Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A FinSec View – Market Updates, Negative Gearing, the Bank of Mum & Dad & much more….

| 25th October 2024 |

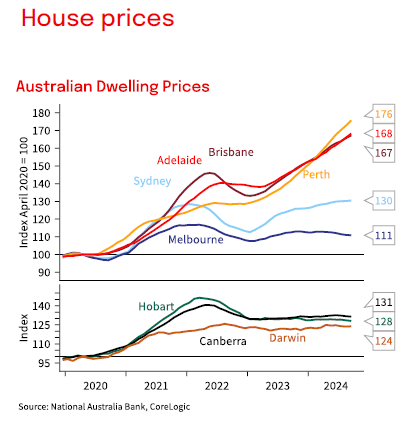

Australian Market UpdateThe ASX 200 started October strongly, buoyed by optimism surrounding global economic stability and China’s stimulus package before reaching new record territory mid-month. On October 15, it briefly sat at 8,331 points, and according to Reuters is up overall more than 18% since the same time last year. This week however, the reality of the timing of any potential rate cuts saw a reality check and the market is back to where it started the month. Materials, real estate, and information technology sectors performed particularly well in October, with materials gaining from China’ s stimulus announcements. The index’s valuation has risen to nearly two standard deviations above its long-run average, reflecting market confidence, particularly in the banking sector. Inflation remains a concern, despite cooling to 2.7% year-on-year, driven by one-off energy subsidies. Staples inflation appears to be under control but it will be much harder to cover the last mile on housing and energy inflation. The labour market remains strong with steady unemployment at 4.2%, although consumer and business confidence is weakening. High interest rates and sluggish wage growth continue to weigh on household spending with the consumer all but on strike!? This was evidenced by the Commonwealth Bank Household Spending Insights index, based on transactions and lending data from CBA customers, which showed household spending fell in September by 0.7 % despite increased spending around the footy finals. Bond yields have remained stable, while natural gas prices surged, and oil prices declined. The Australian dollar has strengthened slightly against the U.S. dollar, benefiting from global monetary easing. Overall, the Australian market continues its resilience, but concerns about inflation and global demand remain significant for investors. |

Global Market UpdateWe’re at the end of October yet it’s the rate cut by the US Federal Reserve back in September that has been the gift that keeps on giving for global financial markets. The bigger-than-expected cut by 50 basis points resulted in cautious optimism, giving markets a boost with stocks, particularly in the US, rising significantly during the third quarter. This marks the best year-to-date performance of the 21st century for the S&P 500. However, inflation remains sticky in some areas, particularly in core components such as housing and healthcare. This has kept the market on edge, as any further cooling in the labour market could tempt the Fed to take more aggressive measures on the risk that the economy is slowing too fast. This potential “hard landing” scenario will prompt more volatility. Global equities have benefited from monetary easing. Still, concerns about geopolitical risks including the upcoming US Presidential Election on November 5 (mostly November 6 in Australia) could stoke volatility in the fourth quarter. Analysts remain broadly optimistic though, especially if the US achieves a “soft landing”, which would be favourable for stock market performance. The Japanese equity market continues to claw its way back after dropping 15 per cent in early August. For the quarter the Japanese equity market was up 5.7 per cent. The UK rallied almost 8 per cent during the quarter, benefiting from reasonable growth, investor focus on more defensive markets and a rising GBP. China’s financial markets have experienced a dramatic turnaround in the past month, driven by significant policy shifts from the government. This period saw a series of carefully crafted interventions, starting with the People’s Bank of China’s (PBOC) moves in late September, which included reducing reserve ratio requirement for banks and cutting mortgage rates to inject liquidity and stimulate the economy – remembering that companies still have to want to borrow! These measures were followed by a Politburo meeting signalling a shift towards supporting private enterprises and consumer spending to drive economic recovery. The stock markets responded strongly, with the Hang Seng, Shanghai Composite, and CSI 300 posting significant gains from recent lows, marking a return to bull market territory. Despite the positive market movements, the long-term sustainability of this recovery depends on whether the government can deliver structural reforms and address challenges in the housing market, consumer confidence, and local debt. The interventions were more modest than originally expected prompting suggestions that they are waiting for the US election result before deciding how to support their economy. |

Final Word on the US Election

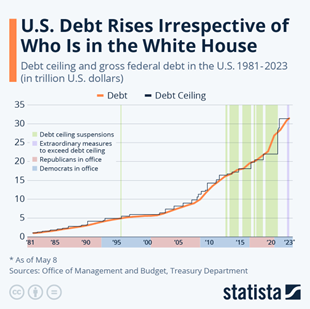

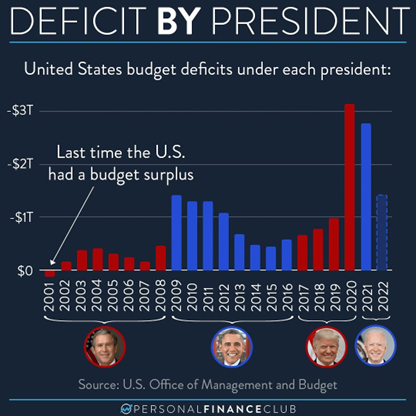

With the US Presidential Election just 11 days away (12 if factor in time zones for us) you’re going to continue to hear a lot about the potential impact financially of either a Harris or Trump presidency. Here’s a summary by RaboBank senior macro strategist Stefan Koopman. “The US presidential election is increasingly becoming the main market focus as the date inches nearer. Polls still show no clear favourite, but market sentiment seems to be shifting in favour of Donald Trump. With the Harris honeymoon officially over, the Trump trade is gaining traction again. This view holds that a Trump win, and a Red Sweep (Republicans controlling both houses) in particular, would be bad for bonds, the euro, the yen, the yuan, and the peso, but a boon for stocks, especially in sectors like financial services, oil, and cryptocurrencies, where tax cuts and deregulation would boost profitability. The thinking goes that less regulation means higher margins, and lower taxes mean more money flowing back to investors.” Koopman says investors only look at the policies that appeal to them. “Trump’s campaign highlights big ideas: tax cuts, deregulation, and tariffs. Investors are zeroing in on the first two, eagerly anticipating another corporate tax windfall against a backdrop of a US economy that’s already doing well. Recent data has been stellar, and the S&P 500 has surged to a fresh high of 5,864, and on top of this traders are rotating into those sectors expected to gain from a potential Red Sweep. Yet this optimism assumes Trump will deliver only the market-friendly aspects of his agenda. In reality, that “most beautiful word in the dictionary” (tariffs) could create significant disruptions. “Back in 2018, trade policy primarily targeted China, with some collateral damage in Europe and Mexico. This time, his proposed tariffs are far more extreme than anything he did during his first term. Unless suppliers have significant profit margins to play with, it will highly likely inflate prices across the economy. “Moreover, Trump’s immigration plans, which involve the deportation of millions of workers, would create severe labour shortages. In industries already struggling with tight labour markets, this would fuel wage inflation and reduce productivity, pushing prices higher and reducing potential GDP growth. “Any economic gains from tax cuts and deregulation would be offset by the broader damage caused by untargeted and indiscriminate tariffs and widespread labour shortages. Trump’s idea that his tariffs will fund his tax cuts is fundamentally flawed, as tariffs mainly transfer surplus from consumers to producers, but don’t generate sustainable long-term revenues. “The deficit is also a looming issue. Trump’s proposals could increase the federal debt by up to $7.5 trillion over a decade, at a time when the US economy is already running a deficit of around 7% of GDP. This would force the government to allocate a larger share of its budget to servicing debt.” |

|

That’s USD $1.8 trillion ( A$2.7 trillion) – and it’s the current US budget deficit, which has ballooned to 7% of US GDP, with total debt to GDP sitting about 100%. To give some perspective, in the early 1980s, when inflation in the US was above 14% (it’s currently 2.4%), it was just 3.5% of US GDP, and total debt was 35% of GDP.

The US mounting debt was recently called “a ticking time bomb” by two titans of the global finance industry, JP Morgan CEO Jamie Dimon and hedge fund legend Ray Dalio. Their commentary, made separately this month in Asia and London, highlighted the striking contrast between optimism and caution that often exists in the financial world. While many economists, strategists, and investors are focused on the timing and magnitude of upcoming US interest rate cuts, Dimon and Dalio have flagged differently: that interest rates might need to rise instead. Both Dimon and Dalio urged investors to be wary of speculation surrounding interest rate movements; their insights have shed light on deeper concerns that transcend mere monetary policy adjustments. Dalio said that while the current state of the US economy is relatively balanced, with inflation and growth maintaining a certain equilibrium, he cautioned that those banking on significant interest rate cuts may be overly optimistic: “The risks are more on the upside than the downside.” Dimon echoed this sentiment, suggesting US rates could either hold steady or even increase slightly. He emphasised the focus shouldn’t solely be on minor adjustments in interest rates but rather on larger economic clouds looming over the nation. “Deficits are inflationary,” he warned, urging that the U.S. needs to address its financial situation proactively rather than wait for a potential crisis. Dalio concurred, emphasising the need for a balanced approach to managing debt. He noted that the increasing supply of bonds necessary to support these deficits poses significant risks, particularly amid geopolitical tensions that might concern foreign investors. For Dimon, geopolitical factors remain a pressing concern. He sighted the invasion of Ukraine as evidence of global instability and the potential for coordinated actions by countries such as China, Russia, and Iran, raises questions about the future of the post-World War II order. He asserted that a riskier global environment may necessitate increased US military spending, further straining the already precarious budget deficit. This interconnection between global conflicts and domestic economic policies complicates the narrative around interest rates.

With the US election just weeks away, the stakes are high. Both Dalio and Dimon are sceptical that either major party will effectively address the pressing issues of debt and deficit. While Trump’s policies will likely see a short term positive impact on markets, the long-term could be the opposite as there is no clear path to fund the initiatives and as a result debt will likely rise at an increased rate. Harris being elected would likely see the opposite. Neither outcome is likely to see a return to ultra-low interest rates. The insights from Dimon and Dalio illuminate a critical reality: the potential for a prolonged period of higher interest rates looms large, influenced by a complex interplay of debt dynamics and geopolitical uncertainties. Should this scenario play out investors need to prepare for a market environment that may not favour easy money any time soon. |

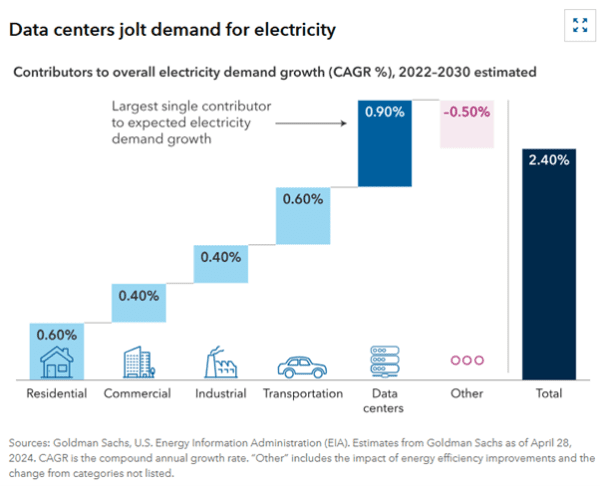

Chart of the MonthThere is more than debt threatening stickier inflation, this weeks chart predicts the impact of AI, data centres and electric cars on the growth of electricity demand over the next few year. It will be a challenge for utilities to meet this once in a generation spike in demand whilst continuing the transition to renewables, without energy prices continuing to rise.

|

Negative Gearing: Lessons from New Zealand & VictoriaPotential tax reform to property investment, particularly negative gearing, is guaranteed to stir debate in Australia. The principle of negative gearing is simple: allowing property investors to deduct their borrowing costs, such as interest and depreciation, from their taxable income. It has made property investment more attractive; according to the Australian Taxation Office, about 2.25 million individual taxpayers (21% of all individual taxpayers) claimed deductions against rental income in 2020-21. It is also criticised for inflating house prices, benefiting wealthier investors and contributing to Australia’s housing affordability crisis. Is it that simple though? Some economists argue that removing negative gearing could increase house prices, as investors may raise rents to cover new tax burdens and maintain yields. This could worsen affordability for renters and first-home buyers. Others suggest that fewer incentives for investors would cool the housing market, stabilising prices and improving affordability for first-home buyers. Cutting negative gearing could boost government revenue, allowing funds to be redirected to public services such as affordable housing schemes, healthcare and education. This assumption would only be true if investors remained in the market at the current level which many economists are sceptical they would. The broader economic impact is even more unclear as the economy moves as a whole and not in isolated pockets. Changes could either slow growth in property but potentially encourage investment in other sectors. As Australia considers reforming negative gearing, the different experiences of New Zealand and Victoria offer valuable insights. In 2019, our friends across the ditch, introduced tax reforms which restricted negative gearing and removed mortgage interest deductibility. The changes naturally caused initial concern about soaring rents. However, housing construction began to surge and house prices levelled off, making the market more accessible to first-home buyers. Rental inflation was ultimately modest and in reality was driven more by population/immigration growth than the tax changes. Victoria experienced a different scenario. Recent state-based tax increases led to a significant investor exodus, but housing affordability improved as property values dropped. Rental inflation in Melbourne, despite investor withdrawal, remained consistent with other Australian cities meaning those who stayed in the market were not really impacted long-term. Victoria is also releasing considerable land around greater Melbourne, prompting a surge in housing construction, similar to the New Zealand experience. Potential changes to negative gearing in Australia will no doubt come with a mix of risk and reward. While reform could improve housing affordability for first-home buyers, there may well be short-term disruption in the rental market. Policymakers should carefully weigh the outcomes from New Zealand and Victoria, ensuring a balanced approach that considers investors, renters, and first-time buyers alike. Prime Minister Anthony Albanese has confirmed that Treasury is looking at options to curb the use of negative gearing and the capital gains tax deduction for investors but is yet to confirm when the government had asked the department to undertake the work.

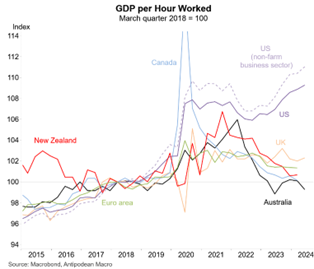

Australia’s Productivity Crisis: How Japan decoupled population and economic growthAustralia’s productivity has been in steady decline for nearly a decade – starting well-before the pandemic – and driven largely by “capital shallowing,” when business and infrastructure investment fail to keep up with rapid population growth. This leads to a reduction in capital per worker, higher congestion costs, stagnating productivity, an over-reliance on government-funded sectors for employment and lowering living standards. As Australia’s immigration-fuelled population expansion continues, it’s worth looking at how other nations, such as Japan, have managed to decouple their economic growth from population growth—offering lessons for Australia’s path forward.

A recent bulletin issued by the Bank for International Settlements (BIS) – known as the bank for central banks – highlighted Australia’ s lagging investment response, noting that “capital shallowing” has been a major contributor to declining productivity. BIS noted Australia’s labour productivity has been stagnating since 2016, with GDP per hour worked showing no growth for nearly eight years. Population growth without matching infrastructure increases congestion and diminishes the quality of life and economic efficiency. Australia is experiencing a “per capita recession,” where per capita GDP has fallen for six consecutive quarters. Household consumption and disposable income have also reached record lows. As Australia grapples with these issues, it risks facing a period of economic stagflation—low growth paired with high inflation if capital shallowing persists. In contrast, Japan has shown how a country can maintain economic growth despite a declining population. Japan’s population has been shrinking since 2011, but the country has managed to improve productivity and maintain living standards by focusing on innovation, technological advancements, and capital deepening. Japan has invested heavily in robotics, automation, and artificial intelligence (AI) to boost labour productivity. By leveraging technology, Japan has offset the impact of a shrinking labour force, enabling its businesses to remain competitive and productive without relying on population growth. Unlike Australia’s capital shallowing, Japan has embraced capital deepening—investing in more capital per worker, such as advanced machinery, digital infrastructure, and high-tech industries. This has allowed Japan to maintain high productivity levels even with fewer workers. Japan’s focus on industrial efficiency and innovation, particularly in sectors such as manufacturing, has helped decouple its economic growth from population trends. By prioritising high-value industries and improving workforce efficiency, Japan has sustained economic performance in a low-population-growth environment. It’s been well-documented that Australia’s post-pandemic productivity decline has been the steepest in the world. Some economists go so far as to describe our economic future as precarious with household consumption declining sharply and real per capita disposable income suffering an 8% decline— the largest fall in modern history. These trends are set to continue unless policymakers address the underlying issues of capital shallowing, workforce inefficiencies, and slow infrastructure growth. Instead of relying solely on population expansion to drive GDP, Australia needs to learn from countries such as Japan and its focus on capital investment, innovation, and workforce efficiency. It’s not too late to reverse our productivity slump and pave the way for a more sustainable economic future. |

Protecting the bank of Mum and DadParents instinctively want to provide their children with the best possible opportunities especially when it comes to major financial undertakings such as buying a first home. While the “Bank of Mum and Dad” is hardly new, it has grown into an economic and social necessity as Australia’s house prices started rising beyond the average person’s means. In the 1980s, only around 15 per cent of first-home buyers received financial support from their parents. Today, according to Australian Housing Monitor research, that’s leapt to a whopping 40 per cent making the Bank of Mum and Dad – colloquially referred to as BOMD by financial journalists – one of Australia’s top money lenders.

Now BOMD is in trouble and not only because many children who were helped buying property now struggle because of rising interest rates and cost-of-living expenses. Parents who lent deposits, gave cash, used equity in their own home or underwrote deposits to help their children buy a first home are also under pressure because their asset base and cash flows have also been reduced. These pressures are putting at risk the financial welfare of the parents, which has implications for their retirement plans. While providing a financial lifeline for a child may feel like rolling every birthday and Christmas present for a couple of decades into a single gift, it is important to still view this gift as you would any financial investment; every risk needs to be assessed first, so you enter the arrangement fully informed and with your eyes wide open. It might make the arrangement feel transactional but there is your own financial future to consider. In the context of your retirement plan, it’s crucial to evaluate the potential financial burden posed by your adult children and ask yourself:

Parents need to ensure that by putting a new roof over the heads of their children they don’t lose their own through expensive legal disputes amid the rise of blended families, cohabitation and bankruptcy. While seeking professional advice is always recommended, there are also some simple actions you could take to mitigate the risks and further protect your retirement:

All parents really want is to see their children be happy and successful and financial assistance is often part of this. By proactively assessing these risks and taking appropriate steps, it is possible to protect your own financial future while supporting your children. It’s important to have open conversations with your family and seek professional advice to ensure a secure and sustainable retirement. |

Ensuring your wishes are being met

Caption: Lachlan and Rupert Murdoch are trying to alter the terms of what was supposed to be an irrevocable family trust. It’s not just high-profile, mega-wealthy families such as the Murdochs, Pratts, Scotts and Hancocks, who become embroiled in legal disputes over inheritances, family trusts and the like. According to estate lawyers, the volume of legal actions relating to family trusts by everyday Australian families has soared in the past decade. Sloppily drafted trusts and wills are often responsible for the fights and the feuds over this intergenerational transfer of wealth. So are the deaths of the originally appointed trustors and the transfer of responsibility for enormous sums of money to extended and blended family members. As with most conflicts, its usually poor communication right from the start that leads to expensive and lengthy litigation. Some families are reportedly now using lawyers and accountants to “war game” their discretionary trusts, using future scenarios or simulating attacks from estranged relatives or black sheep – to find weak spots in the drafting of the trust. Discretionary, or family trusts are commonly used for asset protection, succession planning and tax purposes, such as distributing income to different beneficiaries on lower marginal tax rates. They are called “discretionary” trusts because the trustee has the power to decide how much beneficiaries get from a trust and when they get it. All capital and income is distributed at their discretion. There are about 800,000 discretionary trusts worth $1 trillion in Australia, according to the ATO. Reasons why a family member might be excluded from a trust range from drug and alcohol issues to chronic gambling, membership of a cult or a simple breakdown in the relationship. On the flip side, they could be an unfairly treated victim of a trivial rift, and often, details of a will or trust are kept secret from them and only inadvertently revealed by another beneficiary of the trust. Each trust has a deed, a legal document that sets out the conditions, terms and rules for creating and managing the entity. It must specify beneficiaries, the trustees running the scheme daily, and their successors. A trustee can be a trusted person or a company, called a corporate trustee. The most important role is the appointor, who is the ultimate controller of the trust and has the power to remove or appoint trustees, including themselves. Most experienced lawyers in this area agree it is fundamentally important to get the drafting of the trust deeds right at the start and to consider who should be controlling the trust now and in the future. While it’s impossible to make predictions, the best way to mitigate against potential claims is for a family to openly discuss the aims of a trust and the structure that will best achieve an outcome that keeps everyone happy and avoids surprises. A family meeting or series of meetings is one practical way to discuss issues and reduce the prospect of misunderstandings, so too would be creating an actual family constitution. Similar to a partnership deed, a family constitution is a legal document, signed by all parties, that sets out a family’s values and principles, defines the trust’s objectives and explains how the members will make important decisions. It can also have a governance structure that provides transparency and accountability such as sharing annual accounts. Likewise, appointing an independent professional trustee with no connection to the family can ensure that everyone’s voice is heard, everyone’s financial or legal advisers are coordinated, and liaison happens between trustees and beneficiaries. If a family is concerned one particular member is a litigation risk, a separate trust could even be established for that person. Seek professional advice, proper planning and communication are the basic fundamentals to securing the transfer of your wealth the way you intended, long after you have gone. |

Friday FunnyOnline security is essential and we should never be complacent but I am sure we all get frustrated by the sheer number of passwords we now have to manage. This missive from Dilbert hit a chord!

|

Treasury will also need to consider the fact that negative gearing does not only apply to residential property investments. How will any changes to the rules impact commercial property investments and borrowing to buy shares in listed and unlisted companies given that they use the same rules to offset interest and costs against income derived?

Treasury will also need to consider the fact that negative gearing does not only apply to residential property investments. How will any changes to the rules impact commercial property investments and borrowing to buy shares in listed and unlisted companies given that they use the same rules to offset interest and costs against income derived?