Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A Finsec View – Investing in an inflationary world, A discombobulation, Reversionary pensions, the EV debate and more

|

25th March 2022 |

| The undeniable theme for equity markets at present is ‘energy and then all the rest’!

Energy is one of two S&P 500 sectors showing a gain for 2022, up 37%—the benchmark as a whole is down around 5%—and home to more than half of the index’s 25 best performers. As for ‘the rest’, equities remain weak in both Australia and offshore, with unprofitable tech and growth stocks hit particularly hard amidst concerns of how they will fare in a rising-rate environment. The triggers for all this volatility remain unchanged; the not-so-sudden re-emergence of inflation, Russia’s invasion of Ukraine, the sanctions response and the gyrations in commodity markets. With inflation on the rise and central banks now using interest rates to slow it, the playbook for investors is changing. In this week’s View we share our thoughts on investing in this inflationary world, explore change with the revered Phil Ruthven AO, tackle the electric vehicle debate and take a look at reversionary pensions as an estate planning tool. We hope you enjoy the read. |

|

| Low inflation had spoiled investors for so long that last year’s re-emergence caught some unprepared. As those who lived through the late 1970s and early 1980s can attest, inflation can be an anchor on company growth and cash flow because it erodes purchasing power.

We are now in an environment of high inflation and the implications for many investors is likely to be game-changing. Here’s a brief guide to who we think the winners and losers in a rising-rate world will be. Active management wins In a rising rate, higher-volatility world, selection becomes even more important. In equity markets, companies that can pass on input price rises to their customers will tend to do better than those in hyper-competitive segments, where pushing up prices means pushing down sales. Finding those companies and paying the right price to own them is a job for an active manager, not an index-hugging algorithm. A turn to value Thanks to a decade of low-interest rates, growth stocks have comprehensively outperformed value stocks since the GFC. But the bounce back in value stocks has already started – and is likely to continue. Analysis from our peers at Perpetual Investments explains why. They compare the effect a 1% rise in the discount rate could have on BHP – a giant diversified miner – versus Afterpay, the darling of the high-growth, Buy-Now-Pay-Later stocks (the discount rate is the assumed interest rate analysts use to value the future earnings of a business). On this analysis, higher rates could cut BHP’s valuation by 16%. But it would cut 36% off Afterpay. “Higher rates have a two-fold impact on growth companies. Firstly, their potential earnings get discounted more heavily. Secondly, funding all that growth via debt becomes a lot more expensive and that means lower profits. It’s why the big losers from recent market volatility have been high-growth but unprofitable tech companies. And why the future looks brighter for companies with predictable cash flows – like banks. And those that benefit from higher commodity prices – like miners.” A different multi-asset toolkit From a multi-asset perspective, a more inflationary environment over the medium term could have profound implications in terms of how different asset classes behave and are correlated. This in turn will have repercussions for the way investment strategies are constructed. It will be important to ensure portfolios still have liquidity, tail-risk protection (protection against loss-making events) and alternative capital-preservation tools (investments in more conservative/low-risk vehicles). Analysis of inflationary episodes and how different asset classes have behaved over the past 50 years shows bonds generated negative real returns during most inflationary episodes, while equities as an asset class also frequently underperformed. Gold performed strongly during the inflationary periods of the 1970s, but its price appears to have become much less related to inflation since then. On the other hand, commodities that constitute the raw materials into production processes have had a much more reliable relationship to inflation, with a strong positive correlation between broad commodity prices and inflation. Renewable-energy infrastructure assets, whose revenues are often linked to the rate of inflation, could also be well placed to outperform.

|

|

| One of ‘those people’ – when Phil Ruthven AO puts pen to paper, it is always worth a read.

In this article, Ruthven (founder of the Ruthven Institute and IBISWorld) puts his spin on these volatile and turbulent times. He touts that whilst every decade brings surprises, good and bad, ‘discombobulating’ ones are more rare (being the 1910s, 1930s, 1940s and 1970s in the last century). We may only be two years in, but he believes we can add the 2020s to the list. Exploring some of the key changes; rapid population growth, technological change, economic output and socio-political ideologies and protocols, Ruthven creates a picture of our emerging world in a bid to predict what trends will take place next. Read here.

|

|

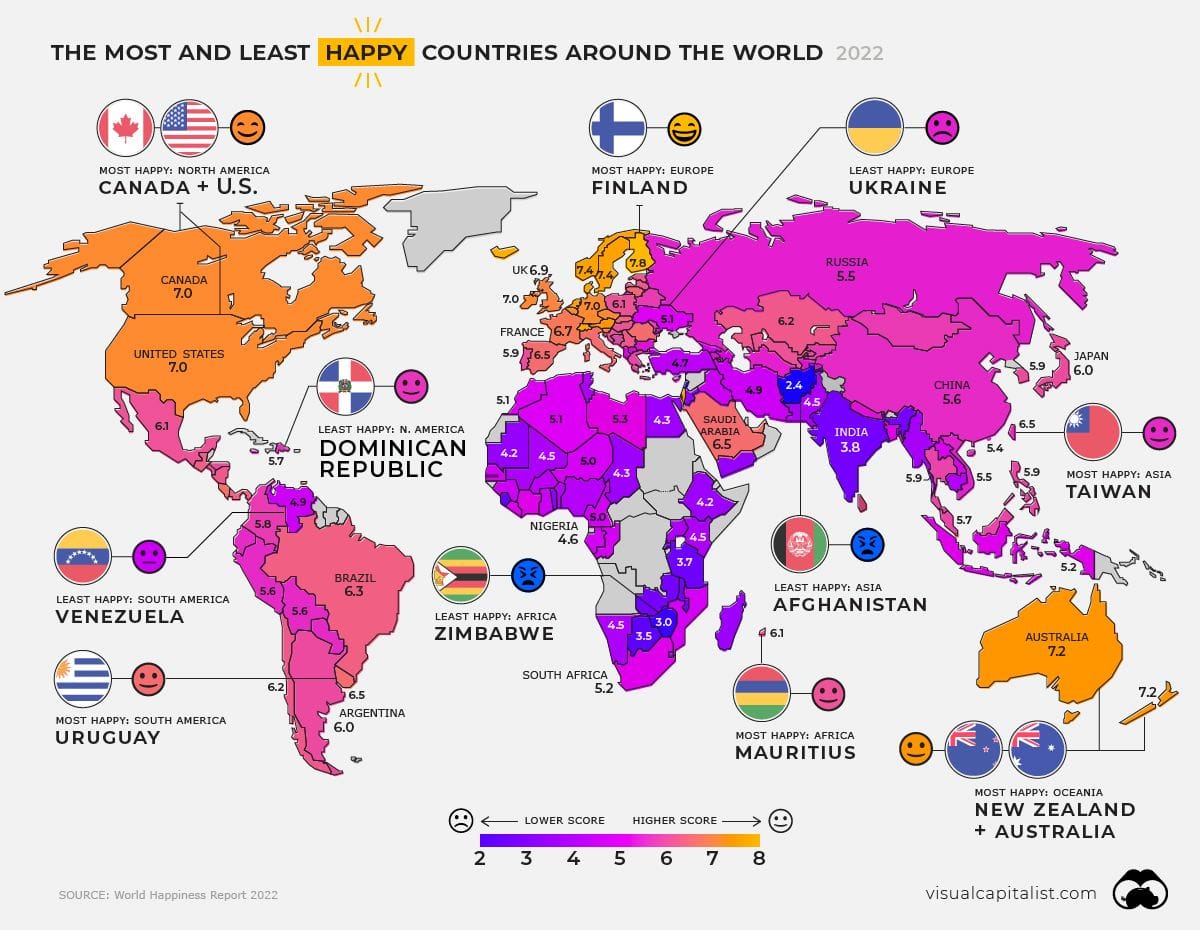

| Every year, the global polling giant Gallup asks hundreds of thousands of people in more than 140 countries questions to measure ‘happiness’ levels as part of its annual survey on emotional well-being. Happiness is measured against a number of factors, including one’s financial security, perceptions of social support and feelings of personal freedom.

This map pulls data from the report (released late last week) to show average scores from 2019 to 2022 and highlights which countries are the happiest—or unhappiest. Australia remains a lucky country!

Looking at the rankings seemingly uncovers a stark global happiness divide. But, a colonial lens may be useful in understanding why this is – we can’t but help question if the measure itself may be centred in a ‘western’ understanding of happiness? You can read the full World Happiness 2022 Report here. |

|

| We are often asked about reversionary pensions as an estate planning tool. The below serves as a simple ‘101’ guide on the topic.

A reversionary pension is actually a bit of a misnomer. It is not a separate or distinct style of pension; rather, it is possible for any style of pension product. In short, it allows a person to nominate a beneficiary who will automatically continue to receive their pension when they die (generally an arrangement limited to couples only). So why do people use it?

Similar to a Binding Death Benefit Nomination, the pension automatically transfers to the surviving spouse. There are no decisions to be made and not much paperwork to prepare.

Reversionary pensions do not allow the surviving spouse to circumvent transfer balance cap rules (currently $1.7 million). However, there is a slight quirk to the rules, which makes it beneficial. If the original pensioner dies in, say, August 2022, a reversionary pension will be inherited by their spouse immediately but won’t count towards the spouse’s transfer balance cap until 12 months later, August 2023. The 12-month delay is to give the surviving spouse time to sort out their own super. In the extreme, the surviving spouse could have two large pensions (let’s say $1.7 million each) running at the same time for nearly 12 months – the original pension plus the reversionary pension they’ve just inherited, with all the benefits (great tax treatment, the ability to take payments) all without having to worry about the transfer balance cap.

Even though the pension doesn’t count towards the transfer balance cap for 12 months, the value that’s reported for this purpose is whatever the pension was worth on the day the original pensioner died. Using our example, the surviving spouse would have nothing counted towards their transfer balance cap until August 2023. At that point, the reversionary pension would be counted, but the ATO would only look at its value in March 2022 – any subsequent growth would be ignored. For these reasons, reversionary pensions are a popular estate planning tool. But, they don’t suit everyone, and there are, of course, a number of nuances too complex to discuss within this short article. As always, please seek advice on individual circumstances.

|

|

|

|

|

| Electric vehicles (EVs) are a hot topic right now – Fuel prices which hit a nationwide high earlier this month, are significantly hurting the hip pockets of households globally. This has more consumers looking for an alternative to the conventional car than ever before. In the week that ended March 13, one-quarter of shoppers on Edmunds.com (the equivalent of carsales.com.au in the US) considered a hybrid, plug-in hybrid or electric vehicle, a 39% increase from the previous week and an 84% surge from the same week in February.

So, why don’t we simply turn the tap off and accelerate the switch to electric vehicles? While it’s an admirable goal for many governments and private sector players to take, there are several obstacles lying in the way. The main obstacles in trying to push towards electric cars come down to:

Electromobility also requires charging infrastructure (think about how much copper it will take to put charging stations in every shopping centre), new electricity generation and more. Countries will need different sources for supplies—both materials and labour—to put all the moving parts together.

If commodity prices remain tight, it’s unlikely the price of EVs will get dramatically cheaper. Mmm… we sense a significant shift in the (EV) uptake debate – the argument is moving from one of demand to more of a question around supply. We expect this will become an even hotter topic in the future. More information (albeit behind the paywall) can be found here in an article by William McInnes for the Financial Review.

|

| This week’s article on the discombobulation decade certainly gets one thinking about change. Most of us are old enough to remember purchasing some or all of these electronics (individually). And, in this particular photo, all the gear was manufactured by Sony.

Now a smartphone can do all this and more. Does anyone own a Sony phone? Like Nokia, Blockbuster and Kodak, Sony was once at the leading edge of technology. In 2000, Sony was valued at over US$100 billion or five times Apple. Sony’s market value is now about US$80 billion while Apple is the world’s most valuable company by market cap at about US$2.5 trillion. Indeed, how times change. |

| Stay safe and look after one another. As always, if you have any concerns or questions at any time, please reach out to your FinSec adviser. |

|

|