the uncertainty around the U.S. debt-ceiling standoff, future path of Fed rate hikes, and potential economic softness.

Market leadership has clearly been narrow this year, led by just a few sectors and a handful of large-cap technology companies, and in many cases driven by valuation expansion. For long-term investors this is not always a sign of healthy market performance, as it can reflect overcrowding in one area and uncertainty around the broader economy in others. In our view, we would expect to see a broadening of market leadership, particularly as an economic downturn and subsequent recovery take shape. Against this backdrop, a recovery playbook could include small-cap stocks, cyclical sectors and international equities, alongside technology and growth parts of the market.

What is driving the outperformance in the technology sector?

There may be a few reasons behind the recent technology outperformance. First, growth sectors experienced the sharpest declines in valuations, perhaps making the technology and growth areas more appealing to investors looking for bargains. Secondly, many large-cap technology stocks have become part of a defensive strategy more recently. These companies have certainly shown resilience through this past earnings season, highlighting their defensible business models and strong financial positions, and returning value to shareholders through share-repurchase programs.

Finally, many investors see the attractive growth potential of the emerging artificial intelligence (AI) space – sparked by ChatGPT / Google Bard, etc. In fact, last week semiconductor company NVIDIA, whose stock soared after it raised its revenue guidance well above analyst expectations, pointed to generative AI as a critical growth driver. Many investors who are sitting on the sidelines, given the better yields from cash-like instruments, need a compelling reason to enter the markets, and the growth potential of AI technologies may be where some of this cash is now flowing. More on this below.

Interest Rates & Inflation – Could a Fed pause be short lived?

As we look past the U.S. debt ceiling, the next market catalyst on the horizon perhaps lies in the June 14 Federal Reserve meeting. In recent weeks, several Fed officials have indicated that the Fed’s focus remains squarely on fighting inflation, which remains too elevated for comfort. Despite better trends in headline inflation, PCE (personal consumption expenditures price index) inflation data last week moved higher, and services inflation remains persistent, driven by a solid labor market and still-elevated wage growth. We saw last week that U.S. GDP growth for the first quarter was also revised upwards modestly to 1.3% annualised (versus the prior estimate of 1.1%), with consumption still resilient at 3.8%.

With a strong labor market and broadly healthy economic backdrop, some Fed officials have been wondering if further rate hikes may be prudent to continue to keep pressure on inflation. In fact, markets are now also starting to price in one additional Fed rate hike (June or July), bringing the fed funds rate to 5.25% – 5.5%.

On home ground

In Australia, all eyes are on the next RBA board meeting this coming Tuesday, 6th June.

We are beginning to see clear evidence that rate hikes are slowing the economy — with falling real retail sales, falling building approvals, slowing business investment plans and early indications of a slowing jobs market. Inflation also remains off its highs and heading down.

This run of weak economic data has experts pointing to a pause in rate hikes and even talk that the lagged effects of previous hikes may pose a danger if the RBA is to keep going.

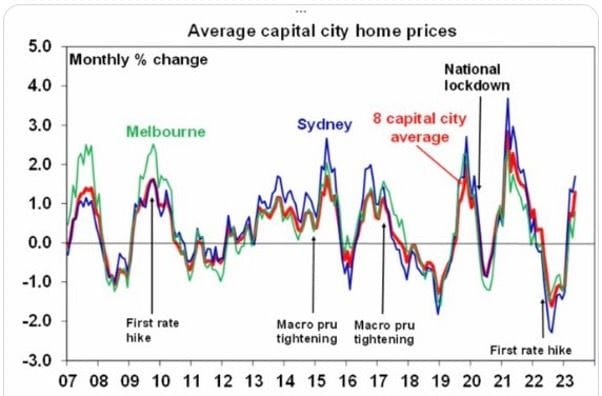

On the flipside, the RBA may yet hike given continuing hawkish commentary, as well as wage growth risks (the Fair Work Commission has announced a minimum wage increase today – the biggest on record) and rising house prices (refer to the below chart of the week).

Chart(s) of the Week

It is fascinating to watch residential property prices at the moment and speculate on what the next few years have in store. As this chart from AMP’s Chief Economist Shane Oliver shows, there is an unexpected price turnaround in the face of rising interest rates due to high immigration, supply shortages and low availability of rental properties. Many people are also helping their children to buy homes, and it may well have implications for the cash rate. As Oliver says:

“Although the RBA does not target home prices, the rebound will be concerning them due to the reversal of the negative wealth effect, leading to a risk of more rate hikes.”

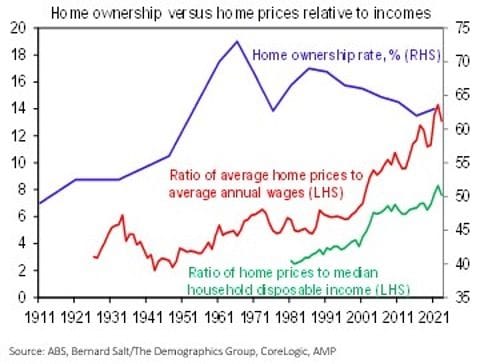

Drawing on work by Bernard Salt of The Demographics Group, Oliver looks at many factors to explain declining home ownership from a peak of 73% in 1966. He says many younger people are now investing in other ways, such as on the stock market and spending more on personal experiences. But a leading cause must also be a decline in housing affordability, as shown in the red and green lines below.

Backing this theory is new research showing that fewer young people even regard home ownership as their ticket to wealth creation.

More than 40 per cent of Gen Z consumers do not agree that owning a home is important to the “Australian dream”; this compares with just 21 per cent of Baby Boomers who believe the same.

Most Gen Z respondents said it was more important for them to attain their dream life (71 per cent) than their dream home (29 per cent). The difference is stark and telling.

Wealth Wisdom

It is nearly tax time, and the Australian Tax Office has warned investors it will take a particularly close look at capital gains and losses made this year.

For investors who joined markets during the pandemic (more people than ever are now investing in the stock market outside of super) whom may have sold shares for the first time because of cost-of-living pressures or more generous interest rates beware – filing your tax return could be a “fairly novel experience”.

A good article on the topic can be found here (unfortunately, it is behind the paywall, so please reach out to your adviser if you require more information).

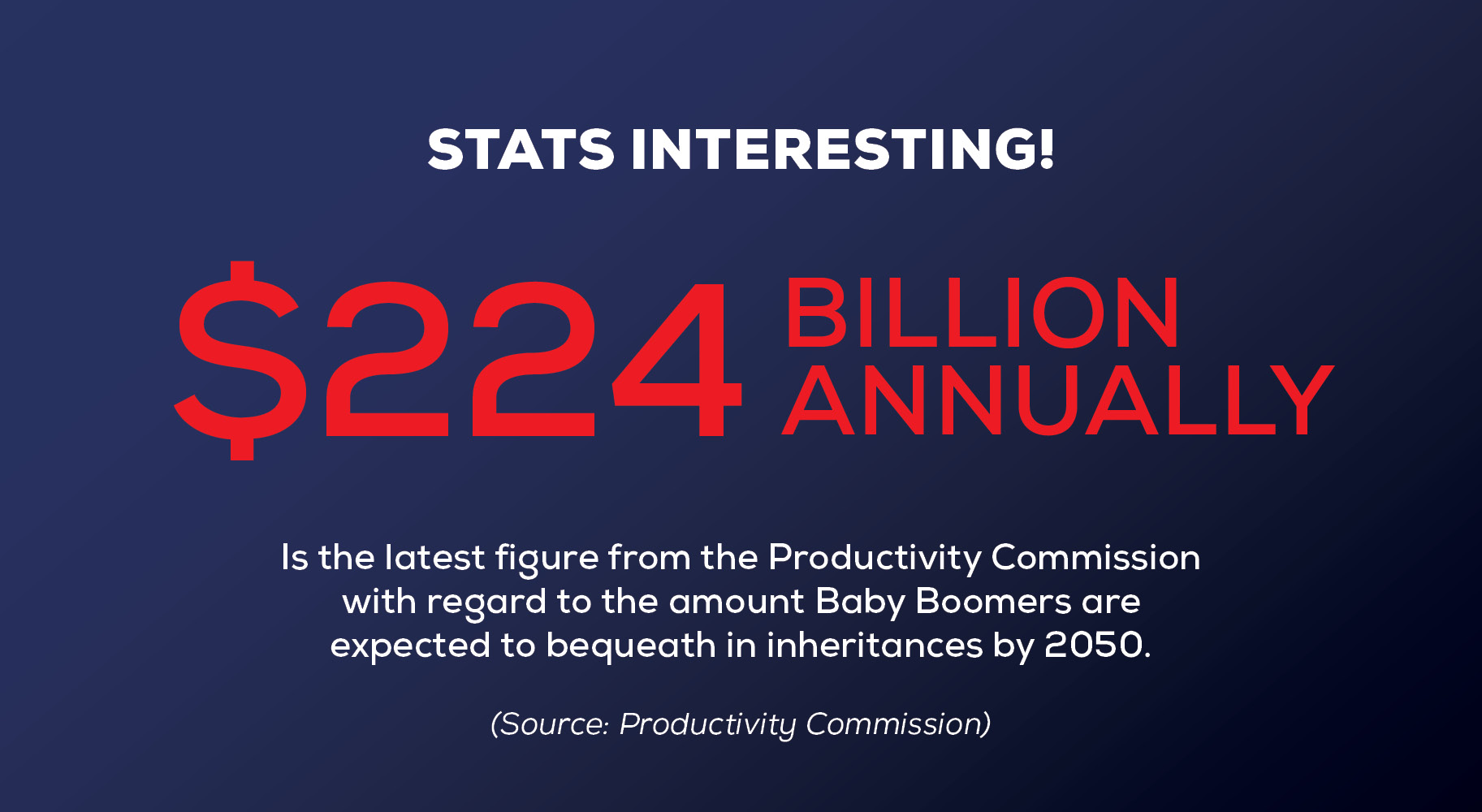

It is an enormous windfall of around $3.5 trillion for younger generations (predominantly property and superannuation). But, the vast majority of families are unprepared for the communication and planning required to ensure a smooth transfer of this wealth.

In fact, according to one private bank (which manages the wealth of around 7000 families), at least 70 per cent of intergenerational wealth transfers fail because of family conflicts, dissipation of wealth, misaligned values and delays.

While each plan will be unique, the most successful plans share a common pathway – Here are three strategies for a smooth transition.

#1 Shared Vision

- Create a strategy that all stakeholders understand, share and agree

- By taking time to discuss, debate and deliberate, families can:

- Understand the views and aspirations of all members of the family and take them into account;

- Share information about the family’s wealth, while maintaining personal and commercial confidentiality;

- Provide the next generation with an idea of the security family wealth can afford – and what responsibilities it involves;

- Discuss options for gradually sharing wealth and opportunity; and

- Reach a collective family view.

#2 Preparing the next generation

- Treat the transfer as a business in itself

- Create a governance structure where each stakeholder has a role and contributes based on their appropriate skills.

- Gradually introduce family members into the “family business” by sharing information and responsibilities in an age-appropriate way.

- Strategies to create opportunities for practical experience include:

- Becoming a trustee to provide insights into managing wealth and demonstrate family values.

- Encourage an understanding of the power of networking

- Interacting with advisers to provide access to experts and business insights.

- Joining the business, which might involve a parent introducing a third party as a coach, mentor or becoming a seed investor.

- Engaging with philanthropy to teach values and responsibility beyond family.

#3 Develop a Plan

- Put the fundamentals in place, such as a will and powers of attorney.

- Insurance can be a tax-effective way to top up an estate and take care of tax obligations and debt. Insurance payouts can also help equalise imbalances in the distribution of wealth, which might arise if there are valuable but illiquid assets.

- Having the right legal structures in place; trusts and/or companies

- Business continuity planning

- Regularly review each aspect of the arrangements to reflect changing business conditions, regulations and family circumstances.

Shrinkflation

The Twitterverse has been enjoying a fun but serious subject this week with many examples of the ‘shrinkflation’ of smaller product sizes sold at the same price as larger predecessors.

Even without the shrinkflation, data collectors UBS Evidence Lab tracked more than 60,000 prices in Coles and Woolworths and estimates that supermarket prices rose 9.6% in the 12 months to April 2023.

Gates on AI

When Bill Gates says that in his entire life, he has only seen two demonstrations of revolutionary technology, we should sit up and listen. His first was in 1980 and called a graphical user interface… which became Windows. And then in 2022, when he saw the latest iteration of OpenAI, he wrote:

“In September, when I met with them again, I watched in awe as they asked GPT, their AI model, 60 multiple-choice questions from the AP Bio exam – and it got 59 of them right. Then it wrote outstanding answers to six open-ended questions from the exam. We had an outside expert score the test, and GPT got a 5, the highest possible score, and the equivalent to getting an A or A+ in a college-level biology course.

Once it had aced the test, we asked it a non-scientific question: “What do you say to a father with a sick child?” It wrote a thoughtful answer that was probably better than most of us in the room would have given. The whole experience was stunning.”

At our recent Principals Community conference (a network of 126 self-licensed firms), we, too, were exposed to some of the new realities of AI in a presentation centred around the financial services industry and, like Gates, were blown away. For those of us that can clearly remember when the internet, email and mobile phones became a “thing”, this is the next reiteration with profound implications for all businesses – if harnessed the right way, the improvements in areas such as productivity and education will be astounding.

What does this mean from an investment perspective?

Taken from an article in this week’s Firstlinks publication and written by editor-in-chief Graham Hand are three charts selected from various sources which summarise AI’s rise.

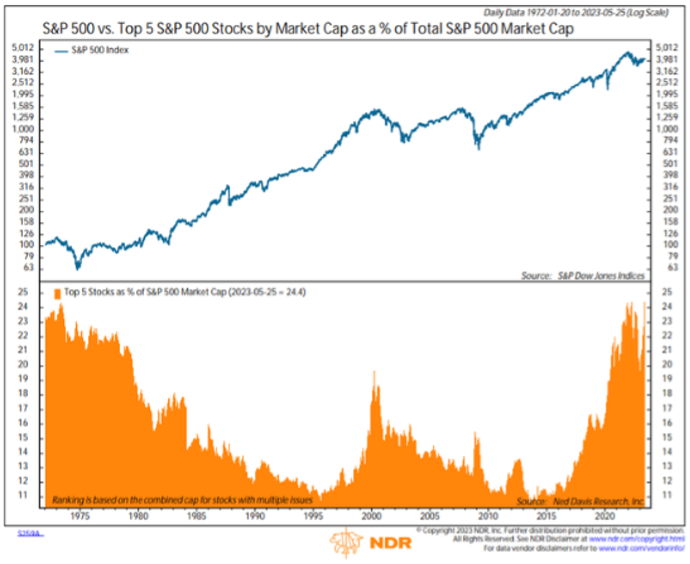

- The five largest companies in the S&P500 (Apple, Microsoft, Alphabet, Amazon and Nvidia) comprise almost a quarter of the index of 500 companies, the highest percentage for 50 years, pushed up by the AI promise.

- The tech Nasdaq index is outperforming the Dow Jones Industrial index by 22% in 2023, the widest margin in any year since Nasdaq launched in 1971.

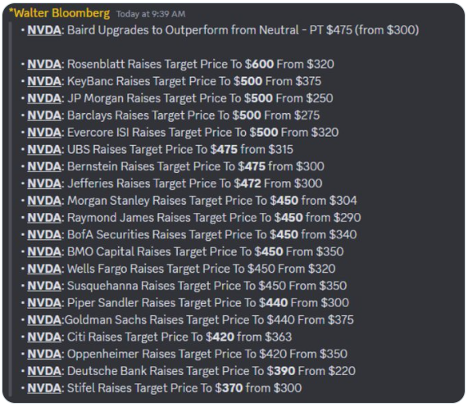

- Analysts have widely-different expectations reporting they have never seen such a wide guidance range on technology stocks as they struggle to understand the consequences of the monetisation possibilities of AI. Within 24 hours of the recent earnings update by Nvidia (NVDA) – the company reached a market cap of US1 trillion on Tuesday – here are the analyst announcements, with a range of US$320 to US$600.

Whilst the market is recognising the AI potential with massive enthusiasm, as always happens in equities, there will be overreactions. At some point, as too many investors jump into the same idea and hedge funds algorithms follow the trends, prices will be pushed beyond reasonable valuations. It is the nature of markets and the human condition.

At FinSec our investment committee is wary of over-exuberance in this space. Clearly, companies developing this technology will create enormous value, but we are tracking our fund managers to ensure we don’t end up overexposed to any potential euphoria that could lead to a future correction. At this point, our managers are taking profits as valuations move upward.

Back to Bill Gates, who most likely reads more widely in a week than most of us do in a year, who concludes:

“I think back to the early days of the personal computing revolution, when the software industry was so small that most of us could fit onstage at a conference. Today it is a global industry. Since a huge portion of it is now turning its attention to AI, the innovations are going to come much faster than what we experienced after the microprocessor breakthrough. Soon the pre-AI period will seem as distant as the days when using a computer meant typing at a C:> prompt rather than tapping on a screen.”

For those interested in more of Bill Gates’s thoughts on AI, please click here.

Impersonation Scams

The increasing sophistication of scammers means yet another important ‘scam’ article – This week it is impersonation scams.

An impersonation scam is when a scammer contacts someone by phone or SMS and impersonates a bank or other service company. They then convince the customer to authorise transactions, make a payment, or provide personal information.

Scammers go to great lengths to look authentic. Before contacting someone, scammers do their research and have well-thought-out details at hand, such as partial card and account numbers.

Recently, scammers have been cold-calling people and using sophisticated scripts and techniques to sound more professional and believable. For example, scammers may introduce themselves as a bank employee using names and job titles obtained on platforms such as LinkedIn to convince the customer that they’re talking to someone legitimate.

In 2022, Scamwatch received 14,603 reports on bank impersonations with more than $20 million reported lost. More than 90 of these reporters individually lost between $40,000 and $800,000.

What to look out for

- Unsolicited contact. Consider whether being contacted makes sense in this scenario.

- Scammers often pitch the reason as urgent and want you to act quickly.

- They pretend to be from the fraud security team to sound more legitimate.

Remember

- Never share passwords with anyone.

- Check contact information and bank details for yourself using a trusted source. If you think you’re on the phone with a scammer, hang up and call the bank/service provider yourself on a trusted number.

- Avoid using phone numbers from text messages, contact your bank/ service provider directly using a trusted source.

Stay safe and look after one another. As always, if you have any concerns or questions at any time, please reach out to your FinSec adviser.