Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A FinSec View – Markets, Wealth Wisdom, Downsizer Rules and more…

|

13th October 2023 |

Plot Twist as Market Braces for ‘Higher for Longer’ Narrative

Any author knows the value of a good plot twist – or two, or three.

The name of the game, of course, is to keep readers guessing. To keep them navigating the carefully constructed twists and turns until there’s some ‘a-ha’ moment of clarity.

And so, it seems, the US Federal Reserve is writing an intriguing page turner – one that’s souring sentiment and prompting investors to question now not how high will rates go, but rather how long will high interest rates last?

And are markets really ready for a ‘higher for longer’ world than they’ve priced in (or not priced in, as the case may be)?

In just over a fortnight, the next US FOMC (Federal Open Market Committee) meeting will be held, after the Fed last month held rates steady at 5.25% – 5.50% – a hawkish pause that provided some relief for a strained banking sector and listless stock market.

The Federal Reserve has left the door ajar for at least one additional hike before the end of the year, although this will depend on economic conditions in the coming months.

The Fed’s board of governors moved their rate projections higher for next year, pencilling in just 50 basis points in potential cuts, compared to a 100-basis point reduction in the June forecast.

Chair Jerome Powell indicated the central bank is concerned that continued economic growth in the US could reignite inflation, but avoided spelling out exactly what could prompt the central bank to cut rates.

Clearly inflation is the most important indicator, and CPI (without volatile components like food and energy) fell to 4.3% for the year ending August 31, from 4.7% in July.

The combination of higher US bond yields, falling US share prices and a rising US dollar has created a significant tightening in financial conditions.

However, latest jobs data released last week show persistent strength in the employment market, with US job openings unexpectedly increasing in August, off the back of a surge in white-collar postings. The AFR reported that the number of available positions increased to 9.61 million from a revised 8.92 million in July. Hiring edged up, while layoffs remained low.

It’s a shifting narrative, and analysts are bracing for what they describe as a critical three to six-month period for stocks, as fiscal policy support continues to wind down, economic growth slows, moderating inflation makes it harder for companies to grow revenue and interest costs rise.

The VIX volatility index, known colloquially as ‘the fear index’, is spiking, and consumer confidence fell to a three-month low.

Meanwhile, back home, our markets have been following the US down. With activity still lagging rate rises, significant cash savings remaining in the system thanks to frugal debt-free Baby Boomers, it is a shambolic landscape. New Reserve Bank Governor Michele Bullock was always going to keep her powder dry, keeping one eye on Q3 figures.

The Royal Adelaide Show may have long packed up and moved on, but it seems we’re still in for a bumpy ride.

| _____________________________________________________________________________________________________________ |

|

So often in life, timing is everything. It’s certainly true when it comes to protecting your wealth. Last edition we discussed the pitfalls of Longevity Risk – a situation where Australian retirees live too frugally because they often fear they will run out of superannuation before they die. This month, we bring you ‘Sequencing Risk’ which refers to the order, or sequence, of investment returns and anticipating the timing of market downturns to avoid any adverse impact on retirement nest eggs. Put simply, it’s the risk that a large market correction around five years either side of your retirement date can have a profound negative impact on the longevity of your accumulated wealth. Who can forget the awful situation some Australians found themselves in back in mid-2007 after taking up Treasurer Peter Costello’s offer of a one-off $1 million non-concessional contribution to super (a last gesture before limiting such contributions). The sting in the tail, as we now know, was that the June 30 deadline roughly coincided with the start of the Global Financial Crisis which sent markets into a tailspin and, effectively, turned that $1 million into $600,000. There were, sadly, many shellshocked Australians who were forced to delay retirement as a result. Some have never fully recovered. If you have a mandatory pension being drawn based on a $1 million starting balance and, suddenly, you only have $600,000, it creates an inevitable snowball effect in relation to how quickly you can eat into your capital. The lesson is to ensure that as you’re heading toward your retirement date and then for a period after your retirement – about 5 years either side – you’ve got enough money to make sure your mandatory pension gets paid from non-volatile assets, giving volatile assets time to recover should something go awry. The last thing you want is for a 50 per cent market correction the year that you retire. Because it’s not just the average investment returns that matter but also the timing of those returns, which can have a profound impact on your financial security, especially during retirement. Timing is everything. At the end of the day, that elusive crystal ball doesn’t exist. It’s not about trying to time the market but using tried and true strategies to mitigate risk. More importantly, as a result of pressure from regulators via the Retirement Income Covenant, product manufacturers are finally starting to innovate in the retirement income space which will further avail people to solutions to protect their nest eggs. |

| _____________________________________________________________________________________________________________ |

|

As an empty-nester, downsizing may seem an appealing prospect.

Less maintenance, less gardening (if that’s not your thing), and the ability to unlock capital tied up in bigger, more established homes that can then be pumped into superannuation, as well as other pursuits like holidays and the like.

Recent analysis by the Australian Taxation Office for the AFR Weekend (published last month) shows almost 60,000 downsizers have sold their homes and poured $14.5 billion into superannuation with the proceeds over the past five years.

They are utilising the federal government initiative that allows them to top up their super by $300,000 for individuals and $600,000 for couples.

The AFR says average downsizer contributions to superannuation hit a record high of just over $280,000 after the former Morrison government (in a bid to free up housing supply) dropped the age of eligibility to 55 which came into effect on January 1 this year. Previous eligibility was 60, and before that was 65.

But before you start calling your nearest real estate agent, it’s important to be aware of the potential downside to the downsizer rule.

The family home is exempt from the Centrelink asset test, however, proceeds from any sale are naturally exposed to the test – so the risk is that you potentially reduce or extinguish any entitlement to Centrelink.

Concurrently, recent changes to the work test (ie retirees aged between 67 and 75 years of age can top up their super through non-concessional contributions of up to $110,000 without having to pass the work test), means that most people can put money into super anyway until they’re 75 depending on their total super balance.

The 3 year bring-forward rule also allows you to make a $330,000 non-concessional contribution up front.

As always, every circumstance is different – estate planning objectives and potential future aged care considerations will be different – and nobody should run headlong into it without first seeking advice from a qualified professional.

|

A Tax by any Other Name |

It’s a staggering thought, but it’s estimated that Baby Boomers will pass on around $224 billion each year in inheritances through to 2050 as record housing and super wealth, and fewer heirs, create a $3.5 trillion bonanza for younger generations.

In the first-ever official study of wealth transfers in Australia (released in December 2021), the Productivity Commission projected a fourfold increase in the value of inheritances over the next 30 years.

The $224 billion estimate is based on the finding that $1.5 trillion was transferred between Australian generations between 2002 and 2018, 90 per cent of which was made up of inheritance payments and the remainder of gifts to mostly younger adult children.

Debate around whether Australia should introduce an inheritance tax has flared again in recent weeks, following a speech by incoming Productivity Commission Chair Danielle Wood – but delivered before her appointment in her capacity as the Chief Executive of the Grattan Institute think tank.

While acknowledging inheritance taxes were ‘political dynamite’, she had urged the government to ‘at least have a sensible conversation’ about ‘taxing large inheritances’.

The government has strongly denied it is considering imposing an inheritance tax, with Labor’s Deborah O’Neill declaring it is ‘absolutely… not on the agenda’.

However, to some extent, we already have two distinct forms of inheritance tax – only, understandably, the government isn’t falling over itself to advertise it in this way.

And for that reason, most people are unaware of it.

Firstly, it applies through the superannuation system where – unless your super is left to a dependent – potentially up to a 17% tax (15% plus 2% medicare levy) is applied. That’s the equivalent of $170,000 in tax on a million dollars that you are required to pay upon death.

That’s death duty in disguise.

Secondly, you can transfer the money to the spouse, and while the tax is not triggered, that money remains pregnant with the tax until the spouse dies.

You are going to pay it one way or another, unless you withdraw your money from super before you die.

If you can look into that elusive crystal ball and calculate your ultimate use-by date, then just make sure you work backwards and take all your money out of super by then.

Simple really!

It’s also important to understand the implications associated with Capital Gains Tax when estate assets change hands. Assets bequeathed through an estate are deemed a ‘transfer of beneficial ownership’ which may be a CGT event. Poorly timed transfers potentially lead to higher tax payments, especially if the assets are transferred during a period of significant appreciation.

Again, an estate tax by another name.

In the case of a property which cannot be ‘broken up’, it can mean that the asset has to be sold to pay the tax.

Proper estate planning is crucial to minimise the tax burden and ensure a smooth transition of assets.

|

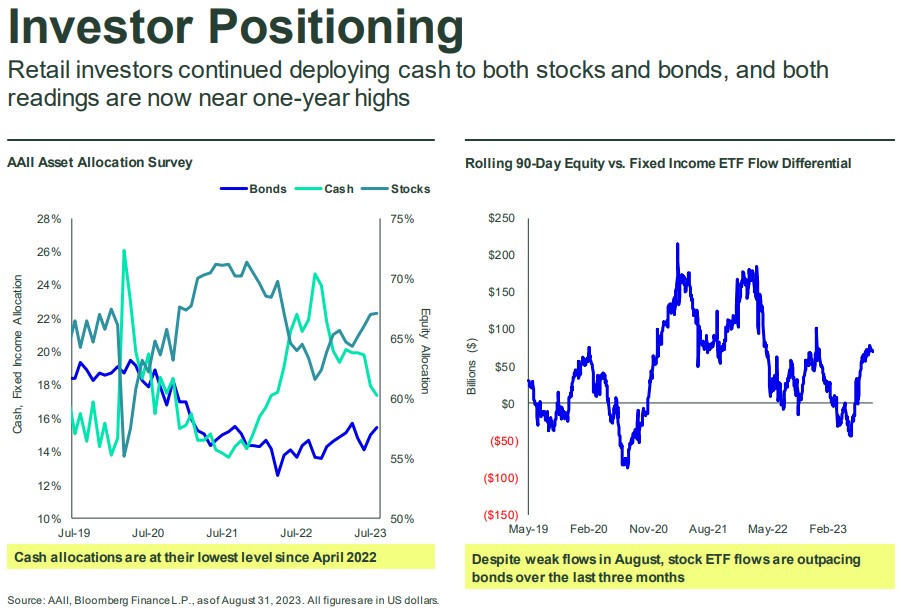

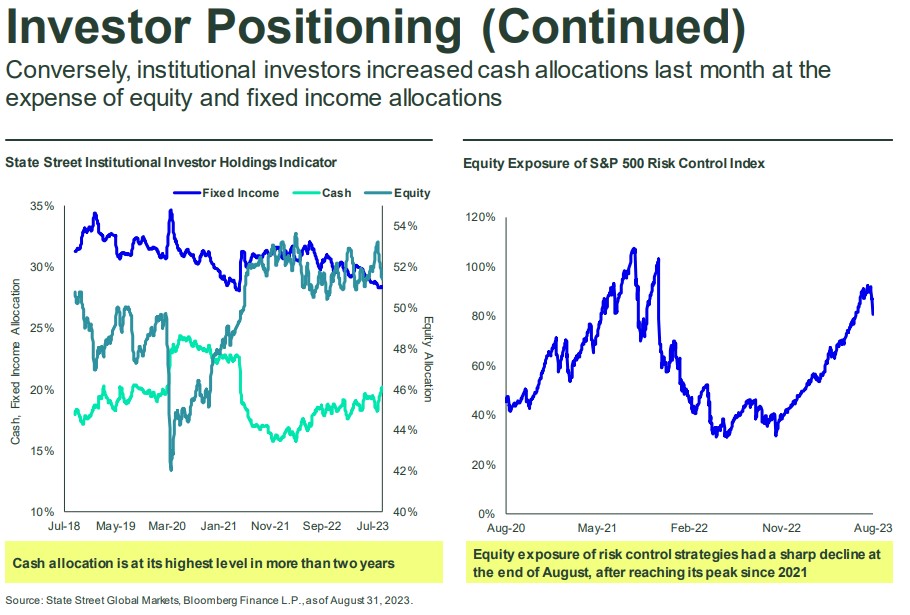

Charts of the Week

Here we have an interesting tale of two investor cohorts and their diametrically opposed approach to the same set of conditions. This is based on US data, and Australia may be different due to tighter consumer protections. Interestingly, while institutions have moved out of equities in the last month and into bonds, retail investors have done the opposite and bought in. The smart money is firming on fears of a looming recession; a view that markets have been too buoyant and we see institutional investors selling out of the stock market – at the exact same time retail investors, flushed with FOMO (a fear of missing out) at signs of the market rising, buy in. Just in time for it to (potentially) fall. The prevailing view is that while rates might not rise much more, they might stay at this level for longer than investors had originally expected. This ‘higher for longer’ rates narrative is casting a negative pall over markets. Realistically, some of the markets already started pricing in rate reductions from early 2024, but if it’s not until early 2025, that’s going to be an extra year of higher rates and higher cash-flow outflows, so this is seeing a repricing. Ultimately, this reinforces the importance of maintaining diversification, to use dollar cost averaging if you’re entering the market, and not to get caught up in the market euphoria. |

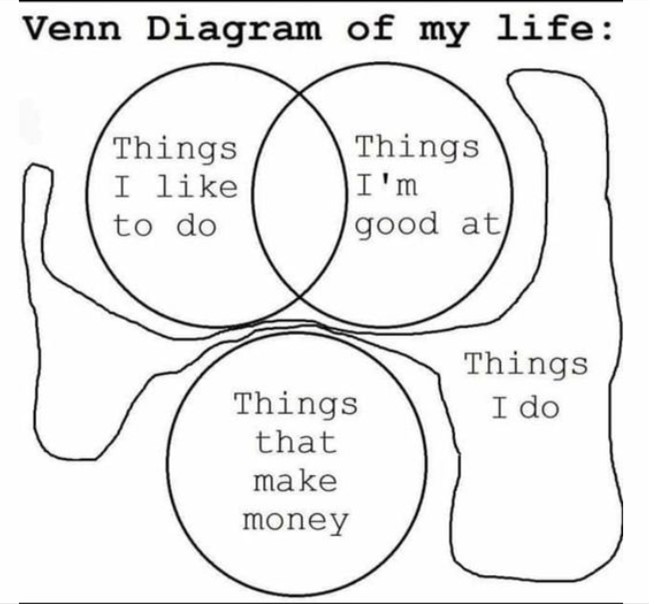

Friday Funny

We send our best wishes to our State’s Year 12s who head back to school next week for what will be their remaining few days in the classroom before they hit the books ahead of their final exams.

In the spirit of this exciting new chapter for them, we thought we’d bring them a little career advice by way of this Venn Diagram.

As someone once said, when you love what you do, you’ll never work a day in your life.

Even better if you’re paid for it.

That’s the average amount of money that Australians believe they need to start investing in the sharemarket – up from 14,800 last year.

The survey* – of 1056 investors by HSBC, found 76 per cent of Australian investors changed their investment approach in the last six months, with 29 per cent of investors becoming more conservative, and only 9 per cent taking a more aggressive approach (interestingly, in contrast to our previous article in relation to the US).

Our view is we don’t think that’s anywhere near enough to allow for adequate diversification – in fact, it probably only allows about 4 stocks and will mean you will likely only be exposed to one sector, eg the banks.

*https://www.about.hsbc.com.au/news-and-media/australians-are-investing-less-and-more-conservatively-hsbc-survey

Difficult balancing act as Australia treads the tightrope of energy transition

Most change comes with a degree of discomfort.

Australia’s commitment to achieving a net-zero emissions target by 2050 – and its more immediate push to meet its 82 per cent renewables and 43 per cent emissions reduction targets by 2030 – is a commendable step towards a sustainable future.

But it’s not without its share of challenges.

Industry experts continue to voice concerns about the rate at which the nation is building renewable energy generation to replace ageing (and retiring) coalfired power generators, with big projects suffering from rapidly escalating costs and/or strong community opposition.

The Australian Energy Regulator’s ‘State of the Energy Market’ report for 2023, released last week, finds that alongside the closure of the Liddell in NSW, a further four coal-fired power stations are scheduled to close in the next decade, requiring urgent investment in generation, storage and transmission capacity to fulfil forecast shortfalls.

It’s also been reported that up to 28,000km of new poles and wires is required to carry green energy across the country, but at the current rate, that seems a long way off.

The mining sector is in the box seat over the next decade as demand for lithium, copper, nickel and rare earths soar on the transition to renewable energy and demand for batteries.

But, with the sector notorious for its volatility, the challenge for investors will be to seek the right level of exposure to seize the moment while mitigating risk.

It’s worth noting too that the AFR’s Energy and Climate Summit last week, which attracted some of the nation’s leading energy experts and industry leaders, heard warnings of an impending summer of blackouts fuelled by the return to El Nino summer conditions, “increasingly unreliable coal power generation, an overstretched transmission system and a slow build-out of renewable energy and the firming generation to support it”.

It will be critical to understand which parts of the economy will be most impacted by outages, should they become more common (as predicted) throughout this transition.

We’ll be watching this space closely.

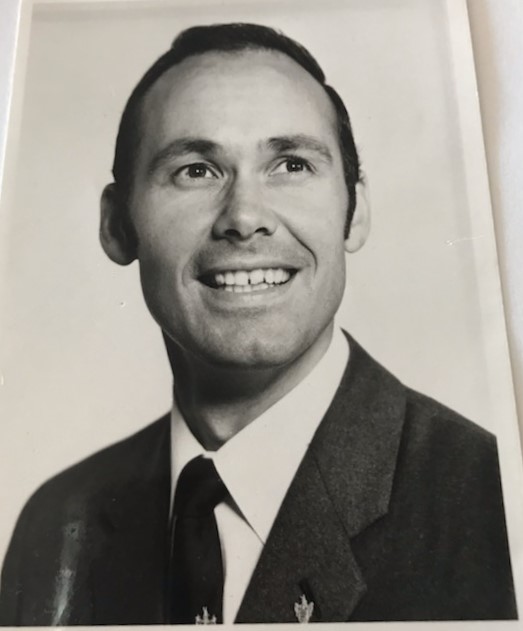

Vale Graham Thomas

It is with sadness we advise of the passing of one of FinSec’s founders, Graham Thomas.

Graham started in the insurance industry as an “office boy” in in the early 1960s before deciding to move into sales as “the man from Prudential” in 1965.

He was successful and before long had built a business which had evolved into personal and corporate superannuation consulting and advice.

Graham became a financial planner before the term even existed.

His business continued to grow until the mid-1990s when he made the decision to retire, aged 59.

He sold the business to David Wade who was a partner at FinSec for nearly 20 years. Many of our long-term clients are part of our business because of Graham’s care and influence and regularly express their gratitude for the impact that Graham had on their lives.

Graham was widely respected across the industry as a true professional and, more importantly, as an absolute gentleman.

Our sympathies are extended to Graham’s wife Joyce and his children, Greg and Donna, and their families.

Graham’s legacy is part of the fabric of FinSec, and we are very grateful for the opportunity to be the current stewards of the business he founded so many years ago.

| Stay safe and look after one another. As always, if you have any concerns or questions at any time, please reach out to your FinSec adviser. |