Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A FinSec View – Markets, Rates, Cyber Scams & more…

|

15th December 2023 |

Yes, Virginia, there is a rate pause (and possible Fed cuts coming into view)

Dear readers, it’s that time of year again, when we put the finishing touches on December and pause to reflect not only on the past 12 months but turn our minds to all the possibilities a New Year brings.

There’s no question it’s been a turbulent economic year, as white-knuckled Central Banks have tried desperately to put the brakes on rampant inflation – and, in doing so, put the squeeze on millions of stressed-out mortgagees and businesses around the world.

US Federal Reserve chair Jay Powell confronts an increasingly mixed economic picture. While the labour market in the world’s largest economy is resilient and consumer spending is solid, there are signs of slower growth and, in turn, lower inflation.

Capping off its final policy meeting of the year in which the Fed left rates flat at a 22-year high for the third straight time, officials signalled that they expect to make three quarter point cuts to their benchmark rate next year.

And while the champagne is on ice, Powell says it’s not the time to be popping the cork just yet.

“No one is declaring victory, that would be premature. We are not guaranteed of progress, so moving carefully in assessment of (whether) we need to do more. The question of when it will be appropriate to cut rates is coming into view,” he said.

Markets, though, were in party mode – welcoming the prospect of lower rates.

In fact, they’d already been flagrantly ignoring Powell’ s previous warnings that additional monetary tightening is on the table, pricing in interest rate cuts sooner than expected. Gold and bitcoin skyrocketed this week, as more optimistic traders switched investing strategies into “riskier” territory – the antithesis of the philosophy of the late Charlie Munger, Vice-President of Berkshire Hathaway, who loathed cryptocurrency.

Allianz chief economic adviser Mohamed El-Erian said ahead of the Fed meeting that the Fed may well tolerate higher inflation instead of pushing the economy into recession to hit its 2 per cent target. But he also said investors are over-reacting by pricing in sharp rate cuts.

“The whole point of forward guidance is for the markets to listen to you and for the markets to do the heavy lifting for you. What we’re seeing now is forward guidance, as we saw last Friday, is being completely ignored by the market,” he told Bloomberg radio.

“The market’s basically telling the Fed ‘I don’ t care what you think about an interest rate that you set, I think you’re going to do something completely different’. That’s quite a statement from the market to the Fed.”

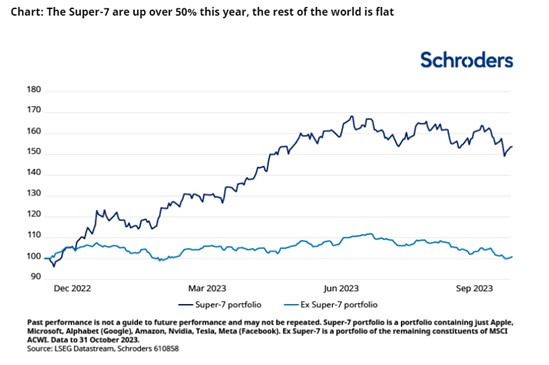

Of particular note this year, has been the stellar performance of the so-called “Magnificent 7” or “Super-7” (US tech companies – Apple, Microsoft, Amazon, Alphabet, Netflix, Nvidia and Tesla).

Shroders’ compelling chart below shows the Super-7 are up over 50% this year, due in part to the impact of generative artificial intelligence, while the other 493 stocks remained flat.

In Australian dollar terms, oil prices have jumped 35 per cent higher since July 1 as major producers Saudi Arabia and Russia support oil revenues with production controls and the prospect of Iran becoming embroiled in the Middle East injecting extra volatility into oil markets.

So, will rising oil prices prove inflationary or deflationary?

On the one hand, higher fuel prices feed into almost everything that is produced, from tradeable goods to services. That will push prices up and stoke community fears of long-term inflation, sparking calls for higher wages. The RBA, some say, will have little option but to jack up rates even further to dampen demand.

On the other hand, after 12 rate hikes in 18 months, household spending was in decline and more Australian households were suffering mortgage stress. Therefore, more businesses may be forced to absorb the costs – protecting the flow-on impact to consumers – which will hit company profits and put pressure on businesses to cut costs, such as staff. Which is precisely what the RBA wants and yesterday’s numbers tend to support this.

In the end though, the RBA’s Melbourne Cup Day decision to lift the cash rate by another 25 basis points to a 12-year high of 4.35% ended its four-month pause, with Bullock citing the need to further reign-in inflation which was declining at a rate ‘ slower than earlier expected’.

An unlucky 13th rate rise for many households and businesses ahead of the festive season.

So, what does this all mean for us here in Australia?

We know 2023 saw the departure of Reserve Bank Governor Dr Philip Lowe from 65 Martin Place – replaced by his deputy after overseeing the most aggressive interest rate tightening cycle in decades, where the RBA increased the cash rate 12 times across 14 meetings to 4.1 per cent – and after he’d put a date on how long interest rates would remain at record pandemic lows.

A hawkish new RBA Governor Michele Bullock added #13 on Melbourne Cup Day (up 25 basis points to 4.35%) – well aware she’s tightening the screws on mortgagees – and warning us all to brace for another “challenging” year ahead.

So, while it may be party time at the caravan park as cashed-up retirees welcome the additional bump to their cash savings, the rest of Australia is expected to retreat post final Christmas spending splurge.

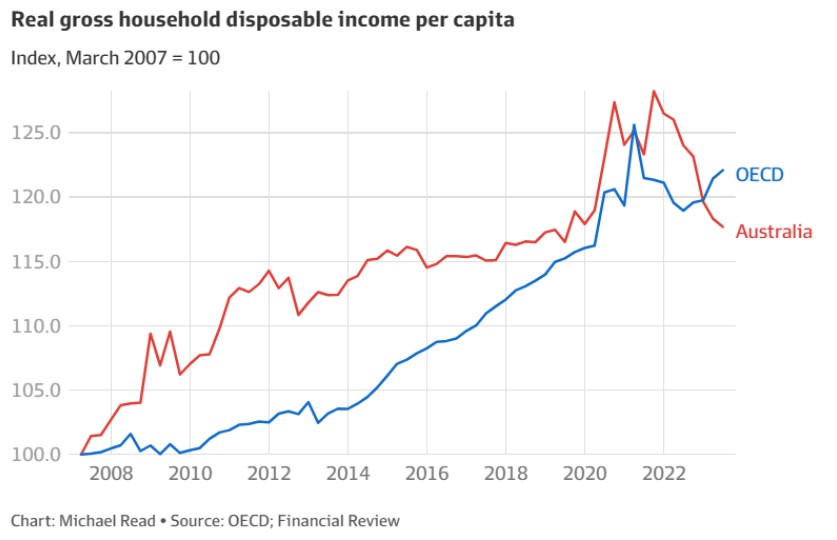

While we may yet avoid a technical recession off the back of net immigration, there’s little doubt we are experiencing an ‘income recession’ – supported by recent data by Michael Read in the AFR showing the largest decline in real per capita household disposable income of any advanced economy over the 2022-23 financial year.

In the 12 months to June, Australian household incomes slumped 5.1%, the “sharpest fall recorded across the OECD”, Read wrote.

Couple this with the fact that unit labour costs have been increasing strongly, reflecting higher nominal wages growth and subdued productivity growth. If sustained, this strong unit labour cost growth would contribute to ongoing inflationary pressures.

The unanswered questions are: Will the US enter recession – even a short and shallow one – and will Australia follow the US down?

Time will tell.

Regardless, we expect inflation will remain sticky.

As the French philosopher Voltaire once famously said: “Uncertainty is an uncomfortable position. But certainty is an absurd one.”

|

Tributes have been flowing in for Charlie Munger, Warren Buffett’s lifelong friend, sounding board and Vice Chairman of Berkshire Hathaway, who passed away last month, at the age of 99 – 34 days shy of his 100th birthday. In a statement following his death, Buffett said: “Berkshire Hathaway could not have been built to its present status without Charlie’s inspiration, wisdom and participation.” It’s been fascinating to read some of Munger’s past interviews and hear others reflect on their encounters with the Billionaire and his philosophies – not just for investment and business, but for life. The AFR put it aptly that Munger “didn’t profit by picking possible winners so much as by backing proven ones”. “Warren Buffett credits Munger as the real brain behind Berkshire Hathaway’s rise into a $US785 billion ($1.2 trillion) powerhouse conglomerate over the past six decades. Rather than speculating on undervalued stock, Munger’s value-investing strategy was to buy well-run companies at reasonable prices,” the AFR said. “Munger’ s magic investment blueprint was beguilingly old-school, logical, patient and simple.” Munger wasn’t seduced by fads, such as cryptocurrencies, (he had absolute disdain for them) and once discussed his rationale for living in the same California home over the past 70 years. “ (Buffett and I) are both smart enough to have watched our friends who got rich build these really fancy houses,” Munger said. “And I would say in practically every case, they make the person less happy, not happier.” He also often preached the merits of living modestly, giving advice like ‘don’t have a lot of envy’ and ‘don’t overspend your income’ and the pursuit of contentment, knowledge, self-improvement and humility was the definition of true wealth. He spent several hours each day reading. “I constantly see people rise in life who are not the smartest, sometimes not even the most diligent, but they are learning machines,” he once said at the commencement address at the University of Southern California Law School.. |

| _____________________________________________________________________________________________________________ |

|

Is the heat coming out of the national Housing Market?

We’ve spoken at length in recent editions about the impacts of the nation’s Housing Supply Crisis and its impact on property and rental prices.

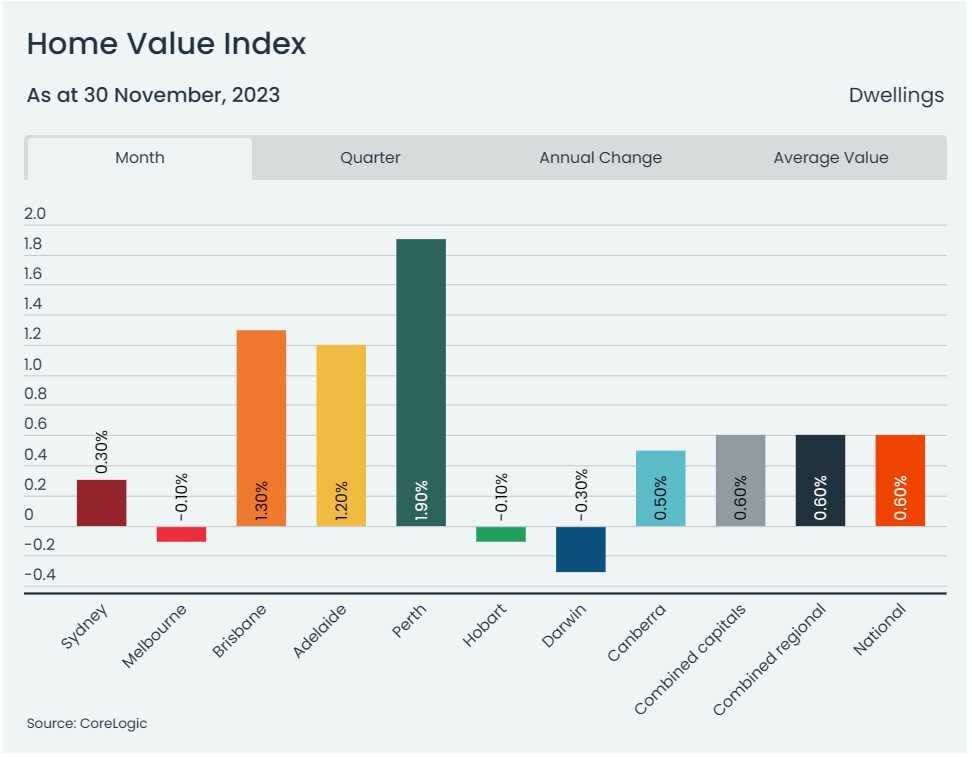

However, CoreLogic reports this week we may have reached the peak of the growth cycle, with its national Home Value Index (HVI) rising 0.6% in November, the smallest monthly gain since the cycle commenced in February.

Despite the slowdown, the national HVI reached a new record high in November.

“While the headline trends have slowed, multi-speed conditions have become increasingly evident across the capitals, with three cities recording a decline in values over the month,” says CoreLogic Research Director Tim Lawless.

The chart above shows the current state of play, with Melbourne, Hobart and Darwin all down.

Growth in Sydney home values also slowed sharply, reducing to 0.3% (the “smallest monthly gain through the recovery cycle to date”) and suggestions “we could see Sydney following Melbourne’s lead, with home values stabilizing or dipping lower in December”.

While the Adelaide market historically tends to be shielded from the price fluctuations experienced on the eastern seaboard, our values are up 1.2%, along with a standout Perth housing market (up 1.9% to record the largest monthly gain since March 2021) and Brisbane (1.3%).

“This imbalance between available supply and demonstrated demand is keeping strong upwards pressure on housing values across these markets, despite the downside factors leading to weaker housing market conditions across the lower eastern seaboard,” Mr Lawless said.

“The Melbourne Cup Day rate hike has clearly taken some heat out of the market, but other factors like rising advertised stock levels, worsening affordability and persistently low consumer sentiment are also acting as a drag on value growth in some markets.”

According to CoreLogic, 3,110 auctions were held across the country last week, with the combined capitals recording a preliminary clearance rate of 66.9% – a fraction off the previous week’s preliminary rate of 67%, which revised down to the “lowest final clearance rate of the year so far (60.7%)”.

They say the easing in the early success rate appears to be ‘driven by vendors, with 12.6% of the 2,087 results collected so far being withdrawn – the capitals’ highest withdrawal rate of the year-to-date.”

| _____________________________________________________________________________________________________________ |

Chart of the Week (#2) |

T

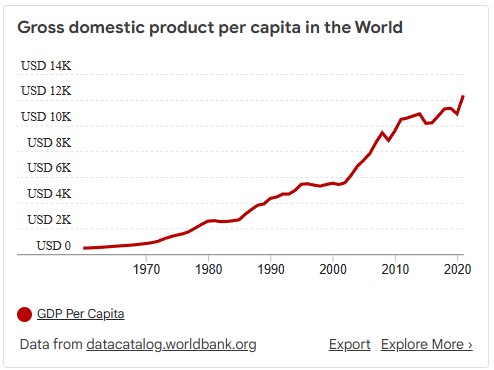

Amid the gloomy outlook, here’ s some cause for optimism.

Data released from Data Commons shows Gross Domestic Product per capita in the world has continued its upward trajectory – currently at just over USD 12,000 per person. Across the world, Gross Domestic Product has continued its upward trajectory – currently at just over USD 12,000 per person.

Noting that this is an average, and that some countries are certainly doing it tougher than others, it’s still a reflection that as humans across world, collectively our standard of living is improving.

A welcome good news story as we round out the year..

|

The Price of Postal Progress

We took the family out for a Japanese meal the other night, and our sushi – which we’d ordered via mobile phone QR code at our table (!) – was brought to us by a pre-programmed robot.

The kids were nonplussed and told us adults to ‘get with the program’, while we just longed for simpler times that involved human interaction.

Call us old fashioned, but the recent news that Australia Post will end daily letter deliveries next year was met with a similar degree of melancholy.

Sure, we understand that not all of us write letters anymore – (the average household now receives just 2.2 addressed letters each week on average, down from 8.5 each week in 2008) – and that emails and digital correspondence has usurped the traditional pen and paper style of communication.

Nonetheless, it reminds us of the ‘ price of so-called progress’.

Australia Post had warned that without changes its $200 million loss in 2022-23 would be the first of many.

Under the new delivery rules being reported, posties will still pass every door on their round every business day, but half their round will receive only parcels, express and priority mail – meaning ordinary letters will be delivered every second day.

Meanwhile parcel volumes continue to grow, although retailers are bracing for a quieter Christmas this year amid predictions shoppers brought forward purchases as part of Black Friday’s record sales.

The volume of parcels from November’s sales looks set to soon pass the annual Christmas peak, with Australia Post delivering more than 46 million parcels in November, compared to 52 million parcels last December (or perhaps they just dropped a card in your letterbox asking you to pick it up at the post office!). |

|

That’ s the average amount each Australian is tipped to spend on Christmas this year – down from $700 last year, according to the Australian Retailers Association (ARA).

ARA chief executive Paul Zahra predicts Australians will spend $67.1 billion in the lead up to Christmas, up just 0.6 per cent on 2022.

“Most retailers say they have met or exceeded their Black Friday sales from last year. What we don’t know is how much people have pulled purchases forward,” ARA chief executive Paul Zahra said.

“People are being much more careful with the spending dollar.”

As mentioned previously, there is a strong suggestion amongst economists that, come January, it will be ‘wallets away’ as consumers batten down the hatches.

Beware of scams – they can be hard to spot

The dodgy text message sent to us this week warning of an alleged ‘overdue toll payment’ demanding us to immediately ‘ click a link’ to resolve the issue was clearly a scam.

Notwithstanding the terrible grammar and the unknown number, the fact we live in Adelaide – without a single toll road – was a dead giveaway that this SMS was not to be trusted.

But scams come in different shapes and can be far more sinister – and harder to spot.

That’s why it’s important to remain vigilant in protecting yourself and your hard-earned savings against them.

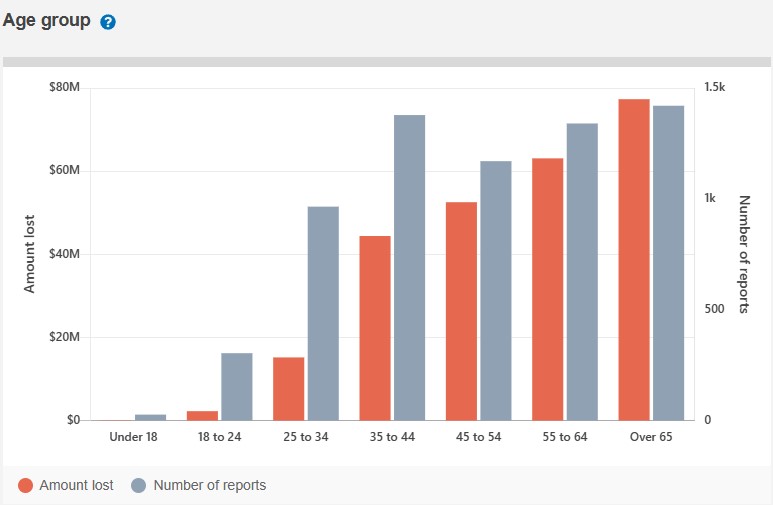

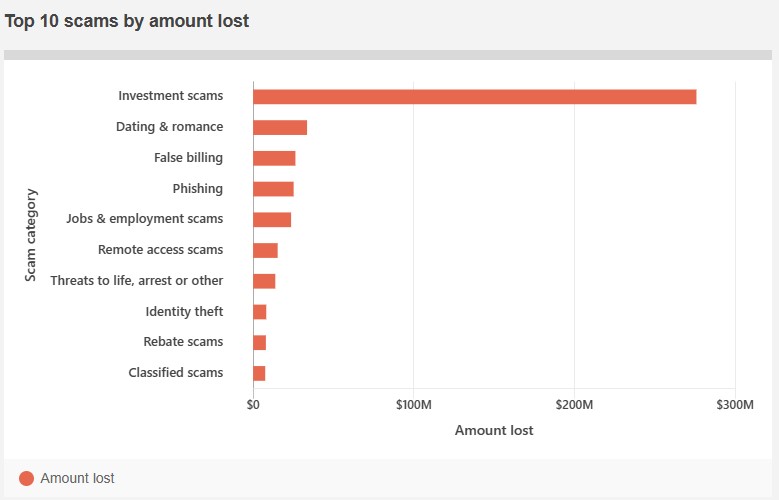

Australians have lost more than $455 million this year to scams, according to the Federal Government’s National Anti-Scam Centre, with more than 280,000 scams reported in the past 12 months alone.

People aged over 65 have lost more than any other age group (over $114 million).

Three scams to watch out for include:

- Impersonation scams

Three in every four scam reports received by the National Anti-Scam Centre involve impersonation – criminals pretending to be people we should trust, such as banks, government authorities – even friends and family – to steal personal information and money.

Steps you can take to protect yourself:

- Ignore them. Delete, block, keep scrolling. Never click the link.

- Independently check who you’re dealing with. Never use contact details they’ve given you. If you want to check who’s really there, use official websites, apps, phone numbers and email addresses you’ve looked up yourself.

Finsec emails will come from our staff in the format “staff name” <FinSec Partner> with the actual email address in the format: staff.name@finsecpartners.com.au. If you are unsure, please call our office for confirmation before taking action.

- Investment scams

Australians lose more money to investment scams than any other type. Scammers use convincing marketing and new technology to make their investment sound too good to miss.

- Always stop, think and check before you act. These scams will often pressure you to act quickly. Don’t let them rush you into a bad decision.

- Get independent legal advice, or financial advice from us

- Product and service scams

This is where scammers pose as buyers or sellers to steal your money. Warning signs include getting an invoice for a product or service you haven’ t bought, or you’re told you must pay by money order, pre-loaded card or pay to several different accounts.

Fraudsters can also use phishing emails to steal usernames and passwords, allowing them to hack your personal or business accounts. They then troll and monitor your email account for an opportunity to intercept an invoice. For example, when you are purchasing goods and awaiting an invoice via email – the scammers intercept the email, change the bank details on the invoice and send it on for payment.

Alternatively, they impersonate a legitimate business and mislead you into believing they’ ve changed their bank details and ask you to pay the outstanding invoice into the new bank account.

- Always check that you are paying the correct people or businesses when buying or selling products and services online. If an invoice from a regular supplier has different bank details to normal, contact the supplier to verify before making payment.

For more information on ways to spot and avoid scams, visit the Federal Government’s ScamWatch website: Ways to spot and avoid scams | Scamwatch

Friday Funny

While being Nice always pays, it can also be costly when it comes to Christmas!

Wishing you all a Merry Christmas and a Safe and Prosperous New YearThat brings us to the end of the final VIEW for 2023. We will take an editorial break in January and return with more of our “Views” in February 2024. Stay safe and look after one another. As always, if you have any concerns or questions at any time, please reach out to your FinSec adviser. |