Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A FinSec View – Markets, SOFY, US Elections and More…

| 28th June 2024 |

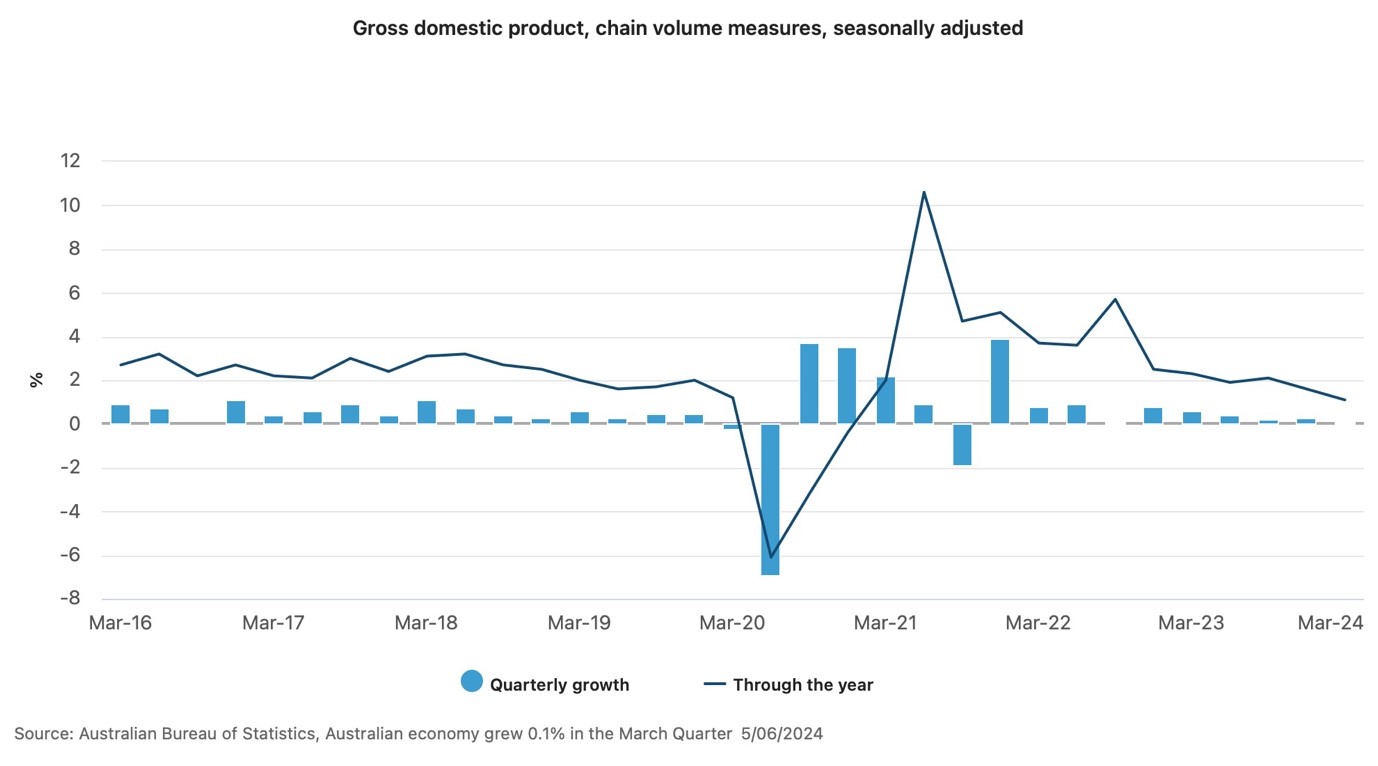

Market UpdateAnother RBA meeting, another month of rates on hold at 4.35%. This remains unchanged for six months. Governor Bullock has expressed concern about potential upside risks to inflation and reserved the right for further rate hikes. So…No reprieve for mortgage holders just yet. Our view remains unchanged: a policy rate of 4.35% is materially tight. You can see this in the percentage of household income being set aside to pay mortgages and it is clearly slowing growth. Australian real GDP for the first quarter grew by just 0.1%. It’s not quite a recession but it’s as close as you can get to a contraction. The labour market is gradually loosening, with job vacancies collapsing, wage growth flattening out and consumer spending stalling. The second quarter inflation print will be important. The result will determine whether the RBA are convinced that they have done enough to bring inflation back to within their target band by the end of year. This week saw May’s number come in at 4% but looking behind the headline, our view is that the RBA have done enough. Australia appears to be three months behind other advanced economies on this journey. It appears that the global easing cycle has started with central banks in Canada and Europe easing policy in the last month with Switzerland and Sweden easing earlier in the year. Markets are pricing in cuts in Australia, UK and New Zealand later in the year. Our view is Australia may be late to the party with cuts not arriving until calendar year 2025. We do however, not expect any further rate rises. Michelle Bullock will no doubt continue her hawkish rhetoric to keep us on our toes but there is enough evidence of a contraction in consumer spending to suggest that any further rate rise risks pushing the economy into a recession. Whilst the Australian consumer has proved incredibly resilient through the pandemic and beyond, it is clear this resilience is now waning. Our post lockdown “revenge spending” has abated, with 40% of households having exhausted their Covid savings. Job security confidence has weakened as corporates start to shed jobs and the reality of “higher for longer” is taking hold. Markets have generally range traded (with the exception of US tech) for most of this year whilst they wait on something concrete to give them direction. It would appear that rate cuts have been priced in for early 2025 however, any surprise on the upside will create some volatility. A very narrow path indeed for our central bank, our view is “on hold for 2024 with some relief in early 2025”. |

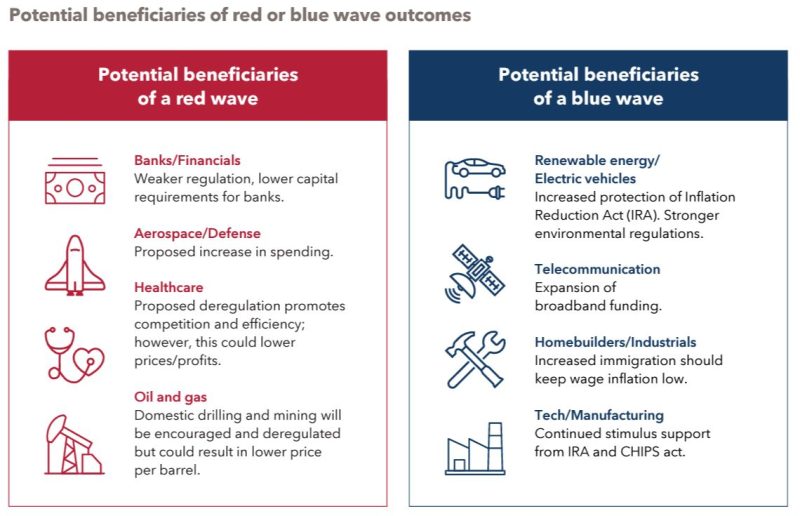

Looming US Elections: Impact on MarketsIn the aftermath of the first US Presidential debate we thought it timely to consider what the election result might mean for markets. Thanks to Capital Group for this summary: The rematch is on. With incumbent President Joe Biden and former President Donald Trump set to square off in November, the 2024 US election could produce a significant shift in political leadership, potentially leading to policy changes that are likely to affect the investment environment. Much depends on whether the winning presidential candidate can muster enough support to propel other candidates in his party to victory, taking control of the US Senate and the House of Representatives in a red wave or blue wave scenario. Otherwise, a gridlock scenario could prevail, with little change expected. However it plays out, investors should expect occasional bouts of market volatility in the months leading up to Election Day. A Republican sweep, or red wave, could benefit banks, health care providers, and oil and gas companies, primarily through deregulation, according to Capital Group’ s Night Watch team, a group of economists, analysts and portfolio managers who track such issues. A Democratic sweep, or blue wave, could provide a boost to renewable energy initiatives, industrial stimulus spending and telecommunications projects through additional funding for nationwide broadband access. As for the presidential election, it remains too close to call. “We’re still a few months away,” says Capital Group political economist Matt Miller. “And that’s a lifetime in politics.”

Source: Capital Group. IRA is the US Inflation Reduction Act which enhanced or created tax incentives for clean energy and manufacturing. CHIPS Act refers to the Creating Helpful Incentives to Produce Semiconductors Act, passed by US lawmakers in 2022 to encourage domestic manufacturing of computer chips. |

SOFY Health CheckOur best intentions to be organised and maximise opportunities as we approach EOFY are often unfulfilled as we find ourselves light on time and resources at crunch time!! The View is therefore declaring the start of the financial year (SOFY) as a more practical and timely opportunity to plan for the year ahead and put the building blocks of your financial strategy in place well before any time pressure kicks in. With the Stage 3 tax cuts coming into play next week, here are some prompters to consider as we enter FY25. Investments

Superannuation

Retirement

Personal Insurance

Stage 3 tax cuts The reworked Stage 3 tax cuts will come into force in July, delivering an average tax saving of $1,888 a year, or $36 a week. What impact could this have on your mortgage or on your superannuation balance? This basic calculation shows the impact of someone putting their weekly tax saving into their super. Starting balance: $100,000 Fortnightly contribution: $72 Avg Superannuation return last 20yrs: 6.6% Increase over 20yrs: $77,430

*The teal blue colored bars = Impact on your super should you invest tax savings. *The light blue colored bards = Impact on your super should you spend the tax savings and not reinvest Alternatively, if the extra cash was channelled to a $500k mortgage, the term would reduce by 2 years. How will the Stage 3 tax cuts affect your overall tax liability?? It depends how you spend it but consider consulting a tax professional to understand the impact for you, taking consideration of your specific circumstances. |

That’s how much Australia’s economy or GDP grew over the first three months of 2024.

Over the past year it’s sitting at just 1.1 per cent. Katherine Keenan, at the ABS, said the national economy had now experienced “its lowest through-the-year growth since December 2020″. AMP chief economist Shane Oliver was among those to call the result the worst since the early ‘90s. While still not in an official or technical recession, economic activity per person has fallen for the fifth consecutive quarter, dropping 0.4 per cent in the March quarter and 1.3 per cent through the year. As The View has alluded to before, it’s largely been due to migration numbers that we haven’t fallen into an actual recession, even if it smells and feels like one. As most economists agree, it’s this formation of new households – setting themselves up in a new country with new cars, appliances, furniture and other household goods, and buying phone and Wi-Fi plans plus everything else essential for basic living – that has offset the weak spending by already established population. The other group still spending includes those who are close to paying off their mortgage or have already done so and are getting higher interest on their term deposits. The minuscule growth we did see can in part be attributed to the hoards who bought a ticket, a flight and accommodation to see either Pink, Taylor Swift or both. This has been dubbed the term ‘ Taylornomics’. The limited growth we had, was kept in check by poor business investment, which fell 0.8 per cent, largely blamed on a 4.3 per cent drop in non-dwelling construction. Nevertheless, spending on machinery and equipment was up 2.2 per cent and computer software up 2.3 per cent, perhaps a sign of companies responding to the AI tech revolution now underway. Australian corporate debt is at the lowest level it has been relative to the size of the economy in about 25 years. This is despite the seemingly record high number of liquidations as discussed in last month’s The View. Treasurer Jim Chalmers leapt on the weak first quarter GDP result saying it supported the federal government’s decision not to pursue more spending restraint in its latest budget. “What we have demonstrated in the budget when it comes to our fiscal strategy is that it is perfectly calibrated for the combination of challenges that we confront.” On the flip side, Shadow Treasurer Angus Taylor called the GDP figures a “wake-up call” for the federal government, saying they were a “truly shocking set of numbers”. Taylor also said the five consecutive quarters of negative GDP per person growth proved that the “household recession” is ongoing and shows no signs of ending. “There’s a whole generation of Australians who have never seen anything like this before.” Taylor said it was proof that the government has “the wrong priorities and the wrong policies”, and Australians are paying “a very high price” as a result. Senior Westpac Currency Strategist Sean Callow put it more bluntly: “Empty all your pockets, check down the back of the couch, smash the piggy bank…” With this week’s sticky inflation numbers it would seem that it is unlikely to get any easier any time soon. |

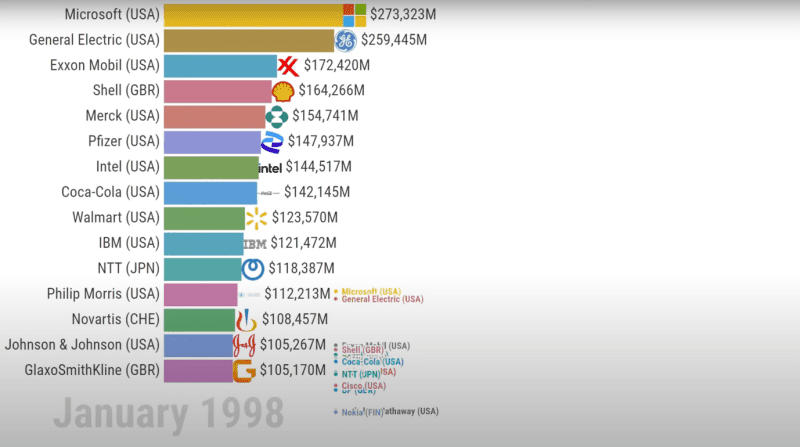

Chart of the WeekThanks to an innovative Chilean statistical information company called Global Stats, which loves to turn a wide variety of data, statistics and information into fascinating, high-quality animated videos, our Chart this month comes from a video found on YouTube called “The World’s Most Valuable Companies 1998-2023”. The following chart profiles the list in 1998, 26 years ago.

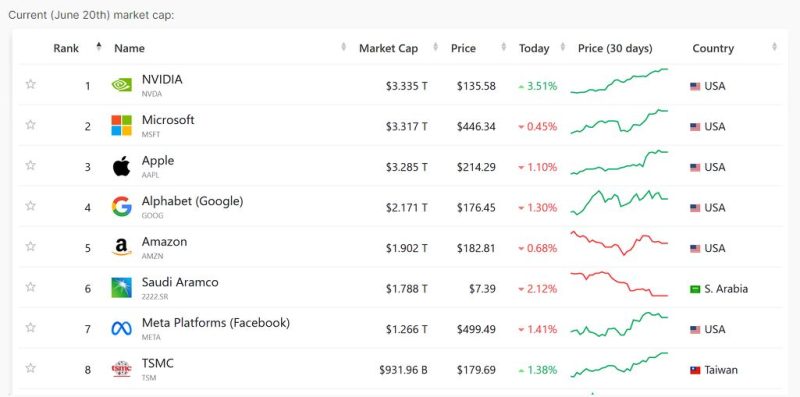

This chart shows an entirely different list from 2023.

We share these screenshots as the start and finish of an eight-minute video, which charts the stratospheric rise over the past 25 years of the biggest technology companies and their global dominance. Watching the whole eight minutes is a fascinating reminder of huge socio-economic changes we’ve witnessed globally – the demise of traditional manufacturing, the proliferation of the world wide web, the tech bubble, mobile phones then smartphones, China’s growth, a global pandemic. Watch the video here. However, the standout change, which is starkly depicted in these two charts is not just who is on top but what they are worth compared to the rest on the list. In the top chart from January 1998, the value of the top 15 companies was pretty even although the Top 5 accounted for 45% of the overall value. Compare that to the second chart below from January 2023, when the top five companies held over double the value of every other company below them and accounted for 63% of the overall value. As a final observation, the chart below highlights that there has been even further consolidation amongst the tech titans in the last 18 months.

|

Cyber Security – Staying updated on Scams

Scamwatch.gov.au is the national anti-scam website run by the ACCC for the National Anti-Scam Centre, aimed at raising awareness about how to recognise, avoid and report scams. It publishes news and alerts based on information from scam reports and works with government, law enforcement and the private sector including the Australian Financial Crimes Exchange (AFCX) to disrupt and prevent scams. The AFCX is an independent, not-for-profit organisation formed by the big four banks to help combat financial-related crimes. The AFCX is a channel through which intelligence and data gathered on financial and cyber-crime is shared and analysed. It aims to get ahead of criminal trends, activity and networks that operate across different businesses not just banking. Some stats from the National Anti-Scam Centre’ s third quarterly update for January to March 2024, which provides a snapshot of Australia’s current scam environment.

With the tax return season approaching, the digital world ever evolving and the age of artificial intelligence becoming more and more prevalent, we wanted to raise awareness about the increased risk of cyber scams. Scammers often exploit this busy period, targeting individuals and businesses with fraudulent schemes designed to steal sensitive information and money. By highlighting the tactics used by these fraudsters and sharing essential security practices, we aim to make you are aware of the riskd and avoid falling victim to these malicious activities and ensure your financial and personal information remains secure. Remote Access Scammers In today’s interconnected world, where remote work and digital interactions are commonplace, remote access scams have emerged as a significant threat to individuals and businesses alike. These scams exploit technology to gain unauthorised access to computers, often under the guise of providing technical support or assistance. Let’s delve into what a remote access scammer does, the tactics they use, and how you can protect yourself. What is a Remote Access Scam? A remote access scam typically begins with an unsolicited phone call, email, or pop-up advertisement claiming to be from a reputable tech support company, software vendor, or even a government agency. The scammer convinces the victim that their computer has been infected with a virus, compromised, or requires urgent updates. They create a sense of urgency and fear to prompt the victim into taking immediate action. Protecting yourself from remote access scams involves being vigilant and taking proactive steps. If you receive an unsolicited call or email claiming to be from tech support, hang up or delete the email. Contact the company directly using official contact information to verify the legitimacy of the request. Remote access scams exploit trust, technology, and fear to deceive victims into compromising their computer security and personal information. By understanding the tactics used by scammers and taking proactive measures to protect yourself, you can reduce the risk of falling victim to these fraudulent schemes. Remain vigilant, verify communications from unfamiliar sources, and prioritise cybersecurity practices to safeguard your digital life. Impersonation Scams Impersonation scams can take various forms, but they typically involve tactics like, a phone call from a scammer pretending to be from a government agency, law enforcement, utility company or financial institution. Claiming you owe money, have unpaid taxes, or is facing legal consequences unless immediate payment or action is taken. If you receive any such phone call, hang up immediately and if you are still concerned, contact the company directly using official contact information to verify the legitimacy of the request. It can even come through in the form of phishing emails or text messages that appear to be from legitimate organisations and contain urgent requests to verify account information, reset passwords, or click on malicious links that lead to fake websites designed to steal personal information. Always treat unsolicited emails and text messages with extra caution especially if they request personal information or financial transactions. Never click on any links or download attachments from unknown senders. What will we do to protect your information:

|

Introducing My ProsperityWith these challenges at the top of minds daily here at FinSec Partners, we have been research methods to further protect your money and data and have identified a technology that will add another layer of protection for your information and financial transactions with us. In the coming months you will receive information about “My Prosperity”, a secure online Australian portal for password-protected exchanges between users. Think of it as a vault that only you and we can access. Some of My Prosperity’s features include:

With its advanced features and robust security measures, My Prosperity will assist Finsec Partners to continue providing our clients with industry leading support and services in a secure, efficient, and collaborative environment. We are in the process of transitioning to the new secure portal, and further information will be shared with you soon. |

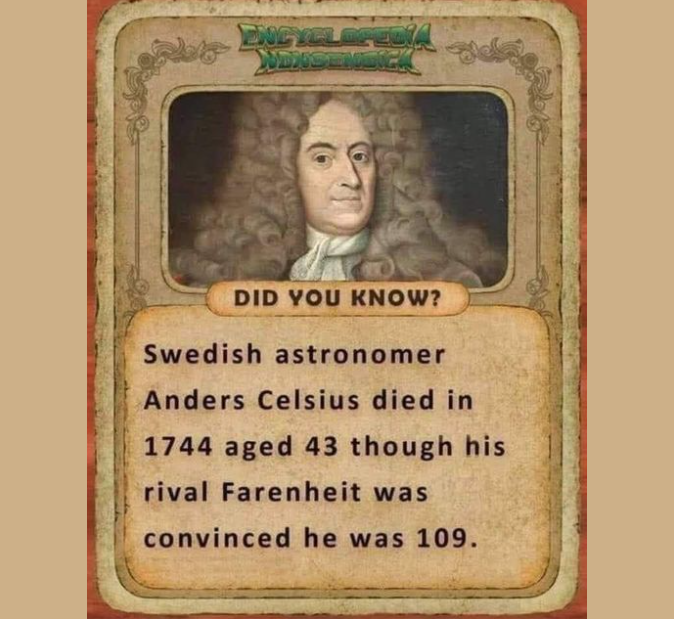

Friday Funny

|