Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A FinSec View #10

Issue: Friday 12 June 2020

Drought, bushfires and coronavirus … the Treasurer has admitted Australia is now in a recession after the fall in the March quarter GDP. The June quarter is certain to be worse. And such are the times we live in, despite mass unrest on the streets of dozens of US cities where 40 million people are unemployed and ongoing tensions with China, markets surged over the last couple of weeks (albeit, like we saw in the US last night still succeptible to some seesawing).

Who would have thought that the stock market would have the biggest 50-day rally in history in the midst of a pandemic. Earlier in the week, John Authers of Bloomberg called it “the most hated rally in history”, because it “far outstrips previous recoveries from major shocks”.

What is driving the rally?

Back in April, Economist Shane Oliver, highlighted what he called the “signposts to watch” in determining when equities would bottom. As highlighted in green below Oliver’s list shows that as it stands today, virtually all developed countries have now achieved these measures.

Its plausible to assume that these indicators are the same drivers behind current investor behaviour and the cause of the share rally over the last few weeks, but the fact remains it is totally at odds with the economic reality.

The extent of the rises is hard to justify, its as if we are returning to pre-COVID levels under the guise that no long-term damage has been done. How can the stock market be booming in the middle of a recession? In this note Chief Investment Officer, Ashley Owen (of Stanford Brown – our esteemed friends and allies in NSW) outlines, while this recession is unlike anything we have ever seen before, a rally is actually quite normal.

He answers the question ‘why are recessions usually good for share prices?’. Click here to read the article.

A Few Important Reminders

Changes to Account Based Pension Withdrawals

A quick reminder regarding the halving of minimum withdrawal requirements for account based pensions – If you believe the new rules affect you and you haven’t yet heard from us, please reach out.

What has changed? In legislation passed on the 24th March withdrawal requirements for account based pensions came into effect. By halving the amount pensioners are required to withdraw as a minimum percentage of their portfolio, the measures aim to reduce the need to sell portfolio holdings during a sharemarket downturn.

The new rules were announced as part of the Governments COVID- 19 stimulus packages and apply to the 19/20 and 20/21 financial years.

New Rules Coming into Effect on 1 July

As part of the 2019-20 Budget, the federal government announced that Australians over age 65 would have greater flexibility in making voluntary contributions to super from 1 July 2020.

The greater flexibility is to be achieved through the following three measures:

- Measure 1: The age at which the work test starts to apply for voluntary contributions is to be increased from 65 to 67

- Measure 2: The cut-off age for spouse contributions is to be increased from 70 to 75 and

- Measure 3: Individuals aged 65 and 66 will be able to make up to $300,000 in contributions under the bring forward rule.

We confirm that Measures 1 and 2, will come into effect 1 July 2020 after enabling regulations were registered with parliament 13 May 2020.

Measure 3 forms part of an act and therefore, must be passed by both houses of parliament to become law. This act was introduced into parliament in May, and it is highly likely the bill will be finalised during the June sitting days.

Chart of the Week

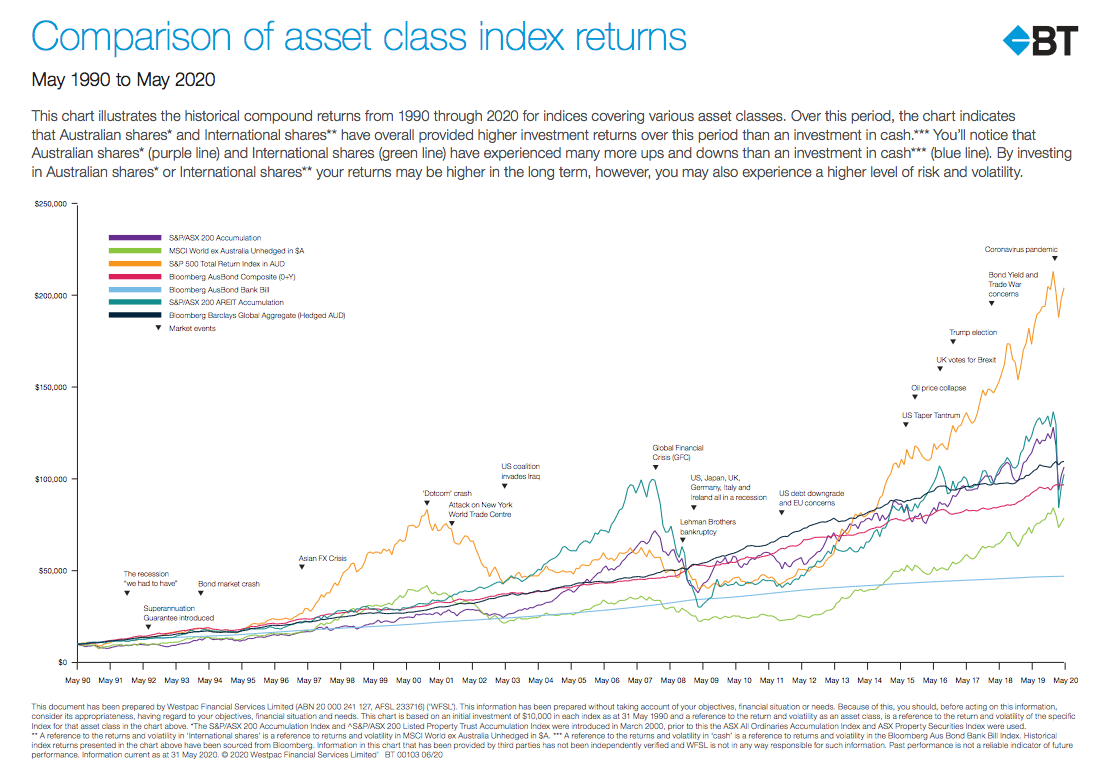

This chart from BT, illustrating the historical compound returns from 1990 through 2020 for indices covering various asset classes, serves as a timely reminder about markets and crises – They always recover!

Knowledge + Clarity = Confidence

The aim of this segment is to provide our clients with an array of tools to deal with the vagaries of financial markets. This week we look at ‘Margin of Safety’.

A margin of safety is a built-in cushion allowing for some losses to be incurred without major negative effect. In simplistic terms, if you’re building a bridge, you make it twice as strong in the event materials are weaker than expected or an allowable load is higher than anticipated. This makes the build more costly, however you mitigate the risk of a disastrous collapse.

In investing the margin of safety principle was popularised by famed British-born American investor Benjamin Graham (known as the father of value investing) and his followers, most notably Warren Buffett.

Investors utilise both qualitative and quantitative factors, including a company’s management, governance, industry performance, assets and earnings, to determine a stock’s value. The market price is then used as the point of comparison to calculate the margin of safety. Buffett, who is a staunch believer in the margin of safety and has declared it one of his “cornerstones of investing,” has been known to apply as much as a 50% discount to the intrinsic value of a stock as his price target.

Taking into account a margin of safety when investing provides a cushion against errors in analyst judgment or calculation. It does not, however, guarantee a successful investment, largely because no one can predict the future and determining a company’s “true” worth, or intrinsic value, is highly subjective.

FinSec Business Update

With the further easing of COVID-19 restrictions coming into effect in South Australia from 1 June 2020, we want to take the opportunity to update you on changes to our business operations.

The following strategies are now in place at FinSec:

Face-to-face meetings

We are pleased to be able to welcome our clients and business associates back to our office for face-to-face meetings, however all meetings will need to be held in accordance with social distancing guidelines. We are also happy to continue to use video conference or telephone meetings if preferred.

The social distancing requirements we must meet include placing limits on the number of people in our meeting rooms to ensure 1 person per 4 square metres, and 1.5 metre distance between people. We are also required to limit the total number of visitors in our office at any one time to 20 people, and this will be monitored by our reception team. Other social distancing measures such as not shaking hands, rescheduling large meetings and events, and promoting good hygiene practices for staff and visitors to the office have been implemented.

Weekly rotation of staff attending the office

With a team of over 20, under current restrictions we are yet unable to have all staff in the office at one time. Consequently, we have deployed a roster system that sees half the team working form the office and half from home, on a weekly rotation.

Staff travel

There will be no interstate business travel undertaken until restrictions are lifted. If staff and/or their immediate families need to travel interstate for personal reasons, they will go into self-isolation for 14 days on their return, in accordance with government directives.

Staff or clients feeling unwell

We have prepared a COVID-Safe plan to make sure our staff and clients are kept safe, and to ensure business continuity. One of the guiding principles to limiting the ability for COVID-19 to be transmitted and spread is to self-isolate and seek medical advice if you feel unwell. FinSec staff have been asked to stay at home if they are unwell and to seek medical advice immediately. Similarly, we ask our clients and associates who may feel unwell, to please not attend our office in person, but contact us via email or telephone instead.

We will continue to review the COVID-19 information being provided, to ensure we are following recommended guidelines and are acting in the best interest of our staff and our clients.

If you have any questions please do not hesitate to contact us.