Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A FinSec View – Market Updates, US Election economic implications, Life Insurance Claims & more…

| 29th November 2024 |

Welcome to a special post-US Election edition of The ViewIt’s been just three weeks since Donald Trump won the US Presidential Election and helped the Republican Party take back the Senate and Congress. Every US Presidential election has economic and global implications, none more so than now. We wrap up the whys, how’s and what it means for the US economy and markets, here, there and globally and take an overview of the world Trump has inherited before our usual Australian market monthly update, Stats Interesting, Chart of the Month and Friday Funny. Enjoy.

|

What does Trump 2.0 mean for US and global markets?The clean sweep of the House and Senate by the Republican party will shape the US’ economic outlook as much as Donald Trump winning the presidency. Volatile is the word most economists and commentators have been using in the past few weeks, with his presidency likely to be marked by high public spending – in contrast to his and Elon Musk’s aim to reduce government size – and low taxes. Inflationary proposals are expected to increase bond yields, putting pressure on the Federal Reserve as it seeks lower interest rates. Stock markets surged following the definitive election outcome, but investors are still assessing how Washington’s new political landscape will impact the economy and markets. Here are some key takeaways: Strong US market reaction The initial market reaction to Trump’s win provides some clues to what markets anticipate for the next year – some upside risk to growth and inflation, a slightly stronger US dollar, and slightly less easing by the Federal Reserve. Many believe Trump will extend his 2017 tax reforms and adopt a lighter regulatory touch, which the financial sector likes. Trump inherits a fundamentally strong economy with GDP growth hovering around 3% for the past year, which is ahead of the long-term average. Meanwhile, inflation is close to the Federal Reserve’s target range, while the unemployment rate is at a healthy 4.1%. Bitcoin surged significantly, partly due to Trump’s promise of establishing a strategic Bitcoin reserve. Interestingly, Trump has chosen a cryptocurrency enthusiast and hedge fund manager, Scott Bessent, to be his US Treasury secretary, enlisting a key adviser to manage the sweeping economic agenda he has vowed to enact in a second term. The one “sour” reaction to the election results has been in the bond market, where yields have risen, and will continue to be impacted by the $1.8 trillion budget deficit. US Market impact Economists like to play down the impact politicians have on the economy. BMO Capital Markets chief economist Doug Porter said: “At the end of the day, politicians do not drive the economy. Fundamentally, there are 160 million Americans getting up every day and going to work and a little over 20 million Canadians – that’s what ultimately drives the economy. It’ s not the political backdrop.” His colleague Brian Belski, chief investment strategist, said the US fundamentals were strong: “In my 35-year career, I’ve never seen certain areas of the market look so sound in terms of being able to understand how earnings look, balance sheet strength, debt-to-equity levels, operating income and things like return on equity, return on assets.” Belski and others remain bullish on the U.S. and, by extension, Canada. “As America goes, so goes Canada,” he said. “Canada is a true stock pickers market. If you take out the biggest 60 companies in Canada, Canada is really a small mid-cap index.” With interest rates coming down and growth moderating, investors should experience fewer wild, volatile swings. Tariffs and taxes “To me, the most beautiful word in the dictionary is tariff,” Trump has said. Tariffs and taxes were key parts of Trump’s campaign, and most economists believed his rhetoric would differ from the reality of what would emerge in the next few years. Well, this week showed otherwise, with the President-elect pledging tariff hits on Mexico, Canada, China from the moment he is inaugurated, in retaliation for supposed illegal migration and drug trafficking. Trump’ s announcement he would target the US’s three biggest trading partners – delivered almost two months before he takes office on January 20 – marks the first specific threat to curb global trade flows and fulfil his campaign promise to “put America first” since his election win. In an apparent violation of a free trade deal, Trump said he would impose a 25 per cent tariff on neighbouring Canada and Mexico until they clamped down on migrants crossing the border as well drugs, particularly the painkiller fentanyl. China will receive “an additional 10 per cent tariff, above any additional tariffs” for failing to curb fentanyl supplies. The question is whether he’ll take it even further with China, having suggested up to 60% was a possibility. The next Trump administration is expected to adopt a lighter touch on the taxation front while putting the focus on tariffs. Although an across-the-board 10% tariff – the figure Trump has flagged – on all imports would be significant, they may not trigger runaway inflation. Another key factor will be how impacted nations react and a stronger US dollar offsetting some of the inflationary effects. Of more concern is Trump’s anti-immigration policy, which could have broader implications for the U.S. economy as employers already struggle to fill vacancies. The Federal Reserve Optimists predict the Fed will cut rates again in December and then move to a quarterly reduction of 25 basis point cuts in 2025. Realists are taking an each-way bet: either a slower return to normal or a lengthier pause by the Fed. At the View we are calling the latter. Impact on the EU and UK Globally, stock markets, including those in Europe and Asia, mirrored the US optimism, with indices such as the FTSE 100 and Japan’s Nikkei 225 rising. However, concerns remain about potential inflationary pressures from Trump’s proposed tariffs and their long-term impact on global economic growth, in addition to his impact on geopolitics. The EU could face tariffs, particularly on sectors like automotive manufacturing. This protectionist approach could disrupt European exports and global trade flows. And the UK, hoping for a US trade deal post-Brexit, may find itself in a weaker negotiating position under a Trump administration that emphasises US dominance. Under Biden, the US collaborated with the EU on green energy and technology policies. A Trump presidency, with its rollback of environmental regulations and scepticism of international agreements, could undermine these efforts. For Europe, this might mean losing a key ally in global climate initiatives, forcing the bloc to recalibrate its strategies for addressing climate change and advancing technology. It may also escalate tensions around tech regulations, given Trump’s close relationship with efficiency lead Elon Musk, who often clashes with EU regulatory frameworks. In this sense, Musk can be seen as a financial risk factor. China During the first trade war between Trump and Xi Jinping, China pumped up its domestic economy with more spending on infrastructure and housing developments. It brought forward future economic growth from the 2030s to insulate its economy. China is now dealing with a hangover from that period as apartment blocks sit vacant and property developers struggle to survive. Trump’s first trade war weakened China over the medium term and its desire for more iron ore and coal for future stimulus will be less – bad news for Australia. Many expect the Chinese government to offer households cash to lift consumer confidence and stimulate the economy. This would also help China’s structural transformation towards a more domestic consumer-driven economy. More broadly, the impact of tariffs on China will depend on how aggressively US customs officials police the country of origin of imports shipped into the US. Chinese firms will probably try to “round trip” through third-party countries such as Vietnam, Malaysia and Singapore, to get around the proposed 60 per cent tariff. These countries could be subject to a less punishing 10 per cent to 20 per cent tariff. Chinese electrical vehicle marker, BYD, is already planning to set up a factory in Mexico. The re-routing and or relocation strategies will add costs to the global trading system and not be helpful for inflation pressures in the world economy. Emerging Markets Even before the election, concerns over Trump’s policies had weighed on emerging economies. In addition to tariffs on China, Trump has said he would slap a tariff as high as 200% on Mexican vehicle imports. Mexico’s peso could weaken beyond 21 to the dollar, levels not seen in more than two years, analysts say. Another potential headwind for emerging markets: Trump’s Vice President-elect JD Vance has proposed a 10% tax on remittances – the money or goods migrants send from the US back to their home countries – which are a vital part of the economies of many Latin American coutnries. South Africa’s rand, Brazil’s real, and stock markets in both these countries are vulnerable if there are tariff hikes, as are chipmakers in Taiwan, South Korea and others that produce for Chinese tech firms. Emerging economies with domestic growth and reform stories such as India or South Africa could benefit and become a haven in otherwise volatile global settings. Copper and lithium producer Chile could be largely spared because of the less-replaceable nature of its exports. So, not all bad news for savvy emerging market investors. |

Why Trump won and political lessons for us in 2025

|

|

*As at November 19, 2024.That’s the dollar price of shares in the Commonwealth Bank of Australia (ASX: CBA) at the time of writing. If it continues on the same trajectory as earlier this month, CBA could easily hit $160 by Christmas. CBA became the largest company on the ASX in July, leapfrogging the other “ big Australian” BHP. Its share price has skyrocketed nearly 50% in the past 12 months, outperforming its major bank peers, whose share prices have risen an average of 33% over the same period. Many CBA shareowners have been with the bank since its privatisation on 12 September 1991 when the issue price was $5.40! No doubt they view its value as positive reinforcement that this is a stock to hold and not sell. Incredulity is felt by everyone else – as one commentator put it, “It’s not normal for an ASX bank’s share price to rise by around 50% in 12 months; it’s not normal for an ASX bank to offer investors a dividend yield of just 3%, and it’s not normal for an ASX bank to trade at a price-to-earnings (P/E) ratio of over 27”. In a recent LinkedIn post, former Morningstar lead Peter Warnes shared his thoughts on why CBA can’t stop breaking records: “The rise of passive investing, particularly through index-tracking Exchange Trade Funds (ETFs), has significantly reshaped the investment landscape over the past two decades. These vehicles are largely indifferent to company fundamentals, and their influence has widened the gap between share prices and valuations based on earnings, cash flow, and book value. “It is Australia’s largest bank and a great organisation. Its place in the Australian financial system is not in question. It is the largest company listed on the ASX with market capitalisation of $268 billion and a weighting of 9.9% in the S&P/ASX 200. Therefore, it attracts substantial passive fund inflows due to its significant weighting.” So, for every dollar that goes into an ASX 200 Index fund, whether via your brokerage account or superannuation fund, means around 10 cents of that dollar will find its way into CBA shares. A feedback loop is in play; the more money that flows into CBA, the higher its share price climbs. And the higher its price climbs, the larger its weighting in the ASX 200 becomes, meaning even more dollars flow in. Yes, it’ s the super funds keeping CBA buoyant. Commentators don’t believe the paradigm can continue in perpetuity; the P/E and price-earnings-to-growth ratios are unsustainable, and eventually, CBA will return to a value based on its true earnings potential rather than because of flows of passive investment or distortion from low interest rates. We shall see. Life Insurance ClaimsThe latest Cbus Super scandal regarding the slow payment of life insurance claims has again highlighted the real life impact of decisions made by back room people, too far from the front line of client needs. The Cbus issues have many contributing factors and we acknowledge their Chairman, Wayne Swan’s apology for the impact on their clients. Most of the issues will be unpacked by the parliamentary committee hearing currently underway and it is not our place to second guess what the findings will be but from our experience these issues are not isolated to Cbus, they occur across several Industry Funds and even retail superannuation providers and retail life insurers. One of the things we can comment on is that claims on life insurance products are rarely straight forward. They are often complex processes to navigate and a deep knowledge of super fund and insurers claims management framework is required. Remember that the claims managers at the insurance companies are employed by the insurers, not you. Super funds and insurers do not set out to not pay claims but they do need to ensure that the claims that they do pay are legitimate. As you can imagine in the world of cyber hacking, identity theft and scamming, there is no shortage of people trying to rip off life insurers too. The most effective way of ensuring smooth passage of a life, total and permanent disability, trauma or income protection claim is to seek the support of a claims management expert who can help you navigate the process and be your advocate when you may be at your most vulnerable. At FinSec we have insurance specialists who can play this role and be in your corner when it matters most. |

Chart of the MonthAustralians have a love-hate relationship with property values depending on their stage of life. Investors, owners and sellers love valuation rises, first-home and next-home buyers plus renters despair every time median house prices set new records. The View has written in the past about the heavy reliance on the ‘bank of mum and dad’ and even the ‘bank of nan and pop’ in funding first and second or third homes by children and grandchildren in Australia today. The family bank is supposedly Australia’s fifth largest money lender. This graph showing the wages Australians need to earn to be able to buy a property in their home city is a stark reminder of just how hard it is for many people to not only fund a deposit but maintain their mortgage payments.

Sydney, Melbourne and Adelaide have been unfortunately described as “impossibly unaffordable” housing markets, with buyers having to fork out a median nine or more times annual household income to secure a median-priced home, according to the 2024 Demographia International Housing Affordability report. “The term ‘impossible’ was chosen to convey the extreme difficulty faced by middle-income households in affording housing,” according to Demographia in its 20th edition. “This level of unaffordability did not exist just over three decades ago. Furthermore, securing financing for a house at this median multiple is largely impossible for middle-income households.” In response to Opposition Leader Peter Dutton’ s promise to restrict immigration if elected, as an answer to our national housing crisis, South Australian Premier Peter Malinauskas has repeatedly said Australia doesn’t have an immigration problem, it has a “housing supply problem”. While governments scramble to find the right mix of answers, from throwing money or taxation relief at developers and investors, fast-tracking housing approvals and cutting stamp duty for first-home buyers, family banks will just keep on lending and hopefully, with the right advice and plans in place, avoid creating intergenerational debt. |

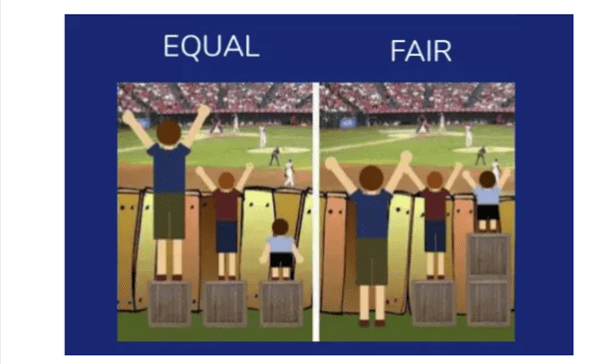

Speaking of the bank of Mum and Dad…We like this image challenging “ fair versus equal”.

Most of us would probably say that fairness should mean everyone gets the same. But in reality, that doesn’t always mean a level playing field. In reality, fairness usually means that everyone gets what he or she needs. So, when it means giving a child an extra leg-up in life, we wouldn’t think twice. But divide up an estate or will in proportion to what each recipient really needs… well, that’s a completely different equation, right? When it comes to helping out adult children or considering inheritances, most people would definitely answer equal is fair…but is it? |

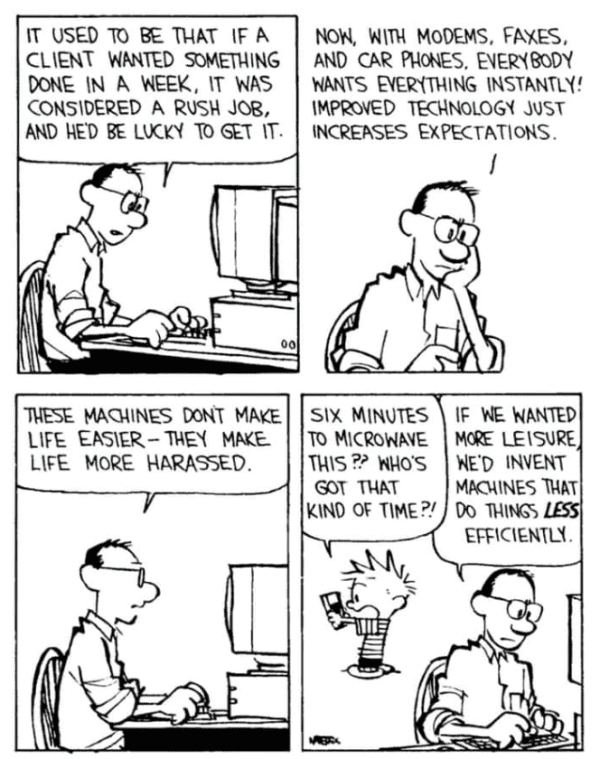

Friday Funny

|

Image courtesy AFR

Image courtesy AFR