Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A FinSec View – Market Wrap up, Goodbye 2024 & Hello 2025, Resolutions & more…

| 20th December 2024 |

Australian Market UpdateWelcome to the final edition of The View for 2024. December has been a classic case of what’s good for the economy (and workers) is bad news for interest rates and stocks. Unexpectedly strong labour figures released two weeks ago saw a hit to the ASX and any talk of rate cut in February 2025 firmly pushed out to May – if not beyond. This was followed by The US Federal Reserve cutting rates but suggesting that there are only two more cuts likely in 2025 seeing our market deliver its worst day in three months on Thursday. Australia’s seasonally adjusted unemployment rate fell by 0.2% to 3.9% in November. Just days before the figures went public, the Reserve Bank had its “dovish pivot”, keeping interest rates steady but signalling the balance of risk favours lower inflation after data showed economic growth was surprisingly weak. Investors interpreted this as a sign that rate cuts could be coming sooner. However, when the jobs data dropped, those expectations flew south, with the first cuts now not expected until May, if not even later. Bad news for the Albanese Government, who have to go to the polls before the end of May. ANZ senior economist Adelaide Timbrell summed it up, saying: “Softer economic data from the recent national accounts release raised the risk of a February cut, but this labour market result offsets that risk somewhat.” Only a bank economist would describe a rate cut as a “risk” in this current climate. The RBA has held its policy steady for a year, judging the current cash rate of 4.35% – up from 0.1% during the pandemic – is restrictive enough now to bring inflation to its target band of 2-3% while preserving employment gains. Low unemployment is likely to keep upward pressure on wages in the medium term, which will in turn, work to stoke inflation, meaning investors and mortgage holders alike could be waiting until the latter months of 2025 for a meaningful reduction in rates. In the September quarter of 2024, Australia’s GDP rose by 0.3% quarter-on-quarter and 0.8% year-on-year. This was the 12th consecutive quarter of anaemic growth, showing the economy is continuing to slow down. The Australian dollar continues to be a slow horse, now sitting around US62 cents (10% lower since September) and is well under what is considered fair value. This will increase the cost of our imports creating more inflationary pressure hence, giving the RBA more reason to hold up rate cuts. We will need to see some productivity gains before we can expect the dollar to recover. |

Global Markets Update

Events in Syria and South Korea have added yet more geo-political tension to the growing list of hot spots worldwide, dampening some of the cautious economic optimism that emerged in November. Last month US stock markets were strong, with the S&P 500 gaining 5.73% and the NASDAQ up 6.21%. This rally was supported by optimistic economic growth expectations, strong consumer data, and investor enthusiasm over business-friendly policies from the incoming Trump administration. The year-to-date return for the S&P 500 was exceeding 28%. In recent weeks, US equities have fluctuated, with gains in technology stocks such as Amazon and Tesla balanced by weakness in other sectors like semiconductors. Nvidia faces pressures after a Chinese antitrust probe. As mentioned above, the Federal Reserve cut rates on Wednesday but also surprised the market by suggesting that there were only two rate cuts likely for 2025. The S& P 500 had 4 cuts priced in and promptly gave up 3%. European stocks have benefited from optimism about potential monetary easing by the European Central Bank, with rate cuts anticipated by many analysts. Gains were led by luxury and retail stocks, bolstered by strong US consumer data and China’s supportive economic policies. Asia, markets reacted positively to China’ s pledge for proactive fiscal measures in 2025, with significant gains in Chinese real estate and consumer sectors. South Korea’s political instability has however introduced volatility, and weak trade data from China reflects ongoing economic challenges. Commodities, particularly gold and silver, have seen price increases amid geopolitical tensions and central bank policies. Crude oil prices have been volatile due to concerns over demand in 2025 despite OPEC+ production restraints. Inflation data from major economies and monetary policy decisions by central banks, including the European Central Bank and the US Federal Reserve continue to influence sentiment. Overall, December has underscored a complex economic environment. While there are positive signals from stimulus measures and potential rate cuts, risks such as geopolitical instability, tariffs, sticky inflation and mixed economic data remain prominent. |

Farewell 2024, Hello 2025

Throughout 2024, the Australian economy has struggled with sticky, though easing, inflation. Price increases above the Reserve Bank’s 2%-3% target range have persisted despite a slowdown in demand because the supply side of the economy also has weakened. One supply-side driver of inflation is that unit labour costs have risen more than 5% year-on-year, faster than before the COVID-19 pandemic. To further depress demand and finish the job of reining in inflation, the Reserve Bank of Australia has kept its target for short-term interest rates in restrictive territory — above 4% since mid-2023. While the CEOs of our big five banks are all confident about rate cuts in 2025, it’s a case of ‘hope for the best, plan for the worst’ in corporate Australia. The CEOs of Commonwealth Bank, National Australia Bank, Westpac and ANZ are tipping two to three interest rate cuts next year, agreeing the first cut should come within six months and be followed by at least another cut in the second half. New Westpac CEO Anthony Miller says “our economists expect the rate to find its way down to 3.35 per cent by the end of 2025. However, this will depend on the impact of a Trump presidency,” which Miller says “poses inflationary risk for Australia”. Macquarie’s Shemara Wikramanayake, who oversees our fifth biggest bank for mortgages and deposits, agrees the first cut will come towards the middle of 2025 but isn’t tipping a return to the low rates seen for most of the past decade. In contrast, the CEOs of Australia’s biggest companies, who are also the banks’ biggest customers, are preparing for higher interest rates. Goodman Group boss Greg Goodman said he would not factor in any rate cuts for the coming year. “Interest rates and inflation will be higher than people would like during 2025, so we’re working on the basis of status quo,” Mr Goodman said. “If there are early cuts, that will be welcomed, but we’re not relying on them.” While the RBA has kept the cash rate at 4.35 per cent all year to curb price increases, the CEOs warn that government spending is hurting its inflation fight. “I’d say it comes back to government spending in the public sector and on infrastructure, which has taken a large amount of capacity out of the economy. If this doesn’t change, interest rate cuts are at risk,” REA Group’ s CEO, Owen Wilson said. Some CEOs also question whether the RBA is hurting the government’s fiscal goals, including building more houses, by keeping interest rates higher for longer. “We can’t predict where the cash rate will be, however the current restrictive monetary policy settings are inconsistent in addressing the long-term economic issues that Australia faces,” Scentre Group’s CEO, Elliott Rusanow said. “We believe that interest rates need to be materially lower in order for monetary policy to be consistent with other fiscal policy settings and support the country’s long-term economic needs.” We doubt it is a coincidence that each CEOs’ predictions would be beneficial to their own business? What else is the crystal ball suggesting for 2025?

The common view is that Australia’s economy is poised to recover gradually having experienced its slowest growth in 32 years in 2024 burdened by a collapse in productivity leading to the afore mentioned sticky inflation and longer restrictive interest rate settings. Expect a modest improvement in economic momentum to be underpinned by rising real household incomes as inflation subsides. A rebounding housing market and rate-cut expectations will all assist in achieving at least 2% growth next year. Stagnant labour productivity growth leaves the economy operating near capacity despite softening demand. Given this challenge, a period of ‘subdued demand’ is called for to reach the Reserve Bank’ s inflation target of 2-3%. The RBA will continue to be patient; any easing from its current policy rate of 4.35% will happen gradually and be dependant on data, not sentiment. Specifically, they need, to see a weakening in both inflation and the labour market. The current unemployment rate of 4.1% is tipped to rise to around 4.6% in 2025 as financial conditions tighten without an interest rate cut in the first quarter. Other 2025 – “Good to Knows”Aged Care Reforms Update (Effective 1 July 2025) The Aged Care Bill 2024, introduced on 12 September 2024, will significantly change residential and home care costs from 1 July 2025. Key reforms include grandfathering current fee arrangements for existing residents, new retention amount calculations, and bi-annual indexation of daily accommodation payments. The bill also introduces the Hotelling Supplement Contribution and replaces the means-tested care fee with a non-clinical care contribution. Home care recipients will see changes in fee structures and means testing. Additionally, the Restorative Care Pathway and Assistive Technologies and Home Modifications Scheme will be implemented to enhance care services and support. Some of these changes may mean it may be beneficial for people thinking about entering care to do so before July 1. FinSec has specialists in this area to assist. ********************************************************************************************************************************************** South Australia to Overhaul Succession Laws in 2025 From 1 January 2025, South Australia will modernise its succession laws under the new Succession Act 2023, repealing outdated legislation and aligning more closely with other Australian states. Key reforms include:

These reforms aim to simplify estate management, enhance fairness, and clarify legal obligations for executors and beneficiaries. An estate planning professional can assist you in understanding whether these changes affect you and or your family. Chart of the Year

At a glance it looks like it’s been a jagged year for the ASX All Ordinaries across 2024. But the trend on the whole has been onwards and upward, driven mainly by our big banks who make up 20% of the value of the index. The ASX had performed strongly to the end of November in 2024, with a year-to-date return of 11.3%, hitting an all-time high on 3 December but has since given up 5% of the joy! So much for the Santa rally! This overall positive performance can be attributed to economic recovery, expectations of interest rate cuts, and stronger corporate profits. While the overall trend is positive, some stocks, particularly in sectors like energy, materials and consumer staples, have underperformed. |

That’s how much adult Australians are expected to spend, just on gifts this Christmas – a 16% increase on 2023. That’s $783 per adult Australian. Did someone say inflation and a cost of living crisis? Then there’s the non gift spending on things like decorations and clothing, that’s likely to be another $3.8bn! Despite economic challenges, Australians are still prioritising holiday spending. The above figure doesn’t include travel and hospitality – our other two major areas of spending at this time of year. The surge in shopping activity also provides a boost to employment, with thousands of seasonal jobs created in retail, logistics, and hospitality?. These numbers have risen from $100 on average back in the 1960s. Whilst the numbers may be on the increase over the decades, they have closely followed inflation. While consumers are still generous, many are opting for value, with discounts and sales playing a significant role in purchasing decisions. Popular gifts include tech gadgets, fashion items, and experiences such as concert tickets or spa vouchers. Additionally, sustainable gifts are gaining popularity, reflecting growing awareness of environmental concerns? among younger generations. Another interesting statistic is that 35% of Australians have an unused gift voucher with $1.4bn left untouched each year. The surge in online shopping is also expected to continue, with more than 35% of gift purchases made through e-commerce?. This was highlighted through the large $6.8bn spending splurge during the 4 days of Black Friday and CyberMonday. In hospitality, Australians are anticipated to spend around $1.2 billion dining out during the festive period, with restaurant bookings expected to increase by 15%. Catering services are also in high demand, driven by office parties and family gatherings. Meanwhile, travel spending, including accommodation and flights, is projected to exceed $3 billion, with a focus on domestic tourism as families travel to popular destinations including the Gold Coast, Tasmania? and the wine regions. While 2024 presented economic challenges, Christmas remains a key period for Australian spending, with significant contributions across retail, hospitality, and tourism. Retailers and consumers alike are adapting, focusing on value and early planning for optimal savings. No doubt the RBA will be poring over Christmas trading data to test the underlying temperature of the economy and the need for any monetary policy relief.

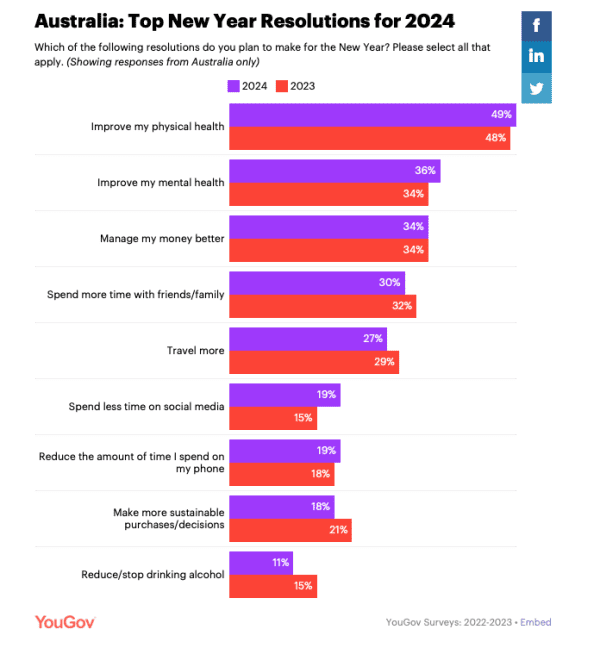

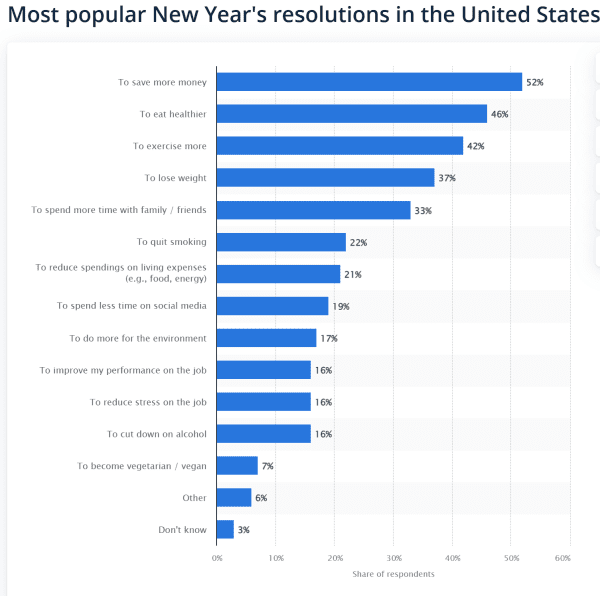

New Year, bring on the ResolutionsEvery year, as the calendar flips to a new year, millions of people worldwide make resolutions to improve their lives. While specific goals may vary, certain themes consistently emerge as the most popular New Year’s resolutions. It’s interesting to compare Australians’ resolutions to those in the US. And it’s no surprise that they’re not much different.

Health and wellness remain at the forefront of many people’s resolutions. A significant portion of us aim to exercise more, eat healthier, and lose weight – heavily influenced by a week of overindulgence over Christmas-New Years. Gyms, personal trainers, dieticians and diet apps, and local sports clubs usually report a surge in inquiries in January, while Dry Feb is also popular. Financial goals are often close behind, with saving more money and spending less being popular choices – especially if we have splurged at Christmas and spent more than we envisaged due to last-minute and desperate gifting. Personal growth is another favourite focus for many people. These resolutions involve learning a new skill, reading more, and reducing stress all aimed at improving our knowledge, creativity and importantly, our mental health. The reasons behind these common resolutions are multifaceted. A new year symbolises a fresh start, an opportunity to break old habits and form new ones. Setting specific goals provides a sense of direction and motivation, while the collective energy surrounding New Year’s resolutions can encourage individuals to participate. However, while making resolutions is easy, sticking to them can be challenging. It is estimated that more than 80% of people don’t manage to stick to their resolution either in full or in part. Experts say to increase the chances of success, it’s essential to set realistic goals, break them down into smaller steps, track progress, seek support, and be patient. |

Holiday ReadingAt The View, we are taking a break over the Christmas New Year period with the hope of enjoying some down time and reading something non-financial. We thought we’d share our recommended reading list…

Winner of the 2024 Financial Times Best Book of the Year and Schroders Business Book of the Year is Supremacy: Al, ChatGPT and the race that will change the world, by Parmy Olson. The Bloomberg journalist uses her 13 years of experience covering technology to bring to light the exploitation of the greatest invention in human history, and how it will impact us all.

It will come as no surprise that we are cricket tragics here at FinSec, so this contribution by memorabilia specialist Michael Fahey and legendary cricket writer Mike Coward is on our Christmas reading list – at least during the breaks of the Boxing Day Test! An update of their original 2008 book of the same name, The Baggy Green book charts its evolution with reflections from many past and present Test players. It explores the cap’s history, mystique and worth, with insight from the sport’s greatest figures, museums and leading auction houses.

The Instant Sunday Times and New York Times Bestseller. A 2024 literary highlight in the Sunday Times, BBC, Grazia, Dazed, Sunday Express, GQ, i-D, Stylist, Bookseller and Literary Friction A BOY MEETS A GIRL. THE PAST MEETS THE FUTURE. A FINGER MEETS A TRIGGER. THE BEGINNING MEETS THE END. ENGLAND IS FOREVER. ENGLAND MUST FALL. In the near future, a disaffected civil servant is offered a lucrative job in a mysterious new government ministry gathering ‘expats’ from across history to test the limits of time-travel. Her role is to work as a ‘bridge’: living with, assisting and monitoring the expat known as ‘1847’ – Commander Graham Gore. As far as history is concerned, Commander Gore died on Sir John Franklin’s doomed expedition to the Arctic, so he’s a little disoriented to find himself alive and surrounded by outlandish concepts such as ‘washing machine’, ‘Spotify’ and ‘the collapse of the British Empire’. With an appetite for discovery and a seven-a-day cigarette habit, he soon adjusts; and during a long, sultry summer he and his bridge move from awkwardness to genuine friendship, to something more. But as the true shape of the project that brought them together begins to emerge, Gore and the bridge are forced to confront their past choices and imagined futures. Can love triumph over the structures and histories that have shaped them? And how do you defy history when history is living in your house? |

Friday FunnyThe Christmas tree goes up every year, you’d think we’d have solved this conundrum!

|

That’s a Wrap for The View for 2024We thank you, our loyal readers, and appreciate the feedback we receive throughout the year. We’ll take an editorial break in January, see you in February for our first edition of 2025. |