Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A FinSec View #14

Issue: Friday 07 August 2020

What a Year This Week Has Been!

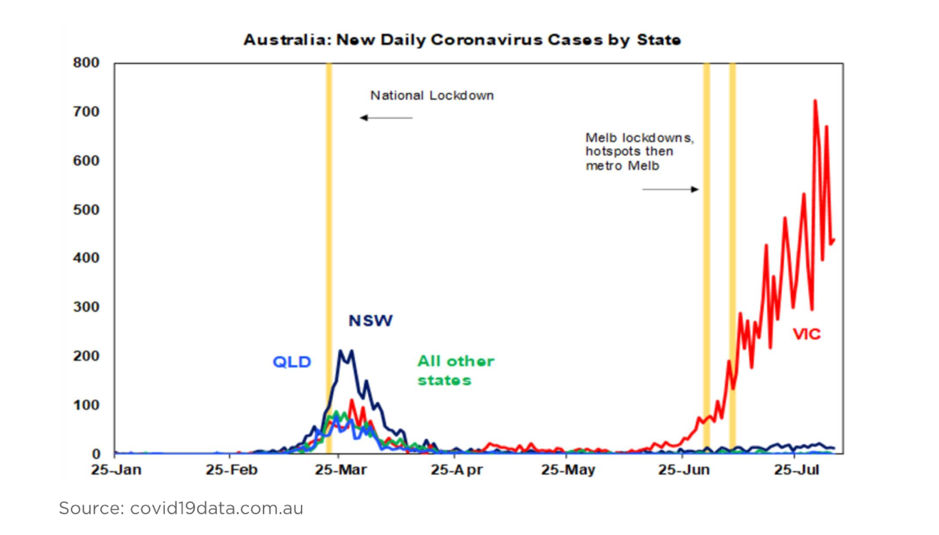

Our thoughts are with our Victorian clients, friends and families as the realities of COVID-19 escalate and they learn to deal with stage four restrictions.

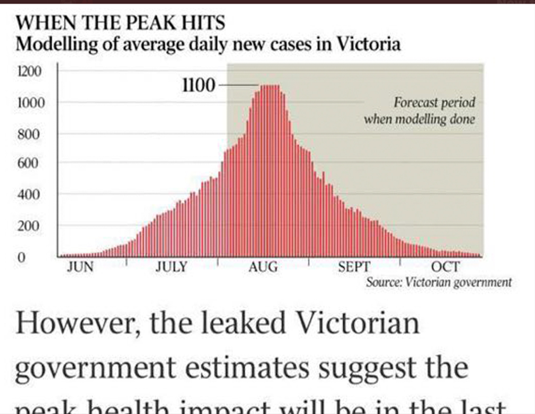

Yesterday, The Australian published alleged Victorian pandemic modelling which suggested new COVID-19 cases would be in the thousands for a protracted period next week, a frightening thought that made headlines around the country!

Subsequently The state’s deputy chief health officer, Professor Allen Cheng, announced that he had never seen this modelling, and had no idea where it came from. The newest report is that it may have actually come not from the Victorian government but a random twitter account.

Mmm… Good news but also a timely reminder that stories that sell newspapers are often as tantalising as they are patently false.

From an economic perspective, the impact is yet unknown and any previous forecasts were outdated as soon as Victoria shut down. It will of course dent Australia’s recovery but, the central bank has previously said it will do everything in its power to support the economy through this period. As a result, it is plausible to expect more broad-based quantitative easing from the RBA.

The central bank has said it doesn’t want negative interest rates, though there is a possibility it could cut rates to 0.1%. It’s questionable whether this would really have much impact, but it remains a possibility. The RBA has also said it doesn’t want to directly finance government spending, or intervene in the foreign exchange market.

In addition, there will be more pressure on the federal government for stimulus, as growth takes more of a hit than forecast in the current quarter from the situation in Victoria. As such, we can expect more support measures from Canberra in the months ahead.

*** Note: Earlier today the Government announced revisions to JobKeeper 2.0

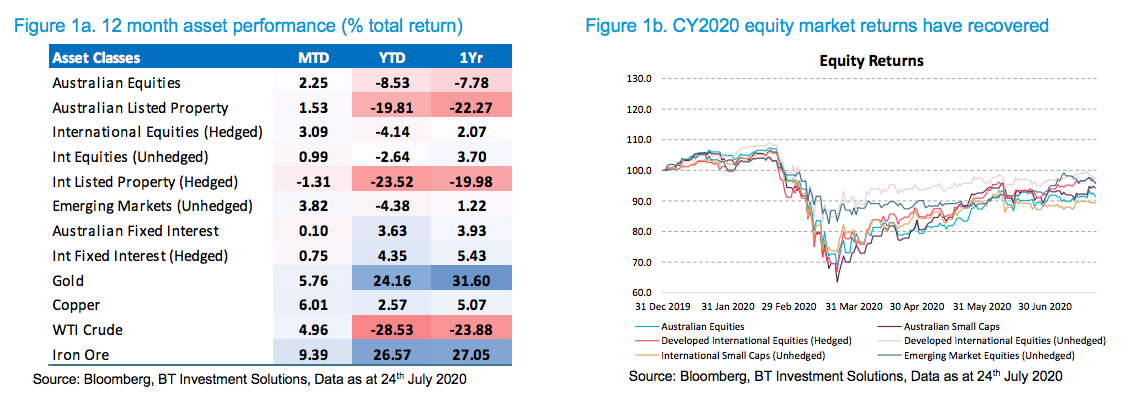

In Markets

When markets opened earlier this year, imagine being told that by August, we would be in the midst of a global pandemic that would kill over 700,000 people among 20 million infections and no vaccine in our immediate future. In Australia, our borders would be closed and one of our biggest cities would be locked down, with a curfew. Many of Australia’s most successful businesses would be forced to shut their doors, many never to reopen. The majority of mortgages would be on income support and companies would be allowed to trade while insolvent. Government debt would head to $1 trillion and unemployment above 13%.

Attempting to comprehend the effect this would surely have on financial markets (regarded as a gauge of current and future sentiment), would be hard to fathom.

At the time of writing the S&P/ASX200 is at 6,042 a fall of less than 10% from its opening figure of 6,700. Historically the index falls by this amount every couple of years, it could, therefore, be considered a normal correction.

The extraordinary market anomaly continues. How can a bull market co-exist alongside an economic and health crisis that is far from over?

With the world economy facing its biggest economic shock since the Great Depression, market bears can make the case there will be bankruptcies, permanently higher unemployment, and financial stress. Yet, as we have commented here in the past, it’s also quite reasonable to make the bullish argument that new modern monetary policies will mean recovery may happen more quickly than first feared, and a breakthrough such as a vaccine could change the picture dramatically.

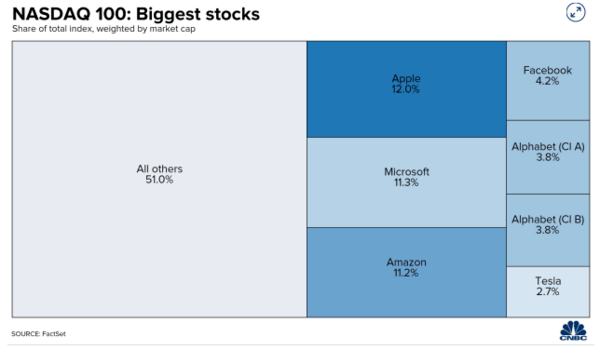

Secondly, it is one of the most polarising markets in history – take out tech and pharmaceuticals and it would paint a very different picture. The US market has increasingly turned into a bet on a sextet of tech stocks (Apple, Microsoft, Amazon, Alphabet (Google), Facebook and Tesla), which now account for half the value of the index.

With the pandemic driving big winners and losers, the US market taking on unusual characteristics and so many companies pivoting, diversification in portfolios is more important than ever.

At the risk of sounding like a broken record …we are operating in a pervasively different and changing world. At FinSec our portfolio’s are focused on the long-term goals of investors. We remain vigilant and agile and continue to monitor events as they unfold. Please stay tuned to these updates (or visit our website) for ongoing information and analysis.

Generational Wars

Former Prime Minister Paul Keating set many a tongue-wagging this week, slamming baby boomers for being greedy, arguing that they would never have tolerated what young people cop today, such as HECS debts and low wages.

“Take my generation, the Baby Boomers. They want everything yesterday and they want it doubled now. If there was no super they wouldn’t be wanting $23,000 they would be wanting $50,000 now. You look at these young people, I mean a lot of them are on low wages, they carry the HECS charge around their neck before they start, they have trouble accommodating themselves. We are saying, ‘Oh, by the way, you can look after the rest of us aged people.’ It’s just fanciful nonsense.”

While the validity of his comments (made at a briefing for Industry Super) are generalised and arguably inappropriate (humanitarian crisis considered) they do support the increasingly popular view that we are on the brink of a generational war, many against the Baby Boomers, with the pandemic creating new tensions.

Negative generational narratives have been building since the early 1980s. Back then, people were worried that ‘under-achieving’ Gen Xers wouldn’t be as financially comfortable as their parents.

Unfortunately, policymakers haven’t done much to change the mood. Governments have become increasingly worried about ageing populations and the strain that pensions and other state benefits could place on national budgets as the average age of citizens rises.

In the pursuit of austerity measures following the GFC, greater political and media emphasis has been placed on highlighting the have and the have-nots across generations.

But while the generational blame game seems to be a favourite topic among politicians, journalists and other social commentators, research suggests one demographic doesn’t buy into it: the general public.

In this article for FirstLinks Emma Davidson of Staude Capital Limited in London

explores generational theory to conclude that now more than ever is not the time to encourage division.

Click here to read the full article.

Jiankangma

An interesting article from the desk of Fidelity, in which China’s Big Data edge is revealed. Specifically, how the nation has used the vast amounts of data it collects – and its ability to make relatively free use of it – as its weapon of choice “Jiankangma” in the war against the Coronavirus.

Privacy concerns aside, it is just one example of the myriad of innovations that we expect to see from Chinese companies and policymakers in the coming years with regard to Big Data. This new ‘information explosion’ is and will continue to fuel growth for some of the country’s rising technology stars. These companies take advantage of an abundance of quality data, which is key for training the algorithms behind their products. Add to this the Chinese government’s 100 billion renminbi (approximately AUS$20 billion) estimated spend per year for the next three years, in new data centres and we are confident this is an area that fund managers the world over will be keeping a close eye on. A copy of the full article can be found by clicking here.

Charts of the Week

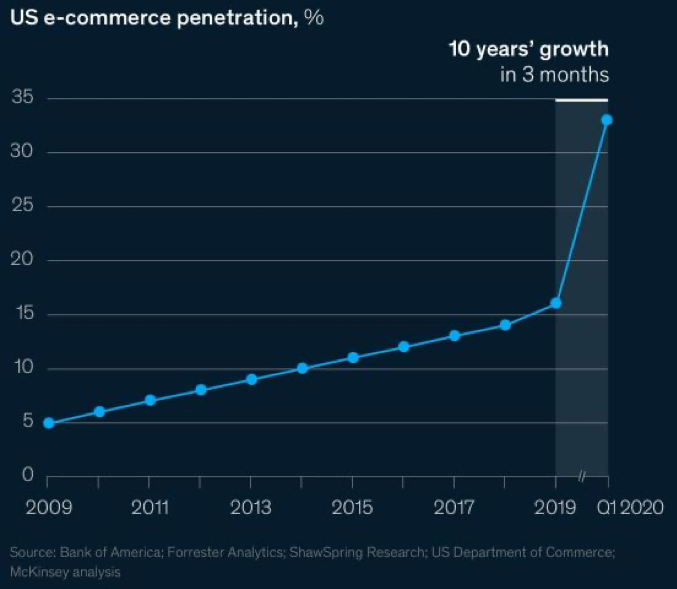

Our charts of the week represent one of COVID-19’s many phenomena.

It comes as little surprise that while many industries are suffering, e-commerce has been supercharged by the pandemic, achieving a whopping 10 years of growth in only three months.

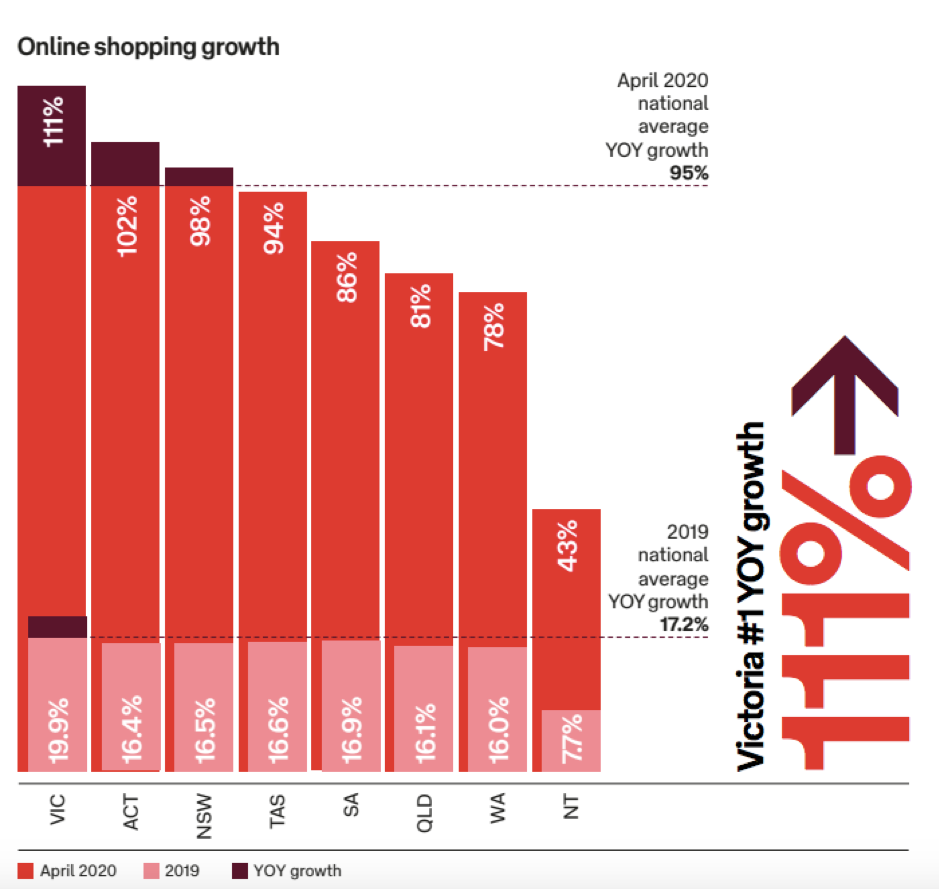

In Australia: The week following the World Health Organisation’s pandemic declaration (11 March 2020), saw online purchases up 28% year on year (YOY), before continuing to climb and hitting a peak of 135% YOY in the week after Easter. To put this into perspective, an average of 1.6 million households bought something online each week in 2019; in April 2020 this increased to 2.5 million households per week.

(Source: Inside Australian Online Shopping 2020 eCommerce Industry Report)

Where did these new online shoppers come from? Here is a list of the top10 postcodes across Australia. On the basis that the majority of our readers are South Australian, you will be interested to see that postcode 5000, the City of Adelaide, comes in at number 3.

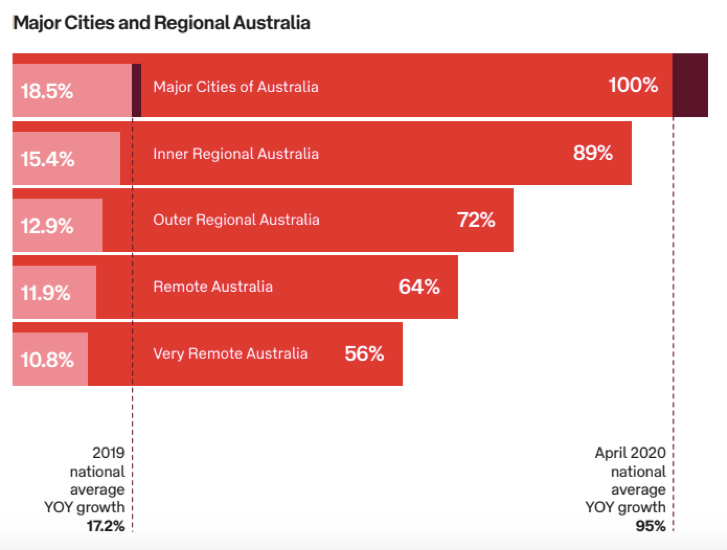

This industry-wide shift has been as dramatic as it has been swift and has not only altered the buying behaviours of city dwellers. Similar trends can be seen when looking at different locations around the country. Very remote Australia registered more than 56% growth YOY in April 2020, compared to 10.8% in 2019.

Knowledge + Clarity = Confidence

Risk, Exotica & Investment Goals

A common question we hear is why we don’t have more exotic investment options in our portfolios. After all, everyone knows a friend who “doubled or tripled their money” on one of these alternative strategies. The answer to this question boils down to our role as advisers, which is to maximise the likelihood of our clients reaching their financial goals.

The issue with exotic investments is that they are inherently risky. Many of these investments are what’s known as “black box” investments, where the manager won’t disclose the underlying investments or strategy of the portfolio to protect their market positions or intellectual property. This means our ability to research appropriately is compromised and investors often risk their savings on an investment they know little about, whilst paying eye-watering management fees for the privilege of doing so.

In cricket, a team wins by scoring more runs than their opponent before all their players get out. A team can score more runs if they bat more aggressively and take more risks, but that increases the chance of a player getting out. On the other hand, if a team isn’t aggressive enough, they will not score enough runs and will lose the game. Our role at FinSec Partners is to determine how many runs (returns) you need to win the game (your financial goals) and then devise the best strategy to ensure you will win the game. If an investor is on track to score the runs required, it is not only unnecessary but reckless, to risk jeopardising their financial health by swinging for the fences in the hopes of scoring some quick runs.