Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A FinSec View – Markets, Super Taxation, NDIS and More…

| 26th July 2024 |

Global Affairs and Market UpdateThere is a lot going on in the world right now! The combination of favourable weather in the northern hemisphere, several major cultural and national celebrations, annual sporting events such as Tour de France, Wimbledon and The Open, in addition to the Olympics, has meant this July has been a particularly active and eventful month globally. Politically, we’ ve seen the UK dump the Conservatives after 14 years and elect a Labor Government under Sir Keir Starmer; France swing to the far right then back to the centre left with an interim caretaker government in place just to get passed the OIympics; and the US lose one presidential candidate/ incumbent to a combination of health issues, mental acuity and party pressure, and nearly lose the other main contender to a snipper’ s bullet. Past Trump court appointments have also passed two favourable judgements for the former president: his legacy stacked Supreme Court ruled he was entitled to some immunity from criminal prosecution for actions relating to his presidency while a lower court judge also found a way to upend the case against him for stashing confidential files all over his Florida mansion. Tensions flared between Turkey and Syria with anti-Turkish riots erupting in northern Syria and Turkish forces opening fire on protestors. Meanwhile, the NATO summit focused on the ongoing conflict between Russian and Ukraine, which was devastated by the bombing of a children’s hospital. Hurricanes in the South East of the US and The Philippines have wreaked havoc causing wide spread flooding, death and destruction. Hurricane Beryl swept through the Caribbean, Texas and other southern US states. Preliminary estimates put damages in the US alone at between $28 billion to $32 billion for direct and indirect costs and damages to homes, businesses, infrastructure, facilities, roads and vehicles, as well as power outages resulting in food spoilage, job and wage losses, flight delays, and interruptions to medical care. It is too soon to count the cost of Typhoon Gaemi in The Phillippines and Taiwan but it will deliver another massive hit to the insurance industry. >>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>> Meanwhile, with all of this going on, the global economy appears to be in a Goldilocks state, with growth hovering around 3%, indicating a balanced state of neither being too hot nor too cold. The US economy, previously showing exceptional growth, is now slowing down due to higher interest rates and the exhaustion of pent-up pandemic savings, which has brought demand and supply into equilibrium. Similarly, the Eurozone, United Kingdom, and Australia have experienced improvements in economic activity, albeit facing challenges related to interest rates and cost of living pressures. China’s economy has seen marginal improvement due to government stimulus measures geared towards supporting the property and stock market, along with a focus on reviving consumer spending and investment. Labor markets in major economies have been cooling, leading to gradual rises in unemployment and easing wage pressures in most regions. Central banks, such as the US Federal Reserve and our RBA, have highlighted downside risks to the labour market and view wage growth as having peaked. Inflation has generally been trending lower across most countries, with the US Federal Reserve officials waiting for more data to ascertain if inflation is sustainably decreasing before considering a rate cut. However, the expectation is that there will likely be one to two rate cuts in the US, another cut in the Eurozone, and two cuts in the UK. In Australia, recent inflation data has exceeded expectations and whilst there has been talk of a rate rise, our view remains (subject to a benign June quester CPI print) that rates will be stable for the duration of the calendar year. In financial markets, the Goldilocks environment of stable global growth, decreasing inflation, and gradually rising unemployment has had a positive impact. Despite a modest increase in bond yields over the June quarter, global equities have continued to reach new record highs. The gains have been supported by solid earnings, particularly from leading US technology stocks, and an optimistic outlook for the broader artificial intelligence theme. However, Australian equities, which lack exposure to significant investments in artificial intelligence, have struggled to keep pace with the gains in US equities. While interest in artificial intelligence is expected to persist, broad equity market gains based on increasing valuation multiples may be challenging in the short-term. The US market has seen the tightest concentration to large cap stocks since the 1920s however, this months there appears to be the beginning of an unwinding and rotation to mid and smaller caps. Consequently, a consolidation period seems likely, as seen in sectors and equity markets outside the leading US technology stocks. Although equity valuations remain high, analysts anticipate global corporate profits to accelerate in the coming years due to reasonable economic growth, lower interest rates, and slower cost growth. This, in turn, is expected to widen profit margins. While the risk of a significant decline in equities is not necessarily high, concerns linger as stock markets are already pricing in a substantial amount of positive news, with year-to-date returns surpassing long run full-year average returns. Any further equity gains would likely depend on the continued optimism surrounding artificial intelligence and the narrow rally of the leading technology stocks. Despite the recent strong earnings results, our view is to remain cautious and expect some bumpiness given the current market dynamics. |

Shipping News

Not only do Australian consumers, businesses and the Reserve Bank have to contend with rising prices and competition because of dual crises in world shipping but port stevedores in Australia are jacking up fees as well. Risk of attack by Yemen’s Houthi militants is forcing freight laden ships to take longer routes to avoid the Suez Canal and Red Sea, and instead travel between Europe and Asia via the Cape of Good Hope. The risk has been heightened for nine months in response to Israel’s war in Gaza after the October 7 assault by Hamas. The additional travel time is adding weeks to voyages and is contributing to massive disruption at the world’s second-largest port in Singapore, where ships and crews sit idle and burning extra energy and fuel for as much as a month. If you have ordered an overseas manufactured vehicle this year – especially at the luxury end – you will be fully aware of the impact of shipping delays. It also doesn’t help that we’re a smaller population right at the end of most international shipping routes. The global uncertainty has international importers particularly in the US scrambling to bring forward delivery schedules over fears of supply chain disruptions and as a result increasing competition for available ships and containers. Meanwhile, there have been calls for the Albanese Government to regulate port fees after DP World raised its imported container fee handling by 21 per cent and fees on exported containers by 52 per cent to $175.70. Since March, Patrick has charged $204.60 for every container into Melbourne, up 20 per cent on a year earlier, and $146.65 for every container exported, up 7.5 per cent.

The port operators charge truck and train companies to access waterfronts to load and unload cargo and the increased fees are adding to shipping costs for Australian importers and exporters who are already facing months long delays because of the Red Sea conflict and Singaporean congestion. Retailers say increasing shipping and transport costs and growing backlogs are forcing them to think about raising prices for some of their imported goods, and economists warn the crunch is a red flag that could drive up goods inflation. According to the AFR, the Australian Competition and Consumer Commission on Thursday said it was “gathering more information and conducting further analysis” on terminal access charges and flagged it would have more to say in its next container stevedoring monitoring report, due by December. Economists and the like agree the global shipping crisis risked stoking local inflation. “It certainly doesn’t help the RBA at a time when inflation is sticky, or perhaps even stuck, at 4 per cent (and) where there is mounting pressure on the RBA to consider an increase interest rates,” says GSFM investment strategist Stephen Miller. Rob Hango-Zada, founder of Shippit, said a retailer could no longer rely on inventory arriving from offshore in a reasonable timeframe. “ As the cost of containers increase, those costs then flow on, and because of those shortages and fluctuations in labour, you then start seeing labour shortages or excessive labour messing around with the unit economics for the ports,” he said. He says the higher port costs had a flow-on effect into fuel, which cascades through the supply chain to the retailer and customer driving up inflation of regular goods. If you want to avoid disappointment this Christmas, definitely don’t leave your shopping to the last-minute. Now would be a good time start. |

Superannuation Bill Update

With the Australian Parliament now on its annual mid-winter break, the controversial Bill to amend taxation rules on superannuation balances above $3 million has been postponed until after both Houses return in mid-August. Keen observers were surprised to see the House and Senate fail to progress the Bill earlier this month; it appears the Government, while not wanting to completely rewrite its intent may be reconsidering elements of the Bill in light of the need for greater crossbench support in the Senate where it doesn’t have the numbers to pass the legislation. This is apparently an outcome of WA Senator Fatima Paymen’s decision to quit the ALP. Just to recap: the Government’s wants to pursue broader reform to superannuation supposedly to ensure greater fairness and its sustainability. When its plan was announced last year to raise the concessional tax rate for balances exceeding $3 million from 15 per cent to 30 per cent, the superannuation industry largely commended the perceived push for equitability. However, that support soon crumbled and morphed into furious opposition when the unintended consequences of the Bill became evident. When it was realised that antiquated bookkeeping systems of most Industry Super funds meant they couldn’t provide the information necessary to levy the proposed tax, the Government instead opted for a tax on gains in the total market value of superannuation funds above $3 million including unrealised capital gains. This means that individuals would be taxed on the increase in the value of their investments even if they have not sold them – a break with conventional taxation principles. The Government defends the Bill by arguing that it targets only the wealthiest superannuation account holders and aims to reduce inequities in the tax system. These super balances of course were created in good faith under previous rules, so this is an effect a retrospective penalty and therefore lacks fairness. Nor, is the threshold indexed, so in decades to come it will capture greater number of Australians. Kate Chaney, independent MP for the WA seat of Curtin summed up the concerns of most independents, Teals and crossbenchers when she told Parliament earlier this year her four main concerns were: taxing unrealised gains; double taxation; not indexing the threshold; and no transition period. “Today, $3 million seems like a lot of superannuation, but $3 million in 2064 won’t look like it does now. It’s been submitted that, for a 30-year-old today, this cap is effectively more like a $1 million cap, in today’s dollars, by the time they retire,” she said. “Indexing these sorts of thresholds allows the intent of a policy to continue into the future, instead of gradually ratcheting down the benefit of superannuation saving over time. Not indexing the $3 million threshold has the potential to embed further intergenerational inequality.” Commentator Robert Gottliebsen, who opposes the Bill on behalf of small business owners and farmers in particular and is keeping watch on its progress, sees sense in the words of the Self-Managed Superannuation Fund Association: “No other pension system in the world taxes unrealised capital gains, and it’s not the way the Australian tax system works either. As soon as you depart from actual taxable earnings as the basis for the calculation, there will be plenty of unintended consequences and unfair outcomes, and that’s exactly how this proposed new tax will play out. The only way to remove unrealised capital gains is to use actual taxable earnings.” If you are likely to be affected by these changes our view at this stage, is to do nothing. Wait for the legislation to pass in whatever form is agreed and from there are a number of strategies available to minimise the impact of the new tax. |

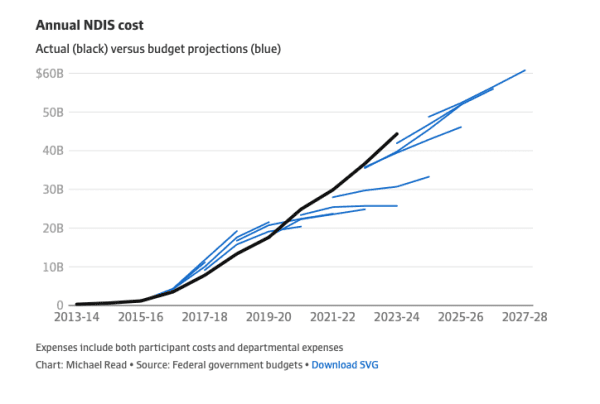

That’s how many jobs created in the past year can be attributed to the ballooning National Disability Insurance Scheme (NDIS). Back in April, The View commented on how the explosive growth in the $42 billion NDIS was masking Australia’s unemployment rate or so-called jobs growth. It’s also helping to propel Commonwealth Government spending to near record levels as a share of GDP.

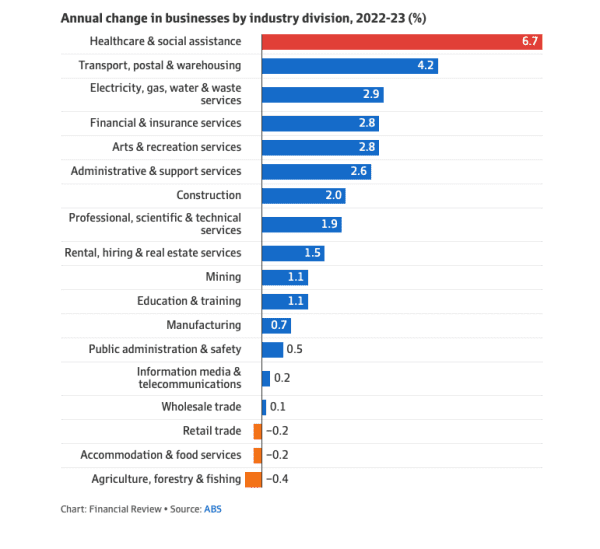

Now, it’s not only a concern to taxpayers but economists now say it partly explains why Australia has a productivity and inflation problem. As a headline in the AFR recently questioned: Is (the NDIS) an economy killer too? Employers in aged care, childcare and cleaning, warehousing, retail and hospitality, are losing staff to $70-an-hour, self-employed NDIS jobs. When employers can’t retain or attract staff, they resort to pushing up pay rates, well above awards, in order to compete. So, the NDIS is now impacting wage growth and productivity. Next impact is overall inflation, and then RBA decision-making. The national accounts last month showed labour productivity, measured as GDP per hour worked, has flatlined over the past 12 months and was sitting 5 per cent below its pre-pandemic peak. Productivity is the key determinant of living standards. The higher it goes, the higher real wages can sustainably rise as workers become more efficient at producing goods and services in a low-inflation way. RBA Governor Michele Bullock has stressed the importance of a productivity recovery to ensure wage rises were sustainable and don’t fuel inflation in a full-employment economy. But while productivity growth in the private sector is in reasonable health and is now above its pre-pandemic level, in industries where the government sets or regulates prices – health care and social services, public administration and safety, education and training – it’s been going backwards. The “ care economy”, of which the NDIS is a growing part, is becoming a bigger share of the overall economy. It’s not just because Australia is ageing. Some 12 per cent of boys aged five to seven for example are enrolled in the NDIS, largely due to autism and developmental delays. That’ s more than one in 10. Many of the jobs being created by the NDIS are not frontline care jobs directly benefiting people living with disability, they’re low-paying administrative and intermediary jobs, such as support co-ordinators and plan managers that help participants to submit their NDIS invoices and navigate the excessively complex NDIS ecosystem. Since June 2020, the number of businesses in social assistance and healthcare has exploded by about 49,000, according to the Australian Bureau of Statistics. The rate of business growth in health and social assistance is nearly three times the pace of population growth. Healthcare and social assistance businesses grew at a faster rate than any other sector in the year to June 30, 2023, expanding by 6.7 per cent. Australia is now among the biggest government spenders on disability in the world, outlaying more than $84 billion a year (more than 3 per cent of GDP), for items such as the NDIS, disability support pensions, and carer payments. The NDIS is a world leading approach to supporting people in the community with a disability however, there should be general concern the scheme is so easily exploited, the target of criminal syndicates and private equity, who all view it as one gigantic pot of money.

|

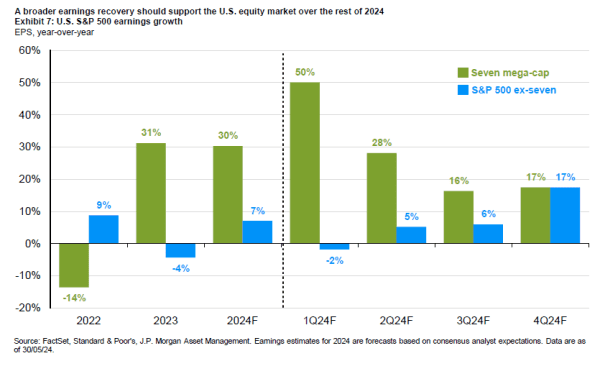

Chart of the MonthTo our comments above about the rotation away from US large caps, our chart of the month shows JP Morgan’s projected equalisation of corporate earnings across the broader index. It also highlights why the Magnificent Seven mega caps have been the primary driver of the US market over the last couple of years.

|

Friday FunnyGiven the cost of living crisis we are all feeling the pinch, wouldn’t it be great if our phone charges could really do this! |